Saif

Senior Member

- Messages

- 17,503

- Likes

- 8,438

- Nation

- Residence

- Axis Group

Internet outage, curfew leave foreign investors in a bind

Violence centring the quota reform movement as well as a five-day internet blackout and the ongoing curfew has shaken foreign investors’ confidence in Bangladesh, tarnishing the country’s image as a reliable investment destination.

Internet outage, curfew leave foreign investors in a bind

Future FDI inflow may be affected, say experts

Violence centring the quota reform movement as well as a five-day internet blackout and the ongoing curfew has shaken foreign investors' confidence in Bangladesh, tarnishing the country's image as a reliable investment destination.

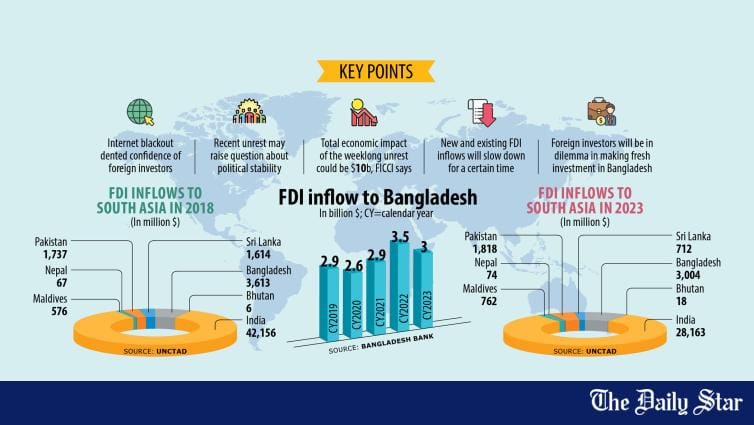

This is likely to affect the inflow of foreign direct investment (FDI) at a time when Bangladesh is in desperate need of foreign funds to diversify its manufacturing bases, enable technology transfer, and attain its goal of becoming a developed economy by 2041.

The country needs to annually attract FDI equivalent to 1.66 percent of its GDP, which was around $459 billion in FY24, to become an advanced economy by 2041.

In regards to luring investors, a country's reputation as a reliable investment destination is vital. In that sense, the damage done in the recent week was severe.

"Beyond financial impacts, the image issue that the country is facing cannot be quantified as the reputation has been severely damaged in the past few weeks," said Zaved Akhtar, president of the Foreign Investors' Chamber of Commerce and Industry (FICCI).

"The credibility of Bangladesh as a reliable investment destination is in question. It is not just important but crucial that we work on rebuilding Bangladesh's reputation as a stable nation and resilient economy, capable of delivering results regardless of circumstances. Rebuilding the confidence of existing investors by smoothening operations and improving the ease of doing business is also critical," he added.

His comments came following an internet outage in the aftermath of the violence centring the quota reform movement, which claimed at least 161 lives, left thousands injured and led to the vandalism of public and private properties.

The FICCI president said the recent shutdown had an economic impact of over $10 billion on Bangladesh in the last seven days.

The fast-moving consumer goods industry faced a setback of over $100 million during the past week as supply lines and operations were significantly impacted, Zaved added.

The recent upheaval affected export-oriented industries, e-commerce, freelancing, ride-hailing, software development, and many micro, small and medium enterprises that rely on social commerce.

"While the country is slowly recovering with limited online and physical connectivity, full operations are yet to revive. We are at best meeting 50 percent of our economic potential," he said.

He added that industries require full broadband and mobile connectivity to operate to their full potential.

Furthermore, businesses are facing challenges related to the release of goods from ports and accumulating demurrage because of the recent inactivity.

"Numerous existing investors are currently in uncertainty as their teams aim to resume regular operations. Challenges and inefficiencies in terms of goods release, running operations and physical reach are driving up the cost of business," he said.

Bangladesh Bank data shows that net FDI inflow fell to $3.8 billion in the July-May period of FY24, down 6.5 percent from $4 billion during the same period the year prior.

Yuji Ando, country representative of the Japan External Trade Organisation (JETRO), said there would be a tremendous negative impact on FDI as Bangladesh failed to ensure internet connectivity, which hindered business operations significantly.

He said Japanese companies in Bangladesh could only resume operations on July 24 after the curfew was relaxed and the internet was restored.

This is because around 20 percent of Japanese companies work remotely, he said. Moreover, some Japanese companies have evacuated their employees due to safety concerns.

According to Ando, at this moment, two major factors are needed to grow FDI inflow. The most fundamental one is to ensure safety. Secondly, internet facilities must be provided without restriction.

M Masrur Reaz, chairman of Policy Exchange of Bangladesh, said: "The economic impacts of last week's incidents can be grim... some foreign investors are nervous about a potential repetition of what occurred over the past week and what it means for their investment on the ground."

According to him, one common concern among investors was that they were almost completely cut off from communications with foreign buyers due to the lack of internet, which is quite rare in today's world where uninterrupted business communication is considered an essential feature of any trade and investment destination.

Reaz added that foreign investors with a stake in the export sector are anticipating losses and increased expenses due to overtime bills as workers will be required to make up for production loss over the past six days.

Additionally, they will now have to go for costly air shipments to make up for lost time and meet their lead times, he commented.

Besides, the inability to take delivery of supplies has led to additional port and transportation charges as well as penalties.

Khondaker Golam Moazzem, research director at the Centre for Policy Dialogue, said the recent scenario would create confusion among potential foreign investors despite the country's positive aspects, such as cheap labour.

He added that the recent incidents would also raise questions about political stability among foreign investors, who are already concerned by the gas crisis and problems in profit repatriation.

Reaz further opined that FDI inflow would not decline significantly, but predicted that existing foreign investors would stop expansion for a certain period.

Syed Almas Kabir, former president of the Bangladesh Malaysia Chamber of Commerce and Industry, echoed those sentiments.

"The recent turmoil in Bangladesh has made both investors and clients alarmed over doing business with us," he said.

Moreover, the internet blackout made it virtually impossible for them to contact their counterparts in Bangladesh, which made them even more worried, he added.

"Even after internet connectivity was restored, slow speeds have been hindering smooth communication," he said, adding that invoices and pictures could hardly be transferred at present due to slow internet speeds.

"Such incidents have tarnished the business-friendly image of Bangladesh. As a result, it has made foreign investors and clients increasingly wary of doing business with us," Kabir said.

Future FDI inflow may be affected, say experts

Violence centring the quota reform movement as well as a five-day internet blackout and the ongoing curfew has shaken foreign investors' confidence in Bangladesh, tarnishing the country's image as a reliable investment destination.

This is likely to affect the inflow of foreign direct investment (FDI) at a time when Bangladesh is in desperate need of foreign funds to diversify its manufacturing bases, enable technology transfer, and attain its goal of becoming a developed economy by 2041.

The country needs to annually attract FDI equivalent to 1.66 percent of its GDP, which was around $459 billion in FY24, to become an advanced economy by 2041.

In regards to luring investors, a country's reputation as a reliable investment destination is vital. In that sense, the damage done in the recent week was severe.

"Beyond financial impacts, the image issue that the country is facing cannot be quantified as the reputation has been severely damaged in the past few weeks," said Zaved Akhtar, president of the Foreign Investors' Chamber of Commerce and Industry (FICCI).

"The credibility of Bangladesh as a reliable investment destination is in question. It is not just important but crucial that we work on rebuilding Bangladesh's reputation as a stable nation and resilient economy, capable of delivering results regardless of circumstances. Rebuilding the confidence of existing investors by smoothening operations and improving the ease of doing business is also critical," he added.

His comments came following an internet outage in the aftermath of the violence centring the quota reform movement, which claimed at least 161 lives, left thousands injured and led to the vandalism of public and private properties.

The FICCI president said the recent shutdown had an economic impact of over $10 billion on Bangladesh in the last seven days.

The fast-moving consumer goods industry faced a setback of over $100 million during the past week as supply lines and operations were significantly impacted, Zaved added.

The recent upheaval affected export-oriented industries, e-commerce, freelancing, ride-hailing, software development, and many micro, small and medium enterprises that rely on social commerce.

"While the country is slowly recovering with limited online and physical connectivity, full operations are yet to revive. We are at best meeting 50 percent of our economic potential," he said.

He added that industries require full broadband and mobile connectivity to operate to their full potential.

Furthermore, businesses are facing challenges related to the release of goods from ports and accumulating demurrage because of the recent inactivity.

"Numerous existing investors are currently in uncertainty as their teams aim to resume regular operations. Challenges and inefficiencies in terms of goods release, running operations and physical reach are driving up the cost of business," he said.

Bangladesh Bank data shows that net FDI inflow fell to $3.8 billion in the July-May period of FY24, down 6.5 percent from $4 billion during the same period the year prior.

Yuji Ando, country representative of the Japan External Trade Organisation (JETRO), said there would be a tremendous negative impact on FDI as Bangladesh failed to ensure internet connectivity, which hindered business operations significantly.

He said Japanese companies in Bangladesh could only resume operations on July 24 after the curfew was relaxed and the internet was restored.

This is because around 20 percent of Japanese companies work remotely, he said. Moreover, some Japanese companies have evacuated their employees due to safety concerns.

According to Ando, at this moment, two major factors are needed to grow FDI inflow. The most fundamental one is to ensure safety. Secondly, internet facilities must be provided without restriction.

M Masrur Reaz, chairman of Policy Exchange of Bangladesh, said: "The economic impacts of last week's incidents can be grim... some foreign investors are nervous about a potential repetition of what occurred over the past week and what it means for their investment on the ground."

According to him, one common concern among investors was that they were almost completely cut off from communications with foreign buyers due to the lack of internet, which is quite rare in today's world where uninterrupted business communication is considered an essential feature of any trade and investment destination.

Reaz added that foreign investors with a stake in the export sector are anticipating losses and increased expenses due to overtime bills as workers will be required to make up for production loss over the past six days.

Additionally, they will now have to go for costly air shipments to make up for lost time and meet their lead times, he commented.

Besides, the inability to take delivery of supplies has led to additional port and transportation charges as well as penalties.

Khondaker Golam Moazzem, research director at the Centre for Policy Dialogue, said the recent scenario would create confusion among potential foreign investors despite the country's positive aspects, such as cheap labour.

He added that the recent incidents would also raise questions about political stability among foreign investors, who are already concerned by the gas crisis and problems in profit repatriation.

Reaz further opined that FDI inflow would not decline significantly, but predicted that existing foreign investors would stop expansion for a certain period.

Syed Almas Kabir, former president of the Bangladesh Malaysia Chamber of Commerce and Industry, echoed those sentiments.

"The recent turmoil in Bangladesh has made both investors and clients alarmed over doing business with us," he said.

Moreover, the internet blackout made it virtually impossible for them to contact their counterparts in Bangladesh, which made them even more worried, he added.

"Even after internet connectivity was restored, slow speeds have been hindering smooth communication," he said, adding that invoices and pictures could hardly be transferred at present due to slow internet speeds.

"Such incidents have tarnished the business-friendly image of Bangladesh. As a result, it has made foreign investors and clients increasingly wary of doing business with us," Kabir said.