Saif

Senior Member

- Joined

- Jan 24, 2024

- Messages

- 15,898

- Likes

- 7,990

- Nation

- Axis Group

Over 450 textile, RMG units cut freshwater usage by 35b litres

Over 450 textiles and readymade garment factories in Bangladesh under IFC-led programme ‘Partnership for Cleaner Textile’ have reduced freshwater consumption by 35 billion litres and cut wastewater discharge by 29 billion litres annually...

www.newagebd.net

www.newagebd.net

Over 450 textile, RMG units cut freshwater usage by 35b litres

Staff Correspondent 02 June, 2024, 22:36

A file photo shows workers sewing clothes at a readymade garment factory at Savar, on the outskirts of Dhaka. | New Age photo

Over 450 textiles and readymade garment factories in Bangladesh under IFC-led programme 'Partnership for Cleaner Textile' have reduced freshwater consumption by 35 billion litres and cut wastewater discharge by 29 billion litres annually.

On the occasion of the 10-year anniversary of the PaCT programme, International Finance Corporation stated that freshwater saved through the reduced consumption under the initiative could meet the annual water need of over 1.9 million people.

Now, these factories save 3.8 million megawatt hours in energy per year and have reduced carbon emissions by 7,23,617 tonnes annually — equivalent to removing nearly 1,60,000 cars from the road each year.

To bring systemic and positive change to the textile value chain in Bangladesh, IFC's partnership for PaCT programme has catalysed transformative change over the last 10 years, contributing to the sector's competitiveness and environmental sustainability, the statement said.

The advisory programme PaCT — supported by Denmark and the Netherlands —is spearheaded by IFC and implemented in collaboration with the Bangladesh Garment Manufacturers and Exporters Association.

Over the years, PaCT has also been working with leading partners, including VF Corp, PUMA, Levi Strauss & Co and TESCO.

'Let me stress how pleased we are to see that PaCT has become a market leader in both its scale and comprehensiveness of its activities, especially on advisory support for energy efficiency and renewable energy,' said Denmark ambassador to Bangladesh Christian Brix Moller.

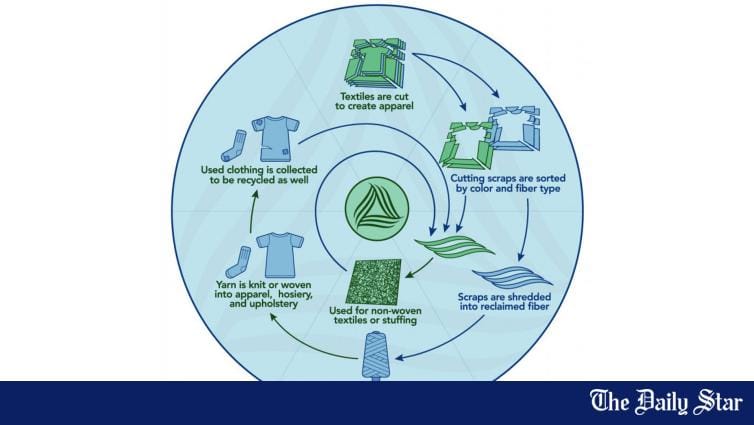

According to IFC, the PaCT programme was launched to support the entire textile value chain — spinning, weaving, wet processing and garment factories — in adopting cleaner production practices.

The programme engaged with brands, technology suppliers, industrial associations, financial institutions and the government to bring about systemic and positive environmental changes in Bangladesh's textile sector, contributing to its long-term competitiveness and environmental sustainability.

To read the rest of the news, please click on the link above.

Staff Correspondent 02 June, 2024, 22:36

A file photo shows workers sewing clothes at a readymade garment factory at Savar, on the outskirts of Dhaka. | New Age photo

Over 450 textiles and readymade garment factories in Bangladesh under IFC-led programme 'Partnership for Cleaner Textile' have reduced freshwater consumption by 35 billion litres and cut wastewater discharge by 29 billion litres annually.

On the occasion of the 10-year anniversary of the PaCT programme, International Finance Corporation stated that freshwater saved through the reduced consumption under the initiative could meet the annual water need of over 1.9 million people.

Now, these factories save 3.8 million megawatt hours in energy per year and have reduced carbon emissions by 7,23,617 tonnes annually — equivalent to removing nearly 1,60,000 cars from the road each year.

To bring systemic and positive change to the textile value chain in Bangladesh, IFC's partnership for PaCT programme has catalysed transformative change over the last 10 years, contributing to the sector's competitiveness and environmental sustainability, the statement said.

The advisory programme PaCT — supported by Denmark and the Netherlands —is spearheaded by IFC and implemented in collaboration with the Bangladesh Garment Manufacturers and Exporters Association.

Over the years, PaCT has also been working with leading partners, including VF Corp, PUMA, Levi Strauss & Co and TESCO.

'Let me stress how pleased we are to see that PaCT has become a market leader in both its scale and comprehensiveness of its activities, especially on advisory support for energy efficiency and renewable energy,' said Denmark ambassador to Bangladesh Christian Brix Moller.

According to IFC, the PaCT programme was launched to support the entire textile value chain — spinning, weaving, wet processing and garment factories — in adopting cleaner production practices.

The programme engaged with brands, technology suppliers, industrial associations, financial institutions and the government to bring about systemic and positive environmental changes in Bangladesh's textile sector, contributing to its long-term competitiveness and environmental sustainability.

To read the rest of the news, please click on the link above.