Saif

Senior Member

- Joined

- Jan 24, 2024

- Messages

- 16,236

- Likes

- 8,069

- Nation

- Axis Group

Remittances hit record $32b in 2025, shoring up reserves

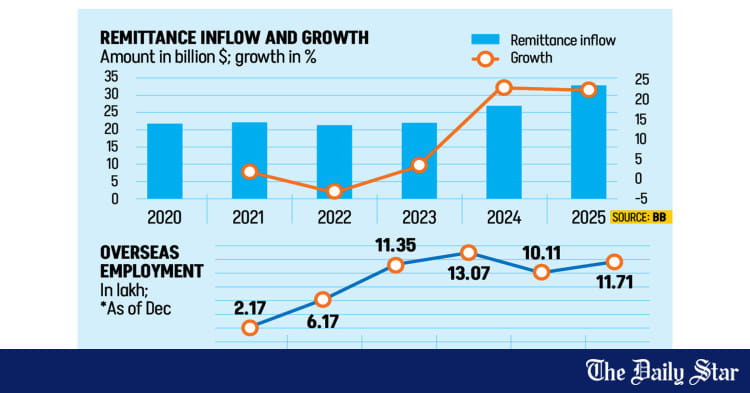

Bangladeshis abroad sent home a record $32.8 billion in 2025, according to central bank data, as economists say more expatriates are now using formal banking channels, with informal routes siphoning off less since the August political changeover.

Remittances hit record $32b in 2025, shoring up reserves

Bangladeshis abroad sent home a record $32.8 billion in 2025, according to central bank data, as economists say more expatriates are now using formal banking channels, with informal routes siphoning off less since the August political changeover.

The historic-high inflows offered a much-needed tonic to the country's fragile external balance.

The amount is 22 percent higher than the $26.88 billion recorded in the previous year, according to Bangladesh Bank (BB) data released yesterday.

In December alone, remittances reached $3.22 billion, the highest monthly inflow in nine months, up 22 percent from the same month last year.

Foreign currency streaming in helped lift gross reserves to $33.18 billion on December 30, up from $25 billion a year earlier.

"Remittances have been a key driver for the recent increase in reserves, indicating improved performance of the external sector," said Mohammed Nurul Amin, former chairman of the Association of Bankers Bangladesh (ABB).

After the fall of the previous government, remittance inflows started to rise every month. Previously, demand for hundi was growing amid large sums of money reportedly being siphoned abroad

"Forex reserve figures are now closely watched, as a rise strengthens confidence and attracts foreign interest," he said.

He hoped that the trend could ease pressure on the external sector in the months ahead.

During the July-December period last year, expatriates sent home $16.26 billion, an 18.1 percent increase on the same period in 2024, according to the BB data.

Industry insiders said government incentives, banks' efforts to attract foreign funds, and the decline of the hundi system -- an illegal yet popular cross-border transfer mechanism -- helped push inflows higher after the political changeover in August 2024.

After the fall of the previous government, remittance inflows started to rise every month. Previously, demand for hundi was growing amid large sums of money reportedly being siphoned abroad. That stopped under the interim government.

Mohammed Nurul Amin, former independent director and chairman of Global Islami Bank, said incentives have played a major role in boosting the inflow. "As a result, people are sending more money through formal channels," he added.

Remittance senders currently get a 2.5 percent government incentive.

He also pointed to a psychological change after the fall of the previous government. "People believe that corruption is no longer as prevalent as before," he said, adding that overseas employment has risen, with more skilled workers leaving home for jobs abroad.

Between January and December 28 last year, as many as 1,116,725 men and women went overseas. In 2023, 1,303,453 workers went abroad, while 1,011,969 left the country for overseas jobs in 2024, according to official data.

According to the Bureau of Manpower, Employment and Training, Saudi Arabia welcomed 744,619 Bangladeshi workers, Qatar 106,805, and Singapore 69,491 during the first 11 months and 28 days of the year.

Zahid Hussain, former lead economist at the World Bank's Dhaka office, said more expatriates are using official channels because less money is now being siphoned abroad, reducing demand for hundi transfers.

"Higher reserves boost confidence in the exchange rate, thereby limiting depreciation," said the economist. "Although investment may rise after the election, the strong reserve position should prevent pressure on the exchange rate."

In December, Islami Bank Bangladesh received the highest inflow at $671 million, followed by Bangladesh Krishi Bank with $353 million, Janata Bank $281 million, and BRAC Bank $261 million, showed BB data.

With rising remittances easing demand for US dollars, the central bank purchased over $3 billion in the current fiscal year, a reflection of ongoing efforts to shore up foreign exchange reserves.

Bangladeshis abroad sent home a record $32.8 billion in 2025, according to central bank data, as economists say more expatriates are now using formal banking channels, with informal routes siphoning off less since the August political changeover.

The historic-high inflows offered a much-needed tonic to the country's fragile external balance.

The amount is 22 percent higher than the $26.88 billion recorded in the previous year, according to Bangladesh Bank (BB) data released yesterday.

In December alone, remittances reached $3.22 billion, the highest monthly inflow in nine months, up 22 percent from the same month last year.

Foreign currency streaming in helped lift gross reserves to $33.18 billion on December 30, up from $25 billion a year earlier.

"Remittances have been a key driver for the recent increase in reserves, indicating improved performance of the external sector," said Mohammed Nurul Amin, former chairman of the Association of Bankers Bangladesh (ABB).

After the fall of the previous government, remittance inflows started to rise every month. Previously, demand for hundi was growing amid large sums of money reportedly being siphoned abroad

"Forex reserve figures are now closely watched, as a rise strengthens confidence and attracts foreign interest," he said.

He hoped that the trend could ease pressure on the external sector in the months ahead.

During the July-December period last year, expatriates sent home $16.26 billion, an 18.1 percent increase on the same period in 2024, according to the BB data.

Industry insiders said government incentives, banks' efforts to attract foreign funds, and the decline of the hundi system -- an illegal yet popular cross-border transfer mechanism -- helped push inflows higher after the political changeover in August 2024.

After the fall of the previous government, remittance inflows started to rise every month. Previously, demand for hundi was growing amid large sums of money reportedly being siphoned abroad. That stopped under the interim government.

Mohammed Nurul Amin, former independent director and chairman of Global Islami Bank, said incentives have played a major role in boosting the inflow. "As a result, people are sending more money through formal channels," he added.

Remittance senders currently get a 2.5 percent government incentive.

He also pointed to a psychological change after the fall of the previous government. "People believe that corruption is no longer as prevalent as before," he said, adding that overseas employment has risen, with more skilled workers leaving home for jobs abroad.

Between January and December 28 last year, as many as 1,116,725 men and women went overseas. In 2023, 1,303,453 workers went abroad, while 1,011,969 left the country for overseas jobs in 2024, according to official data.

According to the Bureau of Manpower, Employment and Training, Saudi Arabia welcomed 744,619 Bangladeshi workers, Qatar 106,805, and Singapore 69,491 during the first 11 months and 28 days of the year.

Zahid Hussain, former lead economist at the World Bank's Dhaka office, said more expatriates are using official channels because less money is now being siphoned abroad, reducing demand for hundi transfers.

"Higher reserves boost confidence in the exchange rate, thereby limiting depreciation," said the economist. "Although investment may rise after the election, the strong reserve position should prevent pressure on the exchange rate."

In December, Islami Bank Bangladesh received the highest inflow at $671 million, followed by Bangladesh Krishi Bank with $353 million, Janata Bank $281 million, and BRAC Bank $261 million, showed BB data.

With rising remittances easing demand for US dollars, the central bank purchased over $3 billion in the current fiscal year, a reflection of ongoing efforts to shore up foreign exchange reserves.