- Copy to clipboard

- Thread starter

- #571

Exports edge up in further relief to economy

Bangladesh’s exports have shown resilience, displaying steady growth in key sectors such as garments, plastics and seafood in the first eight months of fiscal year (FY) 2024-25, somewhat defying global economic headwinds and domestic concerns like high inflation and political uncertainty.

Exports edge up in further relief to economy

Bangladesh's exports have shown resilience, displaying steady growth in key sectors such as garments, plastics and seafood in the first eight months of fiscal year (FY) 2024-25, somewhat defying global economic headwinds and domestic concerns like high inflation and political uncertainty.

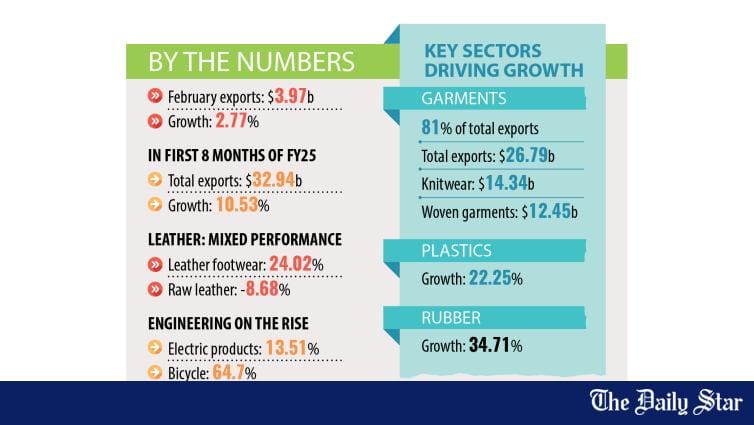

In February, export earnings stood at $3.97 billion, a 2.77 percent year-on-year increase from $3.86 billion, according to data published by the Export Promotion Bureau (EPB) yesterday.

This development comes days after the Bangladesh Bank reported a jump in remittance inflows, which surged 25 percent year-on-year to $2.52 billion last month, offering much-needed relief to a strained economy.

Total exports in the first eight months of FY25 reached $32.94 billion, up 10.5 percent year-on-year.

Exports of the readymade garment (RMG) sector, Bangladesh's largest export earner, grew 1.66 percent last month.

Overall, apparel exports rose 10.64 percent to $26.79 billion in the July-February period compared to the preceding year.

In the same period, knitwear exports climbed 11.01 percent to $14.34 billion, while exports of woven garments increased 10.22 percent to $12.45 billion.

The RMG sector accounted for over 81 percent of total export earnings, yet again underlining its dominance in the country's export basket.

"The outlook of our garment exports is promising as work orders are rebounding," said Faruque Hassan, a former president of the Bangladesh Garment Manufacturers and Exporters Association (BGMEA).

However, he said law and order must be improved as international clothing retailers frequently raise concerns over security.

According to Hassan, the country is also benefiting from US President Donald Trump's tariff policies. Higher tariffs on Chinese and Mexican apparel exports to the US are redirecting orders to Bangladeshi manufacturers, he opined.

However, low pricing remains a key challenge, he mentioned.

Manufactured goods, which make up the bulk of exports, saw a 10.49 percent increase to $31.87 billion in the first eight months of the fiscal year. Key segments such as plastic products, rubber and headgear posted strong growth of 22.25 percent, 34.71 percent and 11.40 percent, respectively.

Leather and leather products showed mixed results. While total exports in this category rose 8.48 percent to $757.50 million, raw leather exports fell 8.68 percent.

In contrast, leather footwear exports surged 24.02 percent to $450.88 million, showing a shift towards higher-value products.

The engineering sector recorded a 7.48 percent rise, led by electric products and bicycle exports, which grew by 13.51 percent and 64.7 percent, respectively.

Specialised textiles, including knitted and woven fabrics, also saw strong growth, increasing 21.62 percent.

Terry towel exports grew by just 3.11 percent in the first seven months but plunged 41 percent in February to $1.5 million from $2.54 million a year earlier.

M Shahadat Hossain Sohel, chairman of the Bangladesh Terry Towel and Linen Manufacturers and Exporters Association, linked the sector's declining competitiveness to rising production costs driven by increased gas and power prices and higher wages.

He said that corruption at customs, including bribes during raw material imports and product shipments, has further complicated the situation.

"Without immediate reforms and a reduction in production costs, the sector may struggle to remain competitive in international markets," Sohel commented.

RN Paul, managing director of RFL Group, said strong performance in the plastics sector was driven by export orders from new destinations.

Previously reliant on European markets, the industry has recently expanded to North America, Australia and parts of Africa.

Paul said RFL registered export growth of 35 percent in the past eight months and anticipates further expansion, particularly with the addition of new products such as toys.

Commenting on the export figures, Selim Raihan, executive director of the South Asian Network on Economic Modeling, expressed mixed sentiments.

The economist said that the sustainability of export growth remains uncertain due to challenges such as stagnant private investment, high inflation and security concerns. The upcoming general election adds to the macroeconomic uncertainty, he noted.

Still, Raihan said the export growth figures are encouraging although the earnings largely came from previous orders.

Bangladesh's exports have shown resilience, displaying steady growth in key sectors such as garments, plastics and seafood in the first eight months of fiscal year (FY) 2024-25, somewhat defying global economic headwinds and domestic concerns like high inflation and political uncertainty.

In February, export earnings stood at $3.97 billion, a 2.77 percent year-on-year increase from $3.86 billion, according to data published by the Export Promotion Bureau (EPB) yesterday.

This development comes days after the Bangladesh Bank reported a jump in remittance inflows, which surged 25 percent year-on-year to $2.52 billion last month, offering much-needed relief to a strained economy.

Total exports in the first eight months of FY25 reached $32.94 billion, up 10.5 percent year-on-year.

Exports of the readymade garment (RMG) sector, Bangladesh's largest export earner, grew 1.66 percent last month.

Overall, apparel exports rose 10.64 percent to $26.79 billion in the July-February period compared to the preceding year.

In the same period, knitwear exports climbed 11.01 percent to $14.34 billion, while exports of woven garments increased 10.22 percent to $12.45 billion.

The RMG sector accounted for over 81 percent of total export earnings, yet again underlining its dominance in the country's export basket.

"The outlook of our garment exports is promising as work orders are rebounding," said Faruque Hassan, a former president of the Bangladesh Garment Manufacturers and Exporters Association (BGMEA).

However, he said law and order must be improved as international clothing retailers frequently raise concerns over security.

According to Hassan, the country is also benefiting from US President Donald Trump's tariff policies. Higher tariffs on Chinese and Mexican apparel exports to the US are redirecting orders to Bangladeshi manufacturers, he opined.

However, low pricing remains a key challenge, he mentioned.

Manufactured goods, which make up the bulk of exports, saw a 10.49 percent increase to $31.87 billion in the first eight months of the fiscal year. Key segments such as plastic products, rubber and headgear posted strong growth of 22.25 percent, 34.71 percent and 11.40 percent, respectively.

Leather and leather products showed mixed results. While total exports in this category rose 8.48 percent to $757.50 million, raw leather exports fell 8.68 percent.

In contrast, leather footwear exports surged 24.02 percent to $450.88 million, showing a shift towards higher-value products.

The engineering sector recorded a 7.48 percent rise, led by electric products and bicycle exports, which grew by 13.51 percent and 64.7 percent, respectively.

Specialised textiles, including knitted and woven fabrics, also saw strong growth, increasing 21.62 percent.

Terry towel exports grew by just 3.11 percent in the first seven months but plunged 41 percent in February to $1.5 million from $2.54 million a year earlier.

M Shahadat Hossain Sohel, chairman of the Bangladesh Terry Towel and Linen Manufacturers and Exporters Association, linked the sector's declining competitiveness to rising production costs driven by increased gas and power prices and higher wages.

He said that corruption at customs, including bribes during raw material imports and product shipments, has further complicated the situation.

"Without immediate reforms and a reduction in production costs, the sector may struggle to remain competitive in international markets," Sohel commented.

RN Paul, managing director of RFL Group, said strong performance in the plastics sector was driven by export orders from new destinations.

Previously reliant on European markets, the industry has recently expanded to North America, Australia and parts of Africa.

Paul said RFL registered export growth of 35 percent in the past eight months and anticipates further expansion, particularly with the addition of new products such as toys.

Commenting on the export figures, Selim Raihan, executive director of the South Asian Network on Economic Modeling, expressed mixed sentiments.

The economist said that the sustainability of export growth remains uncertain due to challenges such as stagnant private investment, high inflation and security concerns. The upcoming general election adds to the macroeconomic uncertainty, he noted.

Still, Raihan said the export growth figures are encouraging although the earnings largely came from previous orders.