Saif

Senior Member

- Messages

- 17,503

- Likes

- 8,438

- Nation

- Residence

- Axis Group

Economic diplomacy in int'l relations

Modern-day diplomacy is all about enhancing collaboration between countries through promotion of trade and investment. Even the big power politics is centred around competition between big economies to get the better of the other in the field of trade and investment. Especially, for countries not p

Economic diplomacy in int'l relations

FE

Published :

Jan 10, 2025 21:18

Updated :

Jan 10, 2025 21:18

Modern-day diplomacy is all about enhancing collaboration between countries through promotion of trade and investment. Even the big power politics is centred around competition between big economies to get the better of the other in the field of trade and investment. Especially, for countries not pursuing a policy of expanding their spheres of influence through military power, economic, i.e., trade diplomacy is the best option to enhance cooperation among one another. In other words, a state's foreign policy objective here is mainly to use diplomacy not as a tool to promote any political ideology, but to benefit mutually through ensuring each other's economic growth. In a narrower sense, economic diplomacy boils down to export promotion and inward investment. So it is also called commercial diplomacy. With trade liberalisation gaining ground globally in the late seventies of the last century, Bangladesh, too, entered the era of trade diplomacy. But due to a lack of democracy in the political culture, the country's trade diplomacy could not flourish. Now that a favourable political climate has been created under the incumbent interim government, all concerned should grab the opportunity and leave no stone unturned to catapult the nation into the era of advanced trade or commercial diplomacy.

To this end, the government will be required to play a proactive role in building rapport between practising diplomats and the business community within the country as well as abroad so they may adapt well to the global trend and bring home positive results for the economy. But given that the age-old bureaucracy is still entrenched in pre-modern mindset inheriting the colonial legacy, it will not come of age automatically. In that case, those from bureaucracy engaged in the country's diplomatic service should undergo necessary re-education and training to learn the art of modern trade diplomacy. It would be worthwhile to note at this point that an apex trade body of the country, Bangladesh Textile Mills Association (BTMA), organised a meeting with a visiting UK-based trade mission, UKBCCI (UK Bangladesh Catalysts of Commerce and Industry), an umbrella organisation embodying successful British-Bangladeshi entrepreneurs in the UK and Bangladesh.

Obviously, as part of an effort to look for avenues for promoting trade cooperation between Bangladesh and the UK, the main focus of the discussion was to achieve the goal through innovative use of trade diplomacy. One way of doing that, as the visiting UK member of parliament, Rupa Huq, for instance, told the said discussion event, was through reaching a Free Trade Agreement (FTA) between UK and Bangladesh. Notably, the British MP, in question, happens to be part of the business team, UKBCCI. So, the event provided a good opportunity for both the working diplomats and those in the making to hone their skill from such occasions where the representative of an advanced Western economy is actively pursuing trade diplomacy alongside the members of business community from either nation. However, trade diplomacy is no magic concept, it has to be with the trend of the time. So, when Artificial Intelligence (AI) is fast emerging as the driving force to propel global trade and industry further forward, Bangladesh cannot stay behind. Needless to mention, the nation's diplomacy has to adapt itself to the dominant trend. Also, the businesses now evincing high growth potential these days include technologies, agriculture and AI.

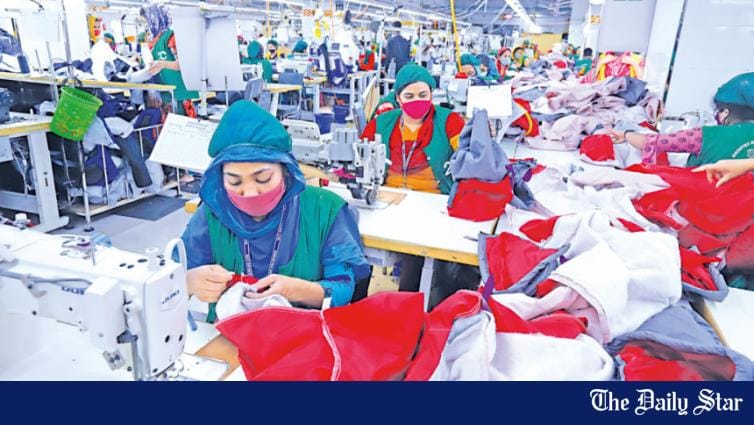

The development is a reminder for the country to diversify its export basket which at present is overwhelmingly dominated by only a single group of items from the apparel industry. So, to ensure that Bangladesh thrives economically in the years ahead, it should emphasise international relations based on sound economic diplomacy.

FE

Published :

Jan 10, 2025 21:18

Updated :

Jan 10, 2025 21:18

Modern-day diplomacy is all about enhancing collaboration between countries through promotion of trade and investment. Even the big power politics is centred around competition between big economies to get the better of the other in the field of trade and investment. Especially, for countries not pursuing a policy of expanding their spheres of influence through military power, economic, i.e., trade diplomacy is the best option to enhance cooperation among one another. In other words, a state's foreign policy objective here is mainly to use diplomacy not as a tool to promote any political ideology, but to benefit mutually through ensuring each other's economic growth. In a narrower sense, economic diplomacy boils down to export promotion and inward investment. So it is also called commercial diplomacy. With trade liberalisation gaining ground globally in the late seventies of the last century, Bangladesh, too, entered the era of trade diplomacy. But due to a lack of democracy in the political culture, the country's trade diplomacy could not flourish. Now that a favourable political climate has been created under the incumbent interim government, all concerned should grab the opportunity and leave no stone unturned to catapult the nation into the era of advanced trade or commercial diplomacy.

To this end, the government will be required to play a proactive role in building rapport between practising diplomats and the business community within the country as well as abroad so they may adapt well to the global trend and bring home positive results for the economy. But given that the age-old bureaucracy is still entrenched in pre-modern mindset inheriting the colonial legacy, it will not come of age automatically. In that case, those from bureaucracy engaged in the country's diplomatic service should undergo necessary re-education and training to learn the art of modern trade diplomacy. It would be worthwhile to note at this point that an apex trade body of the country, Bangladesh Textile Mills Association (BTMA), organised a meeting with a visiting UK-based trade mission, UKBCCI (UK Bangladesh Catalysts of Commerce and Industry), an umbrella organisation embodying successful British-Bangladeshi entrepreneurs in the UK and Bangladesh.

Obviously, as part of an effort to look for avenues for promoting trade cooperation between Bangladesh and the UK, the main focus of the discussion was to achieve the goal through innovative use of trade diplomacy. One way of doing that, as the visiting UK member of parliament, Rupa Huq, for instance, told the said discussion event, was through reaching a Free Trade Agreement (FTA) between UK and Bangladesh. Notably, the British MP, in question, happens to be part of the business team, UKBCCI. So, the event provided a good opportunity for both the working diplomats and those in the making to hone their skill from such occasions where the representative of an advanced Western economy is actively pursuing trade diplomacy alongside the members of business community from either nation. However, trade diplomacy is no magic concept, it has to be with the trend of the time. So, when Artificial Intelligence (AI) is fast emerging as the driving force to propel global trade and industry further forward, Bangladesh cannot stay behind. Needless to mention, the nation's diplomacy has to adapt itself to the dominant trend. Also, the businesses now evincing high growth potential these days include technologies, agriculture and AI.

The development is a reminder for the country to diversify its export basket which at present is overwhelmingly dominated by only a single group of items from the apparel industry. So, to ensure that Bangladesh thrives economically in the years ahead, it should emphasise international relations based on sound economic diplomacy.