Saif

Senior Member

- Joined

- Jan 24, 2024

- Messages

- 15,410

- Nation

- Axis Group

Safety condition improves, challenges remain

Bangladesh’s readymade garment industry has undergone a significant change in the aftermath of the Rana Plaza collapse, one of the deadliest industrial accidents in the country, but there are still in the sector many issues to be addressed...

www.newagebd.net

www.newagebd.net

Safety condition improves, challenges remain

Saddam Hossain 23 April, 2025, 23:34

Representational image. | New Age file photo

Bangladesh’s readymade garment industry has undergone a significant change in the aftermath of the Rana Plaza collapse, one of the deadliest industrial accidents in the country, but there are still in the sector many issues to be addressed.

RMG businesses said that once criticised for its unsafe working conditions, the country’s sole multi-billion-dollar export sector had taken serious strides in rebuilding its reputation and restoring global confidence after the tragic accident 12 years ago.

However, rights activists, brands and foreign partners said that safety issues in the sector had improved after the accident, but the progress could not be termed sustainable.

On April 24, 2013, Rana Plaza, an eight-story building at Savar, on the outskirts of the capital Dhaka, crumbled during working hours, killing 1,138 people, mostly garment workers, and injuring thousands others.

Talking to New Age, Mohammad Hatem, president of the Bangladesh Knitwear Manufacturers and Exporters Association, said that issues related to safety, compliance and worker rights had experienced a major improvement since the Rana Plaza collapse.

‘However, the incident was a tragic and painful event for the industry and we will have to feel the pain in our whole lifetime,’ he added.

Industry insiders said that the factories had followed strict policies to ensure fire, electrical and structural safety and had spent significant amounts of money on those areas.

Mohiuddin Rubel, a former director of the Bangladesh Garment Manufacturers and Exporters Association, told New Age that in recent years, they had taken major initiatives to ensure a safe working environment in the RMG industry.

‘An extensive reform has been carried out in the industry with the support of the government, buyers, trade unions and other international organisations, including the International Labour Organisation,’ he added.

He also said that the government-led initiative and the buyers-led Accord and Alliance inspected about 4,000 factories with the aim of improving safety issues in the units.

‘The building collapse was a tragic incident in the history of this industry. But we have taken that as a turning point and put in all-out efforts to build a safe and sustainable industry,’ he added.

He also said that each factory spent on average Tk 5 crore on factory renovation, detailed engineering assessment and retrofitting.

A 2021 report by McKinsey consultancy labelled Bangladesh’s RMG sector a frontrunner in transparency regarding factory safety and value-chain responsibility.

Another report by QIMA, a global supply chain compliance solutions provider, ranked the country second in the same year’s ethical manufacturing index.

Moreover, Bangladesh also amended its labour law twice, in 2013 and 2018, to safeguard workers’ rights and ensure workplace safety.

The country increased workers’ minimum wages by 56 per cent in 2023 and raised the increment to 9 per cent from 5 per cent in 2024.

In terms of LEED-certified green factories, Bangladesh also witnessed a big jump.

Before the Rana Plaza accident, there were only two green factories in the country.

Currently, the US Green Building Council has certified 240 Bangladeshi factories as LEED (leadership in energy and environmental design).

There are 98 platinum-rated, 128 gold-rated, 10 silver-rated and four certified factories. Moreover, the highest-scoring factory is also from Bangladesh.

After the Rana Plaza collapse, the Accord on Fire and Building Safety in Bangladesh and the Alliance for Bangladesh Workers’ Safety helped the country’s factories to improve their fire, structural and electrical safety measures.

The Alliance left the country in 2018 after remediating 93 per cent across 700 factories it inspected, and the Accord, which lasted until 2020, helped standardise fire and building safety in more than 2,000 RMG factories.

After their departure, the RMG Sustainability Council, an entity comprised of RMG manufacturers, global brands and retailers, and global unions and their Bangladeshi affiliates, started its journey in 2020.

Regarding the RSC, Hatem said that the entity was doing its job as per the global standard, but it also sometimes tried to put artificial pressures on the industry.

‘The biggest paradigm shift since Rana Plaza has been the safety culture that has been developed through public-private partnership in the factories,’ said Mohiuddin.

The BGMEA has also framed its new policy on new member enrolment and subcontracting, he said.

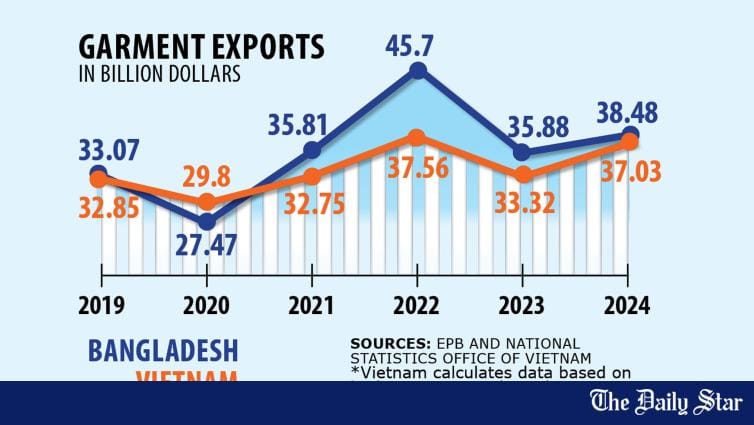

Despite facing crises like the Rana Plaza collapse, Covid pandemic and global economic turmoil due to the Russia-Ukraine war over the years, the RMG sector’s export earnings have never experienced a hard hit.

Bangladesh exported apparel worth $38.48 billion in 2024, a 7.23-per cent increase compared with $35.89 billion in 2023.

Talking to New Age, Nazma Akter, president of the Sommilito Garments Sromik Federation, said that the accused in the Rana Plaza case were yet to be punished and most of the accused were in hiding.

‘Accused Rana along with others must be brought to justice,’ she said.

‘The factory authorities are yet to regularise the remediation activities and the government should do it by maintaining global standard,’ she said.

She also said that safety issues had improved a lot, but this could not be called sustainability, as accidents and fire incidents were still persistent in the sector, along with the absence of earthquake safety.

In some cases, the blacklisting of workers is also persistent, she added, noting that owners had safe passage after committing crimes.

Regarding the cases, Hatem said they also demanded punishment of actual criminals.

Saddam Hossain 23 April, 2025, 23:34

Representational image. | New Age file photo

Bangladesh’s readymade garment industry has undergone a significant change in the aftermath of the Rana Plaza collapse, one of the deadliest industrial accidents in the country, but there are still in the sector many issues to be addressed.

RMG businesses said that once criticised for its unsafe working conditions, the country’s sole multi-billion-dollar export sector had taken serious strides in rebuilding its reputation and restoring global confidence after the tragic accident 12 years ago.

However, rights activists, brands and foreign partners said that safety issues in the sector had improved after the accident, but the progress could not be termed sustainable.

On April 24, 2013, Rana Plaza, an eight-story building at Savar, on the outskirts of the capital Dhaka, crumbled during working hours, killing 1,138 people, mostly garment workers, and injuring thousands others.

Talking to New Age, Mohammad Hatem, president of the Bangladesh Knitwear Manufacturers and Exporters Association, said that issues related to safety, compliance and worker rights had experienced a major improvement since the Rana Plaza collapse.

‘However, the incident was a tragic and painful event for the industry and we will have to feel the pain in our whole lifetime,’ he added.

Industry insiders said that the factories had followed strict policies to ensure fire, electrical and structural safety and had spent significant amounts of money on those areas.

Mohiuddin Rubel, a former director of the Bangladesh Garment Manufacturers and Exporters Association, told New Age that in recent years, they had taken major initiatives to ensure a safe working environment in the RMG industry.

‘An extensive reform has been carried out in the industry with the support of the government, buyers, trade unions and other international organisations, including the International Labour Organisation,’ he added.

He also said that the government-led initiative and the buyers-led Accord and Alliance inspected about 4,000 factories with the aim of improving safety issues in the units.

‘The building collapse was a tragic incident in the history of this industry. But we have taken that as a turning point and put in all-out efforts to build a safe and sustainable industry,’ he added.

He also said that each factory spent on average Tk 5 crore on factory renovation, detailed engineering assessment and retrofitting.

A 2021 report by McKinsey consultancy labelled Bangladesh’s RMG sector a frontrunner in transparency regarding factory safety and value-chain responsibility.

Another report by QIMA, a global supply chain compliance solutions provider, ranked the country second in the same year’s ethical manufacturing index.

Moreover, Bangladesh also amended its labour law twice, in 2013 and 2018, to safeguard workers’ rights and ensure workplace safety.

The country increased workers’ minimum wages by 56 per cent in 2023 and raised the increment to 9 per cent from 5 per cent in 2024.

In terms of LEED-certified green factories, Bangladesh also witnessed a big jump.

Before the Rana Plaza accident, there were only two green factories in the country.

Currently, the US Green Building Council has certified 240 Bangladeshi factories as LEED (leadership in energy and environmental design).

There are 98 platinum-rated, 128 gold-rated, 10 silver-rated and four certified factories. Moreover, the highest-scoring factory is also from Bangladesh.

After the Rana Plaza collapse, the Accord on Fire and Building Safety in Bangladesh and the Alliance for Bangladesh Workers’ Safety helped the country’s factories to improve their fire, structural and electrical safety measures.

The Alliance left the country in 2018 after remediating 93 per cent across 700 factories it inspected, and the Accord, which lasted until 2020, helped standardise fire and building safety in more than 2,000 RMG factories.

After their departure, the RMG Sustainability Council, an entity comprised of RMG manufacturers, global brands and retailers, and global unions and their Bangladeshi affiliates, started its journey in 2020.

Regarding the RSC, Hatem said that the entity was doing its job as per the global standard, but it also sometimes tried to put artificial pressures on the industry.

‘The biggest paradigm shift since Rana Plaza has been the safety culture that has been developed through public-private partnership in the factories,’ said Mohiuddin.

The BGMEA has also framed its new policy on new member enrolment and subcontracting, he said.

Despite facing crises like the Rana Plaza collapse, Covid pandemic and global economic turmoil due to the Russia-Ukraine war over the years, the RMG sector’s export earnings have never experienced a hard hit.

Bangladesh exported apparel worth $38.48 billion in 2024, a 7.23-per cent increase compared with $35.89 billion in 2023.

Talking to New Age, Nazma Akter, president of the Sommilito Garments Sromik Federation, said that the accused in the Rana Plaza case were yet to be punished and most of the accused were in hiding.

‘Accused Rana along with others must be brought to justice,’ she said.

‘The factory authorities are yet to regularise the remediation activities and the government should do it by maintaining global standard,’ she said.

She also said that safety issues had improved a lot, but this could not be called sustainability, as accidents and fire incidents were still persistent in the sector, along with the absence of earthquake safety.

In some cases, the blacklisting of workers is also persistent, she added, noting that owners had safe passage after committing crimes.

Regarding the cases, Hatem said they also demanded punishment of actual criminals.