Saif

Senior Member

- Joined

- Jan 24, 2024

- Messages

- 16,837

- Likes

- 8,152

- Nation

- Residence

- Axis Group

EU supply chain law is both a threat and an opportunity

How will it impact Bangladesh’s garment manufacturers?

EU supply chain law is both a threat and an opportunity

Photo: REUTERS

Recently, the European Parliament approved the Corporate Sustainability Due Diligence Directive (CSDDD), moving it one step closer to formal adoption by the European Union. The CSDDD, once adopted, will create a legal liability for companies in relation to environmental and human rights violations within their global supply chains.

There has been a huge discussion about the CSDDD in Western media, with concerns raised that it has been significantly watered down from the initial proposal. But what is this directive/legislation, and how will it impact Bangladesh's garment manufacturers?

The CSDDD actually represents a significant regulatory initiative by the EU to promote sustainable business practices across various industries, including the garment sector. At its core, it mandates that large companies operating within the EU take active steps to identify, prevent, mitigate, and account for the adverse impacts of their operations on human rights and the environment. It is built on the principle that businesses should be proactive in their sustainability efforts, rather than reactive or merely compliant with existing norms.

The regulation covers a number of areas. In terms of due diligence requirements, it means that companies are required to conduct due diligence processes to assess and address the risks associated with their business operations and their entire supply chain. It also means looking into how their products are made, where materials are sourced, and the working conditions in factories, among other factors. All have obvious implications for manufacturers, particularly with regard to the rights of garment workers, which are a contentious issue throughout Asia.

Transparency is also a crucial aspect of the CSDDD. The new regulations mandate that companies must regularly report on their due diligence activities, findings, and the measures they take to mitigate negative impacts. The reporting ensures that stakeholders, including consumers and investors, are well-informed about the company's sustainability practices.

The key here is that, to ensure greater transparency, fashion brands will have to further engage with suppliers. Will this mean more audits and questionnaires for manufacturers? This seems to be a distinct possibility.

Stakeholder engagement is another key aspect of the CSDDD. Engaging with potentially affected groups and other stakeholders is essential under the new rules. This includes dialogue with local communities, workers, and NGOs to gain insights into the real-world impacts of business operations. If a company identifies that it has caused or contributed to adverse impacts, it must provide or cooperate in remediation. This could involve compensating communities for environmental damage or improving working conditions in factories. Previously, the issue of remediation had been left for the supply chains to sort out. To this extent, it will be interesting how the issue of remediation plays out under the CSDDD.

In Bangladesh, the garment industry is already heavily scrutinised for its environmental and social impacts, ranging from excessive water usage and pollution to labour rights abuses in the supply chains. Given that, I assume the CSDDD could significantly impact garment manufacturers in several ways.

The first of these is supply chain scrutiny. Manufacturers will need to have a thorough understanding of their entire supply chain—from raw material sourcing to the final product. This includes ensuring that all parts of the supply chain adhere to environmental standards and respect workers' rights. For instance, manufacturers might need to switch to suppliers who use sustainable materials or enforce fair labour practices.

The potential for increased costs is another issue. Implementing comprehensive due diligence processes can be costly. Garment manufacturers might face higher operational costs as they invest in better supply chain management systems, conduct audits, and potentially pay higher prices for sustainably sourced materials. These costs could also affect pricing strategies and profit margins.

On the other hand, adhering to the CSDDD could provide a competitive advantage for some suppliers. Consumers are increasingly conscious of the environmental and social impacts of their purchases. Companies that demonstrate genuine commitment to sustainability may attract more customers and build stronger brand loyalty. This could be an opportunity for some suppliers, and we are already seeing this as brands put more effort into supporting progressive, responsible garment manufacturers.

The directive may also spur innovation in the industry. Manufacturers might invest in new technologies and processes that reduce environmental impacts, such as water recycling systems or energy-efficient production techniques. This can not only help comply with the CSDDD but also improve overall efficiency and cost-effectiveness.

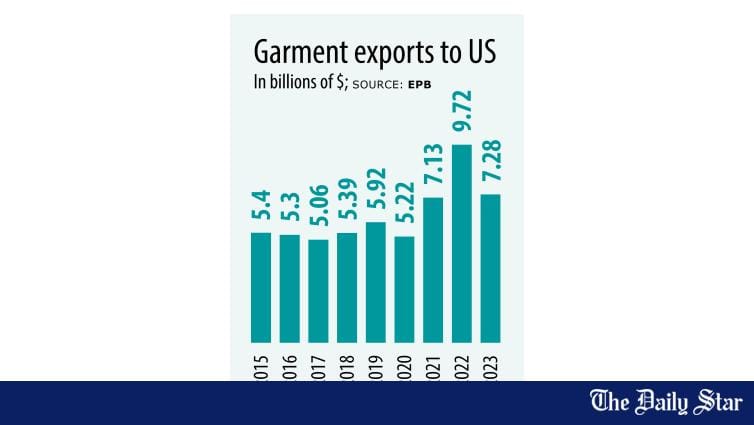

Moving forward, for garment manufacturers in Bangladesh, compliance with the CSDDD is going to be essential for accessing the European market—our largest market alongside the US. Non-compliance can result in legal risks, including fines and restrictions on market access. Therefore, it's crucial for the manufacturers to align their practices with the directive to avoid such risks. We cannot afford to get this wrong.

While the transition may be challenging and costly, the long-term benefits of building a sustainable operation could outweigh these initial investments—not just in profitability, but also in contributing positively to society and the environment.

Mostafiz Uddin is the managing director of Denim Expert Limited. He is also the founder and CEO of Bangladesh Denim Expo and Bangladesh Apparel Exchange (BAE).

Photo: REUTERS

Recently, the European Parliament approved the Corporate Sustainability Due Diligence Directive (CSDDD), moving it one step closer to formal adoption by the European Union. The CSDDD, once adopted, will create a legal liability for companies in relation to environmental and human rights violations within their global supply chains.

There has been a huge discussion about the CSDDD in Western media, with concerns raised that it has been significantly watered down from the initial proposal. But what is this directive/legislation, and how will it impact Bangladesh's garment manufacturers?

The CSDDD actually represents a significant regulatory initiative by the EU to promote sustainable business practices across various industries, including the garment sector. At its core, it mandates that large companies operating within the EU take active steps to identify, prevent, mitigate, and account for the adverse impacts of their operations on human rights and the environment. It is built on the principle that businesses should be proactive in their sustainability efforts, rather than reactive or merely compliant with existing norms.

The regulation covers a number of areas. In terms of due diligence requirements, it means that companies are required to conduct due diligence processes to assess and address the risks associated with their business operations and their entire supply chain. It also means looking into how their products are made, where materials are sourced, and the working conditions in factories, among other factors. All have obvious implications for manufacturers, particularly with regard to the rights of garment workers, which are a contentious issue throughout Asia.

Transparency is also a crucial aspect of the CSDDD. The new regulations mandate that companies must regularly report on their due diligence activities, findings, and the measures they take to mitigate negative impacts. The reporting ensures that stakeholders, including consumers and investors, are well-informed about the company's sustainability practices.

The key here is that, to ensure greater transparency, fashion brands will have to further engage with suppliers. Will this mean more audits and questionnaires for manufacturers? This seems to be a distinct possibility.

Stakeholder engagement is another key aspect of the CSDDD. Engaging with potentially affected groups and other stakeholders is essential under the new rules. This includes dialogue with local communities, workers, and NGOs to gain insights into the real-world impacts of business operations. If a company identifies that it has caused or contributed to adverse impacts, it must provide or cooperate in remediation. This could involve compensating communities for environmental damage or improving working conditions in factories. Previously, the issue of remediation had been left for the supply chains to sort out. To this extent, it will be interesting how the issue of remediation plays out under the CSDDD.

In Bangladesh, the garment industry is already heavily scrutinised for its environmental and social impacts, ranging from excessive water usage and pollution to labour rights abuses in the supply chains. Given that, I assume the CSDDD could significantly impact garment manufacturers in several ways.

The first of these is supply chain scrutiny. Manufacturers will need to have a thorough understanding of their entire supply chain—from raw material sourcing to the final product. This includes ensuring that all parts of the supply chain adhere to environmental standards and respect workers' rights. For instance, manufacturers might need to switch to suppliers who use sustainable materials or enforce fair labour practices.

The potential for increased costs is another issue. Implementing comprehensive due diligence processes can be costly. Garment manufacturers might face higher operational costs as they invest in better supply chain management systems, conduct audits, and potentially pay higher prices for sustainably sourced materials. These costs could also affect pricing strategies and profit margins.

On the other hand, adhering to the CSDDD could provide a competitive advantage for some suppliers. Consumers are increasingly conscious of the environmental and social impacts of their purchases. Companies that demonstrate genuine commitment to sustainability may attract more customers and build stronger brand loyalty. This could be an opportunity for some suppliers, and we are already seeing this as brands put more effort into supporting progressive, responsible garment manufacturers.

The directive may also spur innovation in the industry. Manufacturers might invest in new technologies and processes that reduce environmental impacts, such as water recycling systems or energy-efficient production techniques. This can not only help comply with the CSDDD but also improve overall efficiency and cost-effectiveness.

Moving forward, for garment manufacturers in Bangladesh, compliance with the CSDDD is going to be essential for accessing the European market—our largest market alongside the US. Non-compliance can result in legal risks, including fines and restrictions on market access. Therefore, it's crucial for the manufacturers to align their practices with the directive to avoid such risks. We cannot afford to get this wrong.

While the transition may be challenging and costly, the long-term benefits of building a sustainable operation could outweigh these initial investments—not just in profitability, but also in contributing positively to society and the environment.

Mostafiz Uddin is the managing director of Denim Expert Limited. He is also the founder and CEO of Bangladesh Denim Expo and Bangladesh Apparel Exchange (BAE).