Saif

Senior Member

- Messages

- 17,462

- Likes

- 8,403

- Nation

- Residence

- Axis Group

Bangladesh needs strong diplomatic engagement to delay LDC graduation, says RAPID chief

Bangladesh needs strong diplomatic engagement to delay its graduation from the Least Developed Country (LDC) category, as the country is likely to face multiple post-graduation challenges without adequate preparation, said Dr Mohammad Abdur Razzaque, chairman of the Research and Policy Integration

Bangladesh needs strong diplomatic engagement to delay LDC graduation, says RAPID chief

FE ONLINE REPORT

Published :

Dec 15, 2025 14:29

Updated :

Dec 15, 2025 14:32

File photo of Dr Mohammad Abdur Razzaque

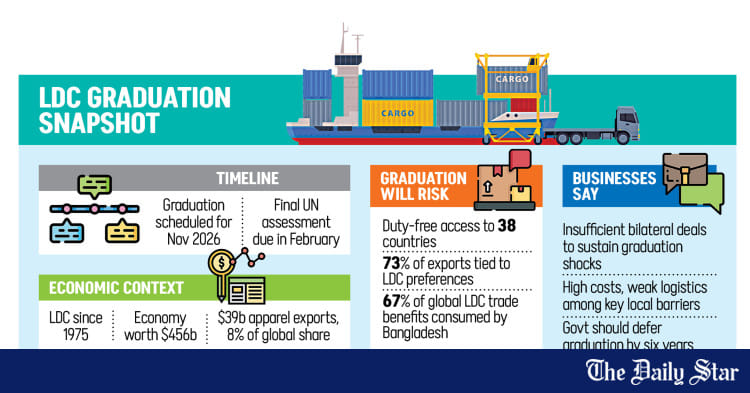

Bangladesh needs strong diplomatic engagement to delay its graduation from the Least Developed Country (LDC) category, as the country is likely to face multiple post-graduation challenges without adequate preparation, said Dr Mohammad Abdur Razzaque, chairman of the Research and Policy Integration for Development (RAPID), on Monday.

He made the remarks at a seminar titled ‘Socio-economic Priorities for the Next Government’, held at the CIRDAP Auditorium in Dhaka.

Dr Razzaque noted that the next government’s first major test would be crisis management, leaving limited scope for articulating long-term vision statements in the early phase of its tenure.

“Immediate challenges related to inflation, banking sector stability, foreign exchange reserves, and LDC graduation will shape the entire term of the next government,” the economist said.

He stressed that the incoming administration must prioritise securing the EU’s GSP+ facility, implementing the ninth five-year plan with a strong focus on job creation, ensuring energy security to support urban development and manufacturing industries, enhancing export competitiveness, attracting greater foreign direct investment (FDI), and strengthening human resource development.

Dr Razzaque warned that failure to act promptly would narrow the policy space and lead to more costly adjustments later, adding that while structural reforms are crucial, they can only succeed if short-term macroeconomic stability is ensured.

“Credible actions taken within the first year can help restore confidence among households, investors, and development partners,” he said.

The seminar was attended by National Board of Revenue (NBR) Chairman Md Abdur Rahman as the chief guest. Other speakers included former caretaker government adviser Rasheda K Chowdhury, RAPID Executive Director Dr M Abu Eusuf, Bangladesh Chamber of Industries President Anwar Ul Alam Parvez, among others.

FE ONLINE REPORT

Published :

Dec 15, 2025 14:29

Updated :

Dec 15, 2025 14:32

File photo of Dr Mohammad Abdur Razzaque

Bangladesh needs strong diplomatic engagement to delay its graduation from the Least Developed Country (LDC) category, as the country is likely to face multiple post-graduation challenges without adequate preparation, said Dr Mohammad Abdur Razzaque, chairman of the Research and Policy Integration for Development (RAPID), on Monday.

He made the remarks at a seminar titled ‘Socio-economic Priorities for the Next Government’, held at the CIRDAP Auditorium in Dhaka.

Dr Razzaque noted that the next government’s first major test would be crisis management, leaving limited scope for articulating long-term vision statements in the early phase of its tenure.

“Immediate challenges related to inflation, banking sector stability, foreign exchange reserves, and LDC graduation will shape the entire term of the next government,” the economist said.

He stressed that the incoming administration must prioritise securing the EU’s GSP+ facility, implementing the ninth five-year plan with a strong focus on job creation, ensuring energy security to support urban development and manufacturing industries, enhancing export competitiveness, attracting greater foreign direct investment (FDI), and strengthening human resource development.

Dr Razzaque warned that failure to act promptly would narrow the policy space and lead to more costly adjustments later, adding that while structural reforms are crucial, they can only succeed if short-term macroeconomic stability is ensured.

“Credible actions taken within the first year can help restore confidence among households, investors, and development partners,” he said.

The seminar was attended by National Board of Revenue (NBR) Chairman Md Abdur Rahman as the chief guest. Other speakers included former caretaker government adviser Rasheda K Chowdhury, RAPID Executive Director Dr M Abu Eusuf, Bangladesh Chamber of Industries President Anwar Ul Alam Parvez, among others.