Saif

Senior Member

- Messages

- 17,560

- Likes

- 8,463

- Nation

- Residence

- Axis Group

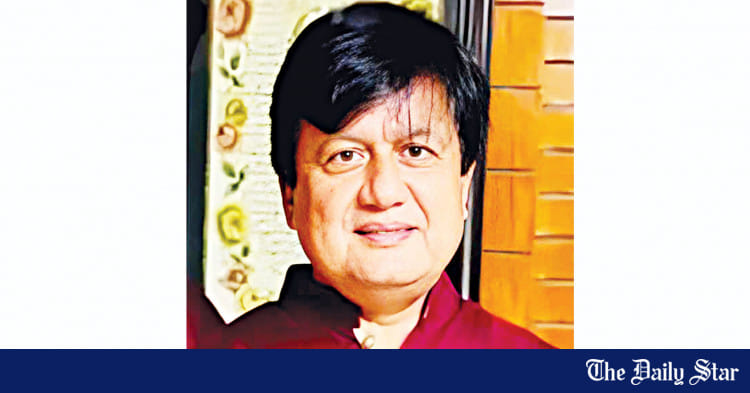

ACC files cases against ex-NBR member Matiur, family

ACC Director General Md Akhtar Hossain said the cases were filed under the Prevention of Corruption Act and the Prevention of Money Laundering Act

ACC files cases against ex-NBR member Matiur, family

The Anti-Corruption Commission today filed separate cases against Matiur Rahman, a former member of the National Board of Revenue, his first wife Laila Kaniz, their daughter Farzana Rahman Ipsita, and son Taufiqur Rahman Arnab, over allegations of acquiring wealth illegally.

ACC Director General Md Akhtar Hossain said the cases were filed under the Prevention of Corruption Act and the Prevention of Money Laundering Act.

According to the ACC, the cases were filed following an investigation into their wealth declarations.

The Anti-Corruption Commission today filed separate cases against Matiur Rahman, a former member of the National Board of Revenue, his first wife Laila Kaniz, their daughter Farzana Rahman Ipsita, and son Taufiqur Rahman Arnab, over allegations of acquiring wealth illegally.

ACC Director General Md Akhtar Hossain said the cases were filed under the Prevention of Corruption Act and the Prevention of Money Laundering Act.

According to the ACC, the cases were filed following an investigation into their wealth declarations.