Saif

Senior Member

- Messages

- 17,560

- Likes

- 8,463

- Nation

- Residence

- Axis Group

Worry about economic woes over now Finance minister tells economic reporters

Concern about the country's economic condition is now all over, claimed the finance minister on Sunday and presented before journalists a brief account of the latest macroeconomic developments. Mr Abul Hassan Mahmood Ali told the economic reporters that due to higher remittance inflow and an incre

Worry about economic woes over now Finance minister tells economic reporters

Finance minister tells economic reporters

Apr 01, 2024 00:11Finance minister tells economic reporters

Updated :

Apr 01, 2024 00:11Concern about the country's economic condition is now all over, claimed the finance minister on Sunday and presented before journalists a brief account of the latest macroeconomic developments.

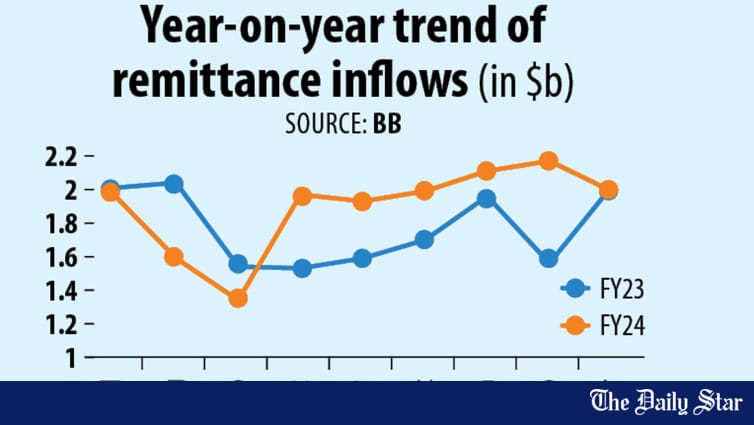

Mr Abul Hassan Mahmood Ali told the economic reporters that due to higher remittance inflow and an increase in export earnings, the dollar crisis eased significantly, leading to improvement in the country's overall the economic condition.

The finance minister was speaking at a pre-budget discussion with a delegation of the Economic Reporters Forum at his secretariat office in the capital, Dhaka.

The ERF team placed a number of recommendations with the minister for consideration as the budget for the next fiscal year is on the anvil with inputs drawn from various quarters concerned.

Mr Ali noted that some people were telling that the country was heading for an economic situation that Sri Lanka experienced-political upheavals triggered by an abrupt financial meltdown in the South Asian island nation.

However, he said, that apprehension proved to be "wrong".

The new economic pointsman of the Awami League government pointed out some developments in the positive direction on the financial front. He said a delegation of the Asian Infrastructure Investment Bank (AIIB) met him recently and assured him of extending financial support as much as needed.

On getting such assurance he feels that there is "nothing to feel concerned about".

"There is no crisis in the country," he said.

The minister thinks whatever needed people are getting those. But he agreed that there is some sort of dissatisfaction brewing over the commodity prices. "The country is running in line with the open-market-economy concept," he said.

Finance Division secretary Dr Khairuzzaman Mozumder said in the last one to two months the country's economy performed "very well". "Our export is rising continuously, remittance is also increasing. The exchange rate has become somewhat stable."

And the good news is the development partners are also telling that Bangladesh's economic condition is becoming stable, he said.

In its proposal, the ERF, the apex body of Dhaka-based economic reporters, advocated for reduction in duty on import of some basic commodities to help lessen the impacts of high inflationary pressure on the consumers.

Also, the forum suggested raising agri-subsidy, lowering import duty on cattle, poultry, and fish feeds, incentives for cottage, micro, small, and medium enterprises, providing subsidy to the exporters in different names like technology-upgrading fund or skills- development fund after Bangladesh's graduation from the least-developed-country club, and ensuring gas and power supply in the industrial units at any cost.

The ERF-delegation members also urged the minister for creation of trustworthy environment in the banking system, ensuring transparency and accountability in the energy sector, stopping gold smuggling, allowing offshore investment by Bangladeshi large businesses, not taking any new mega-infrastructures in next three years, and steps for employment generation, among others.