Saif

Senior Member

- Messages

- 17,462

- Likes

- 8,403

- Nation

- Residence

- Axis Group

A shot in the arm for leather sector

Of the export sectors that did not perform well in the previous fiscal (FY2022-23), 'leather and leather goods' was one. The Export Promotion Bureau (EPB) data say that in FY23, this sector earned US$1.25 billion from exports which was 2.0 per cent less than that of the previous fiscal (FY22). In t

A shot in the arm for leather sector

FEPublished :

Mar 12, 2024 22:02Updated :

Mar 13, 2024 21:51

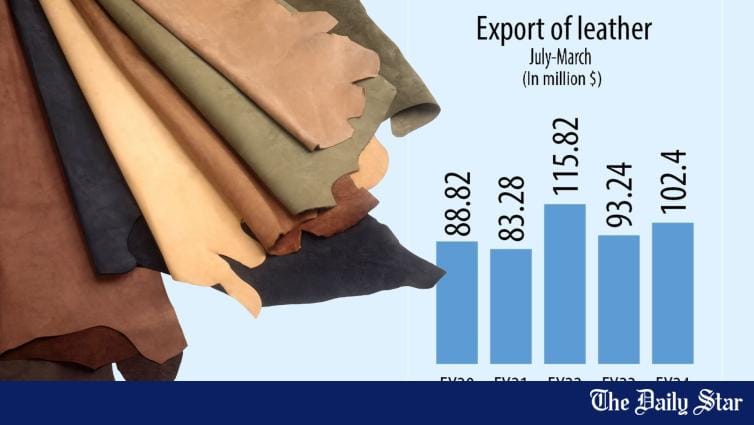

Of the export sectors that did not perform well in the previous fiscal (FY2022-23), 'leather and leather goods' was one. The Export Promotion Bureau (EPB) data say that in FY23, this sector earned US$1.25 billion from exports which was 2.0 per cent less than that of the previous fiscal (FY22). In the eight months between July and February of the current fiscal, the export earnings from this sector decreased by 14 per cent compared to those of the same period in the previous fiscal. Similarly, three other sectors including live and frozen fish, agricultural products and jute and jute goods also registered a decline in export. However, poor performance of the leather sector, which is the second biggest export earner after garment, is indeed concerning. Understandably, the decline in the demands for leather items in the European market, the main export destination of these products, had no doubt to do with wars and high inflation affecting that part of the world during the time in question. But that apart, the main hurdle before Bangladeshi leather items remained the tariff barrier raised by the export markets largely attributable to the failure (of local leather products) to meet the standards set by the Leather Working Group (LWG).

Notably, the LWG is a global non-profit platform dedicated to promoting best practices in leather sector. But meeting LWG's standards is an expensive option. The criterion set for leather and leather goods production facilities is to make them environment-friendly, which requires a lot of investment. Small wonder that our leather items fail to get fair price from western buyers as those are not LWG compliant. Against this backdrop, the government is learnt to have decided to reduce the tax deducted at source (TDS) on leather and leather goods export from the current 1.0 per cent by 50 per cent to 0.5 per cent.

The finance ministry has meanwhile directed the National Board of Revenue (NBR) to implement the order, to be effective till June 30, 2025, exclusively for leather and leather goods export. But, as reported, some pieces of good news are also there for companies paying below the usual 12 per cent year-end tax in addition to the uniform 1.0 per cent tax paid on their export value will also be allowed to pay source tax at a lower rate. In fact, the government move will prove to be a shot in the arm for the leather sector, especially after the reduction of cash incentive or subsidies on the export sector last January. As a result, leather was hit hard as the government decision practically eliminated all export incentives from this sector. Undeniably, the government move to cut TDS against leather items export will enable Bangladeshi leather and leather goods to be more competitive in the western markets. However, it is still going to be a stopgap measure until leather and leather goods from Bangladesh are fully LWG compliant and the only way to do that is by way of installing central effluent treatment plant (CETP) at the Savar Tannery Industrial Estate (STE). With only three factories of the country earning LWG certification, the leather sector has to surrender a large portion of its rightful share in export earnings. The reduction of tax at source has to be complemented by turning the CETP at Savar fully functional. Much depends on the CETP for the leather sector to become LWG compliant and vibrant. Thus the tannery industry can take its rightful place in country's economy, diversifying and enriching its export basket.