Saif

Senior Member

- Joined

- Jan 24, 2024

- Messages

- 17,262

- Likes

- 8,334

- Nation

- Residence

- Axis Group

Govt to unveil Tk 7.9t national budget on June 2 amid economic challenges

The interim government is set to unveil a Tk 7.9 trillion national budget for the 2025–26 fiscal year on June 2, a defining moment for Bangladesh as it navigates mounting economic pressures and charts a course for stability and growth. Finance Adviser Dr Salehuddin Ahmed will deliver the bud

Govt to unveil Tk 7.9t national budget on June 2 amid economic challenges

FE ONLINE DESK

Published :

May 31, 2025 14:05

Updated :

May 31, 2025 14:21

The interim government is set to unveil a Tk 7.9 trillion national budget for the 2025–26 fiscal year on June 2, a defining moment for Bangladesh as it navigates mounting economic pressures and charts a course for stability and growth.

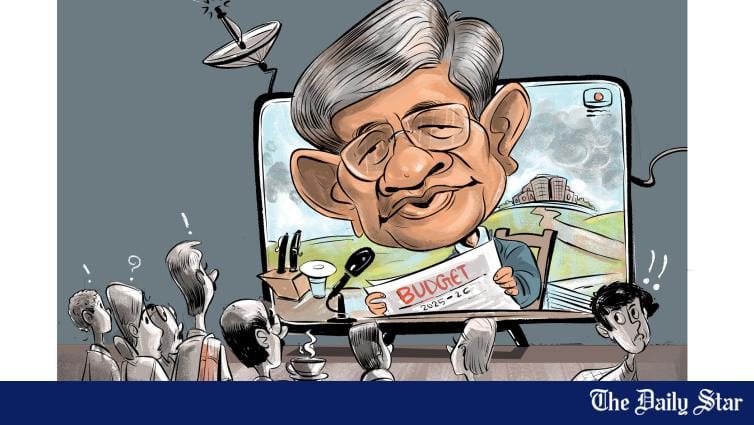

Finance Adviser Dr Salehuddin Ahmed will deliver the budget speech in a pre-recorded broadcast scheduled for 4:00 pm on Bangladesh Television (BTV) and Bangladesh Betar.

Private television channels and radio stations have been requested to air the speech simultaneously, using BTV’s official feed.

This will be the first budget to be presented by the newly appointed administration, which faces the daunting task of curbing persistent inflation, reinvigorating private investment and strengthening social safety nets amid global and domestic uncertainties, as per a UNB report.

In contrast to previous years, the proposed budget is Tk 0.07 trillion lower than the current fiscal year’s allocation of Tk 7.97 trillion.

According to Finance Ministry officials, this reduction aligns with a strategy for fiscal consolidation, ensuring a more implementable and efficient financial plan.

The projected budget deficit stands at Tk 2.26 trillion, down from Tk 2.56 trillion in the current fiscal year, representing 3.62 per cent of the GDP.

To bridge this gap, the government will depend on foreign borrowing, bank loans, and savings certificates.

An ambitious GDP growth target of 5.5 per cent has been set for FY26, slightly higher than the revised 5.25 per cent for the current year. However, international financial institutions, including the World Bank, IMF and ADB, predict growth will remain below 5.0 per cent.

Inflation control remains a priority, with the government aiming to bring it down to 7.0 per cent. However, economists warn that persistent inflationary pressures could pose risks to achieving this target.

To alleviate the financial strain on lower-income groups, the budget includes an expansion of social safety net programs, increasing both beneficiary numbers and allowance amounts.

Key sectors prioritised for funding include agriculture, health, education and technology.

The Annual Development Programme (ADP) allocation is projected at Tk 2.3 trillion, a reduction from Tk 2.65 trillion in the current fiscal year, signifying a more focused investment approach.

Dr Salehuddin Ahmed has assured that the upcoming budget will be business-friendly, introducing tax policies designed to enhance investment, GDP growth and job creation.

The revenue collection target for FY26 is set at Tk 5.18 trillion, up from Tk 4.8 trillion in the current fiscal year. But, the IMF has recommended a more aggressive target of Tk 5.8 trillion under its reform agenda.

Non-development expenditures will rise, with major allocations earmarked for debt servicing, food subsidies, and banking sector reforms.

The non-development budget is expected to reach Tk 5.6 crore, an increase of Tk 0.28 trillion compared to the current fiscal year’s allocation.

The government also plans to strengthen the banking sector with a dedicated allocation to cover the capital shortfall of state-owned banks. Besides, subsidies for agriculture, fertilisers, and electricity will continue to support key industries.

As anticipation builds for the budget announcement, public sentiment is mixed—hopeful about stronger social safety nets and inflation control, yet wary of implementation challenges.

Economists caution that without structural reforms and effective execution, the budget’s ambitious goals may be difficult to achieve.

They advocate for enhanced wealth taxation and improved enforcement mechanisms to broaden direct taxation and minimise dependence on regressive indirect taxes.

The budget presentation by Finance Adviser Dr Salehuddin Ahmed will be closely scrutinised, as it is expected to shape Bangladesh’s economic recovery and growth in the post-uprising political transition era.

FE ONLINE DESK

Published :

May 31, 2025 14:05

Updated :

May 31, 2025 14:21

The interim government is set to unveil a Tk 7.9 trillion national budget for the 2025–26 fiscal year on June 2, a defining moment for Bangladesh as it navigates mounting economic pressures and charts a course for stability and growth.

Finance Adviser Dr Salehuddin Ahmed will deliver the budget speech in a pre-recorded broadcast scheduled for 4:00 pm on Bangladesh Television (BTV) and Bangladesh Betar.

Private television channels and radio stations have been requested to air the speech simultaneously, using BTV’s official feed.

This will be the first budget to be presented by the newly appointed administration, which faces the daunting task of curbing persistent inflation, reinvigorating private investment and strengthening social safety nets amid global and domestic uncertainties, as per a UNB report.

In contrast to previous years, the proposed budget is Tk 0.07 trillion lower than the current fiscal year’s allocation of Tk 7.97 trillion.

According to Finance Ministry officials, this reduction aligns with a strategy for fiscal consolidation, ensuring a more implementable and efficient financial plan.

The projected budget deficit stands at Tk 2.26 trillion, down from Tk 2.56 trillion in the current fiscal year, representing 3.62 per cent of the GDP.

To bridge this gap, the government will depend on foreign borrowing, bank loans, and savings certificates.

An ambitious GDP growth target of 5.5 per cent has been set for FY26, slightly higher than the revised 5.25 per cent for the current year. However, international financial institutions, including the World Bank, IMF and ADB, predict growth will remain below 5.0 per cent.

Inflation control remains a priority, with the government aiming to bring it down to 7.0 per cent. However, economists warn that persistent inflationary pressures could pose risks to achieving this target.

To alleviate the financial strain on lower-income groups, the budget includes an expansion of social safety net programs, increasing both beneficiary numbers and allowance amounts.

Key sectors prioritised for funding include agriculture, health, education and technology.

The Annual Development Programme (ADP) allocation is projected at Tk 2.3 trillion, a reduction from Tk 2.65 trillion in the current fiscal year, signifying a more focused investment approach.

Dr Salehuddin Ahmed has assured that the upcoming budget will be business-friendly, introducing tax policies designed to enhance investment, GDP growth and job creation.

The revenue collection target for FY26 is set at Tk 5.18 trillion, up from Tk 4.8 trillion in the current fiscal year. But, the IMF has recommended a more aggressive target of Tk 5.8 trillion under its reform agenda.

Non-development expenditures will rise, with major allocations earmarked for debt servicing, food subsidies, and banking sector reforms.

The non-development budget is expected to reach Tk 5.6 crore, an increase of Tk 0.28 trillion compared to the current fiscal year’s allocation.

The government also plans to strengthen the banking sector with a dedicated allocation to cover the capital shortfall of state-owned banks. Besides, subsidies for agriculture, fertilisers, and electricity will continue to support key industries.

As anticipation builds for the budget announcement, public sentiment is mixed—hopeful about stronger social safety nets and inflation control, yet wary of implementation challenges.

Economists caution that without structural reforms and effective execution, the budget’s ambitious goals may be difficult to achieve.

They advocate for enhanced wealth taxation and improved enforcement mechanisms to broaden direct taxation and minimise dependence on regressive indirect taxes.

The budget presentation by Finance Adviser Dr Salehuddin Ahmed will be closely scrutinised, as it is expected to shape Bangladesh’s economic recovery and growth in the post-uprising political transition era.