- Copy to clipboard

- Moderator

- #16

- Messages

- 3,095

- Reaction score

- 1,560

Let's focus on India's parts localization effort for making cars, which is an abject failure. I don't shill for China, but the facts speak for themselves, and most of those come from Indian media itself.May be. While being a spokesperson of China, you do not know that you are reducing China from a manufacturer to part supplier. Which one is batter? TO manufacture finish goods or supplier of component?

As of 2025, India's automotive industry aims to achieve around 25% parts localization in vehicle assembly, although the localization of electronic components remains a significant challenge due to reliance on imports amid the drive toward EV cars with heavily embedded electronic components, both of which spell trouble for parts localization in India.

The Indian government is actively promoting domestic parts production (instead of Chinese parts imports) to reduce this dependency by its "Make in India" subsidies, a program which has also become an abject failure. You can't just throw money at a problem and not provide deeper policy support.

The "Make in India" initiative is widely considered a qualified failure by Indian policy thinktanks, as it has not met its ambitious goals, such as increasing the manufacturing sector's contribution to GDP or creating the promised number of jobs. Instead, the share of manufacturing in GDP has decreased, and job creation has fallen short of expectations.

As Modi makes ambitious pitch in the US, Make in India is qualified failure 10 years on

Generous business incentives, foreign investment do not solve the fundamental problems of a huge skills deficit and the complexity of doing business in India.

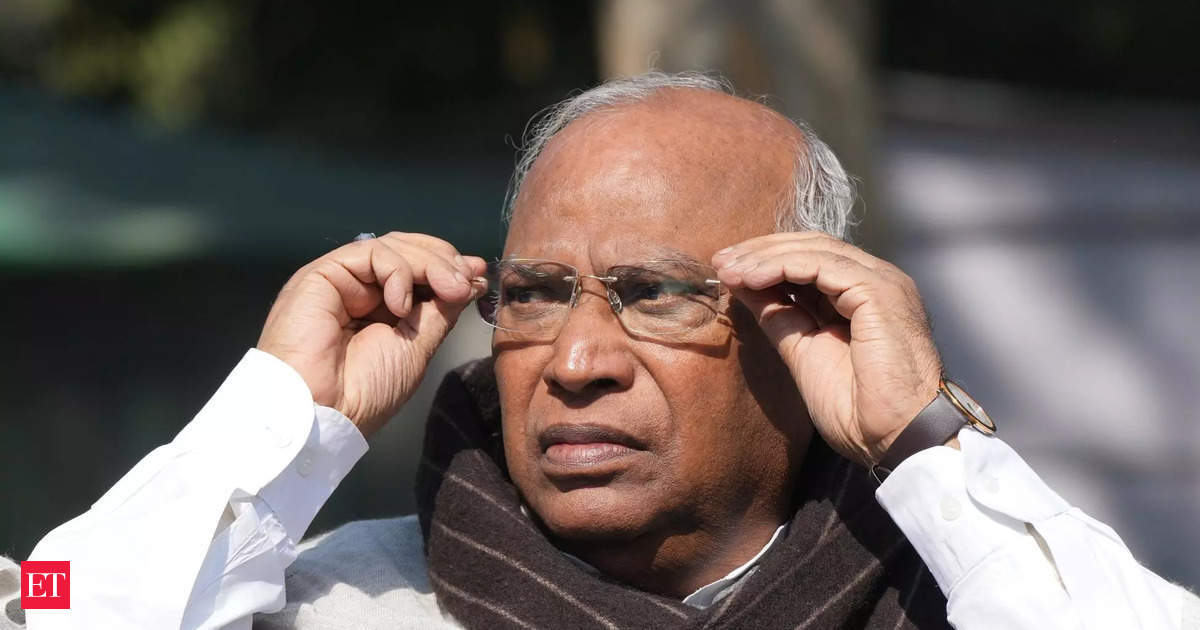

Govt failed to realise 'Make in India' due to 'complete inaction', says Congress chief Mallikarjun Kharge

Congress chief Mallikarjun Kharge criticised the Indian government's 'Make in India' initiative, accusing it of failing to create jobs and utilise funds effectively. He questioned the decline in manufacturing's contribution to GDP, the decrease in manufacturing growth, and the under-utilization...

India is blocking its own road to a manufacturing renaissance | White paper | Hinrich Foundation

To truly revive its industrial sectors, New Delhi has to do more to remove policy roadblocks and level the playing field for foreign and domestic investors. Download paper.

Last edited:

South Asia

South Asia