Govt plans forming dedicated leather industry authority

The government has taken an initiative to establish a dedicated authority for the development and management of the leather industry, Bangladesh’s second-largest sector in terms of export earnings, with a focus on public and private enterprises.

Govt plans forming dedicated leather industry authority

Photo: Star Archive

The government has taken an initiative to establish a dedicated authority for the development and management of the leather industry, Bangladesh's second-largest sector in terms of export earnings, with a focus on public and private enterprises.

As a part of this, the Ministry of Industries published a draft of "Bangladesh Leather Industry Management Authority Act 2024" on its website on June 13 to avail feedback from stakeholders.

The move comes in response to demands from businesses for the creation of a dedicated authority under the Prime Minister's Office to diversify the country's export portfolio.

Prime Minister Sheikh Hasina had informed of the plans while inaugurating the Bangladesh Leather Footwear and Leathergoods International Sourcing Show in October last year.

Leather was once among Bangladesh's three main export items.

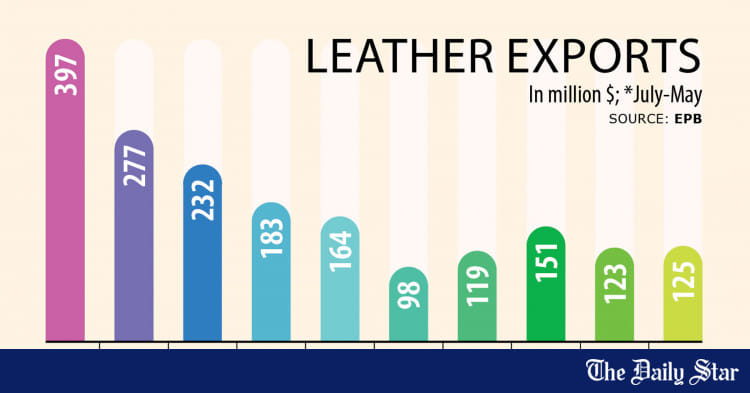

However, rising local value addition, poor compliance with international standards and a shift of buyers to other countries have led to leather exports declining by more than half over the past decade.

In fiscal year 2022-23, leather exports amounted to $123.44 million, down sharply from $397.54 million in FY14, according to data from the Export Promotion Bureau.

Bangladesh produces 400 million square feet of leather annually while there are 165 footwear and leather factories in the country, according to industry insiders.

According to the draft, the authority will be comprised of a chairman and three members while its main office will be in the Savar Tannery Industrial Estate.

The chairman will bear the rank of an additional secretary while the members of joint secretary, it said.

However, the draft also mentions that the authority will operate under an eight-member board, chaired by a secretary or senior secretary of the Ministry of Industries.

The members will include the chairpersons of the Bangladesh Small and Cottage Industries Corporation, Bangladesh Finished Leather, Leather goods and Footwear Exporters' Association and Bangladesh Tanners Association.

It will also include the director of the Institute of Leather Engineering and Technology under the University of Dhaka and representatives from the Ministry of Environment, Forest and Climate Change and the Ministry of Commerce.

Businesses have been demanding the formation of the authority for a long time, said Shaheen Ahamed, chairman of the Bangladesh Tanners Association, adding: "It would be great if it is under the Prime Minister's Office."

"…the problems of our sector will be identified very quickly, and it will be possible to solve those promptly. We have some observations…We will present them very soon," said Ahamed, also managing director of Anjuman Trading Corporation.

Photo: Star Archive

The government has taken an initiative to establish a dedicated authority for the development and management of the leather industry, Bangladesh's second-largest sector in terms of export earnings, with a focus on public and private enterprises.

As a part of this, the Ministry of Industries published a draft of "Bangladesh Leather Industry Management Authority Act 2024" on its website on June 13 to avail feedback from stakeholders.

The move comes in response to demands from businesses for the creation of a dedicated authority under the Prime Minister's Office to diversify the country's export portfolio.

Prime Minister Sheikh Hasina had informed of the plans while inaugurating the Bangladesh Leather Footwear and Leathergoods International Sourcing Show in October last year.

Leather was once among Bangladesh's three main export items.

However, rising local value addition, poor compliance with international standards and a shift of buyers to other countries have led to leather exports declining by more than half over the past decade.

In fiscal year 2022-23, leather exports amounted to $123.44 million, down sharply from $397.54 million in FY14, according to data from the Export Promotion Bureau.

Bangladesh produces 400 million square feet of leather annually while there are 165 footwear and leather factories in the country, according to industry insiders.

According to the draft, the authority will be comprised of a chairman and three members while its main office will be in the Savar Tannery Industrial Estate.

The chairman will bear the rank of an additional secretary while the members of joint secretary, it said.

However, the draft also mentions that the authority will operate under an eight-member board, chaired by a secretary or senior secretary of the Ministry of Industries.

The members will include the chairpersons of the Bangladesh Small and Cottage Industries Corporation, Bangladesh Finished Leather, Leather goods and Footwear Exporters' Association and Bangladesh Tanners Association.

It will also include the director of the Institute of Leather Engineering and Technology under the University of Dhaka and representatives from the Ministry of Environment, Forest and Climate Change and the Ministry of Commerce.

Businesses have been demanding the formation of the authority for a long time, said Shaheen Ahamed, chairman of the Bangladesh Tanners Association, adding: "It would be great if it is under the Prime Minister's Office."

"…the problems of our sector will be identified very quickly, and it will be possible to solve those promptly. We have some observations…We will present them very soon," said Ahamed, also managing director of Anjuman Trading Corporation.