Beijingwalker

Senior Member

- Jan 27, 2024

- 69,455

- 39

- Origin

- Residence

- Axis Group

HUAWEI LEADS IN THE CHINESE SMARTPHONE MARKET FOR THE FIRST TWO WEEKS OF 2024

Huawei, the Chinese tech giant, has made a significant resurgence in the Chinese smartphone market. A few days ago, we quoted an IDC report which said that Huawei made some gains in the Chinese smartphone market in the fourth quarter of 2023 with its shipments increasing by 36.2%. This growth positioned Huawei as the fourth-largest smartphone vendor in China. The Chinese brand now has a market share of 13.9%, up from 10.3% in the same period a year ago. It appears that the company is not slowing down from its blistering performance in Q4 2023. According to Counterpoint Research, Huawei secured the top position in terms of smartphone sales during the first two weeks of 2024.

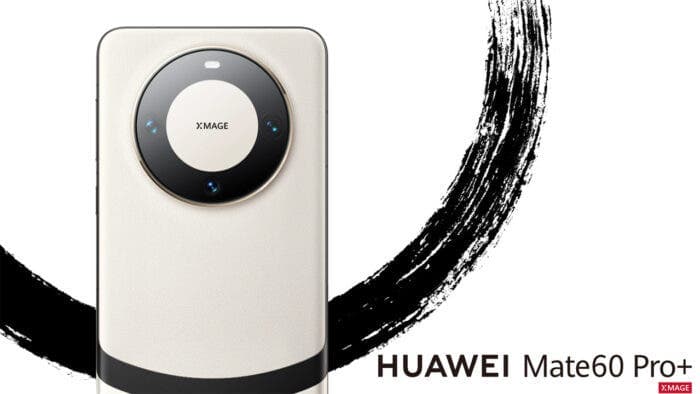

Huawei’s sales share has been declining since the imposition of U.S. sanctions in 2019. This climb marks the first time that the company will be on top of the Chinese mobile phone market in several quarters. This achievement marks a remarkable recovery for the company. The company’s growth has been attributed to the success of its new smartphones, such as the Mate 60 Pro, which has contributed to its strong sales performance.

MARKET PERFORMANCE AND GROWTH

The Huawei Mate 60 series, powered by its self-developed Kirin 9000S chip, is a key driver of Huawei’s recent success, the report said. In addition, its strong brand loyalty and the successful launch of the HarmonyOS operating system have also helped it.The report also stated that China’s high-end smartphone market will grow by 27% in 2023. Apple maintained its market leadership with its outstanding performance in the first half of 2023. However, starting from the third quarter of 2023, Apple’s market share will begin to be eroded by Huawei and other Chinese brands. The agency also expects Chinese brands to continue to make efforts in the high-end market.

In addition, despite Huawei’s strong comeback, market competition remains fierce. Chinese brands such as Xiaomi, OPPO, and vivo are also constantly launching new models in the high-end market, challenging international giants such as Apple and Samsung. A previous Canalys report showed that mainland China shipped 73.9 million smartphones in Q4 2023, with Huawei increasing by 47% and returning to the top four.

RECOVERY AND RESURGENCE

Huawei’s recovery in the Chinese smartphone market has been remarkable, with the company experiencing a significant resurgence following a period of decline. The company’s growth has outpaced that of Apple, making it the fastest-growing smartphone maker in China in the third quarter of 2023, according to Counterpoint Research.

Huawei’s recovery and resurgence have been influenced by various factors, including its technological advancements, global market dynamics, and geopolitical developments. Despite facing challenges such as tech restrictions and competition from other companies like Apple, Huawei has been on the road to recovery.

The company has focused on improving its hardware and keeping prices competitive, which has positioned it as a strong competitor in the global market. Also, the loosening of tech restrictions in China has created opportunities for the recovery of tech companies, including Huawei. The resurgence of China’s Belt and Road Initiative (BRI) and its reorientation towards a ‘Digital Silk Road’ have also played a role in Huawei’s recovery, as the initiative involves significant investments in information and communication technology, offering alternatives to Chinese 5G network infrastructure.

https://www.gizchina.com/2024/02/03/chinese-smartphone-market-huawei-apple-shipping/

Furthermore, Huawei’s recovery is intertwined with the broader geopolitical landscape, including the dynamics of the global tech industry and the competition among major powers. The company’s resilience and recovery are indicative of its ability to navigate these complex dynamics and adapt to changing circumstances.

FORECASTS AND PROJECTIONS

According to market forecasts, China’s smartphone market is expected to ship 287 million units in 2024, a 3.6% year-on-year increase, driven by an improving macroeconomy and consumer appetite for better gadgets. This growth is expected to be driven by consumers’ increasing interest in upgrading their smartphones and the fierce rivalry among domestic brands, which will push vendors to launch more competitive products.

In 2023, Huawei expected a 9% revenue growth, with revenue exceeding 700 billion yuan ($98.5 billion). This forecast indicated a significant rebound for Huawei after facing challenges due to US sanctions. The company’s smartphone shipments surged, contributing to the overall growth of the Chinese smartphone market. Huawei’s strategic focus has become more refined. It aims to compete in the premium segment of the smartphone market, particularly in China. The company also aimed to re-enter the 5G smartphone market by the end of 2023, as it planned to procure 5G chips domestically.

Despite facing challenges, Huawei has set ambitious shipment forecasts. As of 2023, Huawei remains a key player in the smartphone industry. Its strategic decisions and forecasts keep shaping its position in the market. The smartphone industry itself is expected to continue growing. The Asia Pacific region will account for the largest market share in 2024 according to forecasts

FINAL WORDS

Huawei’s leading position in the Chinese smartphone market in the first two weeks of 2024 reflects the company’s remarkable recovery. Huawei’s resurgence in the Chinese smartphone market showcases a remarkable turnaround. It defies the challenges posed by U.S. sanctions and a previous decline in market share. The company’s aggressive push in Q4 2023 helped the company in no small way. The success of the Mate 60 Pro series and the HarmonyOS, highlights a strategic focus on innovation and brand loyalty. This recovery reflects Huawei’s ability to adapt to evolving market dynamics and leverage its technological prowess.As Huawei anticipates a promising future, the high-end smartphone market in China is expected to grow substantially. This means that Huawei will have to compete against both domestic and international rivals. The forecasts of increased smartphone shipments in 2024 further indicate a positive trajectory for the Chinese tech giant. The multifaceted factors contributing to Huawei’s resurgence, include improved hardware and competitive pricing. It also includes geopolitical shifts and a rebounding macroeconomy. These position the company as a key player in the evolving smartphone industry landscape.

East Asian Affairs

East Asian Affairs