Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: this_feature_currently_requires_accessing_site_using_safari

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

[🇧🇩] Monitoring Bangladesh's Economy

Saif

Senior Member

- Messages

- 17,503

- Likes

- 8,438

- Nation

- Residence

- Axis Group

Monetary policy is working

The country’s tight monetary measures are beginning to yield results, paving the way for a gradual stabilisation in consumer prices, according to CAL Bangladesh, a financial services company.

Monetary policy is working

Says CAL Bangladesh

Photo: Star

The country's tight monetary measures are beginning to yield results, paving the way for a gradual stabilisation in consumer prices, according to CAL Bangladesh, a financial services company.

Additionally, a decline in global commodity prices and a stable exchange rate are expected to lower import costs, alleviating some pressure on the domestic economy.

Food prices in Bangladesh, except for rice and soybean oil, have declined for three consecutive months, reflecting a positive trend in stabilising prices for essential commodities.

As Ramadan approaches, consumers in Bangladesh may face some price volatility, but inflation is on track to fall sharply by the second half of this year.

In its latest report released on Wednesday at Renaissance Dhaka Gulshan Hotel, the organisation projected that inflation, currently at elevated levels, will stabilise between 8.5 percent and 9.5 percent by June but fall to 6-7 percent by December.

Deshan Pushparajah, a director of CAL Securities, said the economy has passed its worst in terms of exchange rate, inflation and interest rate except for GDP growth rate.

GROWTH OUTLOOK

GDP growth for FY25 is forecast to range between 2 percent and 3 percent, marking a significant slowdown in economic performance.

This decline is linked to persistent macroeconomic challenges, which have continued to weigh on the country's economic prospects.

The economy suffered a contraction during the July-September quarter, driven by disruptions in production and trade.

A slowdown in consumption has further dampened growth, as rising inflation and economic uncertainty have strained household incomes.

Lower investments have also compounded these issues, with high interest rates and uncertainty discouraging private sector activity.

CAL Bangladesh's outlook also projects the exchange rate to stabilise between Tk 125 and Tk 130 against the dollar.

Interest rates are expected to remain high, with the one-year treasury bill rate ranging from 9.8 percent to 10.5 percent by June 2025, which could present challenges for businesses and borrowers in the near term.

Raihan Shamsi, director of CAL Securities, said the economy has been going through a rough patch for the last two years and a political change took place recently.

He said bleeding in the economy has not stopped yet, but holes were stopped.

RISK FACTORS

CAL Bangladesh report said delay in disbursement of IMF funds could put pressure on the Balance of Payments and create volatility.

Money printing is another concern. It said, "Failure to reverse money printed to support banks could lead to another wave of inflation when credit picks up."

Two more factors—political uncertainty and energy shortage—also pose risks.

CAL Bangladesh said political uncertainty will heighten instability and may raise the country risk premium.

"Shortages of electricity and gas supply could lead to productivity loss."

Says CAL Bangladesh

Photo: Star

The country's tight monetary measures are beginning to yield results, paving the way for a gradual stabilisation in consumer prices, according to CAL Bangladesh, a financial services company.

Additionally, a decline in global commodity prices and a stable exchange rate are expected to lower import costs, alleviating some pressure on the domestic economy.

Food prices in Bangladesh, except for rice and soybean oil, have declined for three consecutive months, reflecting a positive trend in stabilising prices for essential commodities.

As Ramadan approaches, consumers in Bangladesh may face some price volatility, but inflation is on track to fall sharply by the second half of this year.

In its latest report released on Wednesday at Renaissance Dhaka Gulshan Hotel, the organisation projected that inflation, currently at elevated levels, will stabilise between 8.5 percent and 9.5 percent by June but fall to 6-7 percent by December.

Deshan Pushparajah, a director of CAL Securities, said the economy has passed its worst in terms of exchange rate, inflation and interest rate except for GDP growth rate.

GROWTH OUTLOOK

GDP growth for FY25 is forecast to range between 2 percent and 3 percent, marking a significant slowdown in economic performance.

This decline is linked to persistent macroeconomic challenges, which have continued to weigh on the country's economic prospects.

The economy suffered a contraction during the July-September quarter, driven by disruptions in production and trade.

A slowdown in consumption has further dampened growth, as rising inflation and economic uncertainty have strained household incomes.

Lower investments have also compounded these issues, with high interest rates and uncertainty discouraging private sector activity.

CAL Bangladesh's outlook also projects the exchange rate to stabilise between Tk 125 and Tk 130 against the dollar.

Interest rates are expected to remain high, with the one-year treasury bill rate ranging from 9.8 percent to 10.5 percent by June 2025, which could present challenges for businesses and borrowers in the near term.

Raihan Shamsi, director of CAL Securities, said the economy has been going through a rough patch for the last two years and a political change took place recently.

He said bleeding in the economy has not stopped yet, but holes were stopped.

RISK FACTORS

CAL Bangladesh report said delay in disbursement of IMF funds could put pressure on the Balance of Payments and create volatility.

Money printing is another concern. It said, "Failure to reverse money printed to support banks could lead to another wave of inflation when credit picks up."

Two more factors—political uncertainty and energy shortage—also pose risks.

CAL Bangladesh said political uncertainty will heighten instability and may raise the country risk premium.

"Shortages of electricity and gas supply could lead to productivity loss."

Saif

Senior Member

- Messages

- 17,503

- Likes

- 8,438

- Nation

- Residence

- Axis Group

Declining investments dampen growth outlook

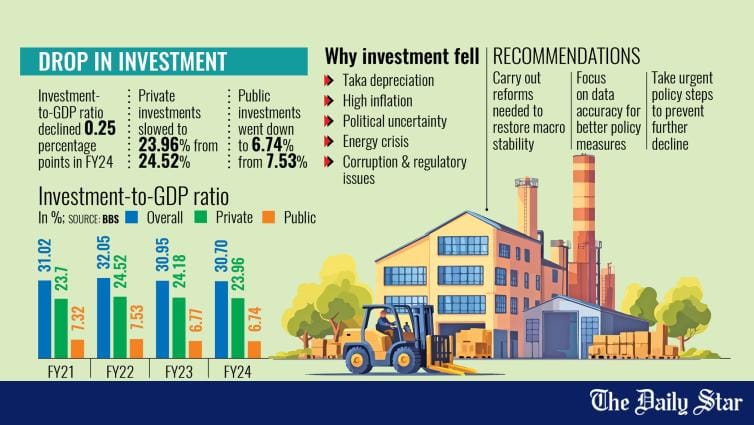

Bangladesh’s investment-to-GDP ratio declined by 0.25 percentage points to 30.70 percent in the fiscal year (FY) 2023-24, according to official data, signalling a potential slowdown in future economic growth.

Declining investments dampen growth outlook

Bangladesh's investment-to-GDP ratio declined by 0.25 percentage points to 30.70 percent in the fiscal year (FY) 2023-24, according to official data, signalling a potential slowdown in future economic growth.

Businesses say fragile confidence, due to a combination of factors such as a depreciating taka, spiking cost of living and political uncertainty, has deterred fresh investments since the Covid-19 pandemic.

According to economists, this plummeting investment could translate into fewer jobs and lacklustre economic growth in the near future.

The investment-to-GDP ratio refers to the percentage of a country's gross domestic product (GDP) dedicated to investment activities.

It shows how much of a nation's economic output is being reinvested in its future through the purchase of capital goods like machinery, infrastructure and buildings to facilitate growth.

The latest data from the Bangladesh Bureau of Statistics (BBS) shows that both private and public sector investment have been falling in recent years.

The Russia-Ukraine war, which broke out in 2022, caused global supply chain disruptions, pushing up Bangladesh's import bills. Consequently, the country's fast-depleting foreign exchange reserves led to the local currency falling steeply against the US dollar.

The devaluation of the taka made imports more expensive, raising the cost of capital goods and raw materials essential for investment.

Besides, stubbornly high inflation, which has remained above 9 percent since March 2023, has squeezed disposable incomes and corporate profits, reducing funds available for reinvestment.

Political uncertainty has further compounded the situation. Frequent policy shifts, regulatory changes and political unrest have made investors cautious, even leading them to delay or cancel planned investments.

Fahmida Khatun, executive director of the Centre for Policy Dialogue, identified corruption, political unrest and the energy crisis as key deterrents to investment, particularly in the private sector.

Many enterprises have been operating at reduced capacities in recent years due to constraints in gas supply and high demand for captive energy generation while power outages are also a concern.

She said, "The low investment-to-GDP ratio reflects the unfavourable conditions for private sector investment due to political uncertainty and high financing costs."

She emphasised that inflation and overall macroeconomic instability have created uncertainty among investors, discouraging them from making fresh investments or expanding their businesses.

Meanwhile, Asif Ibrahim, former chairman of Business Initiative Leading Development (BUILD), identified corruption as a key factor behind escalating business costs.

To improve the investment-to-GDP ratio, he called to curb corruption and focus on economic diversification, reassessment of the incentive structure, protection of small businesses and low-income groups, and reforms in tax incentives.

'ALMOST NO NEW INVESTMENT SINCE COVID'

Businessmen said the country's investment landscape has hit a snag since the pandemic, with private investments almost consistently on a downward trend since FY21.

Al Mamun Mridha, secretary general of the Bangladesh China Chamber of Commerce and Industry, said private investment has been declining since the Covid-19 pandemic.

For the downturn, he blamed an unfavourable investment environment marked by inconsistent energy supplies and macroeconomic vulnerability.

"Some foreign investors closed their businesses in Bangladesh as the cost of doing business increased while the dollar became more expensive," he said.

Mohammad Hatem, president of the Bangladesh Knitwear Manufacturers and Exporters Association, said investment has virtually come to a standstill due to "anti-industrialisation policies", the ongoing energy crisis and a fragile banking sector.

Hatem criticised the government's lack of effective investment policies, citing outdated regulations and poor service delivery. "The regulatory hurdles are delaying our investment process."

Meanwhile, Professor Selim Raihan, executive director of the South Asian Network on Economic Modelling, expressed doubts over the investment figures released by the national statistical agency.

He argued that the reported investment-to-GDP ratio does not align with the economic reality.

"Fresh investment has been almost stagnant -- so how did BBS reveal an investment-to-GDP ratio of more than 30 percent?" Raihan questioned, criticising BBS's methodology and the lack of transparency in data disclosure.

According to him, incorrect national accounting data misleads policymakers and prevents the government from addressing real economic challenges effectively.

Similarly, former BUILD chairman Asif Ibrahim underscored the need for accurate and non-inflated economic data to facilitate effective policy decisions.

With the BBS revising the GDP growth projection for FY24 to 4.22 percent, Ibrahim urged the interim government to focus on restoring macroeconomic stability.

MACRO OUTLOOK NEEDS IMPROVEMENT

M Masrur Reaz, chairman and CEO of Policy Exchange Bangladesh, stressed the need to ensure macroeconomic stability, enhance business confidence and foster an investor-friendly environment.

"The private sector investment-to-GDP ratio has been hovering between 22 to 23 percent for the last few years, which is lower than the target," he said.

Reaz acknowledged that while government investment has seen some growth, the private sector continues to face critical issues that hinder progress.

He emphasised that addressing regulatory inefficiencies and improving investor confidence are crucial to reversing the declining investment trend.

Bangladesh's investment-to-GDP ratio declined by 0.25 percentage points to 30.70 percent in the fiscal year (FY) 2023-24, according to official data, signalling a potential slowdown in future economic growth.

Businesses say fragile confidence, due to a combination of factors such as a depreciating taka, spiking cost of living and political uncertainty, has deterred fresh investments since the Covid-19 pandemic.

According to economists, this plummeting investment could translate into fewer jobs and lacklustre economic growth in the near future.

The investment-to-GDP ratio refers to the percentage of a country's gross domestic product (GDP) dedicated to investment activities.

It shows how much of a nation's economic output is being reinvested in its future through the purchase of capital goods like machinery, infrastructure and buildings to facilitate growth.

The latest data from the Bangladesh Bureau of Statistics (BBS) shows that both private and public sector investment have been falling in recent years.

The Russia-Ukraine war, which broke out in 2022, caused global supply chain disruptions, pushing up Bangladesh's import bills. Consequently, the country's fast-depleting foreign exchange reserves led to the local currency falling steeply against the US dollar.

The devaluation of the taka made imports more expensive, raising the cost of capital goods and raw materials essential for investment.

Besides, stubbornly high inflation, which has remained above 9 percent since March 2023, has squeezed disposable incomes and corporate profits, reducing funds available for reinvestment.

Political uncertainty has further compounded the situation. Frequent policy shifts, regulatory changes and political unrest have made investors cautious, even leading them to delay or cancel planned investments.

Fahmida Khatun, executive director of the Centre for Policy Dialogue, identified corruption, political unrest and the energy crisis as key deterrents to investment, particularly in the private sector.

Many enterprises have been operating at reduced capacities in recent years due to constraints in gas supply and high demand for captive energy generation while power outages are also a concern.

She said, "The low investment-to-GDP ratio reflects the unfavourable conditions for private sector investment due to political uncertainty and high financing costs."

She emphasised that inflation and overall macroeconomic instability have created uncertainty among investors, discouraging them from making fresh investments or expanding their businesses.

Meanwhile, Asif Ibrahim, former chairman of Business Initiative Leading Development (BUILD), identified corruption as a key factor behind escalating business costs.

To improve the investment-to-GDP ratio, he called to curb corruption and focus on economic diversification, reassessment of the incentive structure, protection of small businesses and low-income groups, and reforms in tax incentives.

'ALMOST NO NEW INVESTMENT SINCE COVID'

Businessmen said the country's investment landscape has hit a snag since the pandemic, with private investments almost consistently on a downward trend since FY21.

Al Mamun Mridha, secretary general of the Bangladesh China Chamber of Commerce and Industry, said private investment has been declining since the Covid-19 pandemic.

For the downturn, he blamed an unfavourable investment environment marked by inconsistent energy supplies and macroeconomic vulnerability.

"Some foreign investors closed their businesses in Bangladesh as the cost of doing business increased while the dollar became more expensive," he said.

Mohammad Hatem, president of the Bangladesh Knitwear Manufacturers and Exporters Association, said investment has virtually come to a standstill due to "anti-industrialisation policies", the ongoing energy crisis and a fragile banking sector.

Hatem criticised the government's lack of effective investment policies, citing outdated regulations and poor service delivery. "The regulatory hurdles are delaying our investment process."

Meanwhile, Professor Selim Raihan, executive director of the South Asian Network on Economic Modelling, expressed doubts over the investment figures released by the national statistical agency.

He argued that the reported investment-to-GDP ratio does not align with the economic reality.

"Fresh investment has been almost stagnant -- so how did BBS reveal an investment-to-GDP ratio of more than 30 percent?" Raihan questioned, criticising BBS's methodology and the lack of transparency in data disclosure.

According to him, incorrect national accounting data misleads policymakers and prevents the government from addressing real economic challenges effectively.

Similarly, former BUILD chairman Asif Ibrahim underscored the need for accurate and non-inflated economic data to facilitate effective policy decisions.

With the BBS revising the GDP growth projection for FY24 to 4.22 percent, Ibrahim urged the interim government to focus on restoring macroeconomic stability.

MACRO OUTLOOK NEEDS IMPROVEMENT

M Masrur Reaz, chairman and CEO of Policy Exchange Bangladesh, stressed the need to ensure macroeconomic stability, enhance business confidence and foster an investor-friendly environment.

"The private sector investment-to-GDP ratio has been hovering between 22 to 23 percent for the last few years, which is lower than the target," he said.

Reaz acknowledged that while government investment has seen some growth, the private sector continues to face critical issues that hinder progress.

He emphasised that addressing regulatory inefficiencies and improving investor confidence are crucial to reversing the declining investment trend.

Saif

Senior Member

- Messages

- 17,503

- Likes

- 8,438

- Nation

- Residence

- Axis Group

Macroeconomic indicators show signs of recovery

The key macroeconomic indicators -- such as inflation, exchange rate, and interest rate except the GDP growth are showing signs of recovery after hitting their lowest points in recent times, according to the latest report by CAL Bangladesh, a Sri Lanka-based financial institution and research organ

Macroeconomic indicators show signs of recovery

FE REPORT

Published :

Feb 14, 2025 09:50

Updated :

Feb 14, 2025 09:50

The key macroeconomic indicators -- such as inflation, exchange rate, and interest rate except the GDP growth are showing signs of recovery after hitting their lowest points in recent times, according to the latest report by CAL Bangladesh, a Sri Lanka-based financial institution and research organisation.

For the fiscal year 2024-2025, GDP growth is projected to range between 2.0 per cent and 3.0 per cent, a significant drop from the 4.22 per cent growth reported for the previous fiscal year by the Bangladesh Bureau of Statistics (BBS).

The report also notes that the economy grew by just 1.8 per cent in the first quarter of the current fiscal year-marking the lowest quarterly growth in the past 15 quarters.

These findings were shared during a seminar titled "Bangladesh Macroeconomic Outlook for the Year 2025," held at a hotel in Dhaka on Wednesday evening.

Raihan Shamsi, director of CAL Securities, and Ahmed Omar Siddique, vice-president of the host agency, presented a keynote paper at the event while Deshan Pushparajah, a director of the CAL Securities, spoke at the event.

The organisation has projected inflation to stabilise between 8.5 per cent and 9.5 per cent by June, which will fall further to 6 to 7 per cent by December this year.

The report forecasts GDP growth for FY25 between 2 per cent and 3 per cent due to a significant slowdown in investment, private sector credit and high interest rate. This decline is linked to persistent macroeconomic challenges, which have continued to weigh on the country's economic prospects.

A slowdown in consumption has further dampened growth, as rising inflation and economic uncertainty have strained household incomes. Lower investments have also compounded these issues, with high interest rates and uncertainty discouraging private sector activity.

CAL Bangladesh's outlook also forecasts the exchange rate to stabilise between Tk 125 and Tk 130 against the dollar. Interest rates are expected to be 9.8 per cent to 10.5 per cent by June 2025.

Deshan Pushparajah said the economy has passed its worst in terms of exchange rate, inflation and interest rate except for GDP growth.

Raihan Shamsi said the economy has been going through a rough patch for the last two years and a political changeover took place recently. He said bleeding in the economy has not stopped yet, but holes have been plugged.

The report has identified the delay in foreign funds, money printing, political uncertainty and energy shortage as major risk factors for the economy.

Delay in disbursement of IMF funds could put pressure on the Balance of Payments and create volatility, said Ahmed Omar Siddique. He also said that money printing is another concern and failure to reverse money printed to support banks could lead to another wave of inflation when credit picks up.

FE REPORT

Published :

Feb 14, 2025 09:50

Updated :

Feb 14, 2025 09:50

The key macroeconomic indicators -- such as inflation, exchange rate, and interest rate except the GDP growth are showing signs of recovery after hitting their lowest points in recent times, according to the latest report by CAL Bangladesh, a Sri Lanka-based financial institution and research organisation.

For the fiscal year 2024-2025, GDP growth is projected to range between 2.0 per cent and 3.0 per cent, a significant drop from the 4.22 per cent growth reported for the previous fiscal year by the Bangladesh Bureau of Statistics (BBS).

The report also notes that the economy grew by just 1.8 per cent in the first quarter of the current fiscal year-marking the lowest quarterly growth in the past 15 quarters.

These findings were shared during a seminar titled "Bangladesh Macroeconomic Outlook for the Year 2025," held at a hotel in Dhaka on Wednesday evening.

Raihan Shamsi, director of CAL Securities, and Ahmed Omar Siddique, vice-president of the host agency, presented a keynote paper at the event while Deshan Pushparajah, a director of the CAL Securities, spoke at the event.

The organisation has projected inflation to stabilise between 8.5 per cent and 9.5 per cent by June, which will fall further to 6 to 7 per cent by December this year.

The report forecasts GDP growth for FY25 between 2 per cent and 3 per cent due to a significant slowdown in investment, private sector credit and high interest rate. This decline is linked to persistent macroeconomic challenges, which have continued to weigh on the country's economic prospects.

A slowdown in consumption has further dampened growth, as rising inflation and economic uncertainty have strained household incomes. Lower investments have also compounded these issues, with high interest rates and uncertainty discouraging private sector activity.

CAL Bangladesh's outlook also forecasts the exchange rate to stabilise between Tk 125 and Tk 130 against the dollar. Interest rates are expected to be 9.8 per cent to 10.5 per cent by June 2025.

Deshan Pushparajah said the economy has passed its worst in terms of exchange rate, inflation and interest rate except for GDP growth.

Raihan Shamsi said the economy has been going through a rough patch for the last two years and a political changeover took place recently. He said bleeding in the economy has not stopped yet, but holes have been plugged.

The report has identified the delay in foreign funds, money printing, political uncertainty and energy shortage as major risk factors for the economy.

Delay in disbursement of IMF funds could put pressure on the Balance of Payments and create volatility, said Ahmed Omar Siddique. He also said that money printing is another concern and failure to reverse money printed to support banks could lead to another wave of inflation when credit picks up.

Saif

Senior Member

- Messages

- 17,503

- Likes

- 8,438

- Nation

- Residence

- Axis Group

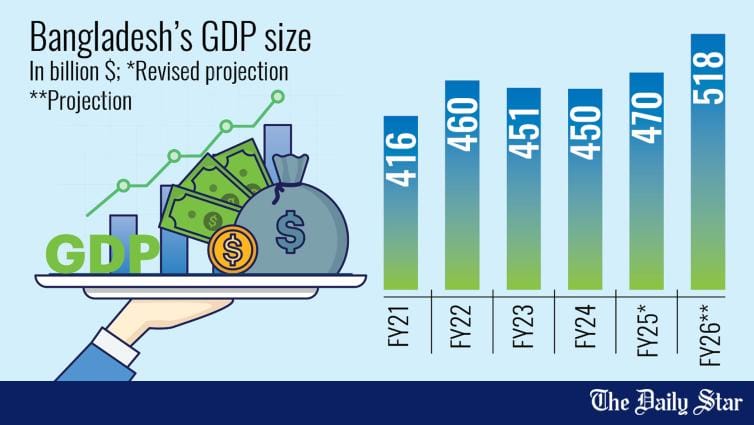

GDP may cross $500b for first time in FY26

The finance ministry is likely to project that the country’s gross domestic product (GDP) will surpass the $500-billion mark for the first time in the upcoming fiscal year (FY), anticipating an economic rebound in FY 2025-26.

GDP may cross $500b for first time in FY26

Finance ministry estimates

The finance ministry is likely to project that the country's gross domestic product (GDP) will surpass the $500-billion mark for the first time in the upcoming fiscal year (FY), anticipating an economic rebound in FY 2025-26.

The ministry made the estimate during a recent budget-related meeting attended by Finance Adviser Salehuddin Ahmed, according to finance ministry officials.

The Finance Division estimates that Bangladesh's GDP at current prices will reach $517.7 billion (Tk 6,315,923 crore) in FY26.

For the ongoing fiscal year, the initial GDP projection was $491 billion (Tk 5,597,414 crore) at current prices.

However, it is likely to be revised downward by $21 billion to $470 billion (Tk 5,645,114 crore), according to finance ministry sources.

This means the size of GDP will grow by 10.21 percent at current prices in FY26 than the revised estimate for the ongoing fiscal year.

However, according to the revised estimate, GDP may increase by 4.44 percent in the current fiscal year.

In the last fiscal year of 2023-24, Bangladesh's GDP stood at $450 billion (Tk 50,026,537 crore), according to data released by the Bangladesh Bureau of Statistics (BBS).

The finance ministry expects the economy to rebound in the coming years, with GDP crossing the $500-billion mark.

Similarly, foreign multilateral lenders, such as the Asian Development Bank (ADB), World Bank, and International Monetary Fund (IMF), have projected higher growth in the coming years, despite lowering their economic growth projections for FY25.

For the next fiscal year, the finance ministry may project real GDP growth at 6 percent and inflation at 6.5 percent.

"This is a pragmatic projection, not an unrealistic one," said Ashikur Rahman, principal economist at the Policy Research Institute (PRI) of Bangladesh.

Rahman also expressed doubts about achieving the 6 percent real GDP growth target.

"Because investments have hit a snag with no sign of improvement anytime soon," he said. "Besides, the development spending has also slowed and there is no guarantee that it will bounce back in the next fiscal year."

In its latest monetary policy, the Bangladesh Bank (BB) projected private sector credit growth at 9.8 percent by June this year, which aligns with the finance ministry's revised projection.

"This projection underpins expectations of a modest overall balance of payments surplus, driven by inflows from official multilateral development partners, sustained growth in export revenues, and remittance inflows," said the monetary policy statement (MPS) published last week.

For the upcoming fiscal year, the finance ministry has projected that private sector credit growth will grow to 11 percent.

Along with the rising trend in exports and remittances, the overall volume of imports is expected to increase in the coming years.

Although import volumes were in negative territory before December last year, overall imports rose by 3.53 percent during the July–December period, according to central bank data.

In FY26, the finance ministry also expects imports to reach 10 percent.

"The government expects GDP size to cross the $500 billion mark, considering the above indicators," said a top finance ministry official.

Contacted, Mustafizur Rahman, a distinguished fellow at the Centre for Policy Dialogue (CPD), underscored the need for the national statistical agency to re-estimate the GDP size.

"Many reports, including the 'White Paper on the State of the Bangladesh Economy', have identified flaws in the BBS's GDP growth estimates," he said.

As a result, the actual tax-GDP ratio and debt-GDP ratio cannot be accurately accounted for, added Rahman.

"First, the BBS should develop a robust methodology for calculating GDP," he emphasised.

Finance ministry estimates

The finance ministry is likely to project that the country's gross domestic product (GDP) will surpass the $500-billion mark for the first time in the upcoming fiscal year (FY), anticipating an economic rebound in FY 2025-26.

The ministry made the estimate during a recent budget-related meeting attended by Finance Adviser Salehuddin Ahmed, according to finance ministry officials.

The Finance Division estimates that Bangladesh's GDP at current prices will reach $517.7 billion (Tk 6,315,923 crore) in FY26.

For the ongoing fiscal year, the initial GDP projection was $491 billion (Tk 5,597,414 crore) at current prices.

However, it is likely to be revised downward by $21 billion to $470 billion (Tk 5,645,114 crore), according to finance ministry sources.

This means the size of GDP will grow by 10.21 percent at current prices in FY26 than the revised estimate for the ongoing fiscal year.

However, according to the revised estimate, GDP may increase by 4.44 percent in the current fiscal year.

In the last fiscal year of 2023-24, Bangladesh's GDP stood at $450 billion (Tk 50,026,537 crore), according to data released by the Bangladesh Bureau of Statistics (BBS).

The finance ministry expects the economy to rebound in the coming years, with GDP crossing the $500-billion mark.

Similarly, foreign multilateral lenders, such as the Asian Development Bank (ADB), World Bank, and International Monetary Fund (IMF), have projected higher growth in the coming years, despite lowering their economic growth projections for FY25.

For the next fiscal year, the finance ministry may project real GDP growth at 6 percent and inflation at 6.5 percent.

"This is a pragmatic projection, not an unrealistic one," said Ashikur Rahman, principal economist at the Policy Research Institute (PRI) of Bangladesh.

Rahman also expressed doubts about achieving the 6 percent real GDP growth target.

"Because investments have hit a snag with no sign of improvement anytime soon," he said. "Besides, the development spending has also slowed and there is no guarantee that it will bounce back in the next fiscal year."

In its latest monetary policy, the Bangladesh Bank (BB) projected private sector credit growth at 9.8 percent by June this year, which aligns with the finance ministry's revised projection.

"This projection underpins expectations of a modest overall balance of payments surplus, driven by inflows from official multilateral development partners, sustained growth in export revenues, and remittance inflows," said the monetary policy statement (MPS) published last week.

For the upcoming fiscal year, the finance ministry has projected that private sector credit growth will grow to 11 percent.

Along with the rising trend in exports and remittances, the overall volume of imports is expected to increase in the coming years.

Although import volumes were in negative territory before December last year, overall imports rose by 3.53 percent during the July–December period, according to central bank data.

In FY26, the finance ministry also expects imports to reach 10 percent.

"The government expects GDP size to cross the $500 billion mark, considering the above indicators," said a top finance ministry official.

Contacted, Mustafizur Rahman, a distinguished fellow at the Centre for Policy Dialogue (CPD), underscored the need for the national statistical agency to re-estimate the GDP size.

"Many reports, including the 'White Paper on the State of the Bangladesh Economy', have identified flaws in the BBS's GDP growth estimates," he said.

As a result, the actual tax-GDP ratio and debt-GDP ratio cannot be accurately accounted for, added Rahman.

"First, the BBS should develop a robust methodology for calculating GDP," he emphasised.

Saif

Senior Member

- Messages

- 17,503

- Likes

- 8,438

- Nation

- Residence

- Axis Group

Bangladesh Remittance Fair at NY on April 19-20

A two-day ‘4th Bangladesh Remittance Fair 2025’ will be held in New York on April 19-20 to increase remittance flow from the USA to Bangladesh.

www.newagebd.net

www.newagebd.net

Bangladesh Remittance Fair at NY on April 19-20

Bangladesh Sangbad Sangstha . Dhaka 15 February, 2025, 23:16

A two-day ‘4th Bangladesh Remittance Fair 2025’ will be held in New York on April 19-20 to increase remittance flow from the USA to Bangladesh.

Bangladesh-USA Chamber of Commerce and Industry and USA-Bangladesh Business Links will jointly organise the fair at Jackson Heights in New York, the USA, said a press release.

As a media partner, the ‘Daily Bonik Barta’, the ‘Business Standard’ and the weekly ‘Thikana’ will publish special supplements on the occasion of remittance fair. In addition, Ekattor TV and New York-based television channel TBN24 will broadcast special programs on the remittance fair.

Under the slogan “Legal Remittance, Better Bangladesh”, the fair will emphasize the role of transparent and compliant remittance processes in supporting Bangladesh’s economic growth and foreign reserve position.

Bangladesh Bank governor Ahsan H Mansur is likely to take part as the chief guest at the inauguration ceremony of the fair.

The event will bring together key stakeholders from both the public and private sectors such as banks, mobile financial service providers, app developers, money exchange houses, and channel partners to showcase their products and services, share insights, explore opportunities and enhance the security and efficiency of remittance channels.

The event will feature a rich program, including demonstrations, presentations, discussions, Q&A sessions, and a Networking Dinner.

The networking sessions will see participation from the Department of Financial Services, New York State, and leading money exchange companies, providing a unique opportunity to engage directly with key industry representatives, explore potential partnerships, and stay abreast of the latest trends and innovations in the remittance sector.

It is mentionable that a number of banks, money exchange houses and remittance channel partners such as Dhaka Bank PLC., Islami Bank Bangladesh PLC. and Uttara Bank PLC had earlier participated in the fair.

Islami Bank Bangladesh PLC, National Bank Limited and Bank Asia PLC were awarded top remittance Bank Receiver Award 2024, Top Remittance Channel Partner 2024 went to BA Express, Sunman Global Express and Standard Express while Top Individual Remittance Award 2024 to 10 remitters at the closing and award ceremony.

Bangladesh Sangbad Sangstha . Dhaka 15 February, 2025, 23:16

A two-day ‘4th Bangladesh Remittance Fair 2025’ will be held in New York on April 19-20 to increase remittance flow from the USA to Bangladesh.

Bangladesh-USA Chamber of Commerce and Industry and USA-Bangladesh Business Links will jointly organise the fair at Jackson Heights in New York, the USA, said a press release.

As a media partner, the ‘Daily Bonik Barta’, the ‘Business Standard’ and the weekly ‘Thikana’ will publish special supplements on the occasion of remittance fair. In addition, Ekattor TV and New York-based television channel TBN24 will broadcast special programs on the remittance fair.

Under the slogan “Legal Remittance, Better Bangladesh”, the fair will emphasize the role of transparent and compliant remittance processes in supporting Bangladesh’s economic growth and foreign reserve position.

Bangladesh Bank governor Ahsan H Mansur is likely to take part as the chief guest at the inauguration ceremony of the fair.

The event will bring together key stakeholders from both the public and private sectors such as banks, mobile financial service providers, app developers, money exchange houses, and channel partners to showcase their products and services, share insights, explore opportunities and enhance the security and efficiency of remittance channels.

The event will feature a rich program, including demonstrations, presentations, discussions, Q&A sessions, and a Networking Dinner.

The networking sessions will see participation from the Department of Financial Services, New York State, and leading money exchange companies, providing a unique opportunity to engage directly with key industry representatives, explore potential partnerships, and stay abreast of the latest trends and innovations in the remittance sector.

It is mentionable that a number of banks, money exchange houses and remittance channel partners such as Dhaka Bank PLC., Islami Bank Bangladesh PLC. and Uttara Bank PLC had earlier participated in the fair.

Islami Bank Bangladesh PLC, National Bank Limited and Bank Asia PLC were awarded top remittance Bank Receiver Award 2024, Top Remittance Channel Partner 2024 went to BA Express, Sunman Global Express and Standard Express while Top Individual Remittance Award 2024 to 10 remitters at the closing and award ceremony.

Saif

Senior Member

- Messages

- 17,503

- Likes

- 8,438

- Nation

- Residence

- Axis Group

MFN tariff and Bangladesh

Three decades after the formal inception of the World Trade Organization (WTO) as a successor of the General Agreement on Tariffs and Trade (GATT), tariffs are still a key tool for navigating global trade. As the average tariff applied by WTO members on a most-favoured nation (MFN) basis has

MFN tariff and Bangladesh

Asjadul Kibria

Published :

Feb 15, 2025 23:35

Updated :

Feb 15, 2025 23:38

Three decades after the formal inception of the World Trade Organization (WTO) as a successor of the General Agreement on Tariffs and Trade (GATT), tariffs are still a key tool for navigating global trade. As the average tariff applied by WTO members on a most-favoured nation (MFN) basis has nearly halved during the period, global trade in goods jumped by four times. In other words, tariff cuts by the countries helped them reduce the cost of trade and ultimately enhance trade. Nevertheless, the importance of tariffs is reasserted by the United States (US) President Donald Trump, who launched his tariff war immediately after assuming the Oval Office in Washington DC. One of the core objectives of the GATT/WTO is reducing tariffs to increase rule-based trade. A tariff is generally a customs duty imposed by a country on goods imported from the rest of the world.

The first principle of WTO is known as MFN, which is when WTO members extend the same trade treatments, including tariff rates and market access, to all other members. So, MFN treatment is the prohibition of discrimination in international trade. To comply with the principle, WTO members must impose MFN tariffs on imports from the other members. A working paper of the WTO, released last month, showed that more than 80 per cent of the global trade in goods is conducted on an MFN basis. This means that trading partners treat one another in a non-discriminatory manner in most cases.

The paper titled 'Significance of Most-Favoured-Nation Terms in Global Trade: A Comprehensive Analysis' divided global imports in 2022 into four segments. These are: (1) MFN duty-free trade; (2) MFN dutiable trade; (3) MFN dutiable trade eligible for, but not using, preferential market access; and (4) trade under preferential duty regimes. It also showed that 51 per cent of the global trade is now tariff-free, 27 per cent is MFN dutiable, and only 17 per cent is subject to preferential tariffs. Though the data used in the study is based mostly on 2022, it may be considered a general scenario.

The scenario indicates that despite various disruptions and troubles in global trade, countries have reduced tariffs significantly although more reduction was possible. So, there is room to cut the tariffs further, although Donald Trump has announced tariff hikes on imports from Canada, Mexico and China and is set to impose higher tariffs on imports from the European Union (EU). China, however, retaliated immediately by announcing an increase in customs duties on various products importable from the US. Trump's action may instigate some other nations, especially those that maintain a higher tariff regime, to keep the level unchanged. Some countries may also be encouraged to raise tariffs to put pressure on their rivals shortly. In this process, the US president is trying to reverse the course of global trade.

Another study finding is that despite a remarkable proliferation of preferential market access under the Generalised System of Preference (GSP) and preferential trade agreements (PTAs), it is yet to reduce the tariff across the nations significantly. During the last three decades, countries have negotiated more than 500 PTAs, or RTAs, and some 340 have been enforced by the countries that are part of these agreements.

The WTO working paper, jointly prepared by Tomasz Gonciarz and Thomas Verbeet, also presented data from 157 countries regarding their imports on MFN and preferential trade arrangements, showing that 66 per cent of the global imports are made by top-10 countries and 85 per cent by the top 20 countries. It identified that advanced small nations are used to importing almost 100 per cent of the products MFN tariff-free. Among the top 20 importers in 2022, Singapore and Hong Kong imported all the products without imposing tariffs. The ratio was 83 per cent for Japan and 70 per cent for Canada. Among the top 20 importers, India is the most restrictive economy, as reflected in its tariff structure. Only five per cent of the Indian imports were based on MFN duty-free in 2022, whereas 69 per cent of the total imports were subject to MFN tariff.

Bangladesh's situation is similar to India's. In 2022, around 72 per cent of the country's imports were subject to MFN tariffs, while 20 per cent were MFN duty-free imports. The report also showed that around seven per cent of Bangladeshi imports were on a preferential basis during the period under review.

World Tariff Profile 2024, jointly published by WTO, International Trade Centre (ITC) and UN Trade and Development (UNCTAD), showed that MFN simple average tariff of Bangladesh was 14.10 per cent in 2023.

There is a shortcoming in Bangladesh-related statistics in the study. It showed that the total imports by Bangladesh in 2022 were US$ 47,247 million. It is almost half of the actual import value of the year, as the World Trade Profiles-2023 put the value at US$ 88,234 million (in 2022). When contacted, the authors of the paper, however, clarified the thing. In reply to an email query sent by this scribe, they said: "To clarify your query regarding Bangladesh's total import data, as explained in the third paragraph of the "4 Data" section, when data for a given reporter and year is not available in either the WTO's Integrated Database or UN Comtrade, we use the nearest available year's data as a substitute. In the case of Bangladesh, Annex Table 4 in our paper reflects data from 2018, as that was the most recent available in our sources at the time of compilation. This varies from the statistical profiles which uses aggregated statistics, whereas we need to have very detailed data by national tariff line in order to do our calculations." The researchers' reply unveiled a big flaw in furnishing trade-related statistics in detail on time to the WTO or UN by Bangladesh. So, the authorities need to take care of the matter. Nevertheless, it can be safely assumed that the import pattern in terms of MFN and preferential tariff regimes do not change significantly in 2022 or later years from 2018.

The tariff patterns also reconfirm that despite a significant liberalisation in trade, there is still room to rationalise the country's tariff regime. As Bangladesh is moving ahead to graduate from the Least Developed Country (LDC) category by the end of 2026, it will face tariff barriers in different markets. However, by reducing import tariffs, Bangladesh can create opportunities to export its products to markets with reduced tariffs, potentially boosting its economy. This strategy will require the country to focus on MFN duty-free and preferential imports and to sign free trade agreements with partner countries.

Asjadul Kibria

Published :

Feb 15, 2025 23:35

Updated :

Feb 15, 2025 23:38

Three decades after the formal inception of the World Trade Organization (WTO) as a successor of the General Agreement on Tariffs and Trade (GATT), tariffs are still a key tool for navigating global trade. As the average tariff applied by WTO members on a most-favoured nation (MFN) basis has nearly halved during the period, global trade in goods jumped by four times. In other words, tariff cuts by the countries helped them reduce the cost of trade and ultimately enhance trade. Nevertheless, the importance of tariffs is reasserted by the United States (US) President Donald Trump, who launched his tariff war immediately after assuming the Oval Office in Washington DC. One of the core objectives of the GATT/WTO is reducing tariffs to increase rule-based trade. A tariff is generally a customs duty imposed by a country on goods imported from the rest of the world.

The first principle of WTO is known as MFN, which is when WTO members extend the same trade treatments, including tariff rates and market access, to all other members. So, MFN treatment is the prohibition of discrimination in international trade. To comply with the principle, WTO members must impose MFN tariffs on imports from the other members. A working paper of the WTO, released last month, showed that more than 80 per cent of the global trade in goods is conducted on an MFN basis. This means that trading partners treat one another in a non-discriminatory manner in most cases.

The paper titled 'Significance of Most-Favoured-Nation Terms in Global Trade: A Comprehensive Analysis' divided global imports in 2022 into four segments. These are: (1) MFN duty-free trade; (2) MFN dutiable trade; (3) MFN dutiable trade eligible for, but not using, preferential market access; and (4) trade under preferential duty regimes. It also showed that 51 per cent of the global trade is now tariff-free, 27 per cent is MFN dutiable, and only 17 per cent is subject to preferential tariffs. Though the data used in the study is based mostly on 2022, it may be considered a general scenario.

The scenario indicates that despite various disruptions and troubles in global trade, countries have reduced tariffs significantly although more reduction was possible. So, there is room to cut the tariffs further, although Donald Trump has announced tariff hikes on imports from Canada, Mexico and China and is set to impose higher tariffs on imports from the European Union (EU). China, however, retaliated immediately by announcing an increase in customs duties on various products importable from the US. Trump's action may instigate some other nations, especially those that maintain a higher tariff regime, to keep the level unchanged. Some countries may also be encouraged to raise tariffs to put pressure on their rivals shortly. In this process, the US president is trying to reverse the course of global trade.

Another study finding is that despite a remarkable proliferation of preferential market access under the Generalised System of Preference (GSP) and preferential trade agreements (PTAs), it is yet to reduce the tariff across the nations significantly. During the last three decades, countries have negotiated more than 500 PTAs, or RTAs, and some 340 have been enforced by the countries that are part of these agreements.

The WTO working paper, jointly prepared by Tomasz Gonciarz and Thomas Verbeet, also presented data from 157 countries regarding their imports on MFN and preferential trade arrangements, showing that 66 per cent of the global imports are made by top-10 countries and 85 per cent by the top 20 countries. It identified that advanced small nations are used to importing almost 100 per cent of the products MFN tariff-free. Among the top 20 importers in 2022, Singapore and Hong Kong imported all the products without imposing tariffs. The ratio was 83 per cent for Japan and 70 per cent for Canada. Among the top 20 importers, India is the most restrictive economy, as reflected in its tariff structure. Only five per cent of the Indian imports were based on MFN duty-free in 2022, whereas 69 per cent of the total imports were subject to MFN tariff.

Bangladesh's situation is similar to India's. In 2022, around 72 per cent of the country's imports were subject to MFN tariffs, while 20 per cent were MFN duty-free imports. The report also showed that around seven per cent of Bangladeshi imports were on a preferential basis during the period under review.

World Tariff Profile 2024, jointly published by WTO, International Trade Centre (ITC) and UN Trade and Development (UNCTAD), showed that MFN simple average tariff of Bangladesh was 14.10 per cent in 2023.

There is a shortcoming in Bangladesh-related statistics in the study. It showed that the total imports by Bangladesh in 2022 were US$ 47,247 million. It is almost half of the actual import value of the year, as the World Trade Profiles-2023 put the value at US$ 88,234 million (in 2022). When contacted, the authors of the paper, however, clarified the thing. In reply to an email query sent by this scribe, they said: "To clarify your query regarding Bangladesh's total import data, as explained in the third paragraph of the "4 Data" section, when data for a given reporter and year is not available in either the WTO's Integrated Database or UN Comtrade, we use the nearest available year's data as a substitute. In the case of Bangladesh, Annex Table 4 in our paper reflects data from 2018, as that was the most recent available in our sources at the time of compilation. This varies from the statistical profiles which uses aggregated statistics, whereas we need to have very detailed data by national tariff line in order to do our calculations." The researchers' reply unveiled a big flaw in furnishing trade-related statistics in detail on time to the WTO or UN by Bangladesh. So, the authorities need to take care of the matter. Nevertheless, it can be safely assumed that the import pattern in terms of MFN and preferential tariff regimes do not change significantly in 2022 or later years from 2018.

The tariff patterns also reconfirm that despite a significant liberalisation in trade, there is still room to rationalise the country's tariff regime. As Bangladesh is moving ahead to graduate from the Least Developed Country (LDC) category by the end of 2026, it will face tariff barriers in different markets. However, by reducing import tariffs, Bangladesh can create opportunities to export its products to markets with reduced tariffs, potentially boosting its economy. This strategy will require the country to focus on MFN duty-free and preferential imports and to sign free trade agreements with partner countries.

Saif

Senior Member

- Messages

- 17,503

- Likes

- 8,438

- Nation

- Residence

- Axis Group

Take measures to boost investment

Economic growth and job creation will continue to suffer otherwise

Take measures to boost investment

Economic growth and job creation will continue to suffer otherwise

The worrisome trend of declining investment in the country over the last few years sadly paints a gloomy picture for job creation and economic growth in the near future. According to the Bangladesh Bureau of Statistics, the investment-to-GDP ratio—which has been struggling to pick up since the Covid pandemic—dropped from 32.25 percent in FY2022 to 30.95 percent in FY2023 and then further declined by 0.25 percentage points in FY2024. If this trend continues, the country risks falling further behind its regional competitors in attracting both domestic and foreign investment.

Global phenomena such as the pandemic and the Russia-Ukraine war are partly responsible for the drop. But at the local level, high inflation, an unreliable energy supply, and the fast depletion of our foreign currency reserves—depreciating the taka against the dollar—have also deterred fresh investments. Moreover, with the cost of doing business increasing due to the dollar becoming more expensive, many foreign businesses have closed their operations and left. Corruption, inconsistent policies, the fragile banking system, and political unrest and instability have added to these troubles, dampening the confidence of the local business community. The growing perception that policies favour a select few rather than fostering a level playing field has further discouraged new ventures and innovation. And even though economic data had been inflated during the past regime to create a rosy picture, casting doubt on the exact investment-to-GDP ratio, the investment atmosphere has undoubtedly hit a snag.

With unemployment already on the rise, especially among graduates, a decrease in investment means fewer jobs will be created in the country, which could exacerbate the ongoing economic struggles and lead to further frustration and discontent among the populace—especially among young people. The lack of well-paying jobs has already pushed many skilled professionals to seek opportunities abroad, intensifying the brain drain issue. Therefore, it is high time for the authorities to focus on boosting investment to achieve long-term economic stability.

The interim government must focus on creating an investment-friendly environment in the country by removing bureaucratic red tape and inefficiencies, curbing corruption, and strengthening the banking sector. Policies for economic diversification, reassessment of the investment structure, protection of small businesses and low-income groups, and reformation of tax incentives should be implemented to restore business confidence. On the global front, proactive diplomatic measures should be taken to tackle uncertainties. In parallel with drawing up policies to restore macroeconomic stability, the accuracy of economic data must also be ensured.

Economic growth and job creation will continue to suffer otherwise

The worrisome trend of declining investment in the country over the last few years sadly paints a gloomy picture for job creation and economic growth in the near future. According to the Bangladesh Bureau of Statistics, the investment-to-GDP ratio—which has been struggling to pick up since the Covid pandemic—dropped from 32.25 percent in FY2022 to 30.95 percent in FY2023 and then further declined by 0.25 percentage points in FY2024. If this trend continues, the country risks falling further behind its regional competitors in attracting both domestic and foreign investment.

Global phenomena such as the pandemic and the Russia-Ukraine war are partly responsible for the drop. But at the local level, high inflation, an unreliable energy supply, and the fast depletion of our foreign currency reserves—depreciating the taka against the dollar—have also deterred fresh investments. Moreover, with the cost of doing business increasing due to the dollar becoming more expensive, many foreign businesses have closed their operations and left. Corruption, inconsistent policies, the fragile banking system, and political unrest and instability have added to these troubles, dampening the confidence of the local business community. The growing perception that policies favour a select few rather than fostering a level playing field has further discouraged new ventures and innovation. And even though economic data had been inflated during the past regime to create a rosy picture, casting doubt on the exact investment-to-GDP ratio, the investment atmosphere has undoubtedly hit a snag.

With unemployment already on the rise, especially among graduates, a decrease in investment means fewer jobs will be created in the country, which could exacerbate the ongoing economic struggles and lead to further frustration and discontent among the populace—especially among young people. The lack of well-paying jobs has already pushed many skilled professionals to seek opportunities abroad, intensifying the brain drain issue. Therefore, it is high time for the authorities to focus on boosting investment to achieve long-term economic stability.

The interim government must focus on creating an investment-friendly environment in the country by removing bureaucratic red tape and inefficiencies, curbing corruption, and strengthening the banking sector. Policies for economic diversification, reassessment of the investment structure, protection of small businesses and low-income groups, and reformation of tax incentives should be implemented to restore business confidence. On the global front, proactive diplomatic measures should be taken to tackle uncertainties. In parallel with drawing up policies to restore macroeconomic stability, the accuracy of economic data must also be ensured.