A difficult year on the apparel factory floor

Despite headline growth, 2025 tested garment exporters across markets and margins

Throughout 2025, local garment makers had to spend much of their time recalculating decisions rather than executing long-term plans in their production lines.

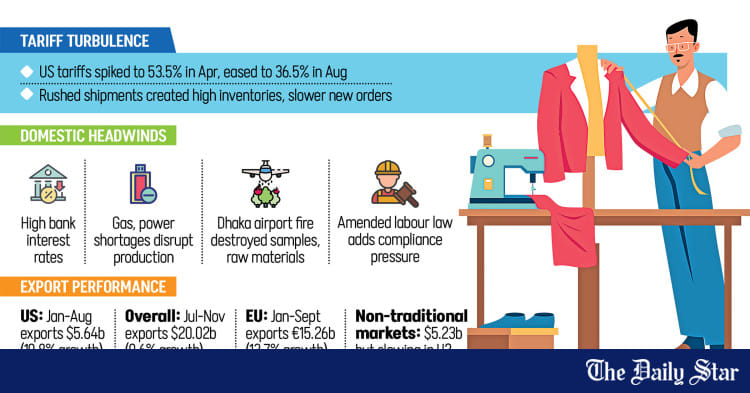

The main uncertainty was how much duty their shipments would face in the US, the largest single-country market for Bangladesh. From April, tariff rates shifted punishingly upwards before settling in August at levels higher than before. By the time some stability returned, much of the damage to margins and order planning had already been done.

Google News LinkFor all latest news, follow The Daily Star's Google News channel.

External volatility coincided with mounting pressures at home.

High bank interest rates squeezed working capital, while inconsistent gas and power supplies disrupted operations. Trade tensions with India continued throughout the year, complicating logistics and sourcing.

In October, a fire at Dhaka airport destroyed garment samples, imported accessories and raw materials worth millions of dollars. Lately, tighter labour rules have added to the manufacturers' concerns.

Looming over all of it was the approach of graduation from the least developed country club in 2026, which would strip away preferential market treatments for "Made in Bangladesh" items.

Exporters say 2025 failed to deliver the stability or margins they had hoped for, despite pockets of shipment growth. Expectations of improvement have largely been deferred to 2026, resting more on political timing and buyer behaviour than on any clear easing of structural pressures.

On April 2 this year, the US announced reciprocal tariffs on several countries, including Bangladesh, setting the rate at 37 percent on apparel, on top of the existing 16.5 percent rate. The move lifted the effective tariff to 53.5 percent, raising costs for exporters and buyers at a time when global demand was already fragile.

After negotiations, the tariff was reduced to 20 percent from August 7, bringing the effective rate down to 36.5 percent.

As part of the agreement, Dhaka committed to importing more American goods to narrow the annual bilateral trade deficit of about $6 billion, tilted towards Bangladesh.

The relief came somewhat late to restore momentum.

Many exporters had already rushed shipments between April and August to avoid higher duties. That front-loading left international retailers with high inventories, which in turn slowed new order placement later in the year, even after US tariffs eased.

In the January-August period, US apparel imports grew 3.32 percent year-on-year to $53.01 billion.

Exports from the country to the US increased 19.82 percent to $5.64 billion over the same period, according to the Office of Textiles and Apparel.

Data from the Export Promotion Bureau (EPB), compiled by the Bangladesh Garment Manufacturers and Exporters Association (BGMEA), show exports to the US at $2.59 billion during the July-October period, up 5.14 percent year-on-year and accounting for nearly one-fifth of total garment shipments.

Overall export earnings tell a flatter story. Total exports rose just 0.62 percent year-on-year to $20.02 billion during the July-November period.

Garment exports increased 1.67 percent to $35.28 billion in the January-November period, far below the double-digit growth rates the sector once considered routine.

"For business, 2025 has not been a good year as companies are facing many domestic and external challenges," said Md Fazlul Hoque, managing director of Plummy Fashions Ltd.

"The situation could improve next year, as an election is scheduled and buyers are expected to place larger volumes of work orders," he added.

Abdul Hai Sarker, chairman and chief executive of Purbani Group, expressed similar views.

Inamul Haq Khan, senior vice-president of BGMEA, also pointed to electoral timing. "Usually, international retailers and brands hold back some work orders before the general election and place full orders after it," he said.

"This year, Christmas sales in the US were disappointing, as clothing prices rose due to higher tariffs," said Khan.

In 2025, export trends to the European bloc were also mixed.

Garment exports to the European Union rose 13.7 percent year-on-year to €15.26 billion in the January-September period, according to Eurostat, as more recent data is unavailable.

During the July-November period, exports to the EU accounted for nearly half of total garment shipments, although earnings from the bloc edged down slightly compared with the same period a year earlier, according to Mohiuddin Rubel, former BGMEA director and managing director of Bangladesh Apparel Exchange Ltd.

He said that Canada and the United Kingdom recorded steady, if unspectacular, export growth.

Non-traditional markets such as Japan, South Korea and India contributed $5.23 billion in the January-October period, or about 16 percent of total exports.

Momentum there faded later in the year, with shipments to these destinations declining during the July-November period, underlining the limits of diversification at a time when exporters had hoped newer markets would soften shocks elsewhere, according to former BGMEA director Rubel.

"The slowdown in garment exports to new markets was a surprising shock for Bangladesh, as shipments to these markets had remained high for many years," said BGMEA Senior Vice-President Inamul Haq Khan.

He added that market peers, including India, China, Vietnam and Pakistan, were sending large volumes to these destinations while also facing higher US tariffs.

Bangladesh did not receive the expected volume of shifting orders from China, as Vietnam, Indonesia and Myanmar got a larger share.

Khan said Brazil is emerging as a promising market, although competition from Indonesia is intensifying.

Performance also diverged by product segment. Knitwear exports slipped slightly during the early months of the current fiscal year, while woven garments recorded slight growth. The split points to uneven demand and cost pressures rather than a broad-based recovery.

Meanwhile, gas shortages hurt spinning mills, a problem worsened by cheaper yarn imports from India. The suspension of transshipment facilities through India in April disrupted logistics, while retaliatory trade restrictions at land ports further slowed cross-border movement.

Several large factories that closed after the political changeover in 2024 have attempted to reopen but remain entangled in bureaucratic processes.

As the year draws to a close, the garment sector somewhat stands on uncertain ground. The hope of stronger performance in 2026 depends on calmer politics, steadier trade relations and renewed buyer confidence.