Saif

Senior Member

- Joined

- Jan 24, 2024

- Messages

- 15,397

- Reaction score

- 7,874

- Nation

- Residence

- Axis Group

Vietnam may surpass Bangladesh in garment export: report

Vietnam is set to generate $44 billion this year through garment exports, surpassing Bangladesh, which is currently the world’s second-largest garment exporter, according to a Vietnamese media report.

Vietnam may surpass Bangladesh in garment export: report

Workers are seen at a garment factory in Hung Yen province of Vietnam. Photo: Reuters/file

Vietnam is set to generate $44 billion this year through garment exports, surpassing Bangladesh, which is currently the world's second-largest garment exporter, according to a Vietnamese media report.

Bangladesh's export goal is $4 billion lower than Vietnam's.

Vietnam's apparel and textile sector is set to earn an export revenue of $44 billion this year, up 11 percent year-on-year, and will likely surpass Bangladesh to become the world's second-biggest exporter in the sector.

Meanwhile, Bangladesh set a target of $40.48 billion for garments, out of a total of $50 billion for overall exports, with an 11.99 percent growth for fiscal year 2024-25. Bangladesh does not set garment export targets on the basis of calendar year.

The export target for knitwear and woven items is $21.7 billion and $18.78 billion respectively.

At a press meeting on Wednesday, Cao Huu Hieu, CEO of Vietnam National Textile and Garment Group (Vinatex), the country's biggest garment maker, announced the $44 billion export target.

He stressed that the sector's performance was weak in the first half of 2024 as the global economy underperformed, and the sector received few orders with strict conditions.

However, the sector recovered and thrived in the second half of this year, not thanks to the growing demand, but because of the political issues in Bangladesh promoting firms to make orders in Vietnam. This is a "fortune" for the sector amid challenges, he added.

Mohammad Hatem, president of the Bangladesh Knitwear Manufacturers and Exporters Association (BKMEA), said there was no doubt that Vietnam would surpass Bangladesh as the east Asian country's apparel industry faces no bottlenecks.

He stated that Vietnam finds it easy to increase exports of garment goods because there was no labour unrest, gas crisis, or tax issue there.

However, he continued, Bangladesh faces numerous issues that make it difficult for exports to increase.

Even though labour costs are lower than those of Vietnam, exporters of garments encounter challenges at every turn, making it impossible to take the initiative to increase production, he said.

Given that the Trump administration will impose high tariffs on Chinese goods, Hatem even mentioned the possibility of obtaining new investment from China.

He added that although there was potential to draw Chinese investment in attempts to avoid high duties in the US market, there are a number of barriers that prevent Chinese investment from coming here.

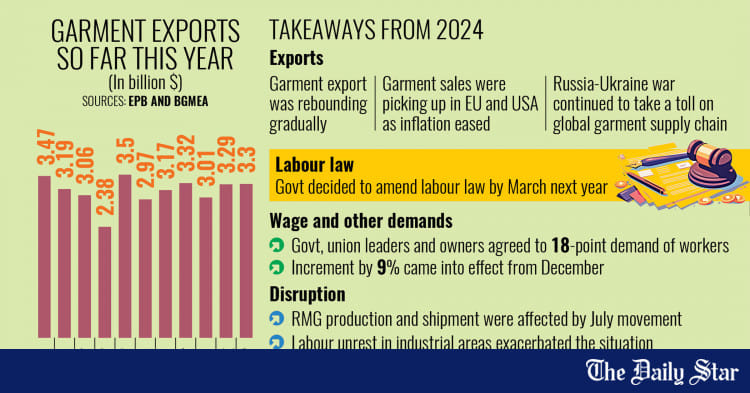

Bangladesh fetched $36.15 billion through garment exports last fiscal year, which was 5.22 percent lower than that in the previous fiscal year.

Of the total export earnings, the knitwear sector earned $19.28 billion while woven garments around $17 billion.

Workers are seen at a garment factory in Hung Yen province of Vietnam. Photo: Reuters/file

Vietnam is set to generate $44 billion this year through garment exports, surpassing Bangladesh, which is currently the world's second-largest garment exporter, according to a Vietnamese media report.

Bangladesh's export goal is $4 billion lower than Vietnam's.

Vietnam's apparel and textile sector is set to earn an export revenue of $44 billion this year, up 11 percent year-on-year, and will likely surpass Bangladesh to become the world's second-biggest exporter in the sector.

Meanwhile, Bangladesh set a target of $40.48 billion for garments, out of a total of $50 billion for overall exports, with an 11.99 percent growth for fiscal year 2024-25. Bangladesh does not set garment export targets on the basis of calendar year.

The export target for knitwear and woven items is $21.7 billion and $18.78 billion respectively.

At a press meeting on Wednesday, Cao Huu Hieu, CEO of Vietnam National Textile and Garment Group (Vinatex), the country's biggest garment maker, announced the $44 billion export target.

He stressed that the sector's performance was weak in the first half of 2024 as the global economy underperformed, and the sector received few orders with strict conditions.

However, the sector recovered and thrived in the second half of this year, not thanks to the growing demand, but because of the political issues in Bangladesh promoting firms to make orders in Vietnam. This is a "fortune" for the sector amid challenges, he added.

Mohammad Hatem, president of the Bangladesh Knitwear Manufacturers and Exporters Association (BKMEA), said there was no doubt that Vietnam would surpass Bangladesh as the east Asian country's apparel industry faces no bottlenecks.

He stated that Vietnam finds it easy to increase exports of garment goods because there was no labour unrest, gas crisis, or tax issue there.

However, he continued, Bangladesh faces numerous issues that make it difficult for exports to increase.

Even though labour costs are lower than those of Vietnam, exporters of garments encounter challenges at every turn, making it impossible to take the initiative to increase production, he said.

Given that the Trump administration will impose high tariffs on Chinese goods, Hatem even mentioned the possibility of obtaining new investment from China.

He added that although there was potential to draw Chinese investment in attempts to avoid high duties in the US market, there are a number of barriers that prevent Chinese investment from coming here.

Bangladesh fetched $36.15 billion through garment exports last fiscal year, which was 5.22 percent lower than that in the previous fiscal year.

Of the total export earnings, the knitwear sector earned $19.28 billion while woven garments around $17 billion.