Saif

Senior Member

- Messages

- 17,462

- Likes

- 8,403

- Nation

- Residence

- Axis Group

Foreign investment pipeline created thru summit: BIDA

A foreign investment pipeline has been created for the country through Bangladesh Investment Summit 2025 organised by the Bangladesh Investment Development Authority...

www.newagebd.net

www.newagebd.net

Foreign investment pipeline created thru summit: BIDA

Staff Correspondent 10 April, 2025, 23:10

Bangladesh Investment Development Authority business development head Nahian Rahman Rochi, executive member Shah Mohammad Mahbub, BEZA director general Doyananda Debnath and chief adviser’s deputy press secretary Mohammad Abul Kalam Azad Majumder are present at a press conference at Hotel Intercontinental in the capital Dhaka on Thursday. | BSS photo

A foreign investment pipeline has been created for the country through Bangladesh Investment Summit 2025 organised by the Bangladesh Investment Development Authority.

BIDA’s Business Development Department head Nahian Rahman made the remark at the closing press conference of the summit at the Intercontinental Hotel in the capital on Thursday.

He also said that the BIDA will maintain continuous communications and monitoring with the company that proposed or promised to invest in Bangladesh.

Responding to a question about whether the government has taken steps to address investors› concerns about resolving bureaucratic complications, he said that earlier, there were bureaucratic complexities due to a large number of ministers and state ministers.

However, with an advisory panel of 24-25 advisers, the issues have been centralised, and they are trying to resolve the bureaucratic complexities.

He said that the investors have reported several problems, including access to resources, continuity of policies, and corruption in broad strokes, and they are working to resolve these problems.

He also said that the BIDA will make an 18–24-month roadmap based on the summit.

‘Investors usually take 18 to 24 months to formalise the investment process. We will contact them after assessing each proposal.’

He disclosed that there were 550 registrations here, and about 400-450 foreign investors participated in the summit.

‘We will share information the complete amount of investment and total number of the participating investors soon in a press conference,’ he added.

He also said that the government offices and the NBR are sluggish, and they are taking steps for inter-ministerial coordination to solve these complexities.

In response to another question, he said Chinese farm Handa Industries signed a deal to invest $150 million in the summit. Moreover, ShopUp also received an investment of $110 million.

‘We will announce the total number of investment proposals received in the summit soon,’ he added.

In the summit, the Bangladesh Garment Manufacturers and Exporters Association and HSBC organised a session titled ‘Apparel & Textiles’.

In the session, Kihak Sung, chairman and CEO of Youngone, presented the keynote titled ‘Bangladesh Moving Forward: Through an Investor’s Lens’.

The session featured expert panel discussions on two critical themes: sustainability and export infrastructure.

Kihak Sung said that Bangladesh can become the world›s leading garment exporter if it can implement the right strategies and reforms.

‘Bangladesh is the second largest garment exporter in the world as a single country. To reach the top position, Bangladesh will have to upgrade its technology and upscale its workers,’ he added.

He also said that Bangladesh has to produce high-value products to survive in the market in the coming days.

He also said that three-month pause on the Trump-era tariff policy has brought some relief and the government must take proactive steps in this regard.

BGMEA administrator Md Anwar Hossain also spoke at the event.

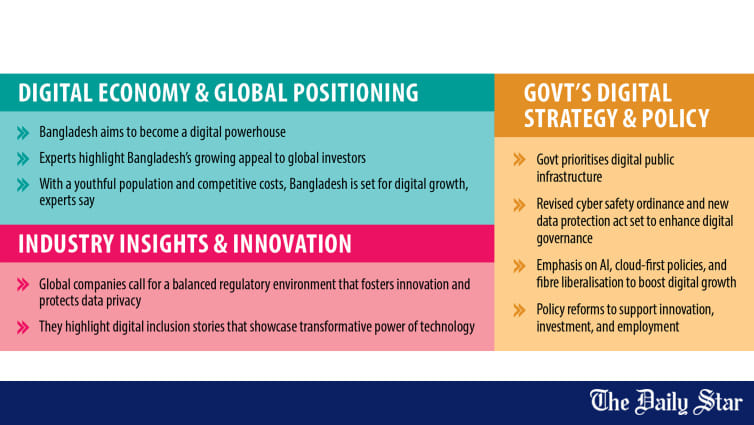

Meanwhile, in partnership with BIDA and UNDP, Citi NA organised A Digital Economy session.

Faiz Ahmad Taiyeb, policy adviser for the ICT Division, gave the keynote presentation during the session.

He said the government was reforming policies to boost the digital economy and preparing the Cyber Security Ordinance, Personal Data Protection Act, Semiconductor Policy, and National Artificial Intelligence Policy.

Md Mainul Haque, country officer of City NA, said Bangladesh can achieve great success through the digital economy even with little capital.

Rujan Sarwar, head of public policy for Meta, Bangladesh, and Nepal, said small entrepreneurs can expand their businesses through advertising on Meta›s Facebook, Instagram, Messenger, and WhatsApp.

Meanwhile, Abdul Samad Dawood, CEO of Engro Holdings of Pakistan, met with chief adviser Professor Muhammad Yunus to discuss investment opportunities in Bangladesh.

During the meeting, the Engro CEO expressed a strong interest in expanding the company›s footprint in Bangladesh, particularly telecommunications and energy.

Moreover, on Thursday, the final day of the Bangladesh Investment Summit, BIDA, UNDP, and ILO organised a roundtable on leveraging the nexus between trade, investment, governance, and responsible business conduct for decent work.

Staff Correspondent 10 April, 2025, 23:10

Bangladesh Investment Development Authority business development head Nahian Rahman Rochi, executive member Shah Mohammad Mahbub, BEZA director general Doyananda Debnath and chief adviser’s deputy press secretary Mohammad Abul Kalam Azad Majumder are present at a press conference at Hotel Intercontinental in the capital Dhaka on Thursday. | BSS photo

A foreign investment pipeline has been created for the country through Bangladesh Investment Summit 2025 organised by the Bangladesh Investment Development Authority.

BIDA’s Business Development Department head Nahian Rahman made the remark at the closing press conference of the summit at the Intercontinental Hotel in the capital on Thursday.

He also said that the BIDA will maintain continuous communications and monitoring with the company that proposed or promised to invest in Bangladesh.

Responding to a question about whether the government has taken steps to address investors› concerns about resolving bureaucratic complications, he said that earlier, there were bureaucratic complexities due to a large number of ministers and state ministers.

However, with an advisory panel of 24-25 advisers, the issues have been centralised, and they are trying to resolve the bureaucratic complexities.

He said that the investors have reported several problems, including access to resources, continuity of policies, and corruption in broad strokes, and they are working to resolve these problems.

He also said that the BIDA will make an 18–24-month roadmap based on the summit.

‘Investors usually take 18 to 24 months to formalise the investment process. We will contact them after assessing each proposal.’

He disclosed that there were 550 registrations here, and about 400-450 foreign investors participated in the summit.

‘We will share information the complete amount of investment and total number of the participating investors soon in a press conference,’ he added.

He also said that the government offices and the NBR are sluggish, and they are taking steps for inter-ministerial coordination to solve these complexities.

In response to another question, he said Chinese farm Handa Industries signed a deal to invest $150 million in the summit. Moreover, ShopUp also received an investment of $110 million.

‘We will announce the total number of investment proposals received in the summit soon,’ he added.

In the summit, the Bangladesh Garment Manufacturers and Exporters Association and HSBC organised a session titled ‘Apparel & Textiles’.

In the session, Kihak Sung, chairman and CEO of Youngone, presented the keynote titled ‘Bangladesh Moving Forward: Through an Investor’s Lens’.

The session featured expert panel discussions on two critical themes: sustainability and export infrastructure.

Kihak Sung said that Bangladesh can become the world›s leading garment exporter if it can implement the right strategies and reforms.

‘Bangladesh is the second largest garment exporter in the world as a single country. To reach the top position, Bangladesh will have to upgrade its technology and upscale its workers,’ he added.

He also said that Bangladesh has to produce high-value products to survive in the market in the coming days.

He also said that three-month pause on the Trump-era tariff policy has brought some relief and the government must take proactive steps in this regard.

BGMEA administrator Md Anwar Hossain also spoke at the event.

Meanwhile, in partnership with BIDA and UNDP, Citi NA organised A Digital Economy session.

Faiz Ahmad Taiyeb, policy adviser for the ICT Division, gave the keynote presentation during the session.

He said the government was reforming policies to boost the digital economy and preparing the Cyber Security Ordinance, Personal Data Protection Act, Semiconductor Policy, and National Artificial Intelligence Policy.

Md Mainul Haque, country officer of City NA, said Bangladesh can achieve great success through the digital economy even with little capital.

Rujan Sarwar, head of public policy for Meta, Bangladesh, and Nepal, said small entrepreneurs can expand their businesses through advertising on Meta›s Facebook, Instagram, Messenger, and WhatsApp.

Meanwhile, Abdul Samad Dawood, CEO of Engro Holdings of Pakistan, met with chief adviser Professor Muhammad Yunus to discuss investment opportunities in Bangladesh.

During the meeting, the Engro CEO expressed a strong interest in expanding the company›s footprint in Bangladesh, particularly telecommunications and energy.

Moreover, on Thursday, the final day of the Bangladesh Investment Summit, BIDA, UNDP, and ILO organised a roundtable on leveraging the nexus between trade, investment, governance, and responsible business conduct for decent work.