Saif

Senior Member

- Messages

- 17,522

- Likes

- 8,438

- Nation

- Residence

- Axis Group

Islamic banks' deposits, investments on wane

A crisis of confidence among clients following massive lending malpractices lands Islamic banking in Bangladesh in a quandary with liquidity crunch bedeviling their operations, according to official disclosure. From deposit to investment, and even in case of wage earners' remittance, the shariah-

Islamic banks' deposits, investments on wane

JUBAIR HASAN

Published :

Jun 11, 2024 00:54

Updated :

Jun 11, 2024 00:54

A crisis of confidence among clients following massive lending malpractices lands Islamic banking in Bangladesh in a quandary with liquidity crunch bedeviling their operations, according to official disclosure.

From deposit to investment, and even in case of wage earners' remittance, the shariah-based banking operations keep losing their share in recent months, which becomes a matter of concern particularly to a section of unconventional bankers.

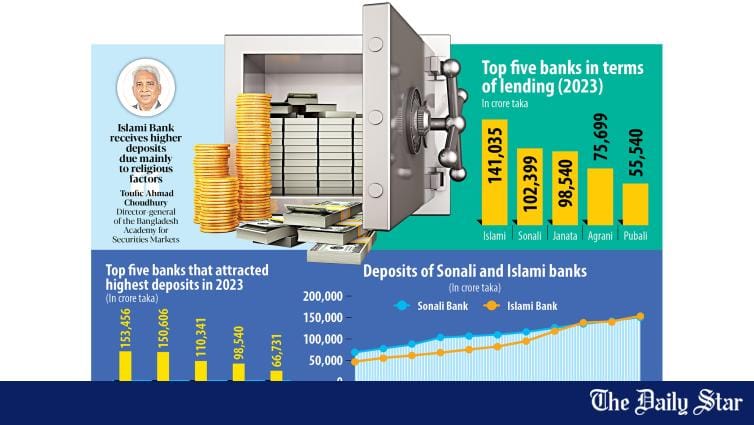

According to Islamic banking-related statistics of Bangladesh Bank, the country's central bank, Islamic banking held 23.86 per cent of the entire deposit portfolio with the country's banking system, as of December 2023.

But, on a slide, the share came down to 23.56 per cent in January 2024 and dropped further down to 23.44 per cent in March.

In terms of investment, such unconventional banking accounted for 24.81 per cent of the total investment made through the banking system up to last December. But their share rose to 28.92 per cent in January. Thereafter, a downturn came: the shariah-based banks saw their share drop to 24.86 per cent until March 2024.

Such massive fall of share was also observed in remittance earning, considered one of the main strengths of such banking operations. The Islamic banking bagged 47.92 per cent of the country's overall remittance earnings through the formal channel. In the following month was there a turnaround with the share having increased to 51.57 per cent.

But, since then, the share has shrunk continuously to reach 41.46 per cent and 37.95 per cent in February and March respectively, according to the central bank's data.

Seeking anonymity, a BB official said there were a number of media reports regarding massive-scale loan-related irregularities in these unconventional banks which might shatter people's confidence.

"These could be a reason behind such fall in market share," the central banker said.

Managing director of an Islamic bank, who preferred not to be quoted by name, said savers started diverting their funds into the conventional banks despite their various steps to convince them.

"As a matter of fact, the growth of deposits in such banks slowed down in recent times, which is probably reflected in the data. The contribution of the shariah-based banks in terms of receiving remittance was huge even a few months ago but it has dropped remarkably in recent times.

"And it is a matter of serious concerns for us. But we're trying our best to improve the situation," he added.

A week ago, American credit-rating agency Fitch said liquidity shortages were still affecting Bangladesh's Islamic banking sector, which is more vulnerable than the conventional banks.

It said though the Islamic-banking market share is sizable in Bangladesh, it has been stagnant over the past two years.

The agency attributed the rot partly to the flight of deposits, governance issues and comparatively lax prudential requirements for Islamic banks.

However, some Islamic banks have been perfirming well in an adverse environment.

JUBAIR HASAN

Published :

Jun 11, 2024 00:54

Updated :

Jun 11, 2024 00:54

A crisis of confidence among clients following massive lending malpractices lands Islamic banking in Bangladesh in a quandary with liquidity crunch bedeviling their operations, according to official disclosure.

From deposit to investment, and even in case of wage earners' remittance, the shariah-based banking operations keep losing their share in recent months, which becomes a matter of concern particularly to a section of unconventional bankers.

According to Islamic banking-related statistics of Bangladesh Bank, the country's central bank, Islamic banking held 23.86 per cent of the entire deposit portfolio with the country's banking system, as of December 2023.

But, on a slide, the share came down to 23.56 per cent in January 2024 and dropped further down to 23.44 per cent in March.

In terms of investment, such unconventional banking accounted for 24.81 per cent of the total investment made through the banking system up to last December. But their share rose to 28.92 per cent in January. Thereafter, a downturn came: the shariah-based banks saw their share drop to 24.86 per cent until March 2024.

Such massive fall of share was also observed in remittance earning, considered one of the main strengths of such banking operations. The Islamic banking bagged 47.92 per cent of the country's overall remittance earnings through the formal channel. In the following month was there a turnaround with the share having increased to 51.57 per cent.

But, since then, the share has shrunk continuously to reach 41.46 per cent and 37.95 per cent in February and March respectively, according to the central bank's data.

Seeking anonymity, a BB official said there were a number of media reports regarding massive-scale loan-related irregularities in these unconventional banks which might shatter people's confidence.

"These could be a reason behind such fall in market share," the central banker said.

Managing director of an Islamic bank, who preferred not to be quoted by name, said savers started diverting their funds into the conventional banks despite their various steps to convince them.

"As a matter of fact, the growth of deposits in such banks slowed down in recent times, which is probably reflected in the data. The contribution of the shariah-based banks in terms of receiving remittance was huge even a few months ago but it has dropped remarkably in recent times.

"And it is a matter of serious concerns for us. But we're trying our best to improve the situation," he added.

A week ago, American credit-rating agency Fitch said liquidity shortages were still affecting Bangladesh's Islamic banking sector, which is more vulnerable than the conventional banks.

It said though the Islamic-banking market share is sizable in Bangladesh, it has been stagnant over the past two years.

The agency attributed the rot partly to the flight of deposits, governance issues and comparatively lax prudential requirements for Islamic banks.

However, some Islamic banks have been perfirming well in an adverse environment.