Saif

Senior Operative

- 13,242

- 7,264

- Origin

- Axis Group

- Copy to clipboard

- Thread starter

- #537

Talks on trade deals show no major progress

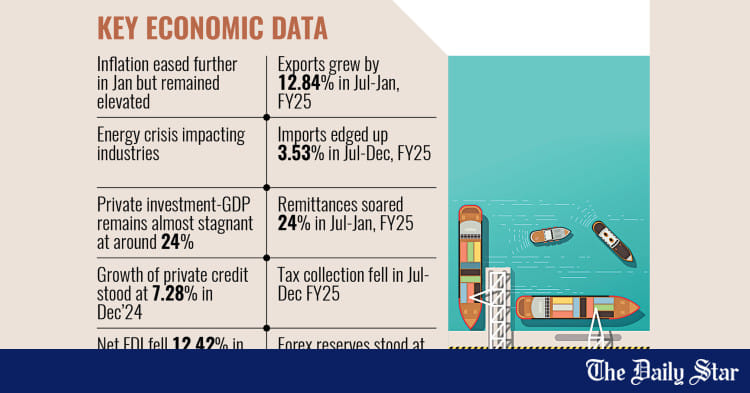

Talks on preferential trade deals with a dozen countries have stalled since the political changeover in August last year, potentially adding to the challenges related to Bangladesh’s graduation from the club of Least Developed Countries (LDCs) in 2026, according to economists and business leaders.

Talks on trade deals show no major progress

Talks on preferential trade deals with a dozen countries have stalled since the political changeover in August last year, potentially adding to the challenges related to Bangladesh's graduation from the club of Least Developed Countries (LDCs) in 2026, according to economists and business leaders.

Apart from the turmoil stemming from the ouster of the Awami League government by a mass uprising last year, experts also blamed ongoing rapid and dramatic changes in the geopolitical landscape and the reluctance of participating countries as reasons for the slow progress in bilateral trade negotiations.

Under the interim government, which assumed office in August last year, authorities have only made progress in negotiating Economic Partnership Agreements (EPAs) with Japan and South Korea.

EPA talks with Japan entered their third and fourth rounds of meetings in Tokyo and Dhaka this month while negotiations with South Korea were launched in Seoul in November last year.

However, negotiations to sign trade deals with other countries such as India, Thailand, Malaysia, Indonesia, China, and Turkey, have hit a virtual deadlock.

After graduation from LDC status, scheduled for November next year, Bangladeshi exports will no longer be eligible for many preferential market benefits. However, bilateral trade deals could help retain these benefits even after graduation.

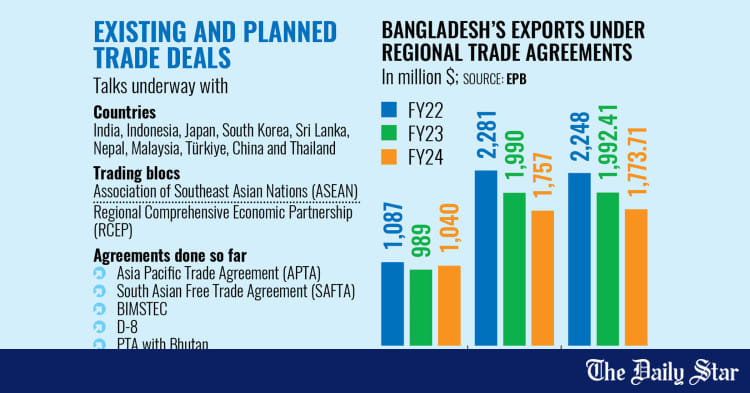

To prepare for graduation and ensure a smooth transition, the commerce ministry has been attempting to negotiate bilateral trade agreements, including Free Trade Agreements (FTAs), Preferential Trade Agreements (PTAs), Economic Partnership Agreements (EPAs), and Comprehensive Economic Partnership Agreements (CEPAs), with several countries and blocs.

The Awami League government was holding similar talks with major trading blocs, such as the Association of Southeast Asian Nations (ASEAN) and the Regional Comprehensive Economic Partnership Agreement (RCEP), to retain trade benefits.

However, Mustafizur Rahman, a distinguished fellow at the Centre for Policy Dialogue, said the progress in this regard has not been encouraging.

The economist identified an inability to negotiate complex trade issues as a key reason for this trend. "Besides, signing trade deals also takes a lot of time as such topics are complicated," Rahman added.

However, Commerce Adviser Sk Bashir Uddin begged to differ.

He stressed that progress in signing trade deals with major countries has not been halted, saying that communications through official channels are ongoing.

To support that stance, the businessman-turned-adviser referenced trade agreement talks with Japan.

After the fourth round of negotiations this month in Dhaka, Japan's foreign ministry stated that both sides had a fruitful discussion on the way forward and areas such as trade in goods, rules of origin, customs procedures, trade facilitation, trade in services, investment, electronic commerce, and intellectual property.

According to the statement, both sides decided to work on scheduling dates for the fifth round of negotiations through diplomatic channels.

Bashir Uddin added that the government first needs to examine whether the country will benefit before signing such deals.

However, other promising negotiations appear to have fallen by the wayside.

Under the previous regime, Bangladesh and neighbouring India made progress in signing a CEPA, even conducting a joint feasibility study more than two years ago. However, no formal meeting has been held since then.

In the case of China, a joint feasibility study was conducted and formal negotiations were supposed to be launched during former prime minister Sheikh Hasina's visit to China last year. But those formal negotiations have not yet commenced.

Bangladesh's imports from China -- mainly comprising raw materials, capital machinery, textile fabrics, chemicals, yarn, woven fabrics, garment articles, and food items -- declined to $16.63 billion in the fiscal year 2023-24 from $17.82 billion the previous fiscal year.

According to Rahman, the progress of negotiations with Japan is positive since an EPA with Japan would enhance Bangladesh's image and could be leveraged to sign deals with other countries.

Acting Commerce Secretary Abdur Rahim Khan also said the progress on talks for bilateral trade agreements has not been halted. Apart from Japan, he said preliminary negotiations with Singapore and South Korea are ongoing.

"If any country shows interest in negotiations, then talks can occur. Negotiations do not take place unilaterally," Khan said.

In the case of Japan, the negotiations have been progressing according to the previously set roadmap, with Japan insistent on strictly following the timeline, he added.

Bangladesh has long been negotiating with countries to sign trade deals, but so far, only a PTA with Bhutan was signed in December 2020.

Currently, Bangladesh also enjoys trade benefits from the South Asian Free Trade Area (SAFTA) and the Asia-Pacific Trade Agreement (APTA).

Talks on preferential trade deals with a dozen countries have stalled since the political changeover in August last year, potentially adding to the challenges related to Bangladesh's graduation from the club of Least Developed Countries (LDCs) in 2026, according to economists and business leaders.

Apart from the turmoil stemming from the ouster of the Awami League government by a mass uprising last year, experts also blamed ongoing rapid and dramatic changes in the geopolitical landscape and the reluctance of participating countries as reasons for the slow progress in bilateral trade negotiations.

Under the interim government, which assumed office in August last year, authorities have only made progress in negotiating Economic Partnership Agreements (EPAs) with Japan and South Korea.

EPA talks with Japan entered their third and fourth rounds of meetings in Tokyo and Dhaka this month while negotiations with South Korea were launched in Seoul in November last year.

However, negotiations to sign trade deals with other countries such as India, Thailand, Malaysia, Indonesia, China, and Turkey, have hit a virtual deadlock.

After graduation from LDC status, scheduled for November next year, Bangladeshi exports will no longer be eligible for many preferential market benefits. However, bilateral trade deals could help retain these benefits even after graduation.

To prepare for graduation and ensure a smooth transition, the commerce ministry has been attempting to negotiate bilateral trade agreements, including Free Trade Agreements (FTAs), Preferential Trade Agreements (PTAs), Economic Partnership Agreements (EPAs), and Comprehensive Economic Partnership Agreements (CEPAs), with several countries and blocs.

The Awami League government was holding similar talks with major trading blocs, such as the Association of Southeast Asian Nations (ASEAN) and the Regional Comprehensive Economic Partnership Agreement (RCEP), to retain trade benefits.

However, Mustafizur Rahman, a distinguished fellow at the Centre for Policy Dialogue, said the progress in this regard has not been encouraging.

The economist identified an inability to negotiate complex trade issues as a key reason for this trend. "Besides, signing trade deals also takes a lot of time as such topics are complicated," Rahman added.

However, Commerce Adviser Sk Bashir Uddin begged to differ.

He stressed that progress in signing trade deals with major countries has not been halted, saying that communications through official channels are ongoing.

To support that stance, the businessman-turned-adviser referenced trade agreement talks with Japan.

After the fourth round of negotiations this month in Dhaka, Japan's foreign ministry stated that both sides had a fruitful discussion on the way forward and areas such as trade in goods, rules of origin, customs procedures, trade facilitation, trade in services, investment, electronic commerce, and intellectual property.

According to the statement, both sides decided to work on scheduling dates for the fifth round of negotiations through diplomatic channels.

Bashir Uddin added that the government first needs to examine whether the country will benefit before signing such deals.

However, other promising negotiations appear to have fallen by the wayside.

Under the previous regime, Bangladesh and neighbouring India made progress in signing a CEPA, even conducting a joint feasibility study more than two years ago. However, no formal meeting has been held since then.

In the case of China, a joint feasibility study was conducted and formal negotiations were supposed to be launched during former prime minister Sheikh Hasina's visit to China last year. But those formal negotiations have not yet commenced.

Bangladesh's imports from China -- mainly comprising raw materials, capital machinery, textile fabrics, chemicals, yarn, woven fabrics, garment articles, and food items -- declined to $16.63 billion in the fiscal year 2023-24 from $17.82 billion the previous fiscal year.

According to Rahman, the progress of negotiations with Japan is positive since an EPA with Japan would enhance Bangladesh's image and could be leveraged to sign deals with other countries.

Acting Commerce Secretary Abdur Rahim Khan also said the progress on talks for bilateral trade agreements has not been halted. Apart from Japan, he said preliminary negotiations with Singapore and South Korea are ongoing.

"If any country shows interest in negotiations, then talks can occur. Negotiations do not take place unilaterally," Khan said.

In the case of Japan, the negotiations have been progressing according to the previously set roadmap, with Japan insistent on strictly following the timeline, he added.

Bangladesh has long been negotiating with countries to sign trade deals, but so far, only a PTA with Bhutan was signed in December 2020.

Currently, Bangladesh also enjoys trade benefits from the South Asian Free Trade Area (SAFTA) and the Asia-Pacific Trade Agreement (APTA).