Saif

Senior Member

- Messages

- 17,503

- Likes

- 8,438

- Nation

- Residence

- Axis Group

Is decline in import concerning?

The moderate decline in the country's overall external trade with the rest of the world in the last fiscal year is not surprising. Both exports and imports dropped in FY24, leading to a fall in overall trade in terms of value. The decline in merchandise imports, which was much higher than that of e

Is decline in import concerning?

Asjadul Kibria

Published :

Sep 28, 2024 22:00

Updated :

Sep 28, 2024 22:00

The moderate decline in the country's overall external trade with the rest of the world in the last fiscal year is not surprising. Both exports and imports dropped in FY24, leading to a fall in overall trade in terms of value. The decline in merchandise imports, which was much higher than that of exports, indicates the sluggish internal demand and foreign exchange crisis in the country.

Statistics available with Bangladesh Bank showed that payment for merchandise import dropped by 11 per cent to US$66.73 billion in the last fiscal year from $75.06 billion in FY23. It was the second consecutive drop in import of goods in the country. In FY23, import value fell by 15.81 per cent from $89.16 billion in FY22. Again, the fall of imports in the last fiscal year was a decline for the third time in the past decade. During the decade, imports first dropped by 8.56 per cent in FY20, whereas the highest growth of imports was recorded at around 36 per cent in FY22. Payments for services import, however, almost unchanged at $10 billion in the last fiscal year. Merchandise exports declined by 4.35 per cent in FY24, reaching $44.48 billion, whereas services exports dropped by 9.78 per cent to around $6.30 billion.

The total value of external trade stood at $127.60 billion in the last fiscal year, a significant drop from $138.60 billion in FY23. This decline in trade is not just a number on a balance sheet; it has real implications for the country's national income. The trade-GDP ratio came down to 28.90 per cent in the last fiscal year from 31 per cent in FY23, according to the preliminary estimation of the Bangladesh Bureau of Statistics (BBS). This decrease in the trade-GDP ratio is a clear indicator of the impact of the trade decline on the country's economic health.

The requirements of higher import payments coupled with a gradual increase in external debt liability drove the rapid depletion of foreign exchange reserves since FY22. The gross forex reserve reached $41.82 billion at the end of FY22 from $46.40 billion in FY21. As it was not possible to suspend the debt repayments, the central bank started to allow currency depreciation and discourage luxury and less-essential imports of goods to contain the fast depletion of reserves. Nevertheless, the forex reserve further dropped to $31.20 billion at the end of FY23, and the declining trend continued till the end of FY24 when gross forex reserve came down to $26.71 billion while the net or disposable reserve slid to $21.69 billion.

In the meantime, the reduction in import payments continued due to various restrictive policy measures implemented by the central bank to curb import growth as well as to reduce the import-induced inflationary pressure. According to a brief analysis of the central bank, factors such as exchange rate depreciation and global price hikes also contributed to the downturn in the last two fiscal years. Specifically, the import cost of intermediate goods, constituting around three-fifths of the total import payments, declined by 20 per cent in FY23 and 9 per cent in FY24. Among the intermediate goods, the import cost of petroleum goods, however, increased by 6.10 per cent in the last fiscal year. The import of capital goods declined by 21.9 per cent, and the import of food grains declined by 20.80 per cent during the period under review.

The decline in imports is also linked to the country's aggregate demand, which also moderated slightly in the last fiscal year. In constant price, domestic demand increased by 4 per cent in FY24, which posted only 2 per cent growth in FY23 but 14 per cent in FY22.

Globally, Bangladesh is now the 51st largest country in terms of merchandise import, according to the World Trade Statistics 2023. Released by the World Trade Organization (WTO) in July last with a new interactive tool, it also showed that the country's annual merchandise import was 0.28 per cent of the global import trade last year. In 2022, the country ranked 47th having 0.34 per cent share in the world import trade. Bangladesh is also the second largest importer in South Asia, after India which ranked 9th in 2022 and 8th in 2023.

The WTO statistics also showed that in the last year, international trade in goods and commercial services dropped on average by 2 per cent to $30.5 trillion, on a balance of payments basis. Trade in goods declined by 5 per cent whereas services trade increased by 9 per cent. The situation in Bangladesh is also largely aliened with the global trend.

As Bangladesh used to import more than export, there is always a trade gap with the rest of the world. Bangladesh Bank data showed that merchandise trade gap stood at $22.43 billion in FY24 from $27.38 billion in FY23. This trade gap, while significant, is due to a slower decline in both exports and imports in the last fiscal year compared to FY23. It's important to note that a trade gap is not always a matter of concern, as it can be a result of strategic import decisions to support domestic industries and economic growth.

There is a misperception in the country that a decline in exports is always a matter of concern, whereas the same trend in imports is not an alarming issue. This is because exports bring foreign exchange from the outside world, and imports cause outflow of the foreign exchange. However, it's crucial to understand that the country's exports largely rely on imports, especially for various raw materials, intermediate goods and capital machinery. For instance, one-fourth of the gross export of ready-made garments (RMG) is the import of raw materials. In other words, the net export of RMG is around three-fourths of the gross export. Cotton, yarn, textile and fabrics are the four key components of RMG, largely imported from abroad. That's why Bangladesh was the fifth largest textile importer last year although the country ranked third as exporter of RMG. Again, the country also imports food grains and consumer items like wheat, edible oil, sugar, pulse, etc, to meet the domestic demand.

So, what is more challenging is importing at a relatively lower price and sourcing the products at a competitive rate. This will help reduce the cost of domestic production of many items and also exportable goods. To achieve this, the country could consider negotiating better trade deals, investing in domestic production capabilities, and improving trade infrastructure. Finally, a rebound in imports is necessary to attain higher economic growth.

Asjadul Kibria

Published :

Sep 28, 2024 22:00

Updated :

Sep 28, 2024 22:00

The moderate decline in the country's overall external trade with the rest of the world in the last fiscal year is not surprising. Both exports and imports dropped in FY24, leading to a fall in overall trade in terms of value. The decline in merchandise imports, which was much higher than that of exports, indicates the sluggish internal demand and foreign exchange crisis in the country.

Statistics available with Bangladesh Bank showed that payment for merchandise import dropped by 11 per cent to US$66.73 billion in the last fiscal year from $75.06 billion in FY23. It was the second consecutive drop in import of goods in the country. In FY23, import value fell by 15.81 per cent from $89.16 billion in FY22. Again, the fall of imports in the last fiscal year was a decline for the third time in the past decade. During the decade, imports first dropped by 8.56 per cent in FY20, whereas the highest growth of imports was recorded at around 36 per cent in FY22. Payments for services import, however, almost unchanged at $10 billion in the last fiscal year. Merchandise exports declined by 4.35 per cent in FY24, reaching $44.48 billion, whereas services exports dropped by 9.78 per cent to around $6.30 billion.

The total value of external trade stood at $127.60 billion in the last fiscal year, a significant drop from $138.60 billion in FY23. This decline in trade is not just a number on a balance sheet; it has real implications for the country's national income. The trade-GDP ratio came down to 28.90 per cent in the last fiscal year from 31 per cent in FY23, according to the preliminary estimation of the Bangladesh Bureau of Statistics (BBS). This decrease in the trade-GDP ratio is a clear indicator of the impact of the trade decline on the country's economic health.

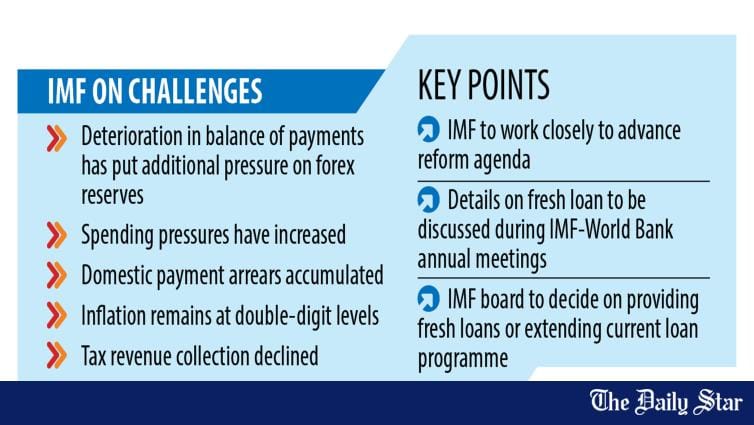

The requirements of higher import payments coupled with a gradual increase in external debt liability drove the rapid depletion of foreign exchange reserves since FY22. The gross forex reserve reached $41.82 billion at the end of FY22 from $46.40 billion in FY21. As it was not possible to suspend the debt repayments, the central bank started to allow currency depreciation and discourage luxury and less-essential imports of goods to contain the fast depletion of reserves. Nevertheless, the forex reserve further dropped to $31.20 billion at the end of FY23, and the declining trend continued till the end of FY24 when gross forex reserve came down to $26.71 billion while the net or disposable reserve slid to $21.69 billion.

In the meantime, the reduction in import payments continued due to various restrictive policy measures implemented by the central bank to curb import growth as well as to reduce the import-induced inflationary pressure. According to a brief analysis of the central bank, factors such as exchange rate depreciation and global price hikes also contributed to the downturn in the last two fiscal years. Specifically, the import cost of intermediate goods, constituting around three-fifths of the total import payments, declined by 20 per cent in FY23 and 9 per cent in FY24. Among the intermediate goods, the import cost of petroleum goods, however, increased by 6.10 per cent in the last fiscal year. The import of capital goods declined by 21.9 per cent, and the import of food grains declined by 20.80 per cent during the period under review.

The decline in imports is also linked to the country's aggregate demand, which also moderated slightly in the last fiscal year. In constant price, domestic demand increased by 4 per cent in FY24, which posted only 2 per cent growth in FY23 but 14 per cent in FY22.

Globally, Bangladesh is now the 51st largest country in terms of merchandise import, according to the World Trade Statistics 2023. Released by the World Trade Organization (WTO) in July last with a new interactive tool, it also showed that the country's annual merchandise import was 0.28 per cent of the global import trade last year. In 2022, the country ranked 47th having 0.34 per cent share in the world import trade. Bangladesh is also the second largest importer in South Asia, after India which ranked 9th in 2022 and 8th in 2023.

The WTO statistics also showed that in the last year, international trade in goods and commercial services dropped on average by 2 per cent to $30.5 trillion, on a balance of payments basis. Trade in goods declined by 5 per cent whereas services trade increased by 9 per cent. The situation in Bangladesh is also largely aliened with the global trend.

As Bangladesh used to import more than export, there is always a trade gap with the rest of the world. Bangladesh Bank data showed that merchandise trade gap stood at $22.43 billion in FY24 from $27.38 billion in FY23. This trade gap, while significant, is due to a slower decline in both exports and imports in the last fiscal year compared to FY23. It's important to note that a trade gap is not always a matter of concern, as it can be a result of strategic import decisions to support domestic industries and economic growth.

There is a misperception in the country that a decline in exports is always a matter of concern, whereas the same trend in imports is not an alarming issue. This is because exports bring foreign exchange from the outside world, and imports cause outflow of the foreign exchange. However, it's crucial to understand that the country's exports largely rely on imports, especially for various raw materials, intermediate goods and capital machinery. For instance, one-fourth of the gross export of ready-made garments (RMG) is the import of raw materials. In other words, the net export of RMG is around three-fourths of the gross export. Cotton, yarn, textile and fabrics are the four key components of RMG, largely imported from abroad. That's why Bangladesh was the fifth largest textile importer last year although the country ranked third as exporter of RMG. Again, the country also imports food grains and consumer items like wheat, edible oil, sugar, pulse, etc, to meet the domestic demand.

So, what is more challenging is importing at a relatively lower price and sourcing the products at a competitive rate. This will help reduce the cost of domestic production of many items and also exportable goods. To achieve this, the country could consider negotiating better trade deals, investing in domestic production capabilities, and improving trade infrastructure. Finally, a rebound in imports is necessary to attain higher economic growth.