Saif

Senior Member

- Joined

- Jan 24, 2024

- Messages

- 16,880

- Likes

- 8,153

- Nation

- Residence

- Axis Group

Economy largely stagnant, with slight relief in reserves

The country began 2024 with negative economic indicators and when the political landscape changed in August, the economy was in dire state. While the interim government took some measures to handle the pressure, the economy did not pick up speed over the past five months

Economy largely stagnant, with slight relief in reserves

Jahangir Shah

Dhaka

Updated: 25 Dec 2024, 18: 15

The country began 2024 with negative economic indicators and when the political landscape changed in August, the economy was in dire state.

While the interim government took some measures to handle the pressure, the economy did not pick up speed over the past five months.

The biggest achievement during this period has been the acknowledgment of the economic crisis. The white paper detailing the economic situation also revealed widespread corruption under the Awami League government.

The people in general continue to suffer under high inflation. The price of the dollar has surpassed Tk 120. There are some positive developments in exports and remittances, but nearly all other macroeconomic indicators remain at rock bottom. Political uncertainty has led to stagnation in investment.

After the mass movement in July-August, the law and order situation has not been fully brought under control. As a result, there is ongoing instability in the industrial sector, particularly in the garment industry. Extortion continues, although reports indicate that some extortionists are being replaced. Overall, it can be said that 2024 is ending with the economy still in crisis.

After the change in power on 5 August, there were significant changes in economic leadership. Key positions, such as finance adviser, planning adviser, trade adviser, as well as the governor of Bangladesh Bank and the chairman of the National Board of Revenue (NBR), were filled with individuals of a good reputation. Over the past five months, the new economic leadership has mostly been focused on clearing the "mess" left by the previous government.

Inflation is villain of the year

The biggest struggle for the general public in the outgoing year has been the cost of daily necessities. For eight consecutive months, food inflation remained in double digits. Even though supply increased during the winter season, the price of vegetables did not decrease significantly. As a result, people with fixed incomes are struggling to make ends meet. According to the latest data from the Bangladesh Bureau of Statistics (BBS), food inflation in November reached 13.80 per cent, the second-highest in the past 13 and a half years. In July, food inflation had risen to 14.10 per cent.

Overall inflation has remained around double digits, but the national wage rate has been stuck at around 8 per cent for several months, meaning people's income is growing at a much slower rate than inflation. After the new government took office, steps like raising interest rates and reducing some duties were taken, but inflation has not been brought under control.

A look at the economy through the white paper

One of the major initiatives of 2024 was the publication of a white paper on the economy. For the first time, this document highlighted how bad the situation had become due to corruption at every level. It was revealed that during the Awami League government's tenure, nearly Tk 28 trillion had been laundered abroad, with an average of Tk 180 billion being sent out each year.

Over a period of 15 years, politicians and bureaucrats took bribes of up to Tk 2500 billion from government procurement. Development projects were plundered to the tune of nearly Tk 3 trillion, while the amount embezzled from the stock market amounted to Tk 1 trillion.

Over a period of 15 years, politicians and bureaucrats took bribes of up to Tk 2500 billion from government procurement. Development projects were plundered to the tune of nearly Tk 3 trillion, while the amount embezzled from the stock market amounted to Tk 1 trillion.

Current state of the economy

The revenue sector is struggling. According to the latest data from the National Board of Revenue (NBR), there was a shortfall of Tk 307.68 billion in customs and tax collection during the first four months of the current fiscal year (July-October). NBR has been falling short of its collection targets every month.

Expenditure on development projects has decreased. Due to many contractors with ties to the Awami League fleeing, the implementation of the Annual Development Programme (ADP) has been poor. In the July-November period, spending was Tk 1.25 trillion less compared to the previous year.

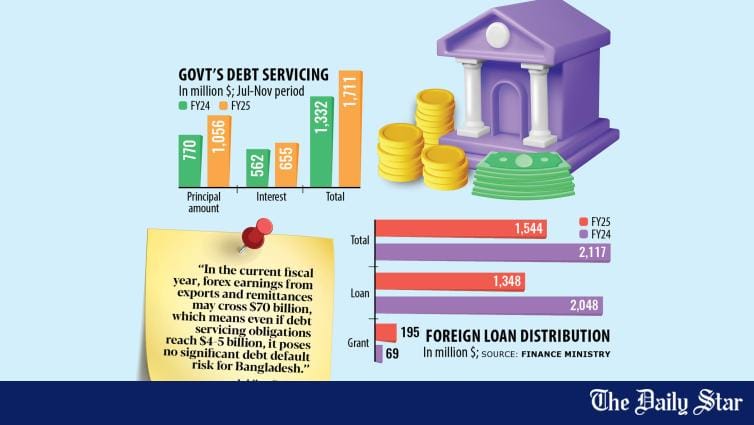

However, the good news is that there has been some momentum in exports and remittances under the interim government. For four consecutive months, remittances have exceeded 2 billion dollars each month. In the first five months of the 2024-25 fiscal year, remittances grew by approximately 26.4 per cent. Additionally, thanks to various measures, export earnings have surpassed 20 billion dollars in the past five months.

The positive performance of exports and remittances has helped prevent a further depletion of reserves.

However, non-performing loans have surged significantly. The loans taken from banks during the Awami League government's tenure, through irregularities and corruption, are now beginning to default. By the end of September, non-performing loans amounted to Tk 2.849 trillion.

Economists' view

Mustafizur Rahman, a distinguished fellow at the Center for Policy Dialogue (CPD), told Prothom Alo that the economy of 2024 should be viewed in two parts: one under the previous government and the other after the student-led uprising. Despite socio-economic progress under the Awami League government, various pressures were building up within the economy, such as unfair distribution, diminishing purchasing power, a sharp fall in the exchange rate, and high inflation. The accumulated economic issues also played a role in the student and public movements.

Mustafizur said that there are high expectations for the interim government regarding the economy and good governance. The second chapter, with aspirations for change, has begun. Issues of inequality and fair distribution are being discussed, but many economic problems remain, such as high inflation and a continuing decline in people's living standards.

The interim government is trying to tackle inflation through contractionary monetary policies, revenue policies, and market monitoring. However, it has not been able to bring about significant change in many economic indicators, and the economy has not gained momentum.

Jahangir Shah

Dhaka

Updated: 25 Dec 2024, 18: 15

The country began 2024 with negative economic indicators and when the political landscape changed in August, the economy was in dire state.

While the interim government took some measures to handle the pressure, the economy did not pick up speed over the past five months.

The biggest achievement during this period has been the acknowledgment of the economic crisis. The white paper detailing the economic situation also revealed widespread corruption under the Awami League government.

The people in general continue to suffer under high inflation. The price of the dollar has surpassed Tk 120. There are some positive developments in exports and remittances, but nearly all other macroeconomic indicators remain at rock bottom. Political uncertainty has led to stagnation in investment.

After the mass movement in July-August, the law and order situation has not been fully brought under control. As a result, there is ongoing instability in the industrial sector, particularly in the garment industry. Extortion continues, although reports indicate that some extortionists are being replaced. Overall, it can be said that 2024 is ending with the economy still in crisis.

After the change in power on 5 August, there were significant changes in economic leadership. Key positions, such as finance adviser, planning adviser, trade adviser, as well as the governor of Bangladesh Bank and the chairman of the National Board of Revenue (NBR), were filled with individuals of a good reputation. Over the past five months, the new economic leadership has mostly been focused on clearing the "mess" left by the previous government.

Inflation is villain of the year

The biggest struggle for the general public in the outgoing year has been the cost of daily necessities. For eight consecutive months, food inflation remained in double digits. Even though supply increased during the winter season, the price of vegetables did not decrease significantly. As a result, people with fixed incomes are struggling to make ends meet. According to the latest data from the Bangladesh Bureau of Statistics (BBS), food inflation in November reached 13.80 per cent, the second-highest in the past 13 and a half years. In July, food inflation had risen to 14.10 per cent.

Overall inflation has remained around double digits, but the national wage rate has been stuck at around 8 per cent for several months, meaning people's income is growing at a much slower rate than inflation. After the new government took office, steps like raising interest rates and reducing some duties were taken, but inflation has not been brought under control.

A look at the economy through the white paper

One of the major initiatives of 2024 was the publication of a white paper on the economy. For the first time, this document highlighted how bad the situation had become due to corruption at every level. It was revealed that during the Awami League government's tenure, nearly Tk 28 trillion had been laundered abroad, with an average of Tk 180 billion being sent out each year.

Over a period of 15 years, politicians and bureaucrats took bribes of up to Tk 2500 billion from government procurement. Development projects were plundered to the tune of nearly Tk 3 trillion, while the amount embezzled from the stock market amounted to Tk 1 trillion.

Over a period of 15 years, politicians and bureaucrats took bribes of up to Tk 2500 billion from government procurement. Development projects were plundered to the tune of nearly Tk 3 trillion, while the amount embezzled from the stock market amounted to Tk 1 trillion.

Current state of the economy

The revenue sector is struggling. According to the latest data from the National Board of Revenue (NBR), there was a shortfall of Tk 307.68 billion in customs and tax collection during the first four months of the current fiscal year (July-October). NBR has been falling short of its collection targets every month.

Expenditure on development projects has decreased. Due to many contractors with ties to the Awami League fleeing, the implementation of the Annual Development Programme (ADP) has been poor. In the July-November period, spending was Tk 1.25 trillion less compared to the previous year.

However, the good news is that there has been some momentum in exports and remittances under the interim government. For four consecutive months, remittances have exceeded 2 billion dollars each month. In the first five months of the 2024-25 fiscal year, remittances grew by approximately 26.4 per cent. Additionally, thanks to various measures, export earnings have surpassed 20 billion dollars in the past five months.

The positive performance of exports and remittances has helped prevent a further depletion of reserves.

However, non-performing loans have surged significantly. The loans taken from banks during the Awami League government's tenure, through irregularities and corruption, are now beginning to default. By the end of September, non-performing loans amounted to Tk 2.849 trillion.

Economists' view

Mustafizur Rahman, a distinguished fellow at the Center for Policy Dialogue (CPD), told Prothom Alo that the economy of 2024 should be viewed in two parts: one under the previous government and the other after the student-led uprising. Despite socio-economic progress under the Awami League government, various pressures were building up within the economy, such as unfair distribution, diminishing purchasing power, a sharp fall in the exchange rate, and high inflation. The accumulated economic issues also played a role in the student and public movements.

Mustafizur said that there are high expectations for the interim government regarding the economy and good governance. The second chapter, with aspirations for change, has begun. Issues of inequality and fair distribution are being discussed, but many economic problems remain, such as high inflation and a continuing decline in people's living standards.

The interim government is trying to tackle inflation through contractionary monetary policies, revenue policies, and market monitoring. However, it has not been able to bring about significant change in many economic indicators, and the economy has not gained momentum.