Saif

Senior Member

- Joined

- Jan 24, 2024

- Messages

- 17,319

- Likes

- 8,373

- Nation

- Residence

- Axis Group

Bangladesh forex reserves increases to $19.53b thanks to additional remittances

Bangladesh’s foreign exchange reserves rose by US $318 million in the span of a week to hit $19.53 billion on June 19. Bangladeshi expatriates have sent about $1.65 billion as remittances in 1-14 days of this month, which is a huge inward flow just in two weeks. But it is usual for expatriat

Bangladesh forex reserves increases to $19.53b thanks to additional remittances

Published :

Jun 20, 2024 20:51

Updated :

Jun 20, 2024 20:55

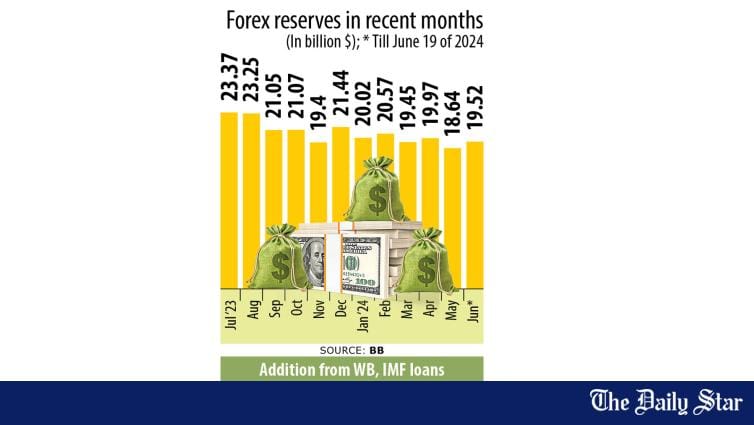

Bangladesh's foreign exchange reserves rose by US $318 million in the span of a week to hit $19.53 billion on June 19.

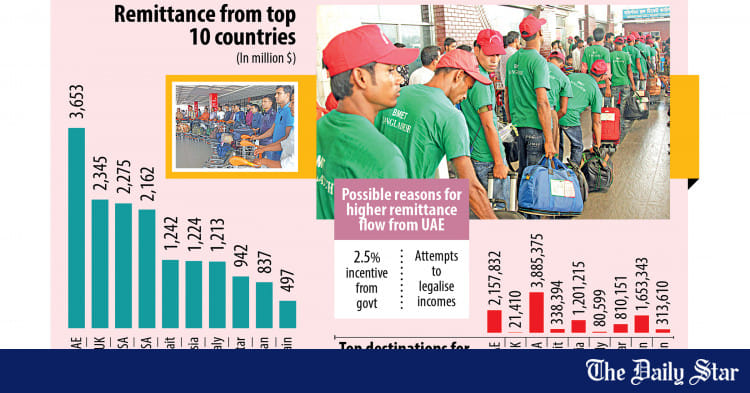

Bangladeshi expatriates have sent about $1.65 billion as remittances in 1-14 days of this month, which is a huge inward flow just in two weeks. But it is usual for expatriates to send additional remittances ahead of Eid-ul-Azha, reports UNB.

According to the latest update of Bangladesh Bank (BB) the foreign exchange reserves were $19.21 billion on June 12. The reserves increased to $19.53 billion on June 19.

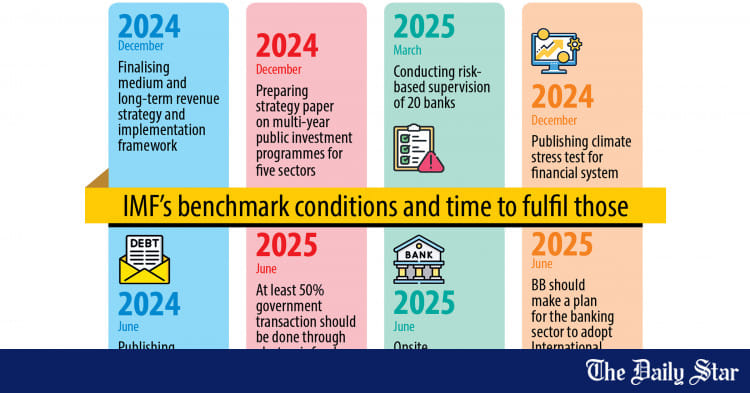

The foreign exchange flow will continue to rise in the coming weeks as the country is set to receive $1.65 billion from the International Monetary Fund (IMF) and the World Bank before the end of this June.

The IMF may release $1.15 billion in the third installment of its $4.7 billion loan in the last week of June while the WB is going to provide $500 million in budget support. This may send the reserves above $21 billion.

The latest improvement in the forex reserves situation comes a month after the central bank relinquished its control over the rate-setting mechanism and introduced a more flexible exchange rate regime.

Published :

Jun 20, 2024 20:51

Updated :

Jun 20, 2024 20:55

Bangladesh's foreign exchange reserves rose by US $318 million in the span of a week to hit $19.53 billion on June 19.

Bangladeshi expatriates have sent about $1.65 billion as remittances in 1-14 days of this month, which is a huge inward flow just in two weeks. But it is usual for expatriates to send additional remittances ahead of Eid-ul-Azha, reports UNB.

According to the latest update of Bangladesh Bank (BB) the foreign exchange reserves were $19.21 billion on June 12. The reserves increased to $19.53 billion on June 19.

The foreign exchange flow will continue to rise in the coming weeks as the country is set to receive $1.65 billion from the International Monetary Fund (IMF) and the World Bank before the end of this June.

The IMF may release $1.15 billion in the third installment of its $4.7 billion loan in the last week of June while the WB is going to provide $500 million in budget support. This may send the reserves above $21 billion.

The latest improvement in the forex reserves situation comes a month after the central bank relinquished its control over the rate-setting mechanism and introduced a more flexible exchange rate regime.