Saif

Senior Member

- Jan 24, 2024

- 12,850

- 7,070

- Origin

- Residence

- Axis Group

- Copy to clipboard

- Thread starter

- #37

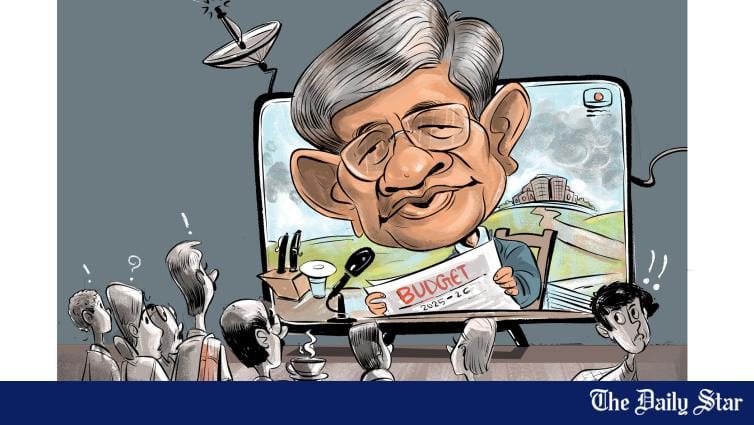

Finance Adviser to unveil FY26 budget on Jun 2

Finance Adviser Dr Salehuddin Ahmed will present the national budget for the fiscal year 2025-26 on June 02 (Monday), according to a government handout. This marks the first budget of the interim government that assumed power following the mass public uprising on August 05. The pre-recorded budge

Finance Adviser to unveil FY26 budget on Jun 2

FE REPORT

Published :

May 30, 2025 08:16

Updated :

May 30, 2025 08:16

Finance Adviser Dr Salehuddin Ahmed will present the national budget for the fiscal year 2025-26 on June 02 (Monday), according to a government handout.

This marks the first budget of the interim government that assumed power following the mass public uprising on August 05.

The pre-recorded budget speech will be aired at 4:00 PM on Bangladesh Television (BTV) and Bangladesh Betar.

To ensure wider reach, all private television channels and radio stations have been requested to broadcast the speech simultaneously by receiving the feed from BTV.

People familiar with the development told the FE that that the size of the upcoming budget has been set at Tk 7.9 trillion-Tk 70 billion less than the budget for the previous fiscal year.

According to officials from the Ministry of Finance and the Planning Commission, the contraction in expenditure aims to meet conditions set by the International Monetary Fund (IMF), reduce the number of non-essential projects, and contain the higher inflation persisting the economy for long.

With the Eid-ul-Azha public holidays scheduled from June 05 to 14, authorities have opted to announce the budget earlier, on June 02. Usually the budget is unveiled on Thursday and the post budget press conference on Friday.

As the National Parliament is not currently in place, the Finance Adviser will present the budget through electronic media.

A presidential ordinance will subsequently be issued to formally enact the budget, in line with procedures applicable under the interim government.

FE REPORT

Published :

May 30, 2025 08:16

Updated :

May 30, 2025 08:16

Finance Adviser Dr Salehuddin Ahmed will present the national budget for the fiscal year 2025-26 on June 02 (Monday), according to a government handout.

This marks the first budget of the interim government that assumed power following the mass public uprising on August 05.

The pre-recorded budget speech will be aired at 4:00 PM on Bangladesh Television (BTV) and Bangladesh Betar.

To ensure wider reach, all private television channels and radio stations have been requested to broadcast the speech simultaneously by receiving the feed from BTV.

People familiar with the development told the FE that that the size of the upcoming budget has been set at Tk 7.9 trillion-Tk 70 billion less than the budget for the previous fiscal year.

According to officials from the Ministry of Finance and the Planning Commission, the contraction in expenditure aims to meet conditions set by the International Monetary Fund (IMF), reduce the number of non-essential projects, and contain the higher inflation persisting the economy for long.

With the Eid-ul-Azha public holidays scheduled from June 05 to 14, authorities have opted to announce the budget earlier, on June 02. Usually the budget is unveiled on Thursday and the post budget press conference on Friday.

As the National Parliament is not currently in place, the Finance Adviser will present the budget through electronic media.

A presidential ordinance will subsequently be issued to formally enact the budget, in line with procedures applicable under the interim government.