Challenges on the road to becoming the 28th largest economy

Investment, both domestic and foreign, plays a pivotal role in fostering economic growth. PHOTO: REUTERS

Bangladesh undeniably stands out as one of the most promising economies in the region. Despite facing resource constraints, the country has made commendable economic and social progress since independence. This success is a testament to the indomitable spirit of the Bangladeshi people, their relentless struggle for survival, and their remarkable commitment, determination, and entrepreneurial spirit. With an average annual GDP growth of six percent since the 2000s, Bangladesh currently holds the 35th position among global economies, and it is projected to become the 28th largest economy by 2030. However, this ambitious journey toward economic advancement is not without its challenges. The critical hurdles on our path include tackling poverty, addressing income inequality, managing high inflation and external debt burden, attracting foreign investment, improving resource mobilisation, addressing foreign exchange shortages, curbing corruption, ensuring the stability of the financial sector, and others.

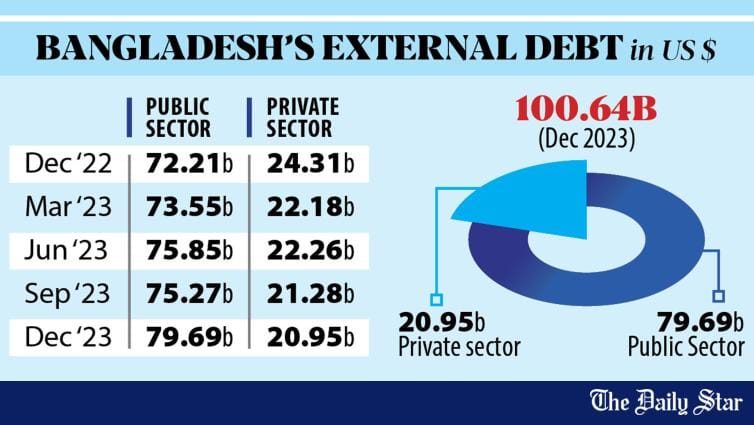

In recent years, Bangladesh has borrowed heavily to finance various mega projects. Consequently, annual debt servicing has been on the rise, which now constitutes a substantial share of the government's expenditures. According to data from the Bangladesh Bank, the total government debt, comprising both domestic and foreign, reached around the $100-billion mark at the end of June 2023. While some of these projects may yield long-term benefits, the immediate requirements for debt servicing pose a challenge for the government's financial capacity. Currently, Bangladesh has to repay foreign loans ranging from $2-2.76 billion annually, and this amount is expected to rise in the coming years. According to a finance ministry projection, foreign debt repayments, including interests, will reach $4.5 billion in 2025-2026. The increasing external debt service payments are straining the country's foreign exchange reserves.

With an average annual GDP growth of six percent since the 2000s, Bangladesh currently holds the 35th position among global economies. VISUAL: TEENI AND TUNI

Concurrently, debt-service payments are diverting already scarce fiscal resources from critical sectors such as healthcare, education, social assistance, and infrastructure development. While experts argue that Bangladesh's current debt-GDP ratio is not a cause for concern, it shouldn't be seen as a green light for indiscriminate loan accumulation. To secure the nation's economic future, it is crucial for policymakers to prioritise projects by carefully assessing payback periods, thus preventing potential debt traps. Ensuring the efficient utilisation of borrowed funds is paramount to sustaining the economic cycle in the face of challenges.

Investment, both domestic and foreign, plays a pivotal role in fostering economic growth, improving the skills of the local workforce through the transfer of technology, leading to job creation, higher incomes, and improved standards of living. Research shows that to transform Bangladesh into a high-income country, it would need to raise its investment-to-GDP ratio to around 40-44 percent of GDP. Regrettably, private investment has shown little growth, hovering at around 23-24 percent of GDP for the past decade, as reported by the Bangladesh Bureau of Statistics (BBS). We are also lagging behind in attracting foreign direct investment (FDI). While even during the pandemic (2020) FDI flow to developing countries in Asia increased by four percent to $535 billion, according to figures from the UN Conference on Trade and Development (UNCTAD), Bangladesh could not achieve the expected FDI. As per Bangladesh Bank's data for the fiscal year 2023, the nation attracted approximately $3.2 billion in foreign direct investment. The rate of FDI inflow in Bangladesh is only around one percent of GDP, one of the lowest in Asia.

ILLUSTRATION: Salman Sakib Shahryar

It's crucial to recognise that the level of convenience in doing business holds significant importance for foreign investors when deciding where to invest. The ease of doing business and global competitiveness are key factors influencing their investment choices. Investors assess various aspects, including the clarity of existing policies, reliability of government officials, taxation policies, adherence to rules and regulations and, most importantly, the security provided for their investments.

Regrettably, in the case of Bangladesh, investors often express frustration due to bureaucratic hurdles that impede smooth business operations. These challenges include bureaucratic red tape, inadequate socio-economic and physical infrastructure, inconsistent energy supply, corruption, underdeveloped money and capital markets, a complicated tax system, along with delays in decision-making processes. Furthermore, hidden costs related to procedures, policies, laws, and infrastructure significantly impact the overall cost of doing business.

Therefore, in light of the current economic challenges, it is essential to boost investment inflow by making timely adjustments to policies. The government should remove the impediments that are responsible for the high cost of investment and promptly take measures to improve public goods and services, including roads, electricity, gas, water, and sewerage. Additionally, the government should implement business-friendly policies safeguarding the rights of enterprises, workers, consumers, the environment and, most importantly, ensure a stable political environment to attract both domestic and foreign investments.

Bangladesh undeniably stands out as one of the most promising economies in the region. VISUAL: REHNUMA PROSHOON

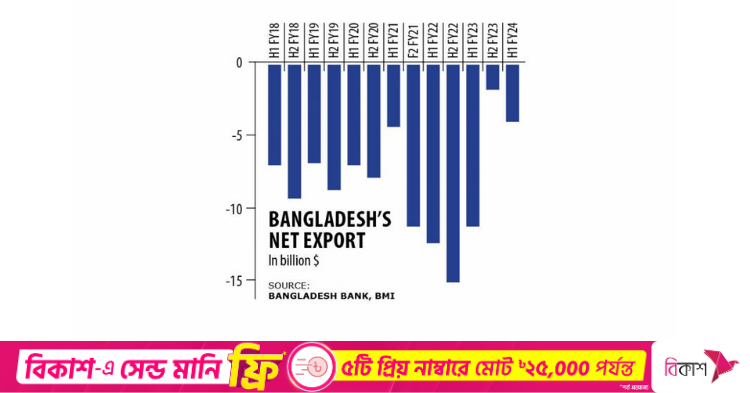

Bangladesh's export portfolio is primarily dominated by its ready-made garments (RMG) sector. In the fiscal year 2022-2023, the total export from Bangladesh amounted to $55.56 billion, with RMG exports contributing $46.99 billion. Currently, the RMG sector accounts for 85 percent of the country's total exports, with primary destinations being the European Union and the United States. The RMG sector has played a transformative role in shaping our economy, job market, and income, but due to ongoing global geopolitical conflicts, energy price hike, domestic political unrests, currently, the RMG sector is in a sluggish state. Hence, for Bangladesh to sustain its growth trajectory, diversification of the export basket and tapping into new markets is imperative.

Industry insiders say that there are promising export sectors such as pharmaceuticals, bicycles, shipbuilding, leather and leather goods, frozen and live fish, terry towels, furniture, and agricultural products, if the government provides adequate policy support, similar to what is offered to the RMG sector.

According to a finance ministry projection, foreign debt repayments, including interests, will reach $4.5 billion in 2025-2026. VISUAL: TEENI AND TUNI

Foreign remittance is Bangladesh's lifeline. Despite an increasing number of Bangladeshis leaving for jobs abroad, in recent times, the remittance inflow has been decreasing at an alarming rate. In September 2023, migrant workers sent home $1.34 billion—the lowest since April 2020, according to data from Bangladesh Bank. Large remittances are sent through informal channels like hundi despite a 2.5 percent incentive for the remitters through the banking channel. Many argue that the widening gap between official and unofficial exchange rates, lack of motivation, and institutional barriers such as high transaction costs and formalities for sending remittances through formal channels hinder remitter's use of banking services. Currently, Bangladesh is struggling with a prolonged dollar crisis and is compelled to restrict imports due to falling reserves. Remittances play a vital role in growing foreign exchange reserves and economic growth. Hence, an urgent policy focus is required to shift remittances from informal to formal channels.

One of the biggest concerns for the economy is our ailing banking sector, which has, on numerous occasions, been tarnished by unwanted malpractices. It is now an open secret that the country's banking sector has been entangled in a series of scams and irregularities, such as the funnelling of loans worth billions of taka by violating banking rules and procedures to influential people known for lax repayments. Unfortunately, violators of banking norms and regulations are hardly ever punished, and they are allowed to continue to default on loans with impunity. As a result, at the end of FY 2022-23, defaulted loans in the banking sector stood at a record Tk 156,040 crore.

Banks are the lifeblood of the economy; therefore, regulators should take pre-emptive measures to control the current situation before it worsens and gets out of control. A combination of strong policy reforms and good governance in the banking sector is the need of the hour. Measures should include legal action against wilful loan defaulters, enhanced banking regulation and supervision, addressing banking sector weaknesses, tighter criteria for loan rescheduling/restructuring, and improved legal systems to accelerate loan recovery. If enforcement authorities take these measures with the right intentions, Bangladesh will embark on a path to creating a stronger economy.

A vendor sells fish at a market in Dhaka. PHOTO: REUTERS

Over the past decade, Bangladesh has consistently demonstrated impressive economic growth. However, one may ask: has everyone been able to share its benefits equally? The answer, sadly, is "no." The growth has, unfortunately, bypassed the majority of the population while higher-income groups have been its main beneficiaries. The country has experienced a rapid increase in income inequality, with 10 percent of the population owning 40 percent of the national income, while the bottom 50 percent possess only 19.05 percent of GDP. The primary factors which deprive poor and vulnerable people of their most elementary rights—and which lead to greater income inequality—are unequal access to education and employment opportunities, low-wage jobs, unchecked corruption and systemic irregularities (such as those enabling the various scams in the banking sector), tax evasion, money laundering, and so on.

The growing gap between the rich and poor not only hinders sustainable growth but also increases the risk of social and political unrest. As such, it's essential for our policymakers to stop favouring the wealthy and start focusing on fair treatment for everyone. The main goal should be to achieve inclusive growth. We need to address issues like wealth sharing, good governance, and social policies that promote fairness and equality. It may be noted that a society that is happy, equal, and just will always experience peace and prosperity.

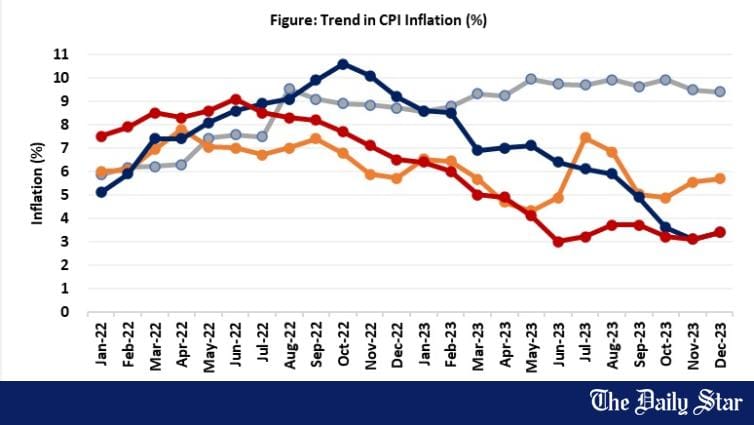

Inflation has been adversely affecting the common people in Bangladesh. Prices of daily essentials, including eggs, chicken, onions, potatoes, sugar, and oil, have consistently increased, contrasting with the global trend of decreasing prices. Purchasing daily necessities has become increasingly challenging, as highlighted in a recent report by the World Bank. According to the report, 71 percent of families are being affected by rising food prices. This alarming statistic implies that out of the 4.10 crore families, almost 2.91 crore are facing food insecurity, a matter of grave concern. If the current trajectory of inflation and escalating living costs persists, there is a significant risk of more families falling into poverty.

VISUAL: STAR

Experts say that soaring food inflation rates in the country are linked to flawed government policies, poor market management and the profit-seeking behaviours of certain businessmen involved in syndicates. Moreover, the control of essential commodity imports by powerful businesses has resulted in market monopoly. The government has to address all the underlying reasons behind food inflation through a well-formulated action plan.

The need for continued investment in education and skill development is another challenge that Bangladesh must address. Over the past few years, numerous experiments have been carried out in the name of modernising and updating our primary, secondary, and higher secondary education. Yet, the existing education curriculum is not aligned with industry needs. While educational institutions worldwide emphasise soft skills like team-building, problem-solving, critical thinking, communication, negotiation, and decision-making, our education system is still stuck in the past.

So, often, we hear complaints from the business community about their inability to find skilled workers, leading them to hire foreign professionals due to a lack of efficient local human resources. This not only hampers the country's job market but also increases the strain on Bangladesh's depleting foreign-currency reserves.

Regrettably, our education budget doesn't reflect the urgency of developing human resources. The country spends around two percent of its GDP on education, which is the lowest among South Asian countries. It is high time for Bangladesh to focus on enhancing its education system, ensuring that the workforce is equipped with the skills necessary for the evolving job market. A well-educated and skilled population is not only vital for fostering innovation but also for attracting high-value industries and investments.

It's unfortunate that, even after 52 years of independence, the country's healthcare sector is in shambles. It is shameful that a nation on the path to becoming the 28th largest economy in the world still witnesses a substantial number of its citizens, including politicians, businessmen, and ordinary people, seeking medical treatment abroad each year. This trend reflects a lack of confidence in our own healthcare system. While individuals choosing overseas medical care may argue that they owe no public explanation, the scenario takes a more alarming turn when Bangladeshi leaders and politicians follow suit. Their decision to seek medical treatment abroad is not just a personal matter but a cause for concern, as they bear the responsibility for the development of a robust healthcare system for their fellow citizens.

This prevailing culture needs to be transformed urgently, given its detrimental impact on our hard-earned foreign currency reserves and the nation's image. The government should prioritise and guarantee equitable access to high-quality health services for all citizens. Failing to improve our health sector not only jeopardises the well-being of our population but also threatens to erode the significant economic gains Bangladesh has achieved over the years. Therefore, concerted efforts are imperative to instigate a paradigm shift and ensure that the healthcare system becomes a source of pride and reliability for every citizen, discouraging the need for seeking medical treatment abroad.

Corruption is a global problem, and Bangladesh is no exception to this pervasive issue. While the country holds the 147th position out of 180 countries in the Corruption Perceptions Index (CPI) for 2022, according to Transparency International, it is important to recognise that this ranking does not implicate every citizen in the web of corruption. I firmly believe that the majority of Bangladeshis are honest and possess integrity. Nevertheless, the harsh reality persists that a handful of people within key sectors such as government offices, businesses, healthcare, education, and political institutions are involved in corrupt practices such as bribery, embezzlement of public funds, bank loan scams, money laundering, under/over invoicing, adulteration of food and drugs, and various forms of cheating.

It is unfortunate that despite governmental claims of zero tolerance for corruption, there is a disconcerting trend where powerful individuals often escape accountability. It should be noted that instances of overlooking or condoning corrupt practices among associates, friends, and political supporters erode public trust, perpetuating a culture where dishonesty might be perceived as justifiable. The need to break free from this complacency is urgent. Holding wrongdoers accountable and instituting stringent measures against corruption are imperative. Currently, the absence of severe consequences for influential figures engaged in corrupt activities not only perpetuates a cycle of impunity but also undermines public confidence in the democratic process. It is time to revisit and reinforce our commitment to eradicating corruption.

Effective law enforcement is a critical pillar in ensuring that the corrupt face justice and that the culture of impunity is dismantled. However, punitive measures alone are insufficient, a comprehensive approach that includes legal reforms, institutional strengthening, and increased societal awareness is indispensable to combatting corruption. These measures are not only vital for sustained economic growth but are also fundamental for elevating Bangladesh's standing on the international stage.

Concurrently, debt-service payments are diverting already scarce fiscal resources from critical sectors such as healthcare, education, social assistance, and infrastructure development. While experts argue that Bangladesh's current debt-GDP ratio is not a cause for concern, it shouldn't be seen as a green light for indiscriminate loan accumulation. To secure the nation's economic future, it is crucial for policymakers to prioritise projects by carefully assessing payback periods, thus preventing potential debt traps. Ensuring the efficient utilisation of borrowed funds is paramount to sustaining the economic cycle in the face of challenges.

Investment, both domestic and foreign, plays a pivotal role in fostering economic growth, improving the skills of the local workforce through the transfer of technology, leading to job creation, higher incomes, and improved standards of living. Research shows that to transform Bangladesh into a high-income country, it would need to raise its investment-to-GDP ratio to around 40-44 percent of GDP. Regrettably, private investment has shown little growth, hovering at around 23-24 percent of GDP for the past decade, as reported by the Bangladesh Bureau of Statistics (BBS). We are also lagging behind in attracting foreign direct investment (FDI). While even during the pandemic (2020) FDI flow to developing countries in Asia increased by four percent to $535 billion, according to figures from the UN Conference on Trade and Development (UNCTAD), Bangladesh could not achieve the expected FDI. As per Bangladesh Bank's data for the fiscal year 2023, the nation attracted approximately $3.2 billion in foreign direct investment. The rate of FDI inflow in Bangladesh is only around one percent of GDP, one of the lowest in Asia.

ILLUSTRATION: Salman Sakib Shahryar

It's crucial to recognise that the level of convenience in doing business holds significant importance for foreign investors when deciding where to invest. The ease of doing business and global competitiveness are key factors influencing their investment choices. Investors assess various aspects, including the clarity of existing policies, reliability of government officials, taxation policies, adherence to rules and regulations and, most importantly, the security provided for their investments.

Regrettably, in the case of Bangladesh, investors often express frustration due to bureaucratic hurdles that impede smooth business operations. These challenges include bureaucratic red tape, inadequate socio-economic and physical infrastructure, inconsistent energy supply, corruption, underdeveloped money and capital markets, a complicated tax system, along with delays in decision-making processes. Furthermore, hidden costs related to procedures, policies, laws, and infrastructure significantly impact the overall cost of doing business.

Therefore, in light of the current economic challenges, it is essential to boost investment inflow by making timely adjustments to policies. The government should remove the impediments that are responsible for the high cost of investment and promptly take measures to improve public goods and services, including roads, electricity, gas, water, and sewerage. Additionally, the government should implement business-friendly policies safeguarding the rights of enterprises, workers, consumers, the environment and, most importantly, ensure a stable political environment to attract both domestic and foreign investments.

Bangladesh undeniably stands out as one of the most promising economies in the region. VISUAL: REHNUMA PROSHOON

Bangladesh's export portfolio is primarily dominated by its ready-made garments (RMG) sector. In the fiscal year 2022-2023, the total export from Bangladesh amounted to $55.56 billion, with RMG exports contributing $46.99 billion. Currently, the RMG sector accounts for 85 percent of the country's total exports, with primary destinations being the European Union and the United States. The RMG sector has played a transformative role in shaping our economy, job market, and income, but due to ongoing global geopolitical conflicts, energy price hike, domestic political unrests, currently, the RMG sector is in a sluggish state. Hence, for Bangladesh to sustain its growth trajectory, diversification of the export basket and tapping into new markets is imperative.

Industry insiders say that there are promising export sectors such as pharmaceuticals, bicycles, shipbuilding, leather and leather goods, frozen and live fish, terry towels, furniture, and agricultural products, if the government provides adequate policy support, similar to what is offered to the RMG sector.

According to a finance ministry projection, foreign debt repayments, including interests, will reach $4.5 billion in 2025-2026. VISUAL: TEENI AND TUNI

Foreign remittance is Bangladesh's lifeline. Despite an increasing number of Bangladeshis leaving for jobs abroad, in recent times, the remittance inflow has been decreasing at an alarming rate. In September 2023, migrant workers sent home $1.34 billion—the lowest since April 2020, according to data from Bangladesh Bank. Large remittances are sent through informal channels like hundi despite a 2.5 percent incentive for the remitters through the banking channel. Many argue that the widening gap between official and unofficial exchange rates, lack of motivation, and institutional barriers such as high transaction costs and formalities for sending remittances through formal channels hinder remitter's use of banking services. Currently, Bangladesh is struggling with a prolonged dollar crisis and is compelled to restrict imports due to falling reserves. Remittances play a vital role in growing foreign exchange reserves and economic growth. Hence, an urgent policy focus is required to shift remittances from informal to formal channels.

One of the biggest concerns for the economy is our ailing banking sector, which has, on numerous occasions, been tarnished by unwanted malpractices. It is now an open secret that the country's banking sector has been entangled in a series of scams and irregularities, such as the funnelling of loans worth billions of taka by violating banking rules and procedures to influential people known for lax repayments. Unfortunately, violators of banking norms and regulations are hardly ever punished, and they are allowed to continue to default on loans with impunity. As a result, at the end of FY 2022-23, defaulted loans in the banking sector stood at a record Tk 156,040 crore.

Banks are the lifeblood of the economy; therefore, regulators should take pre-emptive measures to control the current situation before it worsens and gets out of control. A combination of strong policy reforms and good governance in the banking sector is the need of the hour. Measures should include legal action against wilful loan defaulters, enhanced banking regulation and supervision, addressing banking sector weaknesses, tighter criteria for loan rescheduling/restructuring, and improved legal systems to accelerate loan recovery. If enforcement authorities take these measures with the right intentions, Bangladesh will embark on a path to creating a stronger economy.

A vendor sells fish at a market in Dhaka. PHOTO: REUTERS

Over the past decade, Bangladesh has consistently demonstrated impressive economic growth. However, one may ask: has everyone been able to share its benefits equally? The answer, sadly, is "no." The growth has, unfortunately, bypassed the majority of the population while higher-income groups have been its main beneficiaries. The country has experienced a rapid increase in income inequality, with 10 percent of the population owning 40 percent of the national income, while the bottom 50 percent possess only 19.05 percent of GDP. The primary factors which deprive poor and vulnerable people of their most elementary rights—and which lead to greater income inequality—are unequal access to education and employment opportunities, low-wage jobs, unchecked corruption and systemic irregularities (such as those enabling the various scams in the banking sector), tax evasion, money laundering, and so on.

The growing gap between the rich and poor not only hinders sustainable growth but also increases the risk of social and political unrest. As such, it's essential for our policymakers to stop favouring the wealthy and start focusing on fair treatment for everyone. The main goal should be to achieve inclusive growth. We need to address issues like wealth sharing, good governance, and social policies that promote fairness and equality. It may be noted that a society that is happy, equal, and just will always experience peace and prosperity.

Inflation has been adversely affecting the common people in Bangladesh. Prices of daily essentials, including eggs, chicken, onions, potatoes, sugar, and oil, have consistently increased, contrasting with the global trend of decreasing prices. Purchasing daily necessities has become increasingly challenging, as highlighted in a recent report by the World Bank. According to the report, 71 percent of families are being affected by rising food prices. This alarming statistic implies that out of the 4.10 crore families, almost 2.91 crore are facing food insecurity, a matter of grave concern. If the current trajectory of inflation and escalating living costs persists, there is a significant risk of more families falling into poverty.

VISUAL: STAR

Experts say that soaring food inflation rates in the country are linked to flawed government policies, poor market management and the profit-seeking behaviours of certain businessmen involved in syndicates. Moreover, the control of essential commodity imports by powerful businesses has resulted in market monopoly. The government has to address all the underlying reasons behind food inflation through a well-formulated action plan.

The need for continued investment in education and skill development is another challenge that Bangladesh must address. Over the past few years, numerous experiments have been carried out in the name of modernising and updating our primary, secondary, and higher secondary education. Yet, the existing education curriculum is not aligned with industry needs. While educational institutions worldwide emphasise soft skills like team-building, problem-solving, critical thinking, communication, negotiation, and decision-making, our education system is still stuck in the past.

So, often, we hear complaints from the business community about their inability to find skilled workers, leading them to hire foreign professionals due to a lack of efficient local human resources. This not only hampers the country's job market but also increases the strain on Bangladesh's depleting foreign-currency reserves.

Regrettably, our education budget doesn't reflect the urgency of developing human resources. The country spends around two percent of its GDP on education, which is the lowest among South Asian countries. It is high time for Bangladesh to focus on enhancing its education system, ensuring that the workforce is equipped with the skills necessary for the evolving job market. A well-educated and skilled population is not only vital for fostering innovation but also for attracting high-value industries and investments.

It's unfortunate that, even after 52 years of independence, the country's healthcare sector is in shambles. It is shameful that a nation on the path to becoming the 28th largest economy in the world still witnesses a substantial number of its citizens, including politicians, businessmen, and ordinary people, seeking medical treatment abroad each year. This trend reflects a lack of confidence in our own healthcare system. While individuals choosing overseas medical care may argue that they owe no public explanation, the scenario takes a more alarming turn when Bangladeshi leaders and politicians follow suit. Their decision to seek medical treatment abroad is not just a personal matter but a cause for concern, as they bear the responsibility for the development of a robust healthcare system for their fellow citizens.

This prevailing culture needs to be transformed urgently, given its detrimental impact on our hard-earned foreign currency reserves and the nation's image. The government should prioritise and guarantee equitable access to high-quality health services for all citizens. Failing to improve our health sector not only jeopardises the well-being of our population but also threatens to erode the significant economic gains Bangladesh has achieved over the years. Therefore, concerted efforts are imperative to instigate a paradigm shift and ensure that the healthcare system becomes a source of pride and reliability for every citizen, discouraging the need for seeking medical treatment abroad.

Corruption is a global problem, and Bangladesh is no exception to this pervasive issue. While the country holds the 147th position out of 180 countries in the Corruption Perceptions Index (CPI) for 2022, according to Transparency International, it is important to recognise that this ranking does not implicate every citizen in the web of corruption. I firmly believe that the majority of Bangladeshis are honest and possess integrity. Nevertheless, the harsh reality persists that a handful of people within key sectors such as government offices, businesses, healthcare, education, and political institutions are involved in corrupt practices such as bribery, embezzlement of public funds, bank loan scams, money laundering, under/over invoicing, adulteration of food and drugs, and various forms of cheating.

It is unfortunate that despite governmental claims of zero tolerance for corruption, there is a disconcerting trend where powerful individuals often escape accountability. It should be noted that instances of overlooking or condoning corrupt practices among associates, friends, and political supporters erode public trust, perpetuating a culture where dishonesty might be perceived as justifiable. The need to break free from this complacency is urgent. Holding wrongdoers accountable and instituting stringent measures against corruption are imperative. Currently, the absence of severe consequences for influential figures engaged in corrupt activities not only perpetuates a cycle of impunity but also undermines public confidence in the democratic process. It is time to revisit and reinforce our commitment to eradicating corruption.

Effective law enforcement is a critical pillar in ensuring that the corrupt face justice and that the culture of impunity is dismantled. However, punitive measures alone are insufficient, a comprehensive approach that includes legal reforms, institutional strengthening, and increased societal awareness is indispensable to combatting corruption. These measures are not only vital for sustained economic growth but are also fundamental for elevating Bangladesh's standing on the international stage.