- Copy to clipboard

- Moderator

- #61

- Joined

- Jan 24, 2024

- Messages

- 3,313

- Solutions

- 1

- Reaction score

- 1,718

- Points

- 209

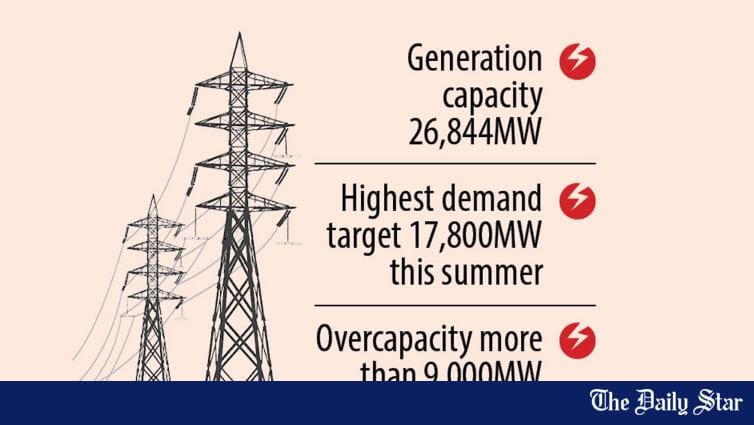

More power plants than needed

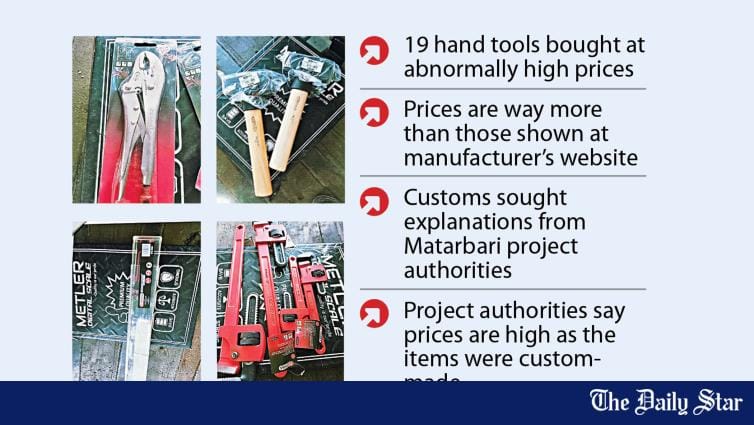

The government is continuing to ramp up the power generation capacity even though the electricity demand did not increase as per projection, putting an additional price burden on consumers, said energy experts.www.thedailystar.net

View attachment 4207

Hard to believe the govt. is still buying electricity from India (Adani et al) in spite of over capacity in this area and several large electricity plants still in the pipeline (including nuclear). The only solace is that demand for electricity is expanding rapidly and that most plants can be left idle 50% or more for now because they have multiple turbines in one plant. Demand is going to catch up very rapidly however - the way new industrialization with new export zones are being built and commissioned all across Bangladesh.

Last edited: