Saif

Senior Member

- 13,623

- 7,405

- Origin

- Axis Group

- Copy to clipboard

- Thread starter

- #151

Banks get remedies but what about ailing NBFIs?

Irregularities, scams, and governance failures necessitate reforms for both banks and non-bank financial institutions (NBFIs), but the severity of ailments in both sectors seems to have left the banking regulator with no option to pick and choose.

Banks get remedies but what about ailing NBFIs?

Irregularities, scams, and governance failures necessitate reforms for both banks and non-bank financial institutions (NBFIs), but the severity of ailments in both sectors seems to have left the banking regulator with no option to pick and choose.

For the Bangladesh Bank, the question is no longer regarding which will get the remedy first, but how long the other can sustain itself in a state of neglect.

The longer NBFIs remain untreated, the worse their condition will become. Banks require urgent reforms, but so do NBFIs, industry leaders say, warning that delays may push them beyond recovery.

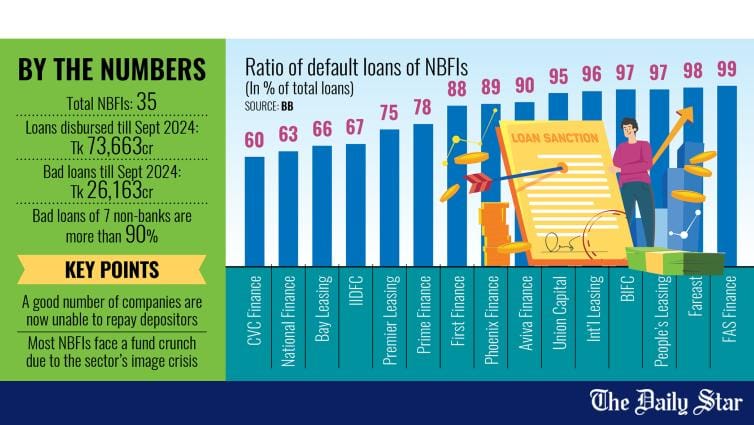

Of the 35 NBFIs in the country, a dozen are currently struggling to repay depositors due to an acute liquidity crisis, a persistent issue that has tarnished the sector's image over the years.

After the political changeover on August 5 last year, the central bank initiated a series of banking sector reforms, including the formation of taskforces, the introduction of new laws and amendments to existing legislation such as the Bank Company Act.

The regulator also injected fresh funds into weak banks to protect depositors.

However, the treatment has been entirely different for struggling NBFIs. Since the interim government took office in early August last year, no visible initiatives have been taken to reform the ailing sector.

The central bank has also refrained from injecting funds to revive the NBFI sector and help companies repay depositors.

Following the political changeover, more than half a dozen banks were unable to repay depositors, prompting the central bank to inject over Tk 25,000 crore into weak banks by printing money.

Justifying this move, BB Governor Ahsan H Mansur said it was necessary to maintain depositor confidence.

This raises a simple but important question: if banks receive central bank funds to protect depositors, why are weak NBFIs denied similar support?

Institutional and individual depositors of over a dozen NBFIs, including People's Leasing, International Leasing, Union Capital, FAS Finance, Aviva Finance, Fareast Finance, and First Finance, are still struggling to recover their deposits. For instance, Khalil Ahmed Khan, a depositor at Aviva Finance, has not received his full deposit despite it maturing on January 21 this year.

He told The Daily Star that he invested Tk 23 lakh in three fixed deposit receipts (FDRs) on January 21, 2024. Despite repeated requests, the company has repaid only Tk 8.98 lakh, while Tk 14.01 lakh remains unpaid.

Many other desperate depositors visit weak NBFIs daily, only to return empty-handed.

The Bangladesh Leasing and Finance Companies' Association (BLFCA), a forum of non-bank financial institutions, has met with the BB governor twice but has yet to receive any commitment regarding liquidity support for weak NBFIs.

Md Golam Sarwar Bhuiyan, managing director of Industrial and Infrastructure Development Finance Company Ltd and former chairman of the BLFCA, told The Daily Star that the central bank informed them it is currently prioritising banking sector reforms.

According to Bhuiyan, NBFI sector reforms will begin once banking reforms are completed.

But Mohammad Rafiqul Islam, managing director of United Finance, believes reforms to both the sectors can run simultaneously. He urged the central bank to extend its focus to ensure depositors recover their funds.

Akin to weak banks, Midas Finance Managing Director Mustafizur Rahman said most NBFIs require liquidity support from the central bank.

Meanwhile, central bank officials maintain that banking sector reforms are crucial for economic stability. However, they assure that a mega reform plan for the NBFI sector is in the pipeline.

"Now is the time to initiate NBFI sector reforms," Fahmida Khatun, executive director of the Centre for Policy Dialogue, told The Daily Star.

She highlighted severe governance issues in the sector, stressing the need for stricter rules and regulations to strengthen governance.

The economist also recommended that regulators conduct audits of NBFIs, similar to banks, to assess their actual financial health.

Irregularities, scams, and governance failures necessitate reforms for both banks and non-bank financial institutions (NBFIs), but the severity of ailments in both sectors seems to have left the banking regulator with no option to pick and choose.

For the Bangladesh Bank, the question is no longer regarding which will get the remedy first, but how long the other can sustain itself in a state of neglect.

The longer NBFIs remain untreated, the worse their condition will become. Banks require urgent reforms, but so do NBFIs, industry leaders say, warning that delays may push them beyond recovery.

Of the 35 NBFIs in the country, a dozen are currently struggling to repay depositors due to an acute liquidity crisis, a persistent issue that has tarnished the sector's image over the years.

After the political changeover on August 5 last year, the central bank initiated a series of banking sector reforms, including the formation of taskforces, the introduction of new laws and amendments to existing legislation such as the Bank Company Act.

The regulator also injected fresh funds into weak banks to protect depositors.

However, the treatment has been entirely different for struggling NBFIs. Since the interim government took office in early August last year, no visible initiatives have been taken to reform the ailing sector.

The central bank has also refrained from injecting funds to revive the NBFI sector and help companies repay depositors.

Following the political changeover, more than half a dozen banks were unable to repay depositors, prompting the central bank to inject over Tk 25,000 crore into weak banks by printing money.

Justifying this move, BB Governor Ahsan H Mansur said it was necessary to maintain depositor confidence.

This raises a simple but important question: if banks receive central bank funds to protect depositors, why are weak NBFIs denied similar support?

Institutional and individual depositors of over a dozen NBFIs, including People's Leasing, International Leasing, Union Capital, FAS Finance, Aviva Finance, Fareast Finance, and First Finance, are still struggling to recover their deposits. For instance, Khalil Ahmed Khan, a depositor at Aviva Finance, has not received his full deposit despite it maturing on January 21 this year.

He told The Daily Star that he invested Tk 23 lakh in three fixed deposit receipts (FDRs) on January 21, 2024. Despite repeated requests, the company has repaid only Tk 8.98 lakh, while Tk 14.01 lakh remains unpaid.

Many other desperate depositors visit weak NBFIs daily, only to return empty-handed.

The Bangladesh Leasing and Finance Companies' Association (BLFCA), a forum of non-bank financial institutions, has met with the BB governor twice but has yet to receive any commitment regarding liquidity support for weak NBFIs.

Md Golam Sarwar Bhuiyan, managing director of Industrial and Infrastructure Development Finance Company Ltd and former chairman of the BLFCA, told The Daily Star that the central bank informed them it is currently prioritising banking sector reforms.

According to Bhuiyan, NBFI sector reforms will begin once banking reforms are completed.

But Mohammad Rafiqul Islam, managing director of United Finance, believes reforms to both the sectors can run simultaneously. He urged the central bank to extend its focus to ensure depositors recover their funds.

Akin to weak banks, Midas Finance Managing Director Mustafizur Rahman said most NBFIs require liquidity support from the central bank.

Meanwhile, central bank officials maintain that banking sector reforms are crucial for economic stability. However, they assure that a mega reform plan for the NBFI sector is in the pipeline.

"Now is the time to initiate NBFI sector reforms," Fahmida Khatun, executive director of the Centre for Policy Dialogue, told The Daily Star.

She highlighted severe governance issues in the sector, stressing the need for stricter rules and regulations to strengthen governance.

The economist also recommended that regulators conduct audits of NBFIs, similar to banks, to assess their actual financial health.