Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: this_feature_currently_requires_accessing_site_using_safari

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

[🇧🇩] Everything about Hasina's misrule/Laundered Money etc.

Saif

Senior Member

- Messages

- 17,596

- Likes

- 8,463

- Nation

- Residence

- Axis Group

Between June 15, 2021, and December 30, 2022, $698.33 million were taken out of the country against this LC using fake Bills of Entry.

Nearly $99.58 million of the $914 million value of the two LCs remains unspent, documents show.

SEPCO did not respond to our email seeking comments. The phone numbers of the company's two representatives in Bangladesh were found switched off over the last three days.

One hundred eighty-four fake invoices – 59 for the first LC and 125 for the second LC – were uploaded on the BB server to launder the $815.78 million.

Nearly $99.58 million of the $914 million value of the two LCs remains unspent, documents show.

SEPCO did not respond to our email seeking comments. The phone numbers of the company's two representatives in Bangladesh were found switched off over the last three days.

One hundred eighty-four fake invoices – 59 for the first LC and 125 for the second LC – were uploaded on the BB server to launder the $815.78 million.

Saif

Senior Member

- Messages

- 17,596

- Likes

- 8,463

- Nation

- Residence

- Axis Group

The Daily Star verified each of these invoices with the NBR server, and found they were not related to the two LCs opened by SS power for the import of capital machinery.

"There is no import data on our server against these two LCs," Mohammad Fyzur Rahman, who was Chattogram Custom House Commissioner until recently, told The Daily Star last month. [He is currently a commissioner at Customs Excise and VAT Commissionerate, Dhaka (North)].

RUPALI'S ROLE

So how did the money fly out of Bangladesh? The answer lies with Rupali Bank.

When any import and export data are uploaded on the NBR server, the data get posted on the Bangladesh Bank server automatically. In this case, however, NBR did not upload any import data because there was no import. Still, all these 184 invoices made their way into the BB server.

"Usually, customs officials upload import data on the NBR server. However, the banks concerned can also upload this data after collecting the information from the importer," said an official at the Foreign Exchange Operation Department of Bangladesh Bank.

In this case, the details of these invoices were uploaded by the respective branch of Rupali Bank, he said on condition of anonymity because he is not authorised to speak to the media.

"This cannot be done without the involvement of some top officials of the bank concerned," he said.

As a standard practice, the central bank clears LC payments upon confirmation from the importer's bank that the import process has been completed and the import value has been deposited in the bank in local currency. This can be done online.

Documents show that the information required for the central bank to clear the dollar payment in favour of the Chinese company were uploaded on Bangladesh Bank server by Rupali Bank. This includes the 184 fake invoices.

"There is no import data on our server against these two LCs," Mohammad Fyzur Rahman, who was Chattogram Custom House Commissioner until recently, told The Daily Star last month. [He is currently a commissioner at Customs Excise and VAT Commissionerate, Dhaka (North)].

RUPALI'S ROLE

So how did the money fly out of Bangladesh? The answer lies with Rupali Bank.

When any import and export data are uploaded on the NBR server, the data get posted on the Bangladesh Bank server automatically. In this case, however, NBR did not upload any import data because there was no import. Still, all these 184 invoices made their way into the BB server.

"Usually, customs officials upload import data on the NBR server. However, the banks concerned can also upload this data after collecting the information from the importer," said an official at the Foreign Exchange Operation Department of Bangladesh Bank.

In this case, the details of these invoices were uploaded by the respective branch of Rupali Bank, he said on condition of anonymity because he is not authorised to speak to the media.

"This cannot be done without the involvement of some top officials of the bank concerned," he said.

As a standard practice, the central bank clears LC payments upon confirmation from the importer's bank that the import process has been completed and the import value has been deposited in the bank in local currency. This can be done online.

Documents show that the information required for the central bank to clear the dollar payment in favour of the Chinese company were uploaded on Bangladesh Bank server by Rupali Bank. This includes the 184 fake invoices.

Saif

Senior Member

- Messages

- 17,596

- Likes

- 8,463

- Nation

- Residence

- Axis Group

NBR data show 88 of the 184 invoices are linked to 50 companies unrelated to SS Power and SEPCO joint venture. The LC numbers, import dates and the exporting companies recorded on the NBR server against these fake invoices also do not match with the corresponding data uploaded on the BB server.

At least one of these invoices even bears a future date – November 29, 2025 – and at least 30 are related to EXPORTS – not import – by different companies that have no links with SS Power.

At least one of these invoices even bears a future date – November 29, 2025 – and at least 30 are related to EXPORTS – not import – by different companies that have no links with SS Power.

The remaining 96 invoices do relate to SS Power, but these products were imported using at least seven different Import Permissions (IPs) and have no connections with these two LCs.

Usually, the commerce ministry issues IPs for imports against foreign loan agreements or back-to-back LCs.

The Daily Star has copies of two of these seven IPs, granted under four conditions.

Usually, the commerce ministry issues IPs for imports against foreign loan agreements or back-to-back LCs.

The Daily Star has copies of two of these seven IPs, granted under four conditions.

"No foreign currency can be spent from Bangladesh end for this particular import," reads the first condition.

This means that even if these 96 invoices against the seven IPs were genuine – and they were not – SS Power violated the IP conditions.

The Daily Star shared its findings and some related documents with Bangladesh Bank Executive Director and Spokesperson Husne Ara Shikha.

"We will verify the information and speak with the relevant authorities, including the bank concerned. We cannot make any comment before this," she said.

This means that even if these 96 invoices against the seven IPs were genuine – and they were not – SS Power violated the IP conditions.

The Daily Star shared its findings and some related documents with Bangladesh Bank Executive Director and Spokesperson Husne Ara Shikha.

"We will verify the information and speak with the relevant authorities, including the bank concerned. We cannot make any comment before this," she said.

Saif

Senior Member

- Messages

- 17,596

- Likes

- 8,463

- Nation

- Residence

- Axis Group

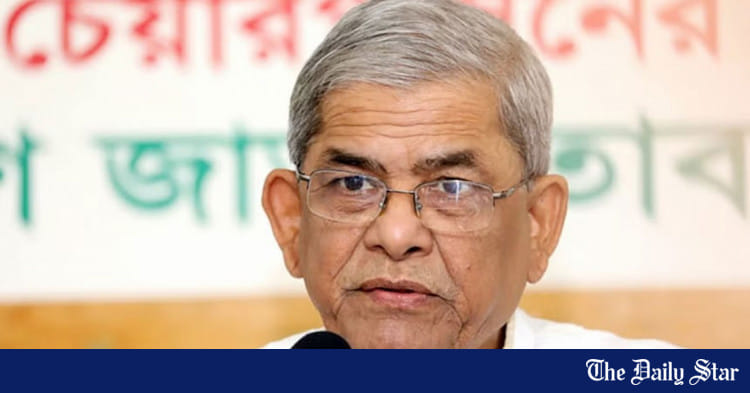

Fakhrul hints at AL conspiracy behind chaos in industrial sector

BNP Secretary General Mirza Fakhrul Islam Alamgir today said that a vested quarter is trying to create an anarchic situation in the industrial sector

Fakhrul hints at AL conspiracy behind chaos in industrial sector

BNP Secretary General Mirza Fakhrul Islam Alamgir today said that a vested quarter is trying to create an anarchic situation in the industrial sector.

Highlighting the need for a task force to safeguard industries and factories, BNP secretary general emphasised that in 2023, 85 percent of exports originated from the garment sector. With over five million workers employed in this sector, he underscored the importance of revitalizing it.

Fakhrul said these things while addressing a rally organised by Gazipur District and Mahanagar Sramik Dal at Konabari Degree College ground this afternoon, as the chief guest.

He further stated that Hasina is responsible for the deaths of workers and students, claiming that the police have created a climate of fear in the country through the use of excessive force.

He accused Hasina of dismantling state systems to maintain her grip on power, particularly by misusing the police to suppress dissent, including through shootings, false arrests, and torture, which has plunged the nation into a state of terror.

The people of the country emerged from a stifling atmosphere after Hasina's departure in the wake of the student and worker movements.

Despite her absence, her influence still looms large. Many cannot forget her, as they have built an empire through theft, corruption, and smuggling wealth abroad. Various conspiracies continue to unfold across the country, particularly within the industrial sector.

Fakhrul claimed that there are factions hoping for Hasina's return to facilitate further looting.

He called on all political parties to unite in order to protect the country, stating, "We must safeguard our freedom by staying vigilant."

At this time, he urged BNP leaders and activists to work a guard to prevent any dissatisfaction in the factories.

Additionally, he called for a resolution to the crisis through dialogue among the government, factory owners, and workers.

Fakhrul said Chief Adviser Mohammad Yunus is respected by people all over the world. He formed the government with some prominent individuals in the country.

"We have asked them to clear the mess of Awami League and hold elections within a reasonable time. We want to vote, elect the government and parliament through voting," added the BNP leader.

"We urged them to expedite the reforms, engage in dialogue with all parties, and ensure fair elections. We hope they will implement the reforms swiftly and organize the elections without delay," he said.

Fakhrul said, "We have told the Indian government not to grant refuge to a murderer accused of genocide and numerous other killings, an individual who has undermined the country's democracy. But India did not reply. We have also asked the current interim government to write a letter to India sending Hasina, the destroyer of the country, back home to face justice."

BNP Secretary General Mirza Fakhrul Islam Alamgir today said that a vested quarter is trying to create an anarchic situation in the industrial sector.

Highlighting the need for a task force to safeguard industries and factories, BNP secretary general emphasised that in 2023, 85 percent of exports originated from the garment sector. With over five million workers employed in this sector, he underscored the importance of revitalizing it.

Fakhrul said these things while addressing a rally organised by Gazipur District and Mahanagar Sramik Dal at Konabari Degree College ground this afternoon, as the chief guest.

He further stated that Hasina is responsible for the deaths of workers and students, claiming that the police have created a climate of fear in the country through the use of excessive force.

He accused Hasina of dismantling state systems to maintain her grip on power, particularly by misusing the police to suppress dissent, including through shootings, false arrests, and torture, which has plunged the nation into a state of terror.

The people of the country emerged from a stifling atmosphere after Hasina's departure in the wake of the student and worker movements.

Despite her absence, her influence still looms large. Many cannot forget her, as they have built an empire through theft, corruption, and smuggling wealth abroad. Various conspiracies continue to unfold across the country, particularly within the industrial sector.

Fakhrul claimed that there are factions hoping for Hasina's return to facilitate further looting.

He called on all political parties to unite in order to protect the country, stating, "We must safeguard our freedom by staying vigilant."

At this time, he urged BNP leaders and activists to work a guard to prevent any dissatisfaction in the factories.

Additionally, he called for a resolution to the crisis through dialogue among the government, factory owners, and workers.

Fakhrul said Chief Adviser Mohammad Yunus is respected by people all over the world. He formed the government with some prominent individuals in the country.

"We have asked them to clear the mess of Awami League and hold elections within a reasonable time. We want to vote, elect the government and parliament through voting," added the BNP leader.

"We urged them to expedite the reforms, engage in dialogue with all parties, and ensure fair elections. We hope they will implement the reforms swiftly and organize the elections without delay," he said.

Fakhrul said, "We have told the Indian government not to grant refuge to a murderer accused of genocide and numerous other killings, an individual who has undermined the country's democracy. But India did not reply. We have also asked the current interim government to write a letter to India sending Hasina, the destroyer of the country, back home to face justice."

Saif

Senior Member

- Messages

- 17,596

- Likes

- 8,463

- Nation

- Residence

- Axis Group

Govt restructures task force on bringing back money illegally taken abroad

Headed by Bangladesh Bank governor, the nine-member task force became operational with immediate effect

Govt restructures task force on bringing back money illegally taken abroad

Headed by Bangladesh Bank governor, the nine-member task force became operational with immediate effect

The interim government today restructured an inter-agency task force meant to bring back money that has been illegally taken abroad.

Headed by the Bangladesh Bank governor, the nine-member task force has become operational with immediate effect, said the finance ministry in a notification.

The previous task force was headed by the attorney general and formed by the immediate past Awami League government on January 15 last year.

The amount of money illegally sent abroad is believed to be over Tk 100,000 crore, said a press statement issued by the office of the chief adviser to the interim government at the end of last month.

Global Financial Integrity (GFI) in 2021 said Bangladesh lost approximately $8.27 billion annually between 2009 and 2018 from misinvoicing of values of import-export goods by traders to evade taxes and illegal movement of money across international borders.

The task force will identify money and assets illegally taken abroad and assist parties concerned in the investigation, said the finance ministry yesterday.

The panel will identify barriers to quickly settling relevant cases and take steps to remove the bottlenecks, it said.

The task force will also take initiatives to quickly bring back the money from foreign lands and take measures to manage seized or recovered assets, it said.

The task force will have representatives from the foreign affairs ministry, financial institutions division, law ministry, Anti-Corruption Commission, Criminal Investigation Department, the attorney general's office, customs intelligence and Bangladesh Financial Intelligence Unit, it added.

The panel will also contact local and foreign agencies to bring back the money from abroad, according to the notification.

Headed by Bangladesh Bank governor, the nine-member task force became operational with immediate effect

The interim government today restructured an inter-agency task force meant to bring back money that has been illegally taken abroad.

Headed by the Bangladesh Bank governor, the nine-member task force has become operational with immediate effect, said the finance ministry in a notification.

The previous task force was headed by the attorney general and formed by the immediate past Awami League government on January 15 last year.

The amount of money illegally sent abroad is believed to be over Tk 100,000 crore, said a press statement issued by the office of the chief adviser to the interim government at the end of last month.

Global Financial Integrity (GFI) in 2021 said Bangladesh lost approximately $8.27 billion annually between 2009 and 2018 from misinvoicing of values of import-export goods by traders to evade taxes and illegal movement of money across international borders.

The task force will identify money and assets illegally taken abroad and assist parties concerned in the investigation, said the finance ministry yesterday.

The panel will identify barriers to quickly settling relevant cases and take steps to remove the bottlenecks, it said.

The task force will also take initiatives to quickly bring back the money from foreign lands and take measures to manage seized or recovered assets, it said.

The task force will have representatives from the foreign affairs ministry, financial institutions division, law ministry, Anti-Corruption Commission, Criminal Investigation Department, the attorney general's office, customs intelligence and Bangladesh Financial Intelligence Unit, it added.

The panel will also contact local and foreign agencies to bring back the money from abroad, according to the notification.

Saif

Senior Member

- Messages

- 17,596

- Likes

- 8,463

- Nation

- Residence

- Axis Group

BFIU finally freezes bank accounts of S Alam, associates

Bangladesh Financial Intelligence Unit has finally frozen the bank accounts of S Alam Group chairman Saiful Alam and his associates, amid allegations of corruption, asset accumulation, and...

www.newagebd.net

www.newagebd.net

BFIU finally freezes bank accounts of S Alam, associates

Staff Correspondent 01 October, 2024, 00:52

Saiful Alam

Bangladesh Financial Intelligence Unit has finally frozen the bank accounts of S Alam Group chairman Saiful Alam and his associates, amid allegations of corruption, asset accumulation, and money laundering against him.

BFIU recently directed all banks and financial institutions to freeze transactions linked to these accounts.

While many businesses had their accounts frozen much earlier, S Alam — the most controversial bank scammer — benefited from inexplicable delays.

BFIU requested for the account details of S Alam group chairman Saiful Alam and his associates on August 8, but mysteriously took over a month to take action.

When asked, Bangladesh Bank’s spokesperson, Husne Ara Shikha, offered no clear reason for the delay, while internal sources pointed at former BFIU deputy director Rafikul Islam for stalling the process.

Rafikul had previously claimed that there were no bank accounts in the names of S Alam and his family members when questioned about the delay in freezing their assets.

During this delay, significant funds were withdrawn from these accounts, adding to suspicions. Only after substantial withdrawals, the BFIU finally has frozen the accounts.

The BFIU eventually froze transactions for accounts held by Saiful Alam, Mohammed Abdullah Hasan, Osman Goni, Abdus Samad, Shahana Ferdous and Badrun Nessa Alam under the Money Laundering Prevention Act of 2019.

The unit has also ordered banks to submit all account-related documentation, including KYC forms and transaction histories.

The BFIU has also frozen bank accounts of Nabil Group chairman Jahan Box Mandol and managing director Aminul Islam and their family members.

The BFIU in a letter on Sunday instructed banks to freeze the transactions of Jahan Box Mondol and his wife Anuara Begum, as well as Aminul Islam, his wife Mosammat Israt Jahan, their son Ejaz Abrar, and daughter Afra Ebnat for 30 days.

It also directed the suspension of transactions from accounts belonging to their businesses. Additionally, in case of their having any lockers at the banks, their access would be restricted for 30 days.

Nabil Group is considered to be closely associated with S Alam Group, and allegedly withdrew large amount of loans in anonymous names.

Under the protection of the Awami League government, S Alam Group allegedly withdrew around Tk 2 lakh crore from the banking system, a substantial part of which is suspected to have been laundered abroad.

This wave of account freeze comes in the wake of prime minister Sheikh Hasina’s resignation and flight to India on August 5, following student-led protests.

After the political shift, Bangladesh Bank dissolved the boards of eight banks owned and controlled by S Alam Group.

Staff Correspondent 01 October, 2024, 00:52

Saiful Alam

Bangladesh Financial Intelligence Unit has finally frozen the bank accounts of S Alam Group chairman Saiful Alam and his associates, amid allegations of corruption, asset accumulation, and money laundering against him.

BFIU recently directed all banks and financial institutions to freeze transactions linked to these accounts.

While many businesses had their accounts frozen much earlier, S Alam — the most controversial bank scammer — benefited from inexplicable delays.

BFIU requested for the account details of S Alam group chairman Saiful Alam and his associates on August 8, but mysteriously took over a month to take action.

When asked, Bangladesh Bank’s spokesperson, Husne Ara Shikha, offered no clear reason for the delay, while internal sources pointed at former BFIU deputy director Rafikul Islam for stalling the process.

Rafikul had previously claimed that there were no bank accounts in the names of S Alam and his family members when questioned about the delay in freezing their assets.

During this delay, significant funds were withdrawn from these accounts, adding to suspicions. Only after substantial withdrawals, the BFIU finally has frozen the accounts.

The BFIU eventually froze transactions for accounts held by Saiful Alam, Mohammed Abdullah Hasan, Osman Goni, Abdus Samad, Shahana Ferdous and Badrun Nessa Alam under the Money Laundering Prevention Act of 2019.

The unit has also ordered banks to submit all account-related documentation, including KYC forms and transaction histories.

The BFIU has also frozen bank accounts of Nabil Group chairman Jahan Box Mandol and managing director Aminul Islam and their family members.

The BFIU in a letter on Sunday instructed banks to freeze the transactions of Jahan Box Mondol and his wife Anuara Begum, as well as Aminul Islam, his wife Mosammat Israt Jahan, their son Ejaz Abrar, and daughter Afra Ebnat for 30 days.

It also directed the suspension of transactions from accounts belonging to their businesses. Additionally, in case of their having any lockers at the banks, their access would be restricted for 30 days.

Nabil Group is considered to be closely associated with S Alam Group, and allegedly withdrew large amount of loans in anonymous names.

Under the protection of the Awami League government, S Alam Group allegedly withdrew around Tk 2 lakh crore from the banking system, a substantial part of which is suspected to have been laundered abroad.

This wave of account freeze comes in the wake of prime minister Sheikh Hasina’s resignation and flight to India on August 5, following student-led protests.

After the political shift, Bangladesh Bank dissolved the boards of eight banks owned and controlled by S Alam Group.

Saif

Senior Member

- Messages

- 17,596

- Likes

- 8,463

- Nation

- Residence

- Axis Group

What Bangladesh can do to get back laundered wealth

Following the fall of the Awami League government, efforts are underway to explore ways to bring back the stolen wealth.

What Bangladesh can do to get back laundered wealth

File visual: Rehnuma Proshoon

Over the past 15 years, people from various sectors—including politicians, businesspeople, bureaucrats, and police officials—have reportedly laundered over $100 billion abroad. This figure is likely underestimated, but even if it's close to the actual amount, the implications are staggering. To put this into context, $100 billion is nearly equivalent to Bangladesh's national budget for the next two years. It also matches the country's total external debt as reported by Bangladesh Bank. One could argue that if this money had not been laundered, it could cover nearly all of Bangladesh's foreign debt across both public and private sectors. Moreover, if repatriated, these funds could ease the strain on Bangladesh's foreign exchange reserves, helping to curb inflation.

Following the fall of the Awami League government, efforts are underway to explore ways to bring back the stolen wealth. Recently, officials from the Anti-Corruption Commission met with representatives from the US Federal Bureau of Investigation (FBI) and the United Nations Office on Drugs and Crime (UNODC), both of whom offered assistance in recovering laundered funds. Additionally, a visiting US delegation led by Department of Treasury Assistant Secretary Brent Neiman met with officials from the interim government. Although details of the discussions remain sparse, it was reported that the US government showed a willingness to aid Bangladesh in this respect, sparking cautious optimism among Bangladeshi analysts.

While some are hopeful about the prospect of repatriating the stolen money, others remain sceptical. Much of this uncertainty probably stems from a lack of awareness about previous cases where the US successfully helped other countries recover laundered funds. If Bangladesh is serious about bringing back the laundered wealth, it can learn from the experiences of countries like Malaysia, the Philippines, and most notably, Nigeria.

Between 1993 and 1998, Nigerian dictator Sani Abacha and his associates stole an estimated $5 billion, much of which was deposited in international banks across Switzerland, the US, the UK, and offshore accounts. After Abacha's death, Nigeria initiated efforts to recover the money. These efforts relied heavily on international legal frameworks such as the UN Convention Against Corruption (UNCAC), which enabled mutual legal assistance (MLA) agreements with other countries.

Switzerland was the first to cooperate, freezing Abacha's assets in 1999 after a formal request from Nigerian authorities. Following legal battles, the Swiss Federal Supreme Court ruled in 2002 in favour of returning $500 million of the laundered funds, marking it one of the largest recoveries of stolen assets by a developing country. By 2006, Switzerland repatriated most of the frozen assets under the condition that the funds be used for public projects like infrastructure, health, and education. To ensure that the funds were not misappropriated again, international organisations like the World Bank closely monitored how Nigeria used them. This level of oversight was a key element of the negotiations, ensuring the funds directly benefited Nigerian citizens.

The United States also played a crucial role in Nigeria's recovery efforts. In 2014, the Nigerian government formally requested assistance from the Department of Justice (DOJ). In response, the DOJ filed an asset forfeiture complaint in April 2014 to seize over $500 million traceable to the Abacha regime, under its Kleptocracy Asset Recovery Initiative. This led to the freezing of assets across several jurisdictions, including France, the UK, and the Crown Dependency of Jersey. By March 2020, the US, Jersey, and Nigeria signed a landmark agreement to repatriate over $308 million laundered through Jersey's financial system. Similar to Switzerland's case, the US and Jersey required that Nigeria use the funds for specific public projects. More recently, in August 2022, the DOJ announced another agreement to return an additional $23 million to Nigeria.

Nigeria's success in recovering stolen assets, with the help of Switzerland and the US, offers key lessons for Bangladesh. First, international cooperation is essential, with MLA treaties and global frameworks like UNCAC providing the legal basis for asset recovery. Second, partnerships with powerful nations like the US can be highly effective, as seen with the DOJ's role in freezing Nigeria's stolen assets. This underscores the importance for Bangladesh to work closely with global enforcement agencies and financial regulators.

Third, Bangladesh must ensure that any recovered funds are transparently managed and used for public projects. Finally, strong political will and patience are crucial, as asset recovery is often a complex and prolonged process. By embracing these strategies, Bangladesh can enhance its chances of recovering stolen wealth and directing it toward national development.

Dr Tasneem Raihan is a Bangladeshi-American financial economist. Views expressed in this article are the author's own.

File visual: Rehnuma Proshoon

Over the past 15 years, people from various sectors—including politicians, businesspeople, bureaucrats, and police officials—have reportedly laundered over $100 billion abroad. This figure is likely underestimated, but even if it's close to the actual amount, the implications are staggering. To put this into context, $100 billion is nearly equivalent to Bangladesh's national budget for the next two years. It also matches the country's total external debt as reported by Bangladesh Bank. One could argue that if this money had not been laundered, it could cover nearly all of Bangladesh's foreign debt across both public and private sectors. Moreover, if repatriated, these funds could ease the strain on Bangladesh's foreign exchange reserves, helping to curb inflation.

Following the fall of the Awami League government, efforts are underway to explore ways to bring back the stolen wealth. Recently, officials from the Anti-Corruption Commission met with representatives from the US Federal Bureau of Investigation (FBI) and the United Nations Office on Drugs and Crime (UNODC), both of whom offered assistance in recovering laundered funds. Additionally, a visiting US delegation led by Department of Treasury Assistant Secretary Brent Neiman met with officials from the interim government. Although details of the discussions remain sparse, it was reported that the US government showed a willingness to aid Bangladesh in this respect, sparking cautious optimism among Bangladeshi analysts.

While some are hopeful about the prospect of repatriating the stolen money, others remain sceptical. Much of this uncertainty probably stems from a lack of awareness about previous cases where the US successfully helped other countries recover laundered funds. If Bangladesh is serious about bringing back the laundered wealth, it can learn from the experiences of countries like Malaysia, the Philippines, and most notably, Nigeria.

Between 1993 and 1998, Nigerian dictator Sani Abacha and his associates stole an estimated $5 billion, much of which was deposited in international banks across Switzerland, the US, the UK, and offshore accounts. After Abacha's death, Nigeria initiated efforts to recover the money. These efforts relied heavily on international legal frameworks such as the UN Convention Against Corruption (UNCAC), which enabled mutual legal assistance (MLA) agreements with other countries.

Switzerland was the first to cooperate, freezing Abacha's assets in 1999 after a formal request from Nigerian authorities. Following legal battles, the Swiss Federal Supreme Court ruled in 2002 in favour of returning $500 million of the laundered funds, marking it one of the largest recoveries of stolen assets by a developing country. By 2006, Switzerland repatriated most of the frozen assets under the condition that the funds be used for public projects like infrastructure, health, and education. To ensure that the funds were not misappropriated again, international organisations like the World Bank closely monitored how Nigeria used them. This level of oversight was a key element of the negotiations, ensuring the funds directly benefited Nigerian citizens.

The United States also played a crucial role in Nigeria's recovery efforts. In 2014, the Nigerian government formally requested assistance from the Department of Justice (DOJ). In response, the DOJ filed an asset forfeiture complaint in April 2014 to seize over $500 million traceable to the Abacha regime, under its Kleptocracy Asset Recovery Initiative. This led to the freezing of assets across several jurisdictions, including France, the UK, and the Crown Dependency of Jersey. By March 2020, the US, Jersey, and Nigeria signed a landmark agreement to repatriate over $308 million laundered through Jersey's financial system. Similar to Switzerland's case, the US and Jersey required that Nigeria use the funds for specific public projects. More recently, in August 2022, the DOJ announced another agreement to return an additional $23 million to Nigeria.

Nigeria's success in recovering stolen assets, with the help of Switzerland and the US, offers key lessons for Bangladesh. First, international cooperation is essential, with MLA treaties and global frameworks like UNCAC providing the legal basis for asset recovery. Second, partnerships with powerful nations like the US can be highly effective, as seen with the DOJ's role in freezing Nigeria's stolen assets. This underscores the importance for Bangladesh to work closely with global enforcement agencies and financial regulators.

Third, Bangladesh must ensure that any recovered funds are transparently managed and used for public projects. Finally, strong political will and patience are crucial, as asset recovery is often a complex and prolonged process. By embracing these strategies, Bangladesh can enhance its chances of recovering stolen wealth and directing it toward national development.

Dr Tasneem Raihan is a Bangladeshi-American financial economist. Views expressed in this article are the author's own.