Saif

Senior Member

- Joined

- Jan 24, 2024

- Messages

- 16,117

- Likes

- 8,060

- Nation

- Axis Group

Time is running out for a deal with the US

Govt should have been better prepared and more proactive

Time is running out for a deal with the US

Govt should have been better prepared and more proactive

VISUAL: STAR

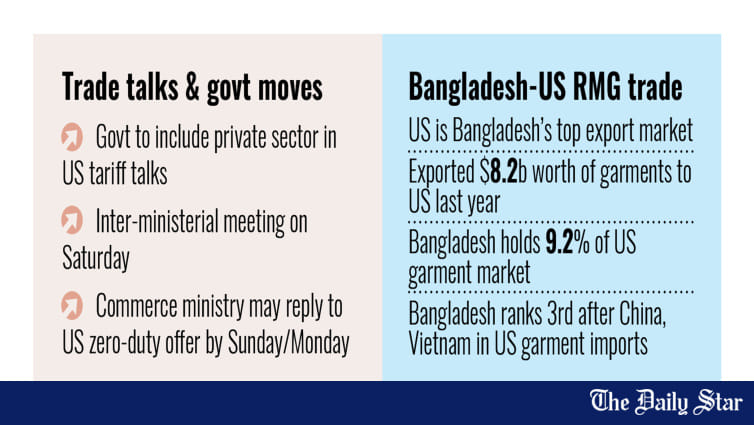

The concerns raised by trade experts and private-sector representatives regarding the interim government's handling of the US tariff negotiations are quite justified. At a roundtable organised by this daily, they expressed frustration over the government's poor preparation, lack of transparency, and minimal private-sector involvement in the trade talks with the US. They warned that a steep 35 percent tariff on Bangladeshi exports including garments to US markets—scheduled to come into effect from August 1—would have greater ramifications for the apparel sector and the wider economy than the government appears to realise. The lack of urgency displayed by it in the face of this enormous threat, and the limited progress made as time runs out to conclude the negotiations, has therefore placed our economic future in a precarious position.

Dhaka is now preparing for a third round of negotiations with the US, but it remains unclear when the talks will take place. While other countries, including our direct trade competitor Vietnam, have either already secured a favourable deal or made significant progress in that direction, Bangladesh still seems to lack any concrete plans. Until recently, the government kept the private sector largely at arm's length. And with very little time left before August 1, how much of the sector's input it can incorporate remains a major question. What the government should have done is establish both a steering committee and a working committee to ensure stakeholder inclusivity and proper preparation.

Moreover, inter-ministerial issues relating to the negotiations also appear to remain unresolved. At this stage, it is not even clear who exactly is leading the talks on Bangladesh's behalf. According to experts, the uncertainty surrounding a deal may prompt buyers to adopt a "wait and see" approach when considering orders from Bangladesh. This could leave businesses idle for several months. Small and medium-sized enterprises, in particular, will struggle to absorb such losses, potentially leading to factory closures and significant job losses.

The uncertainty triggered by the threat of harsher US tariffs will likely have spillover effects in other markets as well. Garment suppliers from other countries may also move quickly to capture European and other export markets, posing further risks to Bangladesh's market share.

Bangladesh, being heavily dependent on garment exports, has always been vulnerable to such external shocks. Despite repeated warnings, little has been done over the years to diversify the export basket, resolve longstanding structural bottlenecks, and enhance overall competitiveness. Given the current global trade landscape, experts believe Bangladesh now has no choice but to reduce trade and business costs through improved logistics and a more enabling business environment, while also boosting productivity through investments in technology and skills development.

However, such changes cannot be achieved overnight—they require consistent, long-term commitment. In the meantime, what the government must urgently do is bring all stakeholders on board and use all possible diplomatic and institutional channels to secure a win-win deal with the US.

Govt should have been better prepared and more proactive

VISUAL: STAR

The concerns raised by trade experts and private-sector representatives regarding the interim government's handling of the US tariff negotiations are quite justified. At a roundtable organised by this daily, they expressed frustration over the government's poor preparation, lack of transparency, and minimal private-sector involvement in the trade talks with the US. They warned that a steep 35 percent tariff on Bangladeshi exports including garments to US markets—scheduled to come into effect from August 1—would have greater ramifications for the apparel sector and the wider economy than the government appears to realise. The lack of urgency displayed by it in the face of this enormous threat, and the limited progress made as time runs out to conclude the negotiations, has therefore placed our economic future in a precarious position.

Dhaka is now preparing for a third round of negotiations with the US, but it remains unclear when the talks will take place. While other countries, including our direct trade competitor Vietnam, have either already secured a favourable deal or made significant progress in that direction, Bangladesh still seems to lack any concrete plans. Until recently, the government kept the private sector largely at arm's length. And with very little time left before August 1, how much of the sector's input it can incorporate remains a major question. What the government should have done is establish both a steering committee and a working committee to ensure stakeholder inclusivity and proper preparation.

Moreover, inter-ministerial issues relating to the negotiations also appear to remain unresolved. At this stage, it is not even clear who exactly is leading the talks on Bangladesh's behalf. According to experts, the uncertainty surrounding a deal may prompt buyers to adopt a "wait and see" approach when considering orders from Bangladesh. This could leave businesses idle for several months. Small and medium-sized enterprises, in particular, will struggle to absorb such losses, potentially leading to factory closures and significant job losses.

The uncertainty triggered by the threat of harsher US tariffs will likely have spillover effects in other markets as well. Garment suppliers from other countries may also move quickly to capture European and other export markets, posing further risks to Bangladesh's market share.

Bangladesh, being heavily dependent on garment exports, has always been vulnerable to such external shocks. Despite repeated warnings, little has been done over the years to diversify the export basket, resolve longstanding structural bottlenecks, and enhance overall competitiveness. Given the current global trade landscape, experts believe Bangladesh now has no choice but to reduce trade and business costs through improved logistics and a more enabling business environment, while also boosting productivity through investments in technology and skills development.

However, such changes cannot be achieved overnight—they require consistent, long-term commitment. In the meantime, what the government must urgently do is bring all stakeholders on board and use all possible diplomatic and institutional channels to secure a win-win deal with the US.