Saif

Senior Member

- Messages

- 17,578

- Likes

- 8,463

- Nation

- Residence

- Axis Group

Date of Event:

Dec 26, 2024

Reopening state-owned sugar mills

MIR MOSTAFIZUR RAHAMAN

Published :

Dec 25, 2024 21:55

Updated :

Dec 25, 2024 21:55

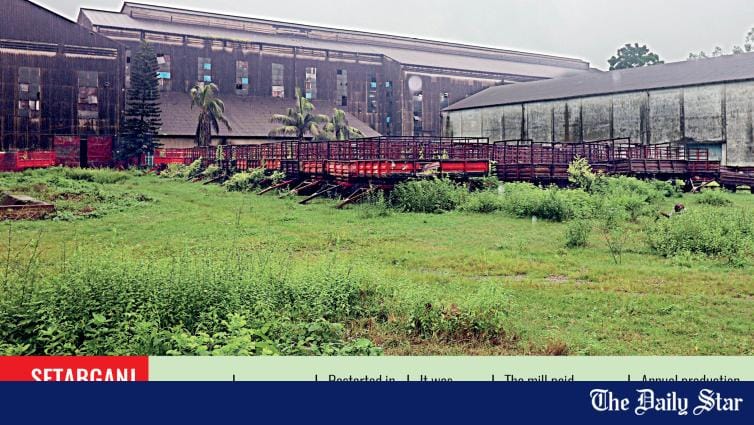

Representational image Photo : Collected

The recent move to reopen six state-owned sugar mills in phases, following the recommendations of a task force, has sparked hope among thousands of workers and sugarcane growers. For years, these individuals struggled to make ends meet after the abrupt closure of the mills under the previous administration. While this move is undoubtedly a positive development, ensuring the sustainability of these mills is paramount to avoid repeating past mistakes.

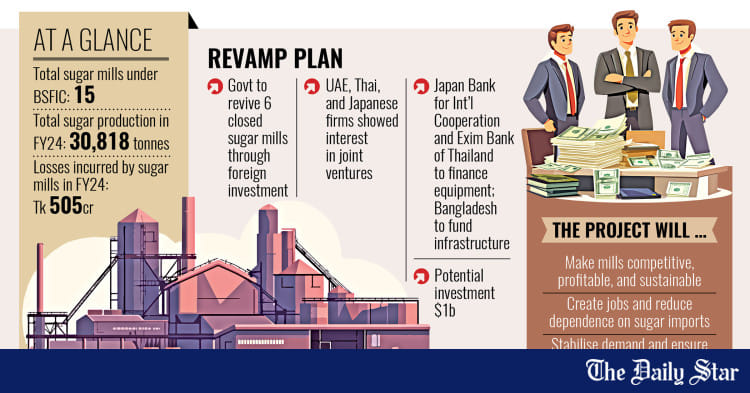

The Bangladesh Sugar and Food Industries Corporation (BSFIC) oversees 15 state-owned mills, which have historically been the backbone of the country's sugar industry. Since independence, these mills were the primary source of sugar for the nation. However, over time, a combination of mismanagement, corruption, and technological stagnation eroded their production capacity. From being industry leaders, these mills gradually became inefficient, producing only around 30,000 tons of sugar annually-an insignificant amount compared to national demand.

This decline provided an opening for private sugar refineries to dominate the market. Unlike state-owned mills, private refiners operated with better efficiency and modern equipment. Over time, the BSFIC mills lost their competitive edge, allowing private companies to manipulate sugar prices and control the market. The government's inability to intervene effectively in sugar price syndication became a direct consequence of the dilapidated state of the BSFIC mills.

The reopening of these mills offers an opportunity to address these challenges, but only if the government implements a comprehensive and sustainable strategy. A superficial or hasty approach could lead these mills down the same path as the state-owned jute mills, which were reopened due to public pressure but closed again within a year due to poor planning and lack of resources.

For the reopening to succeed, the government must prioritise modernisation. The factories are in dire need of technological upgrading to compete with private refiners. This includes investing in machinery and facilities that can increase production capacity and improve the recovery rate of sugar from sugarcane. At present, the recovery rate of state-owned mills is half that of Indian mills-a gap that must be bridged.

Additionally, farmers supplying sugarcane to these mills should be provided with high-yield and high-recovery varieties of sugarcane. Collaboration with agricultural research institutions to introduce modern farming techniques and better crop varieties could significantly improve the efficiency of the supply chain.

Another critical aspect of ensuring sustainability is the efficient management of these mills. The history of state-owned enterprises in Bangladesh is marred by corruption and mismanagement, and the sugar mills are no exception. The government must enforce strict accountability measures and ensure that those engaging in corrupt practices face consequences. Transparent hiring practices, performance-based incentives, and rigorous oversight can help create a more professional and efficient workforce.

The reopening of state-owned sugar mills could also have broader economic benefits. Thousands of workers will regain their livelihoods, and sugarcane farmers will have a stable market for their crops. This could have a ripple effect on rural economies, fostering development and reducing poverty in sugarcane-growing regions.

MIR MOSTAFIZUR RAHAMAN

Published :

Dec 25, 2024 21:55

Updated :

Dec 25, 2024 21:55

Representational image Photo : Collected

The recent move to reopen six state-owned sugar mills in phases, following the recommendations of a task force, has sparked hope among thousands of workers and sugarcane growers. For years, these individuals struggled to make ends meet after the abrupt closure of the mills under the previous administration. While this move is undoubtedly a positive development, ensuring the sustainability of these mills is paramount to avoid repeating past mistakes.

The Bangladesh Sugar and Food Industries Corporation (BSFIC) oversees 15 state-owned mills, which have historically been the backbone of the country's sugar industry. Since independence, these mills were the primary source of sugar for the nation. However, over time, a combination of mismanagement, corruption, and technological stagnation eroded their production capacity. From being industry leaders, these mills gradually became inefficient, producing only around 30,000 tons of sugar annually-an insignificant amount compared to national demand.

This decline provided an opening for private sugar refineries to dominate the market. Unlike state-owned mills, private refiners operated with better efficiency and modern equipment. Over time, the BSFIC mills lost their competitive edge, allowing private companies to manipulate sugar prices and control the market. The government's inability to intervene effectively in sugar price syndication became a direct consequence of the dilapidated state of the BSFIC mills.

The reopening of these mills offers an opportunity to address these challenges, but only if the government implements a comprehensive and sustainable strategy. A superficial or hasty approach could lead these mills down the same path as the state-owned jute mills, which were reopened due to public pressure but closed again within a year due to poor planning and lack of resources.

For the reopening to succeed, the government must prioritise modernisation. The factories are in dire need of technological upgrading to compete with private refiners. This includes investing in machinery and facilities that can increase production capacity and improve the recovery rate of sugar from sugarcane. At present, the recovery rate of state-owned mills is half that of Indian mills-a gap that must be bridged.

Additionally, farmers supplying sugarcane to these mills should be provided with high-yield and high-recovery varieties of sugarcane. Collaboration with agricultural research institutions to introduce modern farming techniques and better crop varieties could significantly improve the efficiency of the supply chain.

Another critical aspect of ensuring sustainability is the efficient management of these mills. The history of state-owned enterprises in Bangladesh is marred by corruption and mismanagement, and the sugar mills are no exception. The government must enforce strict accountability measures and ensure that those engaging in corrupt practices face consequences. Transparent hiring practices, performance-based incentives, and rigorous oversight can help create a more professional and efficient workforce.

The reopening of state-owned sugar mills could also have broader economic benefits. Thousands of workers will regain their livelihoods, and sugarcane farmers will have a stable market for their crops. This could have a ripple effect on rural economies, fostering development and reducing poverty in sugarcane-growing regions.

The government must take lessons from the failures of state-owned jute mills. Without a clear policy framework, adequate financial support, and a commitment to modernisation, the reopened sugar mills risk becoming yet another burden on the national exchequer. Proper planning, long-term investment, and stakeholder collaboration are essential to ensure these mills become profitable and sustainable.

With the right policies and investments, the reopened mills can become a symbol of resilience and progress, contributing to the nation's economic growth and self-reliance. Let this reopening be the beginning of a new chapter for Bangladesh's sugar industry-a chapter defined by efficiency, sustainability, and prosperity.