- Copy to clipboard

- Moderator

- #1

- Messages

- 111,139

- Reaction score

- 834

- Origin

- Residence

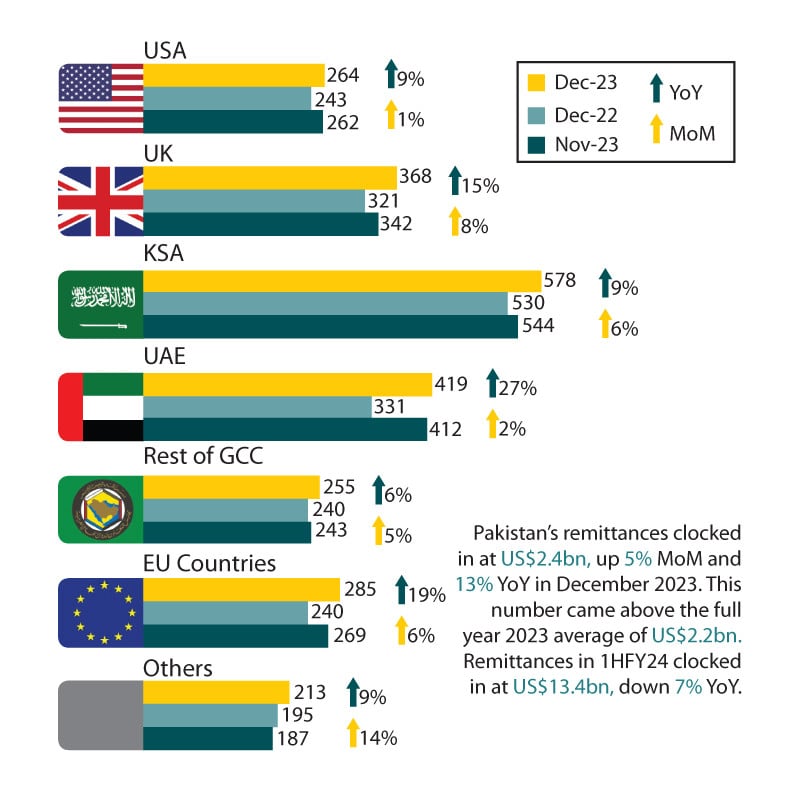

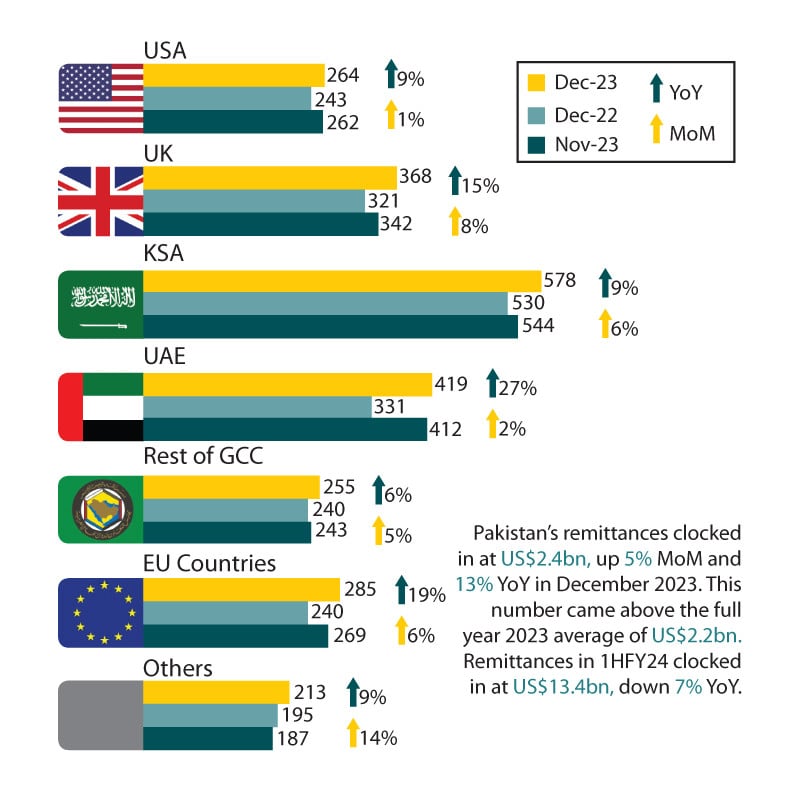

Remittances surge by 13% to $2.38b in Dec 2023

Stability in rupee-dollar parity, crackdown on illegal networks boost numbersSalman Siddiqui

January 11, 2024

design: Ibrahim Yahya

The inflows of workers’ remittances sent home by overseas Pakistanis increased by 13% to $2.38 billion in December 2023, as they dispatched the funds through official channels following the return of stability in the rupee-dollar parity and the crackdown against illegal currency networks.

The improvement in remittances fuelled the ongoing gradual rally in the rupee against the US dollar on Wednesday, strengthening the market view that the balance of the current account would record a surplus for the second consecutive month of December 2023.

The State Bank of Pakistan (SBP) reported that remittances rose by 13% compared to $2.10 billion in the same month of December of the previous year.

Inflows improved by 5.5% in the month compared to $2.26 billion in the prior month of November 2023.

However, workers’ remittances have cumulatively slowed down by 7% in the first half (Jul-Dec) of the current fiscal year 2023-24, amounting to $13.45 billion compared to $14.42 billion in the same period of the previous year, according to the central bank.

Topline Securities, CEO, Muhammad Sohail mentioned that the latest monthly inflows of $2.38 billion are higher than the full-year 2023 average of $2.20 billion a month.

Market talk suggests that the receipts have increased due to the crackdown against foreign currency smugglers, such as hawala-hundi operators and hoarders, since September 2023.

The cleanup operation crushed illicit currency markets, especially in the bordering areas with Afghanistan, and strengthened the hold of off

Remittances surge by 13% to $2.38b in Dec 2023 | The Express Tribune

Stability in rupee-dollar parity, crackdown on illegal networks boost numbers