- Jan 25, 2024

- 111,139

- 585

- Origin

- Residence

- Copy to clipboard

- Moderator

- #1

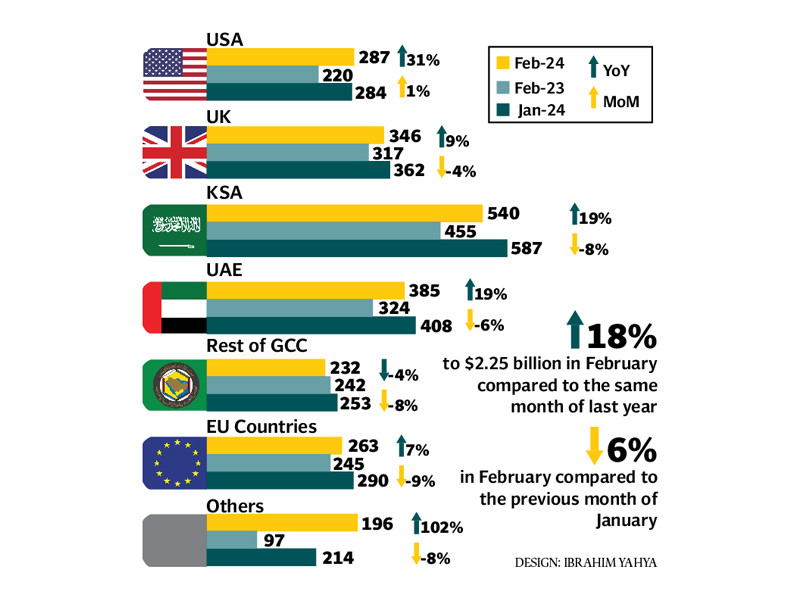

Remittances up ahead of Ramazan

Overseas Pakistanis send 18% higher remittances that reach $2.25bSalman Siddiqui

March 09, 2024

DESIGN: IBRAHIM YAHYA

KARACHI The inflow of workers’ remittances rose 18% in February 2024 compared to the same month of last year, reaching $2.25 billion ahead of the fasting month of Ramazan that is beginning next week.

According to State Bank of Pakistan’s (SBP) data, the remittances had stood at $1.90 billion in February last year.

The higher inflows should help finance the trade deficit and keep the current account balance at breakeven level. They may also support the Pakistani rupee in standing at stronger levels compared to the US dollar and currencies of other trading partners.

Non-resident Pakistanis send more funds to their family members and friends back home ahead of and during Ramazan and Eid festival to help them cope with high inflation and meet relatively higher expenditures.

On a month-on-month basis, however, the remittances fell 6% to $2.25 billion in February compared to $2.39 billion in the prior month.

Topline Securities Deputy Head of Equity Sales Ali Najib linked the drop in remittances with lesser working days in February compared to January as a notable number of non-resident Pakistanis sent money on a weekly or fortnightly basis.

Optimus Securities Head of Research Maaz Azam supported Najib’s views, saying the inflows would have been stable on a month-on-month basis had the number of days in the two months been equal.

Overseas Pakistanis sent on an average $77.57 each day in February compared to $77.35 a day in January, which showed comparatively better inflows in February.

In the first eight months (Jul-Feb) of the current fiscal year, the expatriate Pakistanis remitted $18.08 billion, showing a nominal 1.25% drop compared to $18.31 billion in the same period of last fiscal year, according to the central bank data.

SBP Governor Jameel Ahmad anticipated in late January 2024 that workers’ remittances would increase to $28 billion in the current fiscal year compared to $27 billion in FY23.

He projected that inflows would remain higher in the second half of the fiscal year as against the first one, believing the stability of the rupee-dollar parity and the beginning of Ramazan and two Eid festivals would encourage expatriates to send higher amounts to their family members in Pakistan.

Azam said the remittances increased 18% in February compared to the same month of last year because the Pakistani rupee remained stable in the month compared to high currency volatility in February 2023.

He recalled that former finance minister Ishaq Dar had controlled the rupee-dollar parity and kept the rupee stronger artificially in the inter-bank market in February 2023. The tactic led to the establishment of illegal currency markets in border areas, particularly with Afghanistan, and encouraged the illicit Hawala-Hundi system operators to smuggle foreign currencies to neighbouring countries.

The illegal traders offered significantly higher dollar conversion rates for remittances. Consequently, a significant number of overseas Pakistanis sent remittances through unofficial channels, resulting in lower inflows through official channels in February 2023.

Later, the caretaker government launched a crackdown on currency smugglers and hoarders. The clean-up operation helped crush the illegal markets in border areas. This forced the non-resident Pakistanis to send remittances through official channels, which led to a boost in receipts in February this year.

Country-wise remittances

Workers’ remittances from Saudi Arabia increased 18% to $540 million in February 2024 compared to $455 million in the same month of last year.

Overseas Pakistanis sent 19% higher remittances from the UAE at $385 million compared to $324 million in the corresponding month of last year.

The expatriates dispatched 9% higher funds from the UK at $346 million compared to $317 million in February last year. They remitted 7% higher funds from EU counties that reached $263 million compared to $245 million in the previous year.

From the US, they dispatched $287 million, exhibiting a growth of 31% compared to $220 million last year.

The non-resident Pakistanis sent 102% higher remittances from other countries that touched $196 million compared to $97 million in the same month of last year.

Published in The Express Tribune, March 9th, 2024.

Pakistan: -1,620,000

Pakistan: -1,620,000 Sudan: -1,350,000

Sudan: -1,350,000 India: -979,000

India: -979,000 China: -568,000

China: -568,000 Bangladesh: -550,000

Bangladesh: -550,000 Nepal: -410,000

Nepal: -410,000 Turkey: -318,000

Turkey: -318,000 Ukraine: -300,000

Ukraine: -300,000 Brazil: -240,000

Brazil: -240,000 Philippines: -164,000

Philippines: -164,000 Greece: -159,000

Greece: -159,000 Uganda: -126,000

Uganda: -126,000 Venezuela: -113,000

Venezuela: -113,000 Mexico: -101,000

Mexico: -101,000 Zimbabwe: -97,000

Zimbabwe: -97,000 Azerbaijan: -84,000

Azerbaijan: -84,000 Vietnam: -82,000

Vietnam: -82,000 Nigeria: -58,000

Nigeria: -58,000 Afghanistan: -49,000

Afghanistan: -49,000 Mali: -40,000

Mali: -40,000