- Copy to clipboard

- Thread starter

- #21

Saif

Senior Member

- Joined

- Jan 24, 2024

- Messages

- 15,397

- Reaction score

- 7,865

- Points

- 209

- Nation

- Residence

- Axis Group

Pakistan wants to import medicine from Bangladesh

Pakistan has shown its keenness to import medicine from Bangladesh...

www.newagebd.net

www.newagebd.net

Pakistan wants to import medicine from Bangladesh

United News of Bangladesh . Dhaka 15 December, 2024, 17:24

Pakistan high commissioner to Bangladesh Syed Ahmed Maroof calls on health adviser Nurjahan Begum at her office in Dhaka on Sunday. | UNB Photo

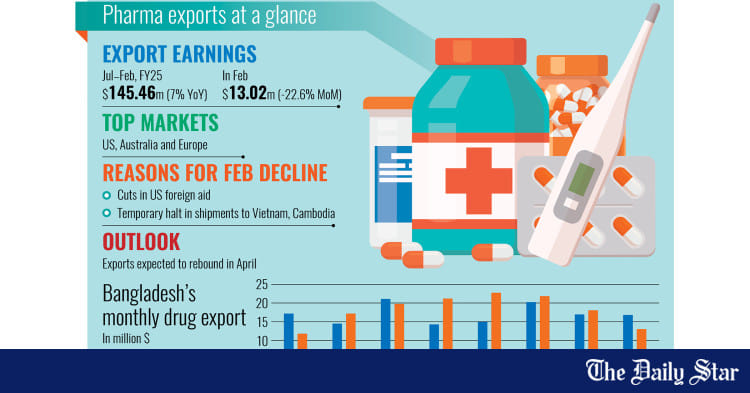

Pakistan has shown its keenness to import medicine from Bangladesh.

Pakistan high commissioner to Bangladesh Syed Ahmed Maroof expressed the interest when he called on health adviser Nurjahan Begum at her office on Sunday.

Bangladesh had made significant progress in the pharmaceutical sector, and Pakistan was interested in importing medicines from Bangladesh, said Maroof.

Healthcare, trade, and overall cooperation between the two countries came for discussion during the meeting.

United News of Bangladesh . Dhaka 15 December, 2024, 17:24

Pakistan high commissioner to Bangladesh Syed Ahmed Maroof calls on health adviser Nurjahan Begum at her office in Dhaka on Sunday. | UNB Photo

Pakistan has shown its keenness to import medicine from Bangladesh.

Pakistan high commissioner to Bangladesh Syed Ahmed Maroof expressed the interest when he called on health adviser Nurjahan Begum at her office on Sunday.

Bangladesh had made significant progress in the pharmaceutical sector, and Pakistan was interested in importing medicines from Bangladesh, said Maroof.

Healthcare, trade, and overall cooperation between the two countries came for discussion during the meeting.