Saif

Senior Member

- Messages

- 17,462

- Likes

- 8,403

- Nation

- Residence

- Axis Group

Footwear sector offers lucrative investment opportunities: Bida

Sustaining growth and enhancing competitiveness are key challenges

Bangladesh's footwear sector is at a turning point, offering lucrative investment opportunities in both the leather and non-leather segments. However, challenges in sustaining growth and enhancing competitiveness remain, the Bangladesh Investment Development Authority (Bida) highlighted in a newsletter released yesterday.

"We see huge potential in this sector. If sufficient facilities are provided, the industry will take off and become a major export earner," said Shah Mohammad Mahboob, an executive member of Bida.

He added that they were working to negotiate with the National Board of Revenue to provide the necessary facilities to attract investment in this sector.

According to Bida, the rise of non-leather footwear—driven by changing consumer preferences and environmental concerns—is opening new investment opportunities, even outpacing the leather footwear sector in terms of growth over the past decade.

"We see huge potential in this sector. If sufficient facilities are provided, the industry will take off and become a major export earner," said Shah Mohammad Mahboob, an executive member of Bida

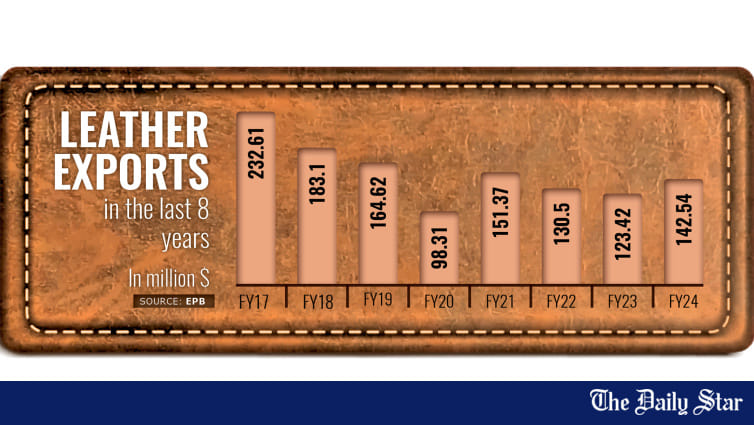

Referring to data from the Export Promotion Bureau (EPB), Bida said non-leather footwear exports grew by 120 percent over the last decade, far exceeding the 6 percent growth rate of leather footwear during the same period.

In the first seven months of FY25, non-leather footwear exports rose by 40.11 percent year-on-year to $318.09 million and are expected to exceed half a billion dollars by the end of the fiscal year.

However, while Bangladesh is the eighth-largest footwear producer in the world, leather goods and footwear remain the dominant force, generating $1.6 billion in exports last fiscal year.

Riad Mahmud, managing director of Shoeniverse Footwear Ltd., a concern of the National Polymer Group, said this offers great potential.

"If any corporate entity makes a major investment in the non-leather footwear sector, it will be a profitable venture," he said.

According to him, Bangladesh has only 15 compliant non-leather shoe factories, which require a capital investment of around Tk 35 crore to set up—posing a barrier to market entry.

Bida also pointed out that many tanneries and footwear factories struggle to meet global environmental and labour standards.

Mahmud further highlighted a shortage of skilled workers and complexities in customs procedures during the import of raw materials and shipment of products.

Hasanuzzaman Hassan, chairman of BLING Leather Products Ltd., a non-leather shoe factory based in rural Rangpur, said he now exports to Poland, Turkey, the United Arab Emirates, Germany, India, and Canada.

His company started shoe production in 2020, initially producing 300 pairs per day. In 2021, the firm entered the global market.

He envisions a promising future for synthetic footwear, stating that his company earned Tk 320 crore from synthetic shoe exports last fiscal year.

However, despite its strong performance, Bangladesh's footwear industry faces several challenges that must be addressed, Bida highlighted.

The lack of a domestic supply chain for synthetic materials increases production costs and lead times, affecting global competitiveness. Meanwhile, inefficiencies in customs clearance, inadequate port facilities, and shipment delays create difficulties for exporters.

The industry also requires specialised labour, but a lack of training programmes is hampering efficiency.

Furthermore, small and medium enterprises (SMEs), which make up a large portion of the industry, struggle with high interest rates, strict loan conditions, and limited access to financial support—posing major challenges to the growth of small-scale factories.

To sustain growth and remain competitive, the focus must be on policy reforms and investment, Bida recommended.

It suggested developing a bonded warehouse system to reduce dependence on imported raw materials and improving logistics and customs processes to enhance export efficiency.

Sustaining growth and enhancing competitiveness are key challenges

Bangladesh's footwear sector is at a turning point, offering lucrative investment opportunities in both the leather and non-leather segments. However, challenges in sustaining growth and enhancing competitiveness remain, the Bangladesh Investment Development Authority (Bida) highlighted in a newsletter released yesterday.

"We see huge potential in this sector. If sufficient facilities are provided, the industry will take off and become a major export earner," said Shah Mohammad Mahboob, an executive member of Bida.

He added that they were working to negotiate with the National Board of Revenue to provide the necessary facilities to attract investment in this sector.

According to Bida, the rise of non-leather footwear—driven by changing consumer preferences and environmental concerns—is opening new investment opportunities, even outpacing the leather footwear sector in terms of growth over the past decade.

"We see huge potential in this sector. If sufficient facilities are provided, the industry will take off and become a major export earner," said Shah Mohammad Mahboob, an executive member of Bida

Referring to data from the Export Promotion Bureau (EPB), Bida said non-leather footwear exports grew by 120 percent over the last decade, far exceeding the 6 percent growth rate of leather footwear during the same period.

In the first seven months of FY25, non-leather footwear exports rose by 40.11 percent year-on-year to $318.09 million and are expected to exceed half a billion dollars by the end of the fiscal year.

However, while Bangladesh is the eighth-largest footwear producer in the world, leather goods and footwear remain the dominant force, generating $1.6 billion in exports last fiscal year.

Riad Mahmud, managing director of Shoeniverse Footwear Ltd., a concern of the National Polymer Group, said this offers great potential.

"If any corporate entity makes a major investment in the non-leather footwear sector, it will be a profitable venture," he said.

According to him, Bangladesh has only 15 compliant non-leather shoe factories, which require a capital investment of around Tk 35 crore to set up—posing a barrier to market entry.

Bida also pointed out that many tanneries and footwear factories struggle to meet global environmental and labour standards.

Mahmud further highlighted a shortage of skilled workers and complexities in customs procedures during the import of raw materials and shipment of products.

Hasanuzzaman Hassan, chairman of BLING Leather Products Ltd., a non-leather shoe factory based in rural Rangpur, said he now exports to Poland, Turkey, the United Arab Emirates, Germany, India, and Canada.

His company started shoe production in 2020, initially producing 300 pairs per day. In 2021, the firm entered the global market.

He envisions a promising future for synthetic footwear, stating that his company earned Tk 320 crore from synthetic shoe exports last fiscal year.

However, despite its strong performance, Bangladesh's footwear industry faces several challenges that must be addressed, Bida highlighted.

The lack of a domestic supply chain for synthetic materials increases production costs and lead times, affecting global competitiveness. Meanwhile, inefficiencies in customs clearance, inadequate port facilities, and shipment delays create difficulties for exporters.

The industry also requires specialised labour, but a lack of training programmes is hampering efficiency.

Furthermore, small and medium enterprises (SMEs), which make up a large portion of the industry, struggle with high interest rates, strict loan conditions, and limited access to financial support—posing major challenges to the growth of small-scale factories.

To sustain growth and remain competitive, the focus must be on policy reforms and investment, Bida recommended.

It suggested developing a bonded warehouse system to reduce dependence on imported raw materials and improving logistics and customs processes to enhance export efficiency.