Saif

Senior Member

- Messages

- 17,481

- Likes

- 8,403

- Nation

- Residence

- Axis Group

Ceramic industry in deep trouble

The ceramic industry is a deeply fossil-fuel driven industry, i.e. gas-dependent. It cannot be run on solar power. In fact, no heavy industrial production unit can for that matter. And while the government keeps harping about renewable energy as being the next big thing, industry suffers in silence

Ceramic industry in deep trouble

SYED MANSUR HASHIM

Published :

Jul 05, 2024 21:47

Updated :

Jul 05, 2024 21:47

The ceramic industry is a deeply fossil-fuel driven industry, i.e. gas-dependent. It cannot be run on solar power. In fact, no heavy industrial production unit can for that matter. And while the government keeps harping about renewable energy as being the next big thing, industry suffers in silence or in mute protest that falls on deaf ears. The fact of the matter is that ceramic-making factories in key areas of Dhaka, Gazipur and Narsingdi have been "struggling to continue production as they have been suffering from a severe gas crisis in recent times" according to a recent report published in this newspaper.

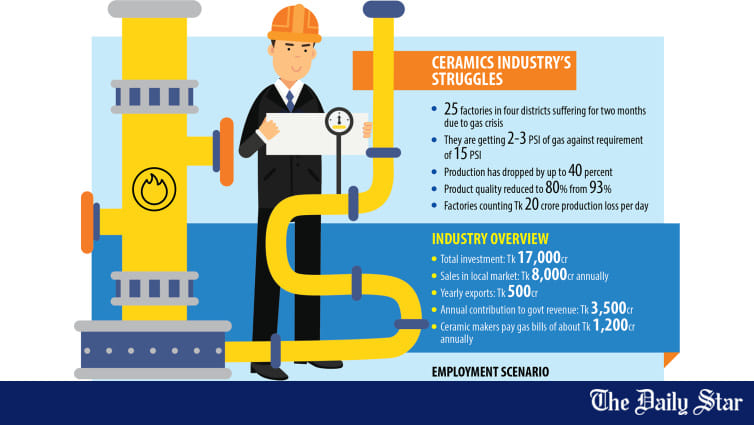

The ceramic industry's apex body, the Bangladesh Ceramic Manufacturers & Exporters' Association (BCMEA) has every right to feel indignant at the situation. Ceramic making is largely concentrated on gas-fired kilns but due to not only a crisis of gas but the hike in gas prices too. Indeed, the recent increase in gas prices was opposed by the industry, but at that time, the concerned ministry had promised uninterrupted supply of gas which turned out to be a fallacy. Moving to the present situation, industry experts state that some 25 factories in this area have been suffering a "production loss of estimated Tk200 million every day for the last one month due to the supply crunch of natural gas." It is only natural that ceramic manufacturers have been clamouring for sufficient gas supply in the areas of Mirpur-12, Dhamrai of Dhaka district, Tongi, Kashimpur, Bhabanipur, Bhawal, Mirzapur, Sreepur, Mawna (of Gazipur), Panchdona (of Narsingdi), Bhaluka and Trishal (of Mymensingh).

Today, the ceramic industry is an important sector with about 70 factories in operation. Only a handful of factories in Habiganj and Bhola get the require gas pressure for production. As stated by BCMEA, manufacturing units need gas supply pressure at 15 PSI (pound per square inch) but affected factories are getting at best, 3 PSI, which is hardly conducive to production. Products include tableware, tiles, sanitary ware and bricks. For normal operation, factories need kilns to have access to gas 24 hours a day that burn at 1,200 centrigrade at the required PSI. Since a constant pressure is required, what happens when the PSI goes down? Wastage of all material inside the kiln. This is unsustainable from a production point of view. Because when production comes to a halt due to this wastage happening from lower PSI, a factory must wait 48 to 72 hours before resuming production.

There is another matter that cannot be overlooked. The depreciation of the Taka against the US dollar, prices of inputs (particularly raw materials), i.e. a lot of the material that has to be imported has also shot up.

Getting back to the price of gas, price per cubic meter had been raised from Tk 13 to 30 on the promise of uninterrupted gas supply. And this turned out to be a mirage. So, not only is industry paying more than double the price per unit, it isn't getting it at the required pressure level - resulting in unsustainability of production. Is the domestic market for ceramic ware to be left to importers in that case? What is to happen to the workforce engaged in this industry and what is to happen to the estimated Tk170 billion in investments that have gone into making this industry that has been touted as one of a handful of industry capable of competing in foreign markets in the near future?

One cannot overlook the fact that domestic manufacturers cater to over 90 per cent of the domestic demand for the items produced by these factories and hence, its concerns for reliable primary energy supply cannot be ignored. There is literally no short-term solution to a problem that has been over a decade in the making. Recapping the folly of policymakers cannot be overstated with the emergence of the all-powerful import lobby for fossil fuel rose through the ranks of policymaking to convince the government that there was no need to explore domestic resources of natural gas (in what geologists have stated umpteen number of times as a natural gas-rich country).

Today, the ceramic industry is finding out to its dismay what it means when the country doesn't have enough foreign exchange to buy natural gas from foreign markets. Industrialisation in the country is in danger of stopping in its tracks- not just for domestic producers but for foreign investors too because there simply enough gas to go around. In the midst of this crisis, active foot-dragging efforts are in play to arrest energy wastage in a number of gas-guzzling plants that have outlived their operational lives and are grossly energy-inefficient.What other proof does the State need to enact measures to improve energy efficiency across the board? Ample studies exist on what needs to be done to save gas, so that it may be diverted to industries that are starving of it, but does the political will exist to save industry? That is the question.

SYED MANSUR HASHIM

Published :

Jul 05, 2024 21:47

Updated :

Jul 05, 2024 21:47

The ceramic industry is a deeply fossil-fuel driven industry, i.e. gas-dependent. It cannot be run on solar power. In fact, no heavy industrial production unit can for that matter. And while the government keeps harping about renewable energy as being the next big thing, industry suffers in silence or in mute protest that falls on deaf ears. The fact of the matter is that ceramic-making factories in key areas of Dhaka, Gazipur and Narsingdi have been "struggling to continue production as they have been suffering from a severe gas crisis in recent times" according to a recent report published in this newspaper.

The ceramic industry's apex body, the Bangladesh Ceramic Manufacturers & Exporters' Association (BCMEA) has every right to feel indignant at the situation. Ceramic making is largely concentrated on gas-fired kilns but due to not only a crisis of gas but the hike in gas prices too. Indeed, the recent increase in gas prices was opposed by the industry, but at that time, the concerned ministry had promised uninterrupted supply of gas which turned out to be a fallacy. Moving to the present situation, industry experts state that some 25 factories in this area have been suffering a "production loss of estimated Tk200 million every day for the last one month due to the supply crunch of natural gas." It is only natural that ceramic manufacturers have been clamouring for sufficient gas supply in the areas of Mirpur-12, Dhamrai of Dhaka district, Tongi, Kashimpur, Bhabanipur, Bhawal, Mirzapur, Sreepur, Mawna (of Gazipur), Panchdona (of Narsingdi), Bhaluka and Trishal (of Mymensingh).

Today, the ceramic industry is an important sector with about 70 factories in operation. Only a handful of factories in Habiganj and Bhola get the require gas pressure for production. As stated by BCMEA, manufacturing units need gas supply pressure at 15 PSI (pound per square inch) but affected factories are getting at best, 3 PSI, which is hardly conducive to production. Products include tableware, tiles, sanitary ware and bricks. For normal operation, factories need kilns to have access to gas 24 hours a day that burn at 1,200 centrigrade at the required PSI. Since a constant pressure is required, what happens when the PSI goes down? Wastage of all material inside the kiln. This is unsustainable from a production point of view. Because when production comes to a halt due to this wastage happening from lower PSI, a factory must wait 48 to 72 hours before resuming production.

There is another matter that cannot be overlooked. The depreciation of the Taka against the US dollar, prices of inputs (particularly raw materials), i.e. a lot of the material that has to be imported has also shot up.

Getting back to the price of gas, price per cubic meter had been raised from Tk 13 to 30 on the promise of uninterrupted gas supply. And this turned out to be a mirage. So, not only is industry paying more than double the price per unit, it isn't getting it at the required pressure level - resulting in unsustainability of production. Is the domestic market for ceramic ware to be left to importers in that case? What is to happen to the workforce engaged in this industry and what is to happen to the estimated Tk170 billion in investments that have gone into making this industry that has been touted as one of a handful of industry capable of competing in foreign markets in the near future?

One cannot overlook the fact that domestic manufacturers cater to over 90 per cent of the domestic demand for the items produced by these factories and hence, its concerns for reliable primary energy supply cannot be ignored. There is literally no short-term solution to a problem that has been over a decade in the making. Recapping the folly of policymakers cannot be overstated with the emergence of the all-powerful import lobby for fossil fuel rose through the ranks of policymaking to convince the government that there was no need to explore domestic resources of natural gas (in what geologists have stated umpteen number of times as a natural gas-rich country).

Today, the ceramic industry is finding out to its dismay what it means when the country doesn't have enough foreign exchange to buy natural gas from foreign markets. Industrialisation in the country is in danger of stopping in its tracks- not just for domestic producers but for foreign investors too because there simply enough gas to go around. In the midst of this crisis, active foot-dragging efforts are in play to arrest energy wastage in a number of gas-guzzling plants that have outlived their operational lives and are grossly energy-inefficient.What other proof does the State need to enact measures to improve energy efficiency across the board? Ample studies exist on what needs to be done to save gas, so that it may be diverted to industries that are starving of it, but does the political will exist to save industry? That is the question.