RMG sector’s resilience tested as 2025 nears end

Saddam Hossain 27 December, 2025, 01:27

A file photo shows workers sewing clothes at a readymade garment factory on the outskirts of Dhaka. | New Age photo

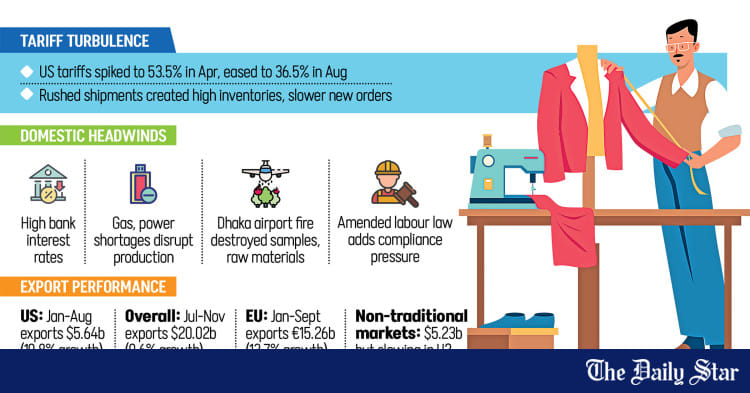

Bangladesh’s readymade garment sector faced one of its most challenging period in 2025, as manufacturers struggled to cope with tariff shocks and volatility in key export markets.

Rising production costs at home, a shaken law-and-order situation and persistent disruptions to energy and logistics forced many manufacturers to prioritise short-term survival over long-term planning.

Shovon Islam, managing director of Sparrow Group, told New Age that 2025 had been challenging for the sector.

‘In many ways, the situation is comparable to the shocks we faced during the abolition of the quota system, the Rana Plaza tragedy and the Covid-19 pandemic,’ he added.

Industry insiders said that the primary source of uncertainty was the US market, Bangladesh’s single-largest apparel export destination.

In April, the United States imposed sharply higher reciprocal tariffs on several countries, including Bangladesh, on which it raised the duty on apparel shipments to the US to 37 per cent. The tariff was later lowered to 35 per cent and then to 20 per cent, following a series of negotiations on July 30.

From August 7, Bangladeshi apparel items have been facing a 20 per cent reciprocal tariff, in addition to the regular 16.5 per cent tariff.

‘During the imposition of the tariff, we were completely in the dark,’ said Shovon Islam, adding that buyers were also operating in a ‘go-slow’ mode.

Although the tariff was eventually reduced, a slowdown on the global market deepened following the US tariff measures, which reshaped global trade by raising costs, industry insiders said.

Exports of RMG items throughout the year fluctuated. While exports maintained positive growth until June 2025, they nosedived consecutively from July.

According to Export Promotion Bureau data, Bangladesh exported RMG items worth $35.49 billion to global destinations during January-November period of 2025, which was 2.53 per cent higher than the $34.71 billion recorded during the same period in 2024.

Although exports posted marginal growth overall, the negative trend that began in July persisted through November, signalling that year-on-year growth could turn negative once data for December becomes available.

Moreover, during the July-November period of FY26, Bangladeshi exporters recorded a 1.03 per cent decline in exports to the European Union to $7.83 billion, while growth to the US market remained thin at 3.06 per cent to $3.22 billion.

Surprisingly, exports to non-traditional markets also declined by 3.19 per cent to $2.67 billion during the July-November period.

Regarding the export decline, Inamul Haq Khan, senior vice-president of the Bangladesh Garment Manufacturers and Exporters Association, said that they had expected a comeback in the second half of 2025.

‘However, instead of a recovery, exports nosedived across all three major destinations — the US, the EU and the non-traditional markets,’ he added.

The slowdown on non-traditional markets is shocking, he said, noting that shipments to these destinations had remained strong for many years.

‘Throughout 2025, the global fashion industry experienced a slowdown that affected us. Most probably, consumers changed their buying patterns due to inflation and economic sluggishness,’ he added.

He said that, due to the US tariffs, China, India and other competitors aggressively entered the EU and new markets, squeezing Bangladesh’s market share.

Moreover, Bangladesh did not receive the expected volume of orders shifting from China, as Vietnam, Indonesia and Myanmar captured a larger share, he added.

Fluctuating inflation in key markets — especially the US, Europe and the United Kingdom — reduced consumers’ appetite for new apparel, forcing retailers to shift from placing large orders to smaller, more cautious purchases.

Several domestic headwinds also affected the RMG sector in 2025, including political instability, labour unrest, banking sector weaknesses, a complete shutdown of the customs house due to officials’ protests, a fire at the airport cargo village and a persistent gas and energy crisis.

Shovon Islam said that throughout 2025, the banking sector experienced severe liquidity shortages, foreign currency constraints, high interest rates and elevated levels of classified loans.

Many RMG exporters faced difficulties opening back-to-back letters of credit due to weakened bank health. Several Shariah-based banks were merged under government supervision because of their volatile condition.

Many RMG factories, including those of BEXIMCO and NASSA, as well as some small and medium-sized ones, were also forced to shut down due to non-performing loans, a lack of orders and unavoidable political situations.

Moreover, confidence among depositors and manufacturers declined as NPLs reached about 36 per cent of total loans.

Throughout the year, operations in Bangladesh’s industrial sectors — particularly the textile sector — were severely affected by frequent interruptions in gas supply, with factories receiving only 2-5 PSI, well below the required 15 PSI.

Due to the persistent gas shortage, production at textile mills fell by nearly 30-35 per cent, industry insiders said.

Mohiuddin Rubel, former BGMEA director, said that intensified labour unrest, including road blockades and factory closures, also disrupted production and deliveries.

‘Moreover, the country experienced a complete shutdown of the customs house for the first time — an event rare globally — which severely impacted exports,’ he added, noting that a significant fire at the cargo village of Hazrat Shahjalal International Airport destroyed garment shipments worth about $1 billion, directly cutting export earnings.

At the same time, he added, the removal of export incentives and the reduction of the Bangladesh Bank’s Export Development Fund to $2 billion also hurt the sector.

On November 17, 2025, the interim government amended the Bangladesh Labour Act to simplify trade union formation, introduce enhanced maternity benefits, mandate provident fund contributions and reduce the minimum wage review cycle from five to three years.

Bangladesh also ratified ILO Conventions C190, C155 and C187, becoming the first South Asian nation to ratify all 10 fundamental conventions.

While worker rights groups widely praised these reforms, industry stakeholders expressed concerns about rising compliance costs and administrative burdens.

Among the mentioned issues, a silent trade war with India was also on, as India imposed a ban on imports of several jute products and ropes through land ports on August 11, following similar import bans on several jute and woven products through land ports on June 27, leaving Kolkata and Mumbai ports open.

Earlier on May 17, India imposed restrictions on the import of most Bangladeshi products, including RMG, processed foods and agro-products.

On April 9, India withdrew the trans-shipment facility it had granted to Bangladesh for exporting various items to the Middle East, Europe and other countries, except Nepal and Bhutan, following Bangladesh’s March 28 ban on importing yarn from India through land ports.

Mustafizur Rahman, distinguished fellow of the Centre for Policy Dialogue, said that Bangladesh had failed to resolve key issues that continued to erode its competitiveness.

Despite these headwinds, Bangladesh achieved some positive milestones in 2025.

During January-September period 2025, Bangladesh’s exports to the US reached $6.42 billion, marking 18.64 per cent growth, according to OTEXA data, while exports to Europe also rose by 9.45 per cent to 16.67 billion euros.

The country maintained its growth trajectory despite intense competition from rival exporters.

According to World Trade Organisation data, Bangladesh remained the world’s second-largest RMG exporter in 2024, with a global market share of 6.9 per cent.

Throughout 2025, Bangladesh also retained its leadership in green transformation, with 38 RMG factories receiving certification from the US Green Building Council for Leadership in Energy and Environmental Design in 2025, bringing the total number of LEED-certified garment factories to 270.

‘As the industry moves forward, the challenge will be to build on this foundation by integrating green factories with low-carbon operations, circular production models and digital sustainability reporting,’ said Mohiuddin Rubel.

The progress achieved in 2025 showed that Bangladesh is not only ready for this transition but is already leading it, he added.

Regarding recommendations for 2026, Mustafizur Rahman said that Bangladesh must address issues related to product and market diversification, reduce the cost of doing business, ease port congestion and develop a comprehensive logistics solution.

‘Bangladesh should focus on attracting more foreign direct investment and implementing a national logistics policy,’ he added, noting that all measures must be taken with the country’s LDC graduation scheduled for November 2026 in mind.

Inamul Haq Khan said that industry players remained cautious about a recovery in 2026 as the global economy continued to face turmoil.

‘However, an elected government could boost buyers’ confidence, as they closely monitor the February election,’ he added.

Echoing similar sentiments, Shovon Islam said that elections and the formation of a political government could help restore confidence.

‘Buyers are focusing on the February elections and they are highly concerned. If a fair election takes place on time, it could significantly boost buyers’ confidence,’ he added.

However, buyers have also expressed disappointment over attacks on media houses and cultural centres, which have tarnished the country’s image, he said.

He added that if political stability and law and order were restored, exports could begin to recover after April.

Mohiuddin Rubel said that Bangladesh must identify and address the root causes of factory closures and strengthen the financial sector’s capacity to provide stable and appropriate support to the industry in 2026.

‘It must also establish effective monitoring systems to ensure that new factories entering the sector align with and contribute to broader industrial development goals,’ he added.

Bangladesh’s competitiveness, he said, will depend on how quickly it can close infrastructure gaps, ease internal bottlenecks and move up the value chain — calling for stronger logistics, political and social stability, better factory-level efficiency and greater investment in research and development, innovation and marketing.