Saif

Senior Member

- Joined

- Jan 24, 2024

- Messages

- 17,239

- Likes

- 8,332

- Nation

- Residence

- Axis Group

All is not well

WITH a population of nearly 170 million in an area of 147,570 square kilometres, Bangladesh is the eighth most populated country in the world. It is still one of the least developed countries, poised to graduate to a developing country by 2026 and a developed country by 2041...

www.newagebd.net

www.newagebd.net

All is not well

Hussain Imam 27 June, 2024, 22:23

| New Age/Mehedi Haque

WITH a population of nearly 170 million in an area of 147,570 square kilometres, Bangladesh is the eighth most populated country in the world. It is still one of the least developed countries, poised to graduate to a developing country by 2026 and a developed country by 2041.

The socio-economic indicators of the country are also impressive. Its per capita income, which was $91 at the time of our independence in 1971, is now $2,854. Its GDP growth, which was 3–4 per cent even in the early 90s, is now well above 6 per cent. The country's social indicators, such as infant and maternal mortality rate, life expectancy, school enrolment rate of children, and overall literacy, have shown phenomenal improvement over the years. The infant mortality rate has declined to 22.64 deaths per 1000 live births and maternal mortality has gone down by 38 per cent to 256 deaths per 100,000 in 22 years from 2000 to 2022.

The country can be proud of its literacy rate increasing to 74 per cent, school enrolment of children to above 96 per cent, and life expectancy of 73.82 years, an increase of 58.8 per cent compared to that of 2011.

Unfortunately, in spite of all those achievements mentioned above, all is not well in Bangladesh. Its economy is in shambles, to say the least. Education is in the doldrums. Healthcare is fragile. Corruption is at its highest peak. To start with, let us talk about the economy, leaving the other three for some other days.

As already mentioned, our economy is in shambles. Inflation has been persistently high over the years. The result is an abnormal rise in the cost of living, and this rise in the cost of living has been at a much greater pace than the increase in earnings. According to economists, the real income of people has remained either static or declined if we consider the rise in the cost of fuel, the sharp depreciation of local currency against the dollar, and the spiralling price hike of essential commodities.

The price hike has been a major problem for the ordinary people of this country. The high rate of inflation for a considerable period of time has drastically reduced the purchasing power of ordinary people. Every day they go to the market, only to be taken aback by the price hike of essentials. The price of potatoes is now Tk 60 a kilogram, onion Tk 90 a kilogram, and egg Tk 160 a dozen. There is hardly any item in the market, be it green papaya, green chilli, lentil, garlic, ginger or vegetable oil, the prices of which are not skyrocketing.

The vast majority of people are literally reeling to their knees in maintaining their livelihood. The unemployment rate is perennially high. The severe dollar crisis has drastically slowed down the import of raw materials and capital machinery for industries, mills and factories to operate. Foreign investment has been, for obvious reasons, dull over the years. The net result is that the job market in the country has remained almost shut.

A consistent rise in loan defaults has been a major cause of concern for the banking sector and economy. According to the Bangladesh Bank, as of March 2024, loan default stood at Tk 182,000 crore, which is an increase of Tk 36,000 crore since December 2023. In terms of percentage, the loan in default is 22 per cent of the total loan. It seems the so-called business icons of the country have been let loose to do whatever they wish.

They launder millions of dollars and buy properties in Malaysia, Singapore, Thailand, Australia, Dubai, England, Europe, Canada and America with the money borrowed from the banks almost 'free' of any liability to repay the loan. The result is the staggering amount of loan default to the tune of Tk 182,000 crore out of the tax payers' money. They were supposed to expand businesses, build industries and create jobs, but they did nothing of the sort except make their own fortune.

Money laundering has been another major concern for the economy in recent years. As revealed at a conference held on June 20, 2024, by the agro-economists' association of the country, $7–8 billion, equivalent to Tk 97,000 crore, are being transferred out of the country every year. This massive illegal transfer of money, either through money laundering or export-import manipulation, has resulted in a severe dollar crisis. This has, in turn, made the import of any item all the more costly. The result is a price hike for essentials beyond common men's reach.

No wonder millions of people, young or old, male or female, educated or uneducated, keep standing in the queue in front of the manpower export bureau or agencies for hours and days to go abroad for a job (any job), be it in the Middle East, Malaysia or Europe, knowing well the risk involved in terms of money and even life.

Although, officially, 24 per cent of people in this country live below the poverty line, in reality, the figure must be much higher than one can imagine. It could be as high as 50 per cent, if not more. It is not rocket science to understand that a huge number of people, from what we used to know as the middle-income group, have been pushed down to the low-income group by high inflation and a dull job market.

The term 'per capita income', so often talked about by economists and financial experts, has always been a puzzle for ordinary people. They don't understand how their country's per capita income of $2,854 could make any impression on them when they earn such a meagre income that they have to remain half-fed or ill-fed for days, months and years and when they cannot buy milk for their babies or pay for the medical care of their children, let alone other family members.

Who will tell them that the real answer lies in the stark inequality of wealth between the rich and the poor? Who will tell them that the income share of the poorest 10 per cent of the country's populace is 3.8 per cent compared to 26.92 per cent for the richest 10 per cent of the population? Who will tell the government that the ever-increasing inequality in the distribution of wealth and opportunities between the rich and the poor is bound to create social unrest leading to anarchy in the near future?

The government, the financial experts, the think tanks and the policymakers of the country ought to find ways to come out of this economic anarchy sooner than later so that people can breathe a sigh of relief and lead a life that is bearable, if not comfortable.

Hussain Imam 27 June, 2024, 22:23

| New Age/Mehedi Haque

WITH a population of nearly 170 million in an area of 147,570 square kilometres, Bangladesh is the eighth most populated country in the world. It is still one of the least developed countries, poised to graduate to a developing country by 2026 and a developed country by 2041.

The socio-economic indicators of the country are also impressive. Its per capita income, which was $91 at the time of our independence in 1971, is now $2,854. Its GDP growth, which was 3–4 per cent even in the early 90s, is now well above 6 per cent. The country's social indicators, such as infant and maternal mortality rate, life expectancy, school enrolment rate of children, and overall literacy, have shown phenomenal improvement over the years. The infant mortality rate has declined to 22.64 deaths per 1000 live births and maternal mortality has gone down by 38 per cent to 256 deaths per 100,000 in 22 years from 2000 to 2022.

The country can be proud of its literacy rate increasing to 74 per cent, school enrolment of children to above 96 per cent, and life expectancy of 73.82 years, an increase of 58.8 per cent compared to that of 2011.

Unfortunately, in spite of all those achievements mentioned above, all is not well in Bangladesh. Its economy is in shambles, to say the least. Education is in the doldrums. Healthcare is fragile. Corruption is at its highest peak. To start with, let us talk about the economy, leaving the other three for some other days.

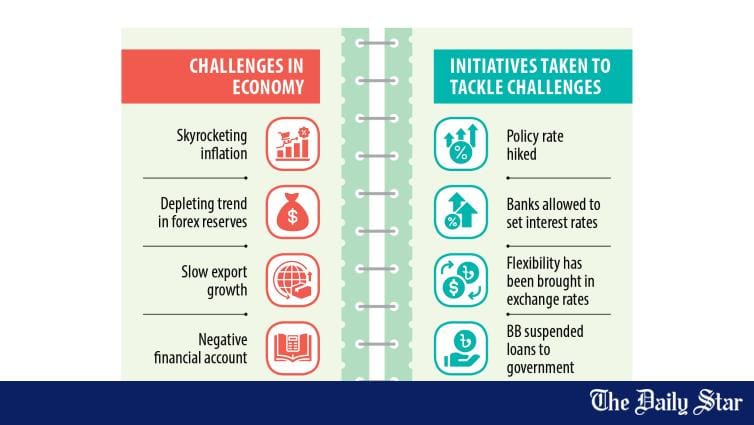

As already mentioned, our economy is in shambles. Inflation has been persistently high over the years. The result is an abnormal rise in the cost of living, and this rise in the cost of living has been at a much greater pace than the increase in earnings. According to economists, the real income of people has remained either static or declined if we consider the rise in the cost of fuel, the sharp depreciation of local currency against the dollar, and the spiralling price hike of essential commodities.

The price hike has been a major problem for the ordinary people of this country. The high rate of inflation for a considerable period of time has drastically reduced the purchasing power of ordinary people. Every day they go to the market, only to be taken aback by the price hike of essentials. The price of potatoes is now Tk 60 a kilogram, onion Tk 90 a kilogram, and egg Tk 160 a dozen. There is hardly any item in the market, be it green papaya, green chilli, lentil, garlic, ginger or vegetable oil, the prices of which are not skyrocketing.

The vast majority of people are literally reeling to their knees in maintaining their livelihood. The unemployment rate is perennially high. The severe dollar crisis has drastically slowed down the import of raw materials and capital machinery for industries, mills and factories to operate. Foreign investment has been, for obvious reasons, dull over the years. The net result is that the job market in the country has remained almost shut.

A consistent rise in loan defaults has been a major cause of concern for the banking sector and economy. According to the Bangladesh Bank, as of March 2024, loan default stood at Tk 182,000 crore, which is an increase of Tk 36,000 crore since December 2023. In terms of percentage, the loan in default is 22 per cent of the total loan. It seems the so-called business icons of the country have been let loose to do whatever they wish.

They launder millions of dollars and buy properties in Malaysia, Singapore, Thailand, Australia, Dubai, England, Europe, Canada and America with the money borrowed from the banks almost 'free' of any liability to repay the loan. The result is the staggering amount of loan default to the tune of Tk 182,000 crore out of the tax payers' money. They were supposed to expand businesses, build industries and create jobs, but they did nothing of the sort except make their own fortune.

Money laundering has been another major concern for the economy in recent years. As revealed at a conference held on June 20, 2024, by the agro-economists' association of the country, $7–8 billion, equivalent to Tk 97,000 crore, are being transferred out of the country every year. This massive illegal transfer of money, either through money laundering or export-import manipulation, has resulted in a severe dollar crisis. This has, in turn, made the import of any item all the more costly. The result is a price hike for essentials beyond common men's reach.

No wonder millions of people, young or old, male or female, educated or uneducated, keep standing in the queue in front of the manpower export bureau or agencies for hours and days to go abroad for a job (any job), be it in the Middle East, Malaysia or Europe, knowing well the risk involved in terms of money and even life.

Although, officially, 24 per cent of people in this country live below the poverty line, in reality, the figure must be much higher than one can imagine. It could be as high as 50 per cent, if not more. It is not rocket science to understand that a huge number of people, from what we used to know as the middle-income group, have been pushed down to the low-income group by high inflation and a dull job market.

The term 'per capita income', so often talked about by economists and financial experts, has always been a puzzle for ordinary people. They don't understand how their country's per capita income of $2,854 could make any impression on them when they earn such a meagre income that they have to remain half-fed or ill-fed for days, months and years and when they cannot buy milk for their babies or pay for the medical care of their children, let alone other family members.

Who will tell them that the real answer lies in the stark inequality of wealth between the rich and the poor? Who will tell them that the income share of the poorest 10 per cent of the country's populace is 3.8 per cent compared to 26.92 per cent for the richest 10 per cent of the population? Who will tell the government that the ever-increasing inequality in the distribution of wealth and opportunities between the rich and the poor is bound to create social unrest leading to anarchy in the near future?

The government, the financial experts, the think tanks and the policymakers of the country ought to find ways to come out of this economic anarchy sooner than later so that people can breathe a sigh of relief and lead a life that is bearable, if not comfortable.