Saif

Senior Member

- Messages

- 17,442

- Likes

- 8,381

- Nation

- Residence

- Axis Group

Revised budget targets record-low deficit

The revised budget for the current fiscal year could see the deficit fall to a record low of 3.3 percent of GDP due mainly to ambitious revenue collection targets and cuts in development spending.

Revised budget targets record-low deficit

The revised budget for the current fiscal year could see the deficit fall to a record low of 3.3 percent of GDP due mainly to ambitious revenue collection targets and cuts in development spending.

The finance ministry presented the plan on Monday at a high-level meeting with Chief Adviser Muhammad Yunus.

Finance ministry officials said the revised budget is likely to be placed before the Advisory Council meeting this week for approval. The government will publish it once the council approves it.

Usually, the new budget for the next fiscal year and the revised budget for the outgoing year are announced in June.

This time, the interim government is finalising the revised budget earlier because the national election is scheduled for February next year, a finance ministry official said.

The government generally aims to keep the budget deficit within 5 percent of GDP. Although after actual implementation, the deficit tends to decrease further.

During the last years of the previous Awami League government, original budget deficits exceeded 6 percent of GDP. As a result, the International Monetary Fund (IMF) set limits on the deficit to maintain fiscal discipline when it began its loan programme in January 2023.

In its first budget, the interim government fixed the deficit target at 3.6 percent for the current fiscal year 2025-26. In the previous fiscal year, the actual deficit also stood at 3.6 percent of GDP, mainly because development spending fell short of the allocation.

Breaking with usual practice, the revised budget now reduces the deficit further. Because revenue collection is projected to grow by around 35 percent, while the annual development programme (ADP) is being cut by 13 percent from the original allocation.

The overall deficit is being reduced by Tk 26,000 crore to Tk 2 lakh crore. Domestic borrowing will rise from Tk 1.25 lakh crore to Tk 1.39 lakh crore, while foreign financing falls from Tk 1.01 lakh crore to Tk 61,000 crore.

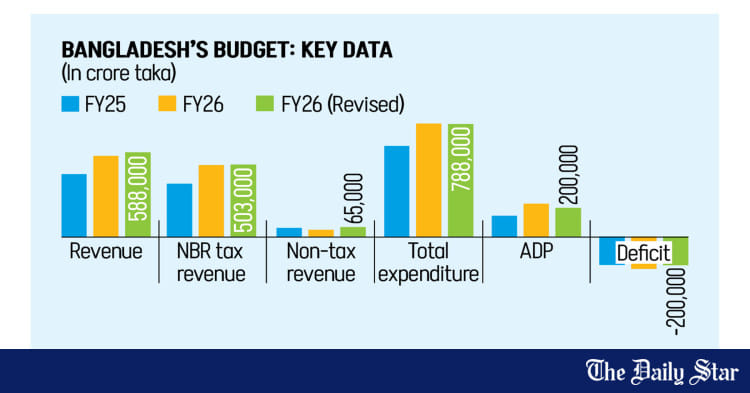

Revenue targets have been increased by 5 percent, or Tk 24,000 crore, to Tk 5.88 lakh crore from the original Tk 5.64 lakh crore, a finance ministry official told The Daily Star on condition of anonymity.

Revenue authorities usually miss their initial targets, forcing the government to lower them near the end of the fiscal year. Even then, reduced targets are often missed, largely due to sluggish performance by the National Board of Revenue (NBR), which accounts for about 90 percent of state revenue.

Under the revised plan, non-NBR tax targets have been increased to Tk 20,000 crore from Tk 19,000 crore. Non-tax revenue has been raised to Tk 65,000 crore from Tk 46,000 crore.

The NBR has increased its target to Tk 5.03 lakh crore, up from Tk 5.02 lakh crore.

An NBR official said collections from customs, income tax and value-added tax (VAT) rose notably in the first quarter, prompting the revision.

In the first five months of FY26, NBR's revenue grew by 15 percent, compared with just 1.9 percent growth last year, said the official.

A senior NBR official cited seven factors behind the revised target's achievability.

Chief among them is the mandatory online submission of individual tax returns. The e-return system also allows automated data collection from institutions through API links, enabling different databases to share information directly with the NBR.

Banks, employers, government agencies and utility service providers can transmit taxpayer information straight to the tax authority's server, which officials expect will curb evasion and boost compliance.

The NBR has also launched a medium and long-term revenue strategy. To raise VAT receipts, the enlistment threshold has been cut from Tk 50 lakh to Tk 30 lakh, and the registration threshold from Tk 3 crore to Tk 50 lakh. VAT on many items has been standardised at 15 percent.

Another important reform is the split of the NBR into the Revenue Policy Division and the Revenue Administration Division through an ordinance.

The government has also adopted a Tax Expenditure Policy and Management Framework to rationalise exemptions and strengthen control over tax spending.

Finance ministry officials said the overall budget for the current fiscal year may be trimmed by Tk 2,000 crore to Tk 7.88 lakh crore. The annual development programme is also likely to be cut by Tk 30,000 crore to Tk 2 lakh crore.

The revised budget for the current fiscal year could see the deficit fall to a record low of 3.3 percent of GDP due mainly to ambitious revenue collection targets and cuts in development spending.

The finance ministry presented the plan on Monday at a high-level meeting with Chief Adviser Muhammad Yunus.

Finance ministry officials said the revised budget is likely to be placed before the Advisory Council meeting this week for approval. The government will publish it once the council approves it.

Usually, the new budget for the next fiscal year and the revised budget for the outgoing year are announced in June.

This time, the interim government is finalising the revised budget earlier because the national election is scheduled for February next year, a finance ministry official said.

The government generally aims to keep the budget deficit within 5 percent of GDP. Although after actual implementation, the deficit tends to decrease further.

During the last years of the previous Awami League government, original budget deficits exceeded 6 percent of GDP. As a result, the International Monetary Fund (IMF) set limits on the deficit to maintain fiscal discipline when it began its loan programme in January 2023.

In its first budget, the interim government fixed the deficit target at 3.6 percent for the current fiscal year 2025-26. In the previous fiscal year, the actual deficit also stood at 3.6 percent of GDP, mainly because development spending fell short of the allocation.

Breaking with usual practice, the revised budget now reduces the deficit further. Because revenue collection is projected to grow by around 35 percent, while the annual development programme (ADP) is being cut by 13 percent from the original allocation.

The overall deficit is being reduced by Tk 26,000 crore to Tk 2 lakh crore. Domestic borrowing will rise from Tk 1.25 lakh crore to Tk 1.39 lakh crore, while foreign financing falls from Tk 1.01 lakh crore to Tk 61,000 crore.

Revenue targets have been increased by 5 percent, or Tk 24,000 crore, to Tk 5.88 lakh crore from the original Tk 5.64 lakh crore, a finance ministry official told The Daily Star on condition of anonymity.

Revenue authorities usually miss their initial targets, forcing the government to lower them near the end of the fiscal year. Even then, reduced targets are often missed, largely due to sluggish performance by the National Board of Revenue (NBR), which accounts for about 90 percent of state revenue.

Under the revised plan, non-NBR tax targets have been increased to Tk 20,000 crore from Tk 19,000 crore. Non-tax revenue has been raised to Tk 65,000 crore from Tk 46,000 crore.

The NBR has increased its target to Tk 5.03 lakh crore, up from Tk 5.02 lakh crore.

An NBR official said collections from customs, income tax and value-added tax (VAT) rose notably in the first quarter, prompting the revision.

In the first five months of FY26, NBR's revenue grew by 15 percent, compared with just 1.9 percent growth last year, said the official.

A senior NBR official cited seven factors behind the revised target's achievability.

Chief among them is the mandatory online submission of individual tax returns. The e-return system also allows automated data collection from institutions through API links, enabling different databases to share information directly with the NBR.

Banks, employers, government agencies and utility service providers can transmit taxpayer information straight to the tax authority's server, which officials expect will curb evasion and boost compliance.

The NBR has also launched a medium and long-term revenue strategy. To raise VAT receipts, the enlistment threshold has been cut from Tk 50 lakh to Tk 30 lakh, and the registration threshold from Tk 3 crore to Tk 50 lakh. VAT on many items has been standardised at 15 percent.

Another important reform is the split of the NBR into the Revenue Policy Division and the Revenue Administration Division through an ordinance.

The government has also adopted a Tax Expenditure Policy and Management Framework to rationalise exemptions and strengthen control over tax spending.

Finance ministry officials said the overall budget for the current fiscal year may be trimmed by Tk 2,000 crore to Tk 7.88 lakh crore. The annual development programme is also likely to be cut by Tk 30,000 crore to Tk 2 lakh crore.