Saif

Senior Member

- Joined

- Jan 24, 2024

- Messages

- 15,828

- Likes

- 7,967

- Nation

- Axis Group

newagebd.net/post/apparel/282228/rmg-exports-to-the-eu-see-13pc-growth

RMG exports to the EU see 13pc growth

Staff Correspondent 15 November, 2025, 22:39

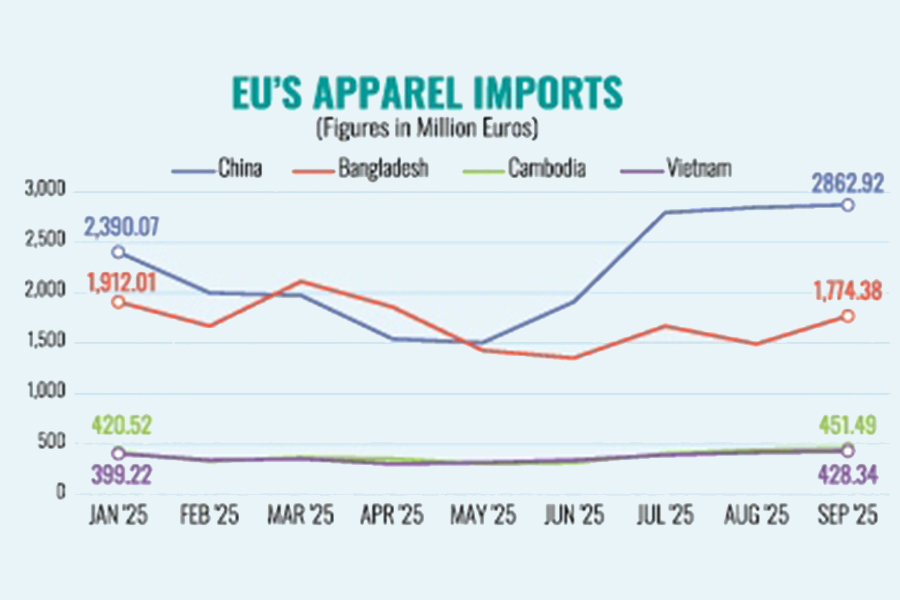

Bangladesh’s exports of readymade garments to the European Union countries grew by 13.17 per cent year-on-year in the January-September 2025 period, reaching €15.26 billion, according to Eurostat data released recently.

The export earnings were €13.48 billion in the same period of 2024.

Bangladesh’s monthly exports to the EU in September of 2025 also grew by 15.47 per cent to €1.78 billion, compared with €1.54 billion in September of 2024.

RMG exporters said that, although the exports to the EU market are normal so far, the United States’ tariff policy has significantly impacted the global apparel industry, leading to shrinking demand.

For this reason, China and India have intensified their presence in the EU to offset their losses in the US market, which might increase competition here.

Bangladesh remained the second-largest apparel exporter to the EU after China, consolidating its position with double-digit growth in 2025.

The country’s 13.17 per cent rise outpaced the EU’s overall import growth of 7.14 per cent, reflecting Bangladesh’s competitiveness in terms of price, compliance, and sustainability credentials.

The European Union’s total apparel imports reached €68.47 billion in the first nine months of 2025, marking a 7.14 per cent year-on-year increase from €63.90 billion in the same period of 2024.

The EU’s imports also surged by 3.17 per cent to €8.57 billion in September 2025.

Among the major exporters, China, while maintaining its dominance, recorded 9.86 per cent growth during the first nine months of 2025, with export earnings rising to €19.77 billion from €18 billion in the same period of 2024.

However, its exports dropped slightly by 4.55 per cent in September 2025 to €2.87 billion, down from €3 billion a year earlier.

Despite securing third place, Turkey also experienced one of the sharpest declines among major suppliers in the EU market.

The country’s apparel exports to the EU fell to €6.42 billion in January-September 2025, a 9.8 per cent drop from €7.12 billion in the same period of 2024, Eurostat data added.

Turkey’s monthly apparel exports to the EU in September 2025 also fell to €704 million, an 8.48 per cent drop from €770 million in the same month of 2024.

India recorded 10 per cent growth to €3.76 billion in January-September 2025, up from €3.40 billion in the same period of 2024.

In September 2025, the South Asian country posted a narrow growth of 0.22 per cent to €308 million, which was €307 million in September 2024.

Cambodia emerged as the strongest performer, registering the highest growth rate among major EU apparel suppliers in the first nine months of 2025, said the Eurostat data.

The country’s apparel exports to the EU rose by 22.51 per cent in January-September 2025 to €3.37 billion, which was €2.97 billion, while cumulative exports for the January-September period surged by 25.9 per cent to €2.74 billion in the mentioned period.

Vietnam and Pakistan also showed solid performance in the EU market, with apparel exports rising by 14.24 per cent and 13.77 per cent, respectively, in January-September of 2025, to €3.26 billion and €2.9 billion, respectively.

Vietnam’s growth was usually driven by its expanding synthetic apparel and sportswear industries and its preferential access under the EU–Vietnam Free Trade Agreement.

Mohammad Hatem, president of the Bangladesh Knitwear Manufacturers and Exporters Association, said that as the US tariff policy changed the global apparel market, China and India have intensified their presence in the EU.

‘This may increase competition in Europe and in this regard, Bangladesh should resolve several domestic factors, including gas and electricity shortages and challenges related to banking and customs,’ he added.

Mohiuddin Rubel, former director of the Bangladesh Garment Manufacturers and Exporters Association, said the scenario in Europe has changed significantly over the last three months.

‘Countries like China, Cambodia, Vietnam, and Pakistan increased their presence in EU markets to offset their losses in the US. Their exports to the EU increased more than the average in the last three months, although Bangladesh remained at its usual position,’ he added.

Bangladesh has started losing its share in Europe due to competitors’ aggressive presence, he added, saying the country should focus on product diversification, resolving domestic issues, and innovation to sustain its position there.

In 2024, Bangladesh exported apparel worth over €17 billion, according to Eurostat data.

Staff Correspondent 15 November, 2025, 22:39

Bangladesh’s exports of readymade garments to the European Union countries grew by 13.17 per cent year-on-year in the January-September 2025 period, reaching €15.26 billion, according to Eurostat data released recently.

The export earnings were €13.48 billion in the same period of 2024.

Bangladesh’s monthly exports to the EU in September of 2025 also grew by 15.47 per cent to €1.78 billion, compared with €1.54 billion in September of 2024.

RMG exporters said that, although the exports to the EU market are normal so far, the United States’ tariff policy has significantly impacted the global apparel industry, leading to shrinking demand.

For this reason, China and India have intensified their presence in the EU to offset their losses in the US market, which might increase competition here.

Bangladesh remained the second-largest apparel exporter to the EU after China, consolidating its position with double-digit growth in 2025.

The country’s 13.17 per cent rise outpaced the EU’s overall import growth of 7.14 per cent, reflecting Bangladesh’s competitiveness in terms of price, compliance, and sustainability credentials.

The European Union’s total apparel imports reached €68.47 billion in the first nine months of 2025, marking a 7.14 per cent year-on-year increase from €63.90 billion in the same period of 2024.

The EU’s imports also surged by 3.17 per cent to €8.57 billion in September 2025.

Among the major exporters, China, while maintaining its dominance, recorded 9.86 per cent growth during the first nine months of 2025, with export earnings rising to €19.77 billion from €18 billion in the same period of 2024.

However, its exports dropped slightly by 4.55 per cent in September 2025 to €2.87 billion, down from €3 billion a year earlier.

Despite securing third place, Turkey also experienced one of the sharpest declines among major suppliers in the EU market.

The country’s apparel exports to the EU fell to €6.42 billion in January-September 2025, a 9.8 per cent drop from €7.12 billion in the same period of 2024, Eurostat data added.

Turkey’s monthly apparel exports to the EU in September 2025 also fell to €704 million, an 8.48 per cent drop from €770 million in the same month of 2024.

India recorded 10 per cent growth to €3.76 billion in January-September 2025, up from €3.40 billion in the same period of 2024.

In September 2025, the South Asian country posted a narrow growth of 0.22 per cent to €308 million, which was €307 million in September 2024.

Cambodia emerged as the strongest performer, registering the highest growth rate among major EU apparel suppliers in the first nine months of 2025, said the Eurostat data.

The country’s apparel exports to the EU rose by 22.51 per cent in January-September 2025 to €3.37 billion, which was €2.97 billion, while cumulative exports for the January-September period surged by 25.9 per cent to €2.74 billion in the mentioned period.

Vietnam and Pakistan also showed solid performance in the EU market, with apparel exports rising by 14.24 per cent and 13.77 per cent, respectively, in January-September of 2025, to €3.26 billion and €2.9 billion, respectively.

Vietnam’s growth was usually driven by its expanding synthetic apparel and sportswear industries and its preferential access under the EU–Vietnam Free Trade Agreement.

Mohammad Hatem, president of the Bangladesh Knitwear Manufacturers and Exporters Association, said that as the US tariff policy changed the global apparel market, China and India have intensified their presence in the EU.

‘This may increase competition in Europe and in this regard, Bangladesh should resolve several domestic factors, including gas and electricity shortages and challenges related to banking and customs,’ he added.

Mohiuddin Rubel, former director of the Bangladesh Garment Manufacturers and Exporters Association, said the scenario in Europe has changed significantly over the last three months.

‘Countries like China, Cambodia, Vietnam, and Pakistan increased their presence in EU markets to offset their losses in the US. Their exports to the EU increased more than the average in the last three months, although Bangladesh remained at its usual position,’ he added.

Bangladesh has started losing its share in Europe due to competitors’ aggressive presence, he added, saying the country should focus on product diversification, resolving domestic issues, and innovation to sustain its position there.

In 2024, Bangladesh exported apparel worth over €17 billion, according to Eurostat data.