Saif

Senior Member

- Joined

- Jan 24, 2024

- Messages

- 17,149

- Likes

- 8,163

- Nation

- Residence

- Axis Group

S Alam issues legal action threat against Bangladesh: UK newspaper

Mohammed Saiful Alam, chairman and founder of S Alam Group, has claimed protection under his Singapore citizenship from what he described as a ‘campaign of intimidation’ led by Bangladesh Bank governor Ahsan H Mansur against his business conglomerate, according to a report published by the...

www.newagebd.net

www.newagebd.net

S Alam issues legal action threat against Bangladesh: UK newspaper

Staff Correspondent 20 November, 2024, 06:36

Mohammed Saiful Alam, chairman and founder of S Alam Group, has claimed protection under his Singapore citizenship from what he described as a ‘campaign of intimidation’ led by Bangladesh Bank governor Ahsan H Mansur against his business conglomerate, according to a report published by the Financial Times on Monday.

In a letter issued by law firm Quinn Emanuel Urquhart & Sullivan on behalf of Saiful and his family, they warned governor Mansur of potential international arbitration proceedings against Bangladesh.

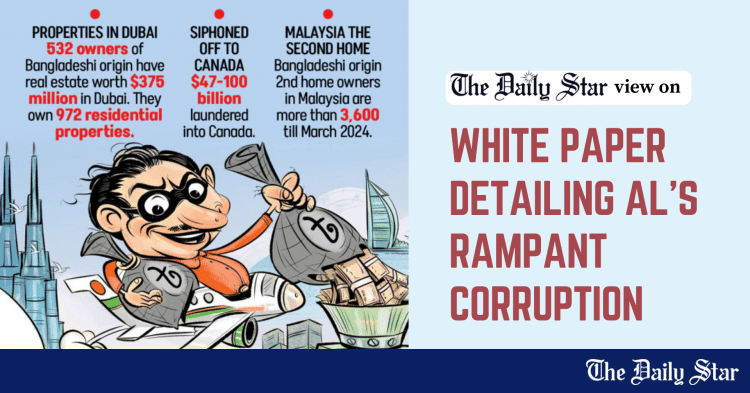

This development follows Mansur’s allegations, published in an interview with British daily Financial Times, that Saiful and associates withdrew at least Tk 1.2 trillion ($10 billion) from Bangladeshi banks during the tenure of now deposed prime minister Sheikh Hasina.

According to the Financial Times report, the letter accuses Mansur of making ‘inflammatory and unsubstantiated public comments’ amounting to a ‘campaign of intimidation against the business group’ that it said employs about 2,00,000 people directly and indirectly in Bangladesh.

The letter and Saiful’s threat to initiate international arbitration mark his most serious opposition to the Bangladesh’s interim government, led by Nobel Peace Prize laureate Muhammad Yunus, which came to power after a student-led mass uprising toppling Sheikh Hasina on August 5.

Mansur, a former International Monetary Fund official who was appointed Bangladesh Bank governor in August, told the British daily last month that Saiful and his cronies had siphoned off money out of the banking sector after taking over the top banks with the help of the members of a powerful military intelligence agency.

Mansur alleged that Saiful, his associates and other groups employed machinations, including loans issued to the banks’ new shareholders, and inflating import invoices, to carry out the ‘biggest, highest robbing of banks by any international standards’.

S Alam Group, which has interests in sectors including food, construction, garments, and banking, rejected Mansur’s allegations last month, saying in a statement through Quinn Emanuel that there was ‘no truth’ in them.

The letter to Mansur—sent on behalf of Saiful Alam, his wife Farzana Parveen and his sons Ashraful Alam and Asadul Alam Mahir, who are said to jointly own and control the ‘major part’ of the S Alam Group, described the allegations as ‘deliberately false” and slanderous’.

‘Your statements only further the aims of an apparent campaign designed to destroy the S Alam Group, and therefore also the investors’ investments,’ it said. ‘It’s remarkable that you seem to be running this campaign, if not organising it.’

The letter also mentioned that all the four investors were Singapore citizens.

A spokesperson for Quinn Emanuel did not respond to the Financial Time’s request for comment on when Saiful Alam’s family had acquired Singaporean citizenship and whether they remained Bangladeshi citizens as well. The government of Singapore did not respond to a request for comment.

Bangladesh and Singapore have a bilateral investment protection treaty dating from 2004.

The letter also cited Bangladesh’s bilateral investment treaty with Singapore and Bangladesh’s Foreign Private Investment Act of 1980 as grounds for protecting the rights of S Alam Group’s investors.

It warned Mansur that any continuation of his alleged campaign could result in legal actions, including arbitration through the International Centre for Settlement of Investment Disputes.

The letter said that if the central bank governor continued to ‘encroach on their rights’ by making ‘false statements’, they and S Alam Group would ‘have no choice but to take legal action’ against Mansur individually for the ‘damage you have inflicted’.

Mansur told the British daily that the claims he made in the interview were ‘fully substantiated’ when asked for a response to the letter.

‘They are still being documented because the range of corrupt activities is widespread across many banks and over many years. The full documentation will take some time,’ he added.

Staff Correspondent 20 November, 2024, 06:36

Mohammed Saiful Alam, chairman and founder of S Alam Group, has claimed protection under his Singapore citizenship from what he described as a ‘campaign of intimidation’ led by Bangladesh Bank governor Ahsan H Mansur against his business conglomerate, according to a report published by the Financial Times on Monday.

In a letter issued by law firm Quinn Emanuel Urquhart & Sullivan on behalf of Saiful and his family, they warned governor Mansur of potential international arbitration proceedings against Bangladesh.

This development follows Mansur’s allegations, published in an interview with British daily Financial Times, that Saiful and associates withdrew at least Tk 1.2 trillion ($10 billion) from Bangladeshi banks during the tenure of now deposed prime minister Sheikh Hasina.

According to the Financial Times report, the letter accuses Mansur of making ‘inflammatory and unsubstantiated public comments’ amounting to a ‘campaign of intimidation against the business group’ that it said employs about 2,00,000 people directly and indirectly in Bangladesh.

The letter and Saiful’s threat to initiate international arbitration mark his most serious opposition to the Bangladesh’s interim government, led by Nobel Peace Prize laureate Muhammad Yunus, which came to power after a student-led mass uprising toppling Sheikh Hasina on August 5.

Mansur, a former International Monetary Fund official who was appointed Bangladesh Bank governor in August, told the British daily last month that Saiful and his cronies had siphoned off money out of the banking sector after taking over the top banks with the help of the members of a powerful military intelligence agency.

Mansur alleged that Saiful, his associates and other groups employed machinations, including loans issued to the banks’ new shareholders, and inflating import invoices, to carry out the ‘biggest, highest robbing of banks by any international standards’.

S Alam Group, which has interests in sectors including food, construction, garments, and banking, rejected Mansur’s allegations last month, saying in a statement through Quinn Emanuel that there was ‘no truth’ in them.

The letter to Mansur—sent on behalf of Saiful Alam, his wife Farzana Parveen and his sons Ashraful Alam and Asadul Alam Mahir, who are said to jointly own and control the ‘major part’ of the S Alam Group, described the allegations as ‘deliberately false” and slanderous’.

‘Your statements only further the aims of an apparent campaign designed to destroy the S Alam Group, and therefore also the investors’ investments,’ it said. ‘It’s remarkable that you seem to be running this campaign, if not organising it.’

The letter also mentioned that all the four investors were Singapore citizens.

A spokesperson for Quinn Emanuel did not respond to the Financial Time’s request for comment on when Saiful Alam’s family had acquired Singaporean citizenship and whether they remained Bangladeshi citizens as well. The government of Singapore did not respond to a request for comment.

Bangladesh and Singapore have a bilateral investment protection treaty dating from 2004.

The letter also cited Bangladesh’s bilateral investment treaty with Singapore and Bangladesh’s Foreign Private Investment Act of 1980 as grounds for protecting the rights of S Alam Group’s investors.

It warned Mansur that any continuation of his alleged campaign could result in legal actions, including arbitration through the International Centre for Settlement of Investment Disputes.

The letter said that if the central bank governor continued to ‘encroach on their rights’ by making ‘false statements’, they and S Alam Group would ‘have no choice but to take legal action’ against Mansur individually for the ‘damage you have inflicted’.

Mansur told the British daily that the claims he made in the interview were ‘fully substantiated’ when asked for a response to the letter.

‘They are still being documented because the range of corrupt activities is widespread across many banks and over many years. The full documentation will take some time,’ he added.