- Copy to clipboard

- Thread starter

- #541

Saif

Senior Member

- Joined

- Jan 24, 2024

- Messages

- 15,397

- Reaction score

- 7,865

- Points

- 209

- Nation

- Residence

- Axis Group

Private sector struggling under mounting pressure

The private sector is facing increasing uncertainty as stubbornly high inflation, stagnant investments and inconsistent energy supplies continue to weigh on businesses, according to industry leaders.

Private sector struggling under mounting pressure

Businesses say at seminar

The private sector is facing increasing uncertainty as stubbornly high inflation, stagnant investments and inconsistent energy supplies continue to weigh on businesses, according to industry leaders.

"In recent months, business sentiment has been significantly affected by inflationary pressures, high borrowing costs and exchange rate volatility," said Taskeen Ahmed, president of the Dhaka Chamber of Commerce & Industry (DCCI), at an event in Dhaka yesterday.

He called for policy stability and structural reforms to restore business confidence.

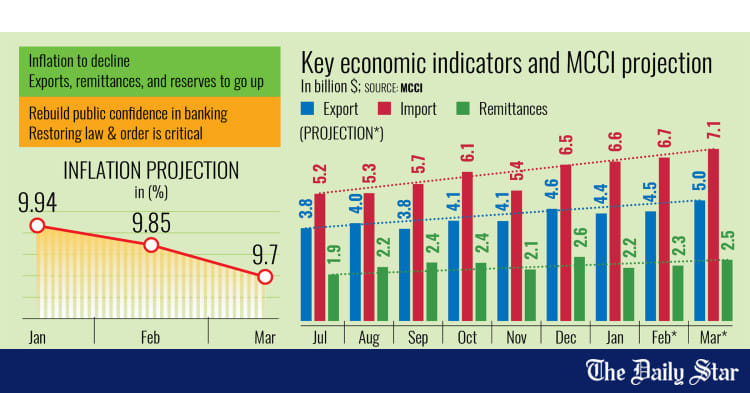

Red-hot prices remain a key concern for both individuals and businesses, with inflation hovering at over 9 percent since March 2023. Making things worse, Bangladesh's foreign exchange reserves have been under strain for nearly three years, leading to a depreciation of the local currency against the US dollar.

For manufacturers, rising commodity prices usually result in reduced demand, while a weaker taka increases operational costs. Besides, authorities have raised interest rates to battle inflation, further pushing up borrowing costs for businesses.

In his keynote address at the event, titled "Bi-Annual Economic State and Future Outlook of Bangladesh Economy – Private Sector Perspective," the DCCI president said that industries are already under pressure due to inconsistent energy supplies, which they fear will worsen during the upcoming summer.

"Industries are struggling with frequent power shortages and an unpredictable energy supply. The cost of gas has increased, yet supply is inconsistent," Ahmed said.

"If this continues, businesses will find it difficult to remain competitive."

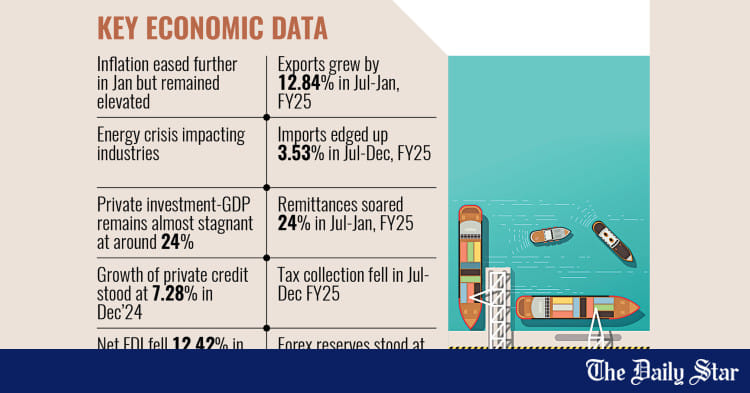

The DCCI president mentioned that private investment has stagnated at 24 percent of GDP almost since the pandemic, while foreign direct investment (FDI) has dropped to a six-year low.

"Without urgent interventions, sustaining economic momentum will be challenging."

Regarding the financial sector, Ahmed pointed to the growing liquidity crisis, especially its impact on businesses.

"The central bank hiking the policy rate to 10 percent has made credit inaccessible for small and medium enterprises. Private sector credit growth fell to 7.28 percent in December 2024, well below the target of 9.8 percent for the fiscal year 2024-25. The high cost of borrowing is discouraging investment."

Ahmed called for policy consistency, tax reforms and investment in infrastructure to support private sector growth.

"The private sector is ready to drive economic expansion, but we need clear and stable policies. If inflation, energy crises and financial instability drag on, businesses will struggle to sustain operations," he mentioned.

M Masrur Reaz, chief executive officer of the Policy Exchange Bangladesh, said the country's macroeconomic situation has been in a fragile state since 2022 due to high inflationary pressures.

He believes macroeconomic stability will remain elusive if the foreign exchange reserves do not increase by $7 to $8 billion by the end of this year. As such, the economist requested the government to secure $5 to $6 billion from multilateral lenders by June to stabilise forex reserves.

Reaz also advocated a stable and sufficient energy supply.

Sayera Younus, executive director (research) of Bangladesh Bank, said inflation would decline to around 6 percent by the end of the current fiscal year.

She hoped that the foreign exchange reserves would increase by at least $5 billion by the end of June, driven by growing exports and remittance inflows.

Mohammad Abu Eusuf, a professor of development studies at the University of Dhaka, said financing a deficit by borrowing from the banking sector would hurt private sector credit flow.

Mohammad Yunus, research director at the Bangladesh Institute of Development Studies, highlighted the potential for FDI and joint ventures, especially in the leather and pharmaceutical sectors.

Md Abdur Rahim Khan, additional secretary (export) of the commerce ministry, said export diversification remains a significant challenge, with garments accounting for more than 85 percent of export earnings.

Khan, who is currently the secretary of the commerce ministry, said the local light engineering sector holds immense potential, though exports in this sector declined in the last fiscal year.

Regarding Bangladesh's graduation from least developed country (LDC) status, which is scheduled in 2026, he said that despite the phasing out of subsidies and incentives, reducing business costs by 10–15 percent could enhance global competitiveness.

However, he pointed out that access to financing poses a challenge for entrepreneurs. Besides, it is important to attract foreign investment to build a diversified economy.

Referring to the current tax-to-GDP ratio of 8 percent, Khan said, "$40 billion in revenue collection for a $450 billion economy is completely unacceptable."

He also expressed concerns over the lack of full automation of government services and the inadequate implementation of the National Single Window system.

Businesses say at seminar

The private sector is facing increasing uncertainty as stubbornly high inflation, stagnant investments and inconsistent energy supplies continue to weigh on businesses, according to industry leaders.

"In recent months, business sentiment has been significantly affected by inflationary pressures, high borrowing costs and exchange rate volatility," said Taskeen Ahmed, president of the Dhaka Chamber of Commerce & Industry (DCCI), at an event in Dhaka yesterday.

He called for policy stability and structural reforms to restore business confidence.

Red-hot prices remain a key concern for both individuals and businesses, with inflation hovering at over 9 percent since March 2023. Making things worse, Bangladesh's foreign exchange reserves have been under strain for nearly three years, leading to a depreciation of the local currency against the US dollar.

For manufacturers, rising commodity prices usually result in reduced demand, while a weaker taka increases operational costs. Besides, authorities have raised interest rates to battle inflation, further pushing up borrowing costs for businesses.

In his keynote address at the event, titled "Bi-Annual Economic State and Future Outlook of Bangladesh Economy – Private Sector Perspective," the DCCI president said that industries are already under pressure due to inconsistent energy supplies, which they fear will worsen during the upcoming summer.

"Industries are struggling with frequent power shortages and an unpredictable energy supply. The cost of gas has increased, yet supply is inconsistent," Ahmed said.

"If this continues, businesses will find it difficult to remain competitive."

The DCCI president mentioned that private investment has stagnated at 24 percent of GDP almost since the pandemic, while foreign direct investment (FDI) has dropped to a six-year low.

"Without urgent interventions, sustaining economic momentum will be challenging."

Regarding the financial sector, Ahmed pointed to the growing liquidity crisis, especially its impact on businesses.

"The central bank hiking the policy rate to 10 percent has made credit inaccessible for small and medium enterprises. Private sector credit growth fell to 7.28 percent in December 2024, well below the target of 9.8 percent for the fiscal year 2024-25. The high cost of borrowing is discouraging investment."

Ahmed called for policy consistency, tax reforms and investment in infrastructure to support private sector growth.

"The private sector is ready to drive economic expansion, but we need clear and stable policies. If inflation, energy crises and financial instability drag on, businesses will struggle to sustain operations," he mentioned.

M Masrur Reaz, chief executive officer of the Policy Exchange Bangladesh, said the country's macroeconomic situation has been in a fragile state since 2022 due to high inflationary pressures.

He believes macroeconomic stability will remain elusive if the foreign exchange reserves do not increase by $7 to $8 billion by the end of this year. As such, the economist requested the government to secure $5 to $6 billion from multilateral lenders by June to stabilise forex reserves.

Reaz also advocated a stable and sufficient energy supply.

Sayera Younus, executive director (research) of Bangladesh Bank, said inflation would decline to around 6 percent by the end of the current fiscal year.

She hoped that the foreign exchange reserves would increase by at least $5 billion by the end of June, driven by growing exports and remittance inflows.

Mohammad Abu Eusuf, a professor of development studies at the University of Dhaka, said financing a deficit by borrowing from the banking sector would hurt private sector credit flow.

Mohammad Yunus, research director at the Bangladesh Institute of Development Studies, highlighted the potential for FDI and joint ventures, especially in the leather and pharmaceutical sectors.

Md Abdur Rahim Khan, additional secretary (export) of the commerce ministry, said export diversification remains a significant challenge, with garments accounting for more than 85 percent of export earnings.

Khan, who is currently the secretary of the commerce ministry, said the local light engineering sector holds immense potential, though exports in this sector declined in the last fiscal year.

Regarding Bangladesh's graduation from least developed country (LDC) status, which is scheduled in 2026, he said that despite the phasing out of subsidies and incentives, reducing business costs by 10–15 percent could enhance global competitiveness.

However, he pointed out that access to financing poses a challenge for entrepreneurs. Besides, it is important to attract foreign investment to build a diversified economy.

Referring to the current tax-to-GDP ratio of 8 percent, Khan said, "$40 billion in revenue collection for a $450 billion economy is completely unacceptable."

He also expressed concerns over the lack of full automation of government services and the inadequate implementation of the National Single Window system.