Saif

Senior Member

- Joined

- Jan 24, 2024

- Messages

- 15,898

- Likes

- 7,990

- Nation

- Axis Group

Garment export to EU may face cutthroat competition

Bangladesh's readymade garment (RMG) export to its largest destination may face tough competition as competitors like China, Vietnam, Cambodia, Pakistan and Sri Lanka have incrementally raised their concentration in the European Union (EU) for a decade, sources say. The trade race may intensify

Garment export to EU may face cutthroat competition

New US tariff regime likely to intensify trade race further: Experts

Monira Munni

Published :

May 09, 2025 00:44

Updated :

May 09, 2025 00:44

Bangladesh's readymade garment (RMG) export to its largest destination may face tough competition as competitors like China, Vietnam, Cambodia, Pakistan and Sri Lanka have incrementally raised their concentration in the European Union (EU) for a decade, sources say.

The trade race may intensify further in the days ahead, especially following the new US tariff regime, as the reciprocal tariffs on higher scales may force the players to diversify their shipment destinations to the 27-nation bloc.

Data analysis shows 56 per cent of China's total apparel exports were destined for the EU in 2012, which edged up to 68 per cent in 2023. The figure was 44 per cent for the US in 2012, which decreased to 32 per cent in 2023.

About 32 per cent of Vietnam's total apparel was shipped to the EU in 2023--an increase from 26 per cent in 2012. The US accounted for 68 per cent in 2023, which was 74 per cent in 2012, according to data.

Cambodia's overall apparel shipments to the EU came to 63 per cent in 2023, which was 40 per cent in 2012. On the other hand, 60 per cent of its apparel was destined for the US in 2012, which fell to 37 per cent in 2023, according to latest data.

Similarly, 52 per cent of Pakistan's total apparel exports went to the EU in 2012, which rose to 71 per cent in 2023. Some 48 per cent of its total apparel exports were shipped to the US market in 2012, which fell to 29 per cent in 2023.

Sri Lanka's apparel exports were 46 per cent to the EU and 54 per cent to the US in 2012, which stood at 57 per cent to the EU and 43 per cent to the US in 2023.

Only India is an exception as 42 per cent and 58 per cent of its total garment exports were destined for the EU and the United States, respectively, in 2023, which was 48 per cent to the EU and 52 per cent to the US in 2012.

On the other hand, the EU accounted for 79 per cent of Bangladesh's total readymade garment (RMG) exports in 2023, up from 72 per cent in 2012. About 21 per cent of the total RMG was shipped to the US in 2023, which was 28 per cent in 2012.

Talking to The Financial Express, Dr Mohammad Abdur Razzaque, chairman of Research and Policy Integration for Development (RAPID), said the greater concern lies beyond the US market. "Constrained by American tariffs, supplies may be diverted to other key destinations, such as the EU, Japan, and Canada."

With Bangladesh holding more than 20-percent share in the EU apparel market, this diversion could intensify price competition, squeezing margins and undermining profitability, he also predicts.

"Compounding these pressures is the risk of competitive currency devaluations among export-reliant economies, as countries seek to counteract the loss in price competitiveness," Dr Razzaque explains.

For Bangladesh, which is already contending with foreign-exchange shortages and inflationary stress, such developments could deepen macroeconomic vulnerabilities and complicate efforts toward external and fiscal stabilisation, the economist adds.

When asked, Fazlul Hoque, former president of Bangladesh Knitwear Manufacturers and Exporters Association (BKMEA), said competition would increase on the existing market not only for foreign competitors but also for local exporters.

Local exporters who ship goods to the US may shift to other countries, especially to the EU, which would intensify the competition within the borders, he notes, fearing "unhealthy price competition" among local exporters to linger.

The situation would be "terrific" if the same trend is followed by other garment-producing countries, resulting in "price pressure" as the market size of the importing countries, like the EU, remains the same, he explains.

Abdullah Hil Rakib, managing director of Team Group, says business shifting from the US would go to the EU, slowing the latter's existing business and it would be for the US tariff hike.

"The situation will be concerning as there would be huge price pressure," says Mr Rakib, also a former leader of Bangladesh Garment Manufacturers and Exporters Association (BGMEA).

Mahmud Hasan Khan, managing director of Rising Group, thinks the likely outcome is a sharp drop in demand on the US market, with severe consequences for the exporting countries.

He also echoes Mr Hoque' views about the price pressure, raising questions as to whether local exporters would get the same volume of work orders that they are receiving.

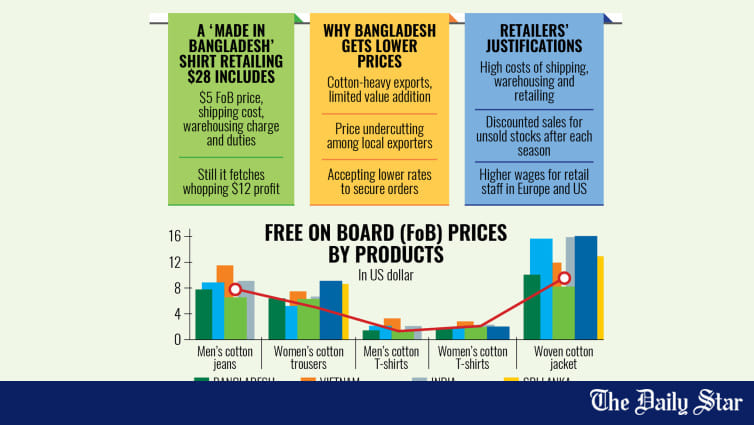

Meanwhile, exporters have said they are not getting fair prices of locally-made garments, and in many cases, they accept work orders below their production costs mainly to run the business and pay workers.

According to BGMEA data, Bangladesh's apparel shipments to the EU rose by 4.86 per cent year on year to $19.77 billion in 2024.

In 2024, Bangladesh exported 1.23 billion kilograms of garments to the EU, up by 10.18 per cent from 1.10 billion kg shipped in 2023.

The per-unit price fell to $16.07 per kg in 2024 from $16.88 per kg in the previous year, marking a 4.84-percent decline.

Though the EU's overall apparel imports increased 1.53 per cent year on year in terms of value to reach $92.56 billion in 2024, the import volume grew 8.98 per cent to 4.27 billion kg, resulting in a 6.83-percent decline in average unit prices, impacting major sourcing countries, including Bangladesh.

New US tariff regime likely to intensify trade race further: Experts

Monira Munni

Published :

May 09, 2025 00:44

Updated :

May 09, 2025 00:44

Bangladesh's readymade garment (RMG) export to its largest destination may face tough competition as competitors like China, Vietnam, Cambodia, Pakistan and Sri Lanka have incrementally raised their concentration in the European Union (EU) for a decade, sources say.

The trade race may intensify further in the days ahead, especially following the new US tariff regime, as the reciprocal tariffs on higher scales may force the players to diversify their shipment destinations to the 27-nation bloc.

Data analysis shows 56 per cent of China's total apparel exports were destined for the EU in 2012, which edged up to 68 per cent in 2023. The figure was 44 per cent for the US in 2012, which decreased to 32 per cent in 2023.

About 32 per cent of Vietnam's total apparel was shipped to the EU in 2023--an increase from 26 per cent in 2012. The US accounted for 68 per cent in 2023, which was 74 per cent in 2012, according to data.

Cambodia's overall apparel shipments to the EU came to 63 per cent in 2023, which was 40 per cent in 2012. On the other hand, 60 per cent of its apparel was destined for the US in 2012, which fell to 37 per cent in 2023, according to latest data.

Similarly, 52 per cent of Pakistan's total apparel exports went to the EU in 2012, which rose to 71 per cent in 2023. Some 48 per cent of its total apparel exports were shipped to the US market in 2012, which fell to 29 per cent in 2023.

Sri Lanka's apparel exports were 46 per cent to the EU and 54 per cent to the US in 2012, which stood at 57 per cent to the EU and 43 per cent to the US in 2023.

Only India is an exception as 42 per cent and 58 per cent of its total garment exports were destined for the EU and the United States, respectively, in 2023, which was 48 per cent to the EU and 52 per cent to the US in 2012.

On the other hand, the EU accounted for 79 per cent of Bangladesh's total readymade garment (RMG) exports in 2023, up from 72 per cent in 2012. About 21 per cent of the total RMG was shipped to the US in 2023, which was 28 per cent in 2012.

Talking to The Financial Express, Dr Mohammad Abdur Razzaque, chairman of Research and Policy Integration for Development (RAPID), said the greater concern lies beyond the US market. "Constrained by American tariffs, supplies may be diverted to other key destinations, such as the EU, Japan, and Canada."

With Bangladesh holding more than 20-percent share in the EU apparel market, this diversion could intensify price competition, squeezing margins and undermining profitability, he also predicts.

"Compounding these pressures is the risk of competitive currency devaluations among export-reliant economies, as countries seek to counteract the loss in price competitiveness," Dr Razzaque explains.

For Bangladesh, which is already contending with foreign-exchange shortages and inflationary stress, such developments could deepen macroeconomic vulnerabilities and complicate efforts toward external and fiscal stabilisation, the economist adds.

When asked, Fazlul Hoque, former president of Bangladesh Knitwear Manufacturers and Exporters Association (BKMEA), said competition would increase on the existing market not only for foreign competitors but also for local exporters.

Local exporters who ship goods to the US may shift to other countries, especially to the EU, which would intensify the competition within the borders, he notes, fearing "unhealthy price competition" among local exporters to linger.

The situation would be "terrific" if the same trend is followed by other garment-producing countries, resulting in "price pressure" as the market size of the importing countries, like the EU, remains the same, he explains.

Abdullah Hil Rakib, managing director of Team Group, says business shifting from the US would go to the EU, slowing the latter's existing business and it would be for the US tariff hike.

"The situation will be concerning as there would be huge price pressure," says Mr Rakib, also a former leader of Bangladesh Garment Manufacturers and Exporters Association (BGMEA).

Mahmud Hasan Khan, managing director of Rising Group, thinks the likely outcome is a sharp drop in demand on the US market, with severe consequences for the exporting countries.

He also echoes Mr Hoque' views about the price pressure, raising questions as to whether local exporters would get the same volume of work orders that they are receiving.

Meanwhile, exporters have said they are not getting fair prices of locally-made garments, and in many cases, they accept work orders below their production costs mainly to run the business and pay workers.

According to BGMEA data, Bangladesh's apparel shipments to the EU rose by 4.86 per cent year on year to $19.77 billion in 2024.

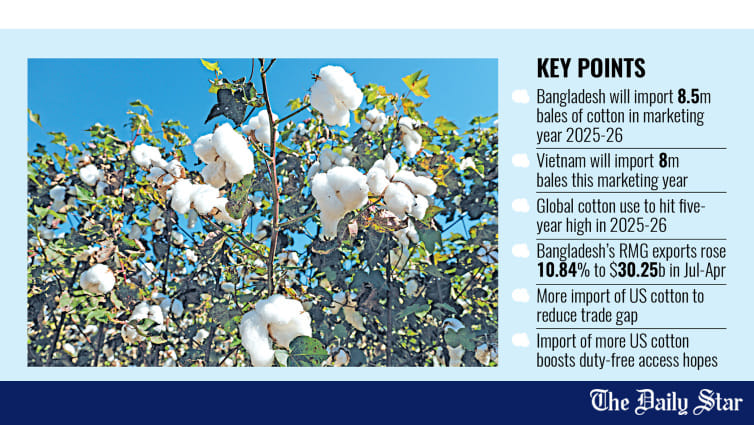

In 2024, Bangladesh exported 1.23 billion kilograms of garments to the EU, up by 10.18 per cent from 1.10 billion kg shipped in 2023.

The per-unit price fell to $16.07 per kg in 2024 from $16.88 per kg in the previous year, marking a 4.84-percent decline.

Though the EU's overall apparel imports increased 1.53 per cent year on year in terms of value to reach $92.56 billion in 2024, the import volume grew 8.98 per cent to 4.27 billion kg, resulting in a 6.83-percent decline in average unit prices, impacting major sourcing countries, including Bangladesh.