Krishna with Flute

Senior Member

- Messages

- 5,473

- Likes

- 2,976

- Axis Group

Date of Event:

Sep 13, 2024

This is to track developments in Indian economy. To begin with:

www.thehindubusinessline.com

www.thehindubusinessline.com

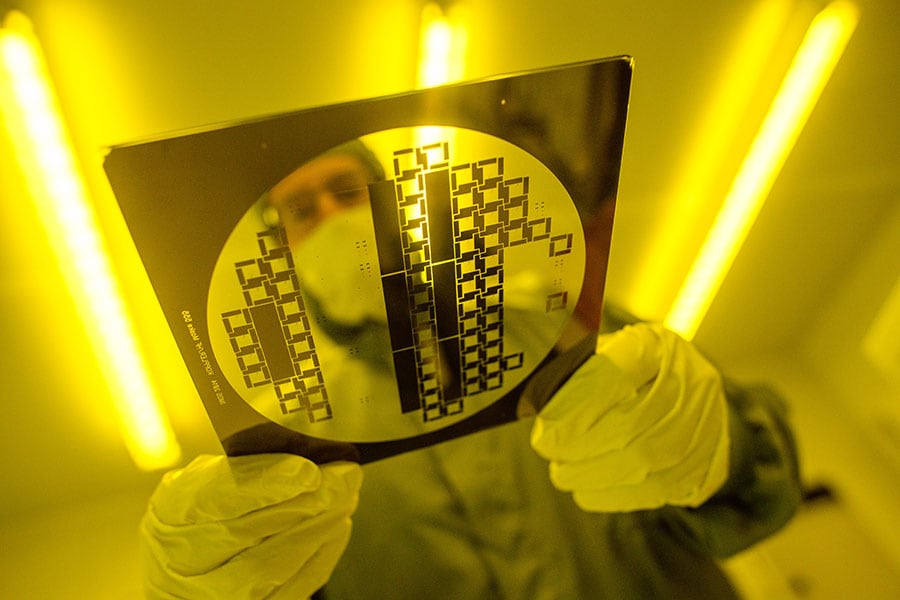

PM Modi sets ambitious USD 500 billion electronic industry size by 2030 against USD 150 billion now

Prime Minister Narendra Modi aims to grow India's electronics sector to USD 500 billion, creating millions of jobs.