Saif

Senior Member

- Joined

- Jan 24, 2024

- Messages

- 16,880

- Likes

- 8,153

- Nation

- Residence

- Axis Group

No special liquidity for ailing banks

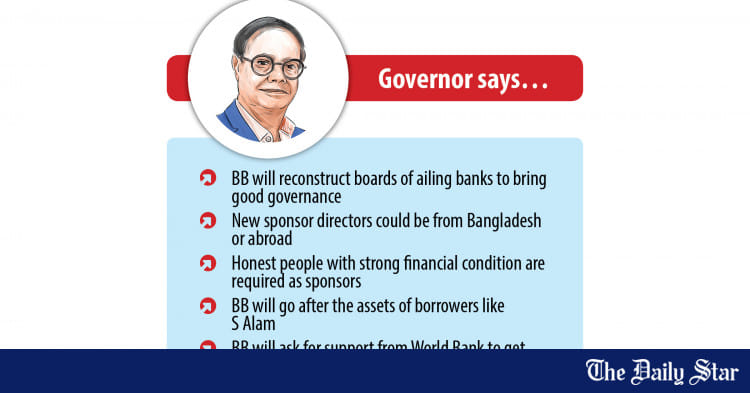

Bangladesh Bank will no longer try to save any ailing bank by providing it special liquidity support, said Governor Ahsan H Mansur yesterday.

No special liquidity for ailing banks

BB governor says

Bangladesh Bank will no longer try to save any ailing bank by providing it special liquidity support, said Governor Ahsan H Mansur yesterday.

The central bank has suspended its special liquidity support for some Shariah-based banks, he said at a press briefing after meeting with a delegation of the Federation of Bangladesh Chambers of Commerce and Industry (FBCCI) at the latter's office yesterday.

Seven banks, including six Shariah-based banks, have been facing a deficit in their current account balance with the central bank for more than a year.

The central bank was keeping those banks alive by providing special liquidity support. Only one recently showed signs of recovery.

Seven banks, including six Shariah-based ones, have been facing a deficit in their current account balance with the central bank

As of August 7, the remaining six lender's current account deficit with Bangladesh Bank stood at Tk 14,621 crore. However, the combined shortfall is Tk 20,774 crore if their cash reserve ratio deficit is considered, as per central bank data.

The ailing banks are National Bank, First Security Islami Bank (FSIBL), Social Islami Bank, Union Bank, Global Islami Bank and Bangladesh Commerce Bank.

Chattogram-based conglomerate S Alam Group has controlling stakes in all of these banks, except for National Bank.

Mansur said the banking regulator has already capped the lending activities of the six banks.

Replying to a question, Mansur said depositors have the right to withdraw money from the ailing banks, which would be liable for losing the confidence of their clients.

Against this backdrop, he said neither closing the banks or providing liquidity support was a solution.

Journalists also questioned how S Alam Group was allowed to control and take advantage of some weak Shariah-based banks.

In response, Mansur said the central bank has taken initiatives to prevent the withdrawal of funds by people who were responsible for ruining the financial health of these banks.

He added that a banking commission would soon be formed and the weak banks would have to cut down on their operations or merge with other banks under the banking commission, he added.

The new central bank governor also said the guilty or ill-motivated people would be caught but no business would be targeted.

"Action will be taken if any official, irrespective of the organisation, is found responsible," he said, adding that the same applies for central bank officials as well.

Regarding the ongoing inflationary pressure, Mansur said the inflation rate would come down to around 5 to 6 percent within the next seven to eight months.

The central bank will increase the policy rate until the inflationary pressure begins to decline, he added.

The business delegation led by FBCCI President Mahbubul Alam included former FBCCI president and BNP Vice Chairman Abdul Awal Mintoo, BKMEA Executive President Mohammad Hatem and Metropolitan Chamber of Commerce and Industry President Kamran T Rahman.

The businesspeople present demanded punishment for people who scammed and looted banks in the pretext of doing business.

At the meeting, FBCCI President Alam urged to stabilise the interest rates on bank loans, ensure adequate US dollar supply and provide support to affected industries and commercial establishments.

BB governor says

Bangladesh Bank will no longer try to save any ailing bank by providing it special liquidity support, said Governor Ahsan H Mansur yesterday.

The central bank has suspended its special liquidity support for some Shariah-based banks, he said at a press briefing after meeting with a delegation of the Federation of Bangladesh Chambers of Commerce and Industry (FBCCI) at the latter's office yesterday.

Seven banks, including six Shariah-based banks, have been facing a deficit in their current account balance with the central bank for more than a year.

The central bank was keeping those banks alive by providing special liquidity support. Only one recently showed signs of recovery.

Seven banks, including six Shariah-based ones, have been facing a deficit in their current account balance with the central bank

As of August 7, the remaining six lender's current account deficit with Bangladesh Bank stood at Tk 14,621 crore. However, the combined shortfall is Tk 20,774 crore if their cash reserve ratio deficit is considered, as per central bank data.

The ailing banks are National Bank, First Security Islami Bank (FSIBL), Social Islami Bank, Union Bank, Global Islami Bank and Bangladesh Commerce Bank.

Chattogram-based conglomerate S Alam Group has controlling stakes in all of these banks, except for National Bank.

Mansur said the banking regulator has already capped the lending activities of the six banks.

Replying to a question, Mansur said depositors have the right to withdraw money from the ailing banks, which would be liable for losing the confidence of their clients.

Against this backdrop, he said neither closing the banks or providing liquidity support was a solution.

Journalists also questioned how S Alam Group was allowed to control and take advantage of some weak Shariah-based banks.

In response, Mansur said the central bank has taken initiatives to prevent the withdrawal of funds by people who were responsible for ruining the financial health of these banks.

He added that a banking commission would soon be formed and the weak banks would have to cut down on their operations or merge with other banks under the banking commission, he added.

The new central bank governor also said the guilty or ill-motivated people would be caught but no business would be targeted.

"Action will be taken if any official, irrespective of the organisation, is found responsible," he said, adding that the same applies for central bank officials as well.

Regarding the ongoing inflationary pressure, Mansur said the inflation rate would come down to around 5 to 6 percent within the next seven to eight months.

The central bank will increase the policy rate until the inflationary pressure begins to decline, he added.

The business delegation led by FBCCI President Mahbubul Alam included former FBCCI president and BNP Vice Chairman Abdul Awal Mintoo, BKMEA Executive President Mohammad Hatem and Metropolitan Chamber of Commerce and Industry President Kamran T Rahman.

The businesspeople present demanded punishment for people who scammed and looted banks in the pretext of doing business.

At the meeting, FBCCI President Alam urged to stabilise the interest rates on bank loans, ensure adequate US dollar supply and provide support to affected industries and commercial establishments.