Saif

Senior Member

- Messages

- 17,522

- Likes

- 8,438

- Nation

- Residence

- Axis Group

Bangladesh doesn’t need IMF funds, but right policies: governor

Bangladesh does not need funds from the International Monetary Fund (IMF) if it can mobilise enough domestic resources, said Bangladesh Bank Governor Ahsan H Mansur, as he stressed that the country requires the right policies rather than “begging for foreign funds”.

Bangladesh doesn’t need IMF funds, but right policies: governor

“Bangladesh’s financial position is strong. The only weak area is revenue collection, and the solution lies in improving revenue generation.” Ahsan H Mansur, Bangladesh Bank governor

Bangladesh does not need funds from the International Monetary Fund (IMF) if it can mobilise enough domestic resources, said Bangladesh Bank Governor Ahsan H Mansur, as he stressed that the country requires the right policies rather than "begging for foreign funds".

"Bangladesh's financial position is strong. The only weak area is revenue collection, and the solution lies in improving revenue generation," Mansur said at a roundtable yesterday.

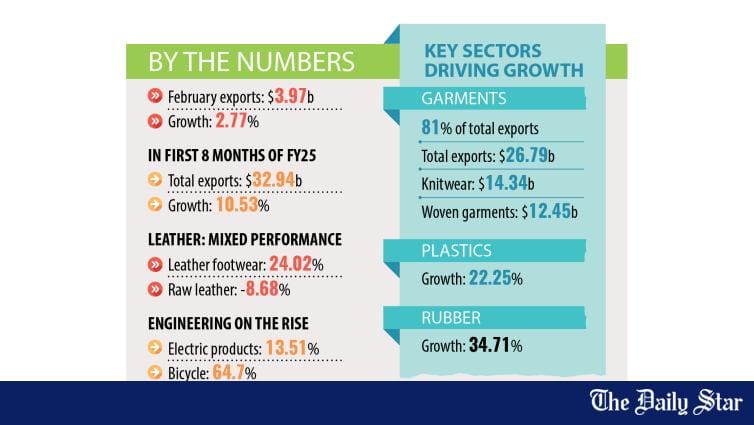

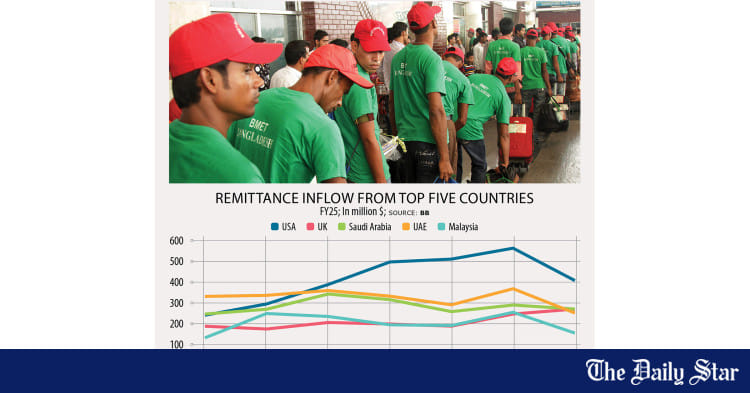

"This fiscal year, the country has nearly $29 billion in remittances and $50 billion in exports. These two sources alone contribute about $80 billion. After deducting letters of credit (LCs), the country still has $10 billion in hand," the central bank governor said at a roundtable organised by The Business Standard at its office at Eskaton in Dhaka.

"Why should I have to go and beg for money?"

Speaking at the event titled "Path to Recovery for the Banking Sector", Mansur said, "I still publicly say that we don't need IMF money, but we do need the right policies. If our policies are correct, we won't need foreign funds; we can manage with our own resources."

He pointed out that despite rising interest rates, deposit growth remains sluggish. The banking sector's ultimate solution lies in increasing deposits.

"To resolve non-performing loans (NPLs), deposit growth must be high, and that will happen only with good governance. When there are enough deposits, it becomes easier to tackle other banking sector issues," said Mansur, an economist who served the IMF earlier in his career.

He said the Bangladesh Bank will soon conduct a fit and proper test for bank directors to assess their suitability. "If found unfit, they will be asked to resign."

"We don't want to see housewives, daughters and sons on boards who have no proper experience."

The governor said the central bank will also form a panel of independent directors so that banks can appoint them. The government has sought suggestions from the Association of Bankers, Bangladesh (ABB) on the qualifications required for directors.

"The central bank will not allow the country's exchange rate to be dictated by Dubai or any other external market," he said. "That is not acceptable."

"The central bank will determine the exchange rate pragmatically, considering the country's needs and economic conditions. If necessary, it will devalue the local currency in a structured manner," said the governor.

"Let that be absolutely clear to transactors and aggregators."

Agent banking is thriving and 50 percent of agents will have to be women, he said, adding that a circular on this will be issued soon as part of financial inclusion efforts.

He believes agent banking may overtake traditional banking due to its growing popularity. Meanwhile, the central bank is taking steps to promote QR code payments to further financial inclusion.

On recovery of laundered assets, Mansur said, "All we can hope for is to secure judgments at home and send them abroad with attachments to properties there."

Repatriating wealth takes time, but countries like Nigeria, Malaysia, and Angola have successfully done so, he further said.

"We hope the next political government will continue the effort to recover assets -- a process we have already initiated. Civil society can exert pressure on political parties to maintain the momentum," added the governor.

A five-year reform agenda cannot be completed in a year or 18 months. The current government will push as much as possible following the international standards, and the next government must carry it forward, Mansur commented.

As the tax-to-GDP ratio remains low, the government is borrowing from banks, while high NPLs are straining liquidity, said Syed Mahbubur Rahman, managing director and CEO of Mutual Trust Bank.

On the NPL crisis, he cited weak governance, inadequate central bank supervision and the absence of a level playing field.

Rahman said law and order needs to be improved and a stable energy supply for industries must be ensured.

Selim RF Hussain, managing director and CEO of BRAC Bank, said banking regulations have become overly complex and should be liberalised.

He also urged aligning the NPL definition with international standards so that banks cannot conceal bad loans.

Ali Reza Iftekhar, managing director & CEO of Eastern Bank Limited, said the banking sector suffers from weak corporate governance at the board level.

He called for regulatory improvements to meet international benchmarks. Banks with capital and provisioning shortfalls should have a clear roadmap to address these issues, he added.

Other speakers at the event included Mashrur Arefin, managing director & CEO of City Bank; Sohail R. K. Hussain, president & managing director of Bank Asia PLC; Sharif Zahir, chairman of United Commercial Bank PLC (UCB); Mohammad Abdul Mannan, chairman of First Security Islami Bank PLC; Md Obayed Ullah Al Masud, chairman of Islami Bank; and Mati ul Hasan, managing director of Mercantile Bank.

Fahmida Khatun, executive director of the Centre for Policy Dialogue, also spoke at the event, which was chaired by The Business Standard Editor Inam Ahmed.

“Bangladesh’s financial position is strong. The only weak area is revenue collection, and the solution lies in improving revenue generation.” Ahsan H Mansur, Bangladesh Bank governor

Bangladesh does not need funds from the International Monetary Fund (IMF) if it can mobilise enough domestic resources, said Bangladesh Bank Governor Ahsan H Mansur, as he stressed that the country requires the right policies rather than "begging for foreign funds".

"Bangladesh's financial position is strong. The only weak area is revenue collection, and the solution lies in improving revenue generation," Mansur said at a roundtable yesterday.

"This fiscal year, the country has nearly $29 billion in remittances and $50 billion in exports. These two sources alone contribute about $80 billion. After deducting letters of credit (LCs), the country still has $10 billion in hand," the central bank governor said at a roundtable organised by The Business Standard at its office at Eskaton in Dhaka.

"Why should I have to go and beg for money?"

Speaking at the event titled "Path to Recovery for the Banking Sector", Mansur said, "I still publicly say that we don't need IMF money, but we do need the right policies. If our policies are correct, we won't need foreign funds; we can manage with our own resources."

He pointed out that despite rising interest rates, deposit growth remains sluggish. The banking sector's ultimate solution lies in increasing deposits.

"To resolve non-performing loans (NPLs), deposit growth must be high, and that will happen only with good governance. When there are enough deposits, it becomes easier to tackle other banking sector issues," said Mansur, an economist who served the IMF earlier in his career.

He said the Bangladesh Bank will soon conduct a fit and proper test for bank directors to assess their suitability. "If found unfit, they will be asked to resign."

"We don't want to see housewives, daughters and sons on boards who have no proper experience."

The governor said the central bank will also form a panel of independent directors so that banks can appoint them. The government has sought suggestions from the Association of Bankers, Bangladesh (ABB) on the qualifications required for directors.

"The central bank will not allow the country's exchange rate to be dictated by Dubai or any other external market," he said. "That is not acceptable."

"The central bank will determine the exchange rate pragmatically, considering the country's needs and economic conditions. If necessary, it will devalue the local currency in a structured manner," said the governor.

"Let that be absolutely clear to transactors and aggregators."

Agent banking is thriving and 50 percent of agents will have to be women, he said, adding that a circular on this will be issued soon as part of financial inclusion efforts.

He believes agent banking may overtake traditional banking due to its growing popularity. Meanwhile, the central bank is taking steps to promote QR code payments to further financial inclusion.

On recovery of laundered assets, Mansur said, "All we can hope for is to secure judgments at home and send them abroad with attachments to properties there."

Repatriating wealth takes time, but countries like Nigeria, Malaysia, and Angola have successfully done so, he further said.

"We hope the next political government will continue the effort to recover assets -- a process we have already initiated. Civil society can exert pressure on political parties to maintain the momentum," added the governor.

A five-year reform agenda cannot be completed in a year or 18 months. The current government will push as much as possible following the international standards, and the next government must carry it forward, Mansur commented.

As the tax-to-GDP ratio remains low, the government is borrowing from banks, while high NPLs are straining liquidity, said Syed Mahbubur Rahman, managing director and CEO of Mutual Trust Bank.

On the NPL crisis, he cited weak governance, inadequate central bank supervision and the absence of a level playing field.

Rahman said law and order needs to be improved and a stable energy supply for industries must be ensured.

Selim RF Hussain, managing director and CEO of BRAC Bank, said banking regulations have become overly complex and should be liberalised.

He also urged aligning the NPL definition with international standards so that banks cannot conceal bad loans.

Ali Reza Iftekhar, managing director & CEO of Eastern Bank Limited, said the banking sector suffers from weak corporate governance at the board level.

He called for regulatory improvements to meet international benchmarks. Banks with capital and provisioning shortfalls should have a clear roadmap to address these issues, he added.

Other speakers at the event included Mashrur Arefin, managing director & CEO of City Bank; Sohail R. K. Hussain, president & managing director of Bank Asia PLC; Sharif Zahir, chairman of United Commercial Bank PLC (UCB); Mohammad Abdul Mannan, chairman of First Security Islami Bank PLC; Md Obayed Ullah Al Masud, chairman of Islami Bank; and Mati ul Hasan, managing director of Mercantile Bank.

Fahmida Khatun, executive director of the Centre for Policy Dialogue, also spoke at the event, which was chaired by The Business Standard Editor Inam Ahmed.