Saif

Senior Member

- Joined

- Jan 24, 2024

- Messages

- 16,880

- Likes

- 8,153

- Nation

- Residence

- Axis Group

Reforming Bangladesh's banking sector - piecemeal or holistic approach?

Haradhan Sarker Bangladesh Bank (BB) in the current regime of the interim government is committed to reforming the banking sector. It is a long-awaited requirement to streamline the banking system of the country, and fortunately,

Reforming Bangladesh's banking sector - piecemeal or holistic approach?

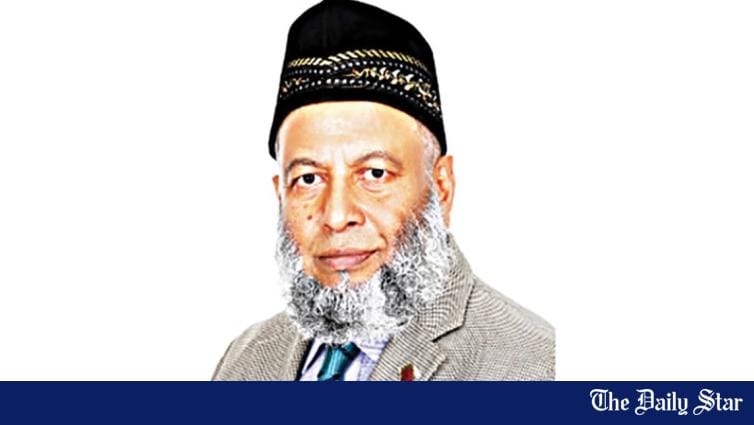

Haradhan Sarker

Published :

Nov 22, 2025 23:56

Updated :

Nov 23, 2025 00:03

A bank staff counting notes at a bank in Dhaka —FE Photo

Bangladesh Bank (BB) in the current regime of the interim government is committed to reforming the banking sector. It is a long-awaited requirement to streamline the banking system of the country, and fortunately, the steps already taken by the central bank deserve appreciation. However, planned efforts are a must for reforms to be effective and sustainable. Present focus would, therefore, be upon the nature and structure of reform initiatives as well as their cohesiveness and congruence towards development of a good banking governance model. Obviously, a holistic approach to reforms instead of a piecemeal one is critically required to align with the excellence of governance in banking in the modern context.

OVERVIEW OF REFORM INITIATIVES: The entire set of reform initiatives is not easily available in a single source. However, most of the reform activities/steps/decisions have been obtained from the monetary policy statement (July-December 2025), some from BB circulars and newspapers. These are briefly described below:

Bangladesh Bank (BB) has formed three task forces-- Banking Sector Reforms Task Force (BSR-TF) entrusted with strengthening regulatory framework, improving asset quality, and developing effective bank resolution, the second Task Force entrusted with strengthening Bangladesh Bank's institutional capacity and restructuring its operations, and the third Task Force entrusted with identification, investigation, and repatriation of assets siphoned off from Bangladesh.

The BSR-TF has introduced the Asset Quality Review (AQR) framework and issued suitable regulations to facilitate independent assessments by internationally recognised consulting firms. Accordingly, BB has signed a Memorandum of Understanding (MoU) with the UK's Foreign, Commonwealth & Development Office (FCDO) to get technical assistance from Deloitte LLP for the reforms .

BB has set up Bank Resolution Department and subsequently finalised the Bank Resolution Ordinance (BRO) 2025 empowering BB to initiate a resolution process for distressed banks.

A draft Bangladesh Bank Order 2025 has been framed and is currently under review.

Bangladesh Bank dissolved 15 Boards of Directors and reconstructed them to restore effective governance and ensure sound bank management. BB also issued a circular titled "Transactions with Bank-Related Persons or Institutions" on May 8, 2025. The bank-related persons or institutions include current directors, MDs or CEOs, significant shareholders, their family members, the ultimate beneficial owner (UBO), and affiliated institutions. In fact, the circular imposes stricter limits and provisions on extending credit facilities to such bank-related persons or institutions.

To expedite proceedings, managing recovered assets, coordinating with international partners for information sharing, and strengthening institutional capacity and internal coordination to ensure effective asset recovery, the Ministry of Finance issued two circulars on June 15, 2025, restructuring the Inter-Agency Task Force on Stolen Asset Recovery and Management, chaired by the Governor of the Bank and coordinated by the Head of the BFIU. The BFIU has formed Joint Investigation Teams (JITs), led by the Anti-Corruption Commission (ACC).

7.Bangladesh Bank revised Core Risk Guidelines, including the Guidelines on Credit Risk Management (CRM) for banks and issued a circular addressed to all scheduled banks regarding introduction and implementation of Risk-Based Supervision (RBS) in banking from January, 2026.

A total of 17 banks were selected for AQR in three phases. The first phase covering six banks has been completed with KPMG and Ernst & Young (EY) Sri Lanka engaged to conduct the assessments. BB continued its coordination with development partners including the World Bank and the Asian Development Bank (ADB) to launch the second and third phases of the AQR, covering the remaining 11 banks.

Amendments were made to the Bank Companies Act, Money Laundering Act, and Deposit Insurance Act to improve accountability and loan recovery. Reforms are being made to Money Loan Court Act to help resolve long-pending loan default cases more effectively.

Bangladesh Bank provided stringent guidelines on loan classification, provisioning, and recovery, effective from April 2025. BB has decided to implement an Expected Credit Loss (ECL) methodology (similar to IFRS 9) by 2027. Under Phase I, scheduled banks are now complying with BB's directives and have submitted Time-Bound Action Plans. These plans include pre-assessment reports detailing the transition from the existing rule-based model to the ECL model, anticipated challenges, and necessary actions for full implementation of IFRS 9.

The Prompt Corrective Action (PCA) framework was put into effect on March 31, 2025. This provides early-warning tools (capital, NPL, liquidity, governance metrics) for regulator's intervention to address financially weak banks.

OBSERVATIONS: Reform efforts are going on but seem to be not backed by any master plan. Problems are cropping up and then courses of actions are being designed and implemented. We observe no integrated framework to develop a sustainable, effective, efficient, transparent, accountable and dynamic governance model in banking industry.

Now what is going in the name of reforms is just on piece-meal and major problem-centred basis. Individually many reform steps are appropriate and essential but collectively lack strategic cohesiveness. For examples : (i) mounting NPLs have led to Assets Quality Review (AQR); (ii) Dissolution of Boards of Directors triggered by governance failure in selected banks; (iii) Amendment to Deposit Insurance Act is the outcome of eroding depositors' confidence; (iv) Huge bank money siphoned off has caused amendments to money laundering Act; and so on. Undoubtedly , the problems are severe and need urgent actions All these phenomena along with related minor and major issues should be analysed introspectively and considering short and long-run perspectives.

Now-a-days, spurred by rapidly flourishing technology and ever-increasing competitive environment, banks are facing new challenges, risks, situations, and new activities are being added to the conventional set of banking activities. Against this backdrop, renovation of the existing governance system in banking is crucial. Since even 54 years after independence, we could not construct a solid foundation for banking sector governance, we need fundamental reforms. Partial reforms would be something like patch-work. We ardently expect our newly-constituted task forces to present before the nation a good governance model for our banking sector. Successful implementation of a new model is, among other several factors, largely determined by the commitment of the political government.

Haradhan Sarker, PhD, is ex-Financial Analyst, Sonali Bank & retired Professor of Management.

Haradhan Sarker

Published :

Nov 22, 2025 23:56

Updated :

Nov 23, 2025 00:03

A bank staff counting notes at a bank in Dhaka —FE Photo

Bangladesh Bank (BB) in the current regime of the interim government is committed to reforming the banking sector. It is a long-awaited requirement to streamline the banking system of the country, and fortunately, the steps already taken by the central bank deserve appreciation. However, planned efforts are a must for reforms to be effective and sustainable. Present focus would, therefore, be upon the nature and structure of reform initiatives as well as their cohesiveness and congruence towards development of a good banking governance model. Obviously, a holistic approach to reforms instead of a piecemeal one is critically required to align with the excellence of governance in banking in the modern context.

OVERVIEW OF REFORM INITIATIVES: The entire set of reform initiatives is not easily available in a single source. However, most of the reform activities/steps/decisions have been obtained from the monetary policy statement (July-December 2025), some from BB circulars and newspapers. These are briefly described below:

Bangladesh Bank (BB) has formed three task forces-- Banking Sector Reforms Task Force (BSR-TF) entrusted with strengthening regulatory framework, improving asset quality, and developing effective bank resolution, the second Task Force entrusted with strengthening Bangladesh Bank's institutional capacity and restructuring its operations, and the third Task Force entrusted with identification, investigation, and repatriation of assets siphoned off from Bangladesh.

The BSR-TF has introduced the Asset Quality Review (AQR) framework and issued suitable regulations to facilitate independent assessments by internationally recognised consulting firms. Accordingly, BB has signed a Memorandum of Understanding (MoU) with the UK's Foreign, Commonwealth & Development Office (FCDO) to get technical assistance from Deloitte LLP for the reforms .

BB has set up Bank Resolution Department and subsequently finalised the Bank Resolution Ordinance (BRO) 2025 empowering BB to initiate a resolution process for distressed banks.

A draft Bangladesh Bank Order 2025 has been framed and is currently under review.

Bangladesh Bank dissolved 15 Boards of Directors and reconstructed them to restore effective governance and ensure sound bank management. BB also issued a circular titled "Transactions with Bank-Related Persons or Institutions" on May 8, 2025. The bank-related persons or institutions include current directors, MDs or CEOs, significant shareholders, their family members, the ultimate beneficial owner (UBO), and affiliated institutions. In fact, the circular imposes stricter limits and provisions on extending credit facilities to such bank-related persons or institutions.

To expedite proceedings, managing recovered assets, coordinating with international partners for information sharing, and strengthening institutional capacity and internal coordination to ensure effective asset recovery, the Ministry of Finance issued two circulars on June 15, 2025, restructuring the Inter-Agency Task Force on Stolen Asset Recovery and Management, chaired by the Governor of the Bank and coordinated by the Head of the BFIU. The BFIU has formed Joint Investigation Teams (JITs), led by the Anti-Corruption Commission (ACC).

7.Bangladesh Bank revised Core Risk Guidelines, including the Guidelines on Credit Risk Management (CRM) for banks and issued a circular addressed to all scheduled banks regarding introduction and implementation of Risk-Based Supervision (RBS) in banking from January, 2026.

A total of 17 banks were selected for AQR in three phases. The first phase covering six banks has been completed with KPMG and Ernst & Young (EY) Sri Lanka engaged to conduct the assessments. BB continued its coordination with development partners including the World Bank and the Asian Development Bank (ADB) to launch the second and third phases of the AQR, covering the remaining 11 banks.

Amendments were made to the Bank Companies Act, Money Laundering Act, and Deposit Insurance Act to improve accountability and loan recovery. Reforms are being made to Money Loan Court Act to help resolve long-pending loan default cases more effectively.

Bangladesh Bank provided stringent guidelines on loan classification, provisioning, and recovery, effective from April 2025. BB has decided to implement an Expected Credit Loss (ECL) methodology (similar to IFRS 9) by 2027. Under Phase I, scheduled banks are now complying with BB's directives and have submitted Time-Bound Action Plans. These plans include pre-assessment reports detailing the transition from the existing rule-based model to the ECL model, anticipated challenges, and necessary actions for full implementation of IFRS 9.

The Prompt Corrective Action (PCA) framework was put into effect on March 31, 2025. This provides early-warning tools (capital, NPL, liquidity, governance metrics) for regulator's intervention to address financially weak banks.

OBSERVATIONS: Reform efforts are going on but seem to be not backed by any master plan. Problems are cropping up and then courses of actions are being designed and implemented. We observe no integrated framework to develop a sustainable, effective, efficient, transparent, accountable and dynamic governance model in banking industry.

Now what is going in the name of reforms is just on piece-meal and major problem-centred basis. Individually many reform steps are appropriate and essential but collectively lack strategic cohesiveness. For examples : (i) mounting NPLs have led to Assets Quality Review (AQR); (ii) Dissolution of Boards of Directors triggered by governance failure in selected banks; (iii) Amendment to Deposit Insurance Act is the outcome of eroding depositors' confidence; (iv) Huge bank money siphoned off has caused amendments to money laundering Act; and so on. Undoubtedly , the problems are severe and need urgent actions All these phenomena along with related minor and major issues should be analysed introspectively and considering short and long-run perspectives.

Now-a-days, spurred by rapidly flourishing technology and ever-increasing competitive environment, banks are facing new challenges, risks, situations, and new activities are being added to the conventional set of banking activities. Against this backdrop, renovation of the existing governance system in banking is crucial. Since even 54 years after independence, we could not construct a solid foundation for banking sector governance, we need fundamental reforms. Partial reforms would be something like patch-work. We ardently expect our newly-constituted task forces to present before the nation a good governance model for our banking sector. Successful implementation of a new model is, among other several factors, largely determined by the commitment of the political government.

Haradhan Sarker, PhD, is ex-Financial Analyst, Sonali Bank & retired Professor of Management.