Saif

Senior Member

- Messages

- 17,522

- Likes

- 8,438

- Nation

- Residence

- Axis Group

Banks are being merged due to lack of farsightedness

Discover the reasons behind the merging of banks in Bangladesh due to lack of farsightedness and the impact on the country's overall economy, inflation, and dollar crisis in an exclusive interview with Dr. Zahid Hussain, former chief economist of the World Bank’s Dhaka office.

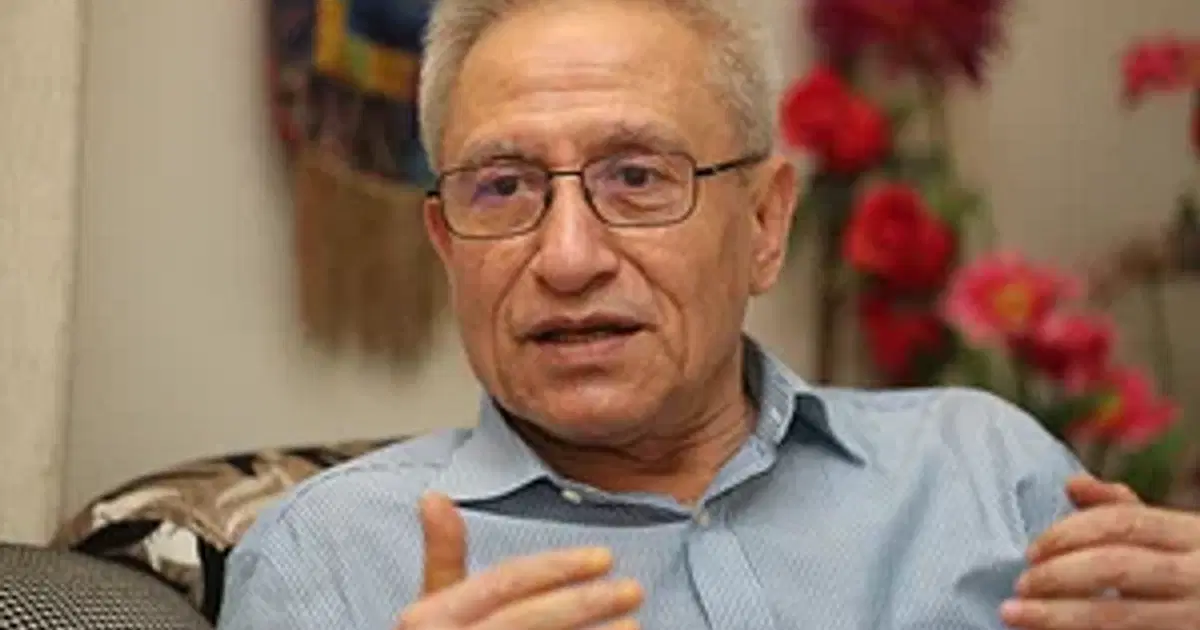

Interview: Zahid Hussain

Banks are being merged due to lack of farsightedness

Zahid Hussain

Dr Zahid Hussain is former lead economist of the World Bank's Dhaka office. In an interview with Prothom Alo's AKM Zakaria, he talks about the country's overall economy, the dollar crisis, bank mergers, inflation, lifting subsidies in the power sector and the budget.

Updated: 20 May 2024, 12: 39

Prothom Alo : There had been apprehensions for quite some time that the economy would be at risk. Economists had been warning about this too. Compared to the state of the economy three or four months ago, have things deteriorated further?

Zahid Hussain It certainly hasn't improved. None of the indicators regarding the economy are in good shape. If we consider the available data on inflation, reserves, revenue income, the financial sector's dwindling resources, negative imports, the GDP or industrial growth – the situation has taken a nose dive. The only area where there is some respite is in remittance. For the past few months, remittance of USD 2 billion (USD 200 crore) has been coming in monthly. The export figures don't look bad either but are these figures accurate? They don't tally with reality.

Prothom Alo : Does that mean the economists' apprehensions were not taken into consideration? Or were the right steps not taken at the right time?

Zahid Hussain I would say that timely measures were not taken. Now some measures are being taken which can be called correct. But then in certain cases, these are confusing – such as in the case of the foreign exchange market and management. It is difficult to say whether these measures will yield results. There have been assurances and promises that all sorts of things will be done regarding the monetary policy, the exchange rate and so on. We must wait to see if this is reflected in the forthcoming budget.

The structural reforms that were needed at this time, have not taken place. The regulatory bodies did not, or could not, play their due role in establishing good governance in the financial sector. It had been expected that they would have an active role regarding weak institutions. The bottom line is, the initiatives and policies required for the situation, were not taken up.

Prothom Alo : Why could these measures not be taken? What is your opinion?

Zahid Hussain The path chosen to resolve the problems are, in many cases, not correct. Then again, I do not think that the government or the policymakers are doing this out of ignorance. Let me give an example. The 9 per cent ceiling on interest has now been lifted. We have gone back to the previous policy. It is a misconception that business will do well if interest rates are low. Why was this done then? This was done to facilitate certain vested interest quarters. The consideration was possibly that if loans can be given cheaply, it will be possible to remain in power.

We see that same wrong policy in the case of market management. When the prices of onion and such commodities go up, we talk of market manipulations. What does the government do then? It fixes a retail price. This can never work. The government does not touch, or does not want to touch, the importers, the stockists or the wholesalers. How can it be effective it if does not intervene where necessary?

Prothom Alo : We see the dollar price scaling up. Now the government has used the crawling peg system to devaluate the taka. Many say that this should have been done earlier. What do you say? Can this crawling peg measure make any difference now?

Zahid Hussain There are questions about whether it is actually a crawling peg that has been put into effect here. If the system put in place is actually crawling peg, then there must be space for fluctuation. Here we see that Bangladesh Bank has fixed a rate for the dollar, that is, 117 taka. The Bangladesh Bank circular doesn't mention how far it will rise or fall above or below this. According to the media, it may fluctuate up or down by a taka. Then there is matter of the buying and selling rate of the dollar. This is not clear. We see the "peg" fixed at 117 taka, but we don't see the "crawling".

The question is, if we cannot pay more than 118 taka for the dollar, will the inflow of dollars though formal channels drop? The market itself doesn't believe this rate will last. The currency market has become volatile. Since there is no possibility of the dollar rate falling, exporters who receive their bills in dollars may delay bringing in their dollars in the hope of the dollar price going up further.

The crawling peg system is in place in Nicaragua and Vietnam. Nicaragua's situation is different. And in Vietnam, the central bank fixes the rate every day based on the previous day's market. Buying and selling can be done at a 5 per cent fluctuation, up or down. Interestingly, IMF has given recognition to what is being done in Bangladesh in the name of crawling peg. I feel that they know something that we don't know. Perhaps they have been told the ceiling of the dollar buying and selling rate.

We may be creating special zones for foreign investment, but why will they invest here if they have apprehensions regarding the country's macro-economy, if they feel they will not be able to take their money back? They have alternative countries for their investment.

Prothom Alo : What do you think of the interest rate being wholly opened up?

I think it is good, albeit late. There is no need to worry about where the interest rate will go or whether it will spiral very high. It will be determined by bank-customer relations and that is nothing new. Problems crop up when the interest rate is fixed with no considerations to the risks involved. Now there will be scope to amend that. The interest rate can be higher for loans where there are risks. And where the risks are low, the banks can lend with low interest rates.

Many may feel that the financial institutions can hold the borrowers hostage by keeping the interest rates open. I feel that this will not happen. Our regulatory authorities must keep their eyes open and remain alert in this regard. No irregularities can be condoned.

Prothom Alo : The downslide of reserves can't be stopped either. Is there anything to be done here?

Zahid Hussain If the currency exchange is left to the market, then there is chance of the reserves increasing. However, the transparency of the market must be ensured. If Bangladesh Bank creates a platform in cooperation with BAFEDA, the the rate at which the various banks buy and sell dollars every day, can be availed on this platform. If the official market rate is near that of the unofficial rate, then a big obstacle to dollars coming through formal channels will be lifted. Transparency in exchange market will leave no room for manipulations.

Prothom Alo : Due to the dollar crisis, foreign companies are unable to take their profits back home. During his recent visit, the US assistant secretary of state Donald Lu expressed his concern in this regard. Will the dollar crisis discourage foreign investment?

Zahid Hussain It is very natural that there will be an impact on foreign direct investment. Those who are to come to this country with foreign investment, will lose confidence. They see that there is no continuity in policies here. We may be creating special zones for foreign investment, but why will they invest here if they have apprehensions regarding the country's macro-economy, if they feel they will not be able to take their money back? They have alternative countries for their investment.

Prothom Alo : Inflation emerged as a serious problem worldwide since the Ukraine war. Everyone managed to get things under control, but why not us? Even Sri Lanka which had faced bankruptcy managed to speedily tackle the situation.

Zahid Hussain We have to take into consideration what are the weapons with which inflation can be tackled. The central bank had the monetary policy, the government has the fiscal policy and the regulatory authority. We took the reverse route with the monetary policy. Money was printed to meet the budget deficit. Rather than taking contractionary measures, the budget was expanded. In order to save dollars, tariff on commodities was increased. This increased inflation further. After the outbreak of the Ukraine war, everyone increased interest rates, while we reduced interest rates. There was talk about savings in the revenue policy, but this was not reflected in reality. In market management, we fixed prices at the retail level, but took no measures against those manipulating the market. We did not use the weapons we had to control inflation.

In no way can there be any decrease in allocations for the health, education and social safety net sectors. On the contrary, allocations to these sectors should be increased. People may question the spending capacity in these sectors, but that cannot be an excuse to cut allocations. Focus should be on why the funds can't be spent. The procedures must be simplified

Prothom Alo : Loans are being taken from IMF because of the economic crisis and they have laid down all sorts of terms and conditions. Is their involvement yielding results?

Zahid Hussain We have to see how it was before IMF became involved and how it is after. Over a year has passed, but we are yet to see any results. They have given all sorts of policy advice. Implementation of some of the recommendation has started. The interest corridor policy has been adopted, the taka has been devalued, an automatic system has been put in place to determine the price of fuel oil. Our biggest area of concern is whether inflation has lessened or not, whether reserves have increased. We can say some work has been carried out, but this has had no impact so far. And we must bear in mind that not all of IMF's advice will be effective.

Prothom Alo : Meanwhile, in keeping with IMF conditions, the government is reducing subsidy on electricity, sending electricity costs up. This is an extra burden on the people already floundering under the weight of inflation.

Zahid Hussain IMF has said that there can be no subsidies, particularly in the case of energy and power. There is a link between power production and environment and climate change. In our country the government buys electricity at high costs and sells it to the people at low costs. There are two ways to reduce this subsidy. One, increase the price of electricity. Two, reduce the government's costs in purchasing electricity. The government took the easy way out of hiking power prices to slash subsidies. But it took no measures to slash corruption in this sector and to move away from the illogical deals to purchase power from private producers. During the quick rental deal, there were conditions that even if power is not generated, capacity charge must be paid. The term of the contract is over, but the government simply renews it again and again. The government could save a lot of money by taking up a 'no power, no pay' policy. But instead of doing that, the price of electricity is being increased.

The government can also save a lot of money by load management. Power can be purchased first from producers that can provide power at the lowest cost, then gradually from others according to price. Power can be bought at lower costs in winter when the demand is less. The government can save a lot of money by applying these methods of loan management. A study of the World Bank says that the government can save up to around USD 1 billion (USD 100 crore) by means of proper load management.

Prothom Alo : So what has happened about the bank mergers? It looks like Bangladesh Bank's initiative has failed.

Zahid Hussain The government adopted 'prompt correction action' or PCA to address the banking sector problems. Weak banks were divided into four categories. These banks were supposed to have been given a chance to overcome their weaknesses. If they failed to do so, then they could face termination, acquisition or merging with another bank. But it is being said that this will be implemented from 2025. Why? What was the problem is doing that from now?

Instead, Bangladesh Bank took measures to merge weak and bad banks with some good ones. This provoked negative reactions. A sense of anxiety was seen among the good banks. This initiative has been suppressed for the time being. If measures were taken in accordance to the PCA, at least some process would have started. Instead of doing so, banks are being merged due to a lack of farsightedness.

Prothom Alo : After the hike in the dollar price, there is talk of stopping incentives in the export sector. What do you think about that?

Zahid Hussain Even if the price of the dollar did not increase, I would still be in favour of reevaluating the matter of incentives in the export sector. We have provided incentives to the readymade garment sector as well as various other export-oriented industries. The main objective was to diversify exports. This was hardly effective.

Also, after LDC graduation, we will have to maintain WTO standards. That means we will not be able to provide incentives to many industries, even if we want to. That is why we should wrap up the matter of incentives from beforehand. And now in place of 84 taka, we are getting 117 taka per dollar. So there is no need for incentives. There is no scope to keep any industry alive on life support.

Prothom Alo : The budget is ahead. How should the budget be, given the prevailing economic condition? What would some of your basic recommendations be?

Zahid Hussain I would like to place stress on certain factors regarding the coming budget. Firstly, expenditure must be curtailed, wasteful expenditure must be dropped with contractionary policies particularly in the purchase of vehicles, construction of buildings and travel. And in no way can there be any decrease in allocations for the health, education and social safety net sectors. On the contrary, allocations to these sectors should be increased. People may question the spending capacity in these sectors, but that cannot be an excuse to cut allocations. Focus should be on why the funds can't be spent. The procedures must be simplified.

Secondly, we hear of certain good measures being taken in the case of revenue. We agree that revenue income must be increased, but not by increasing tax rates. The concessions in place regarding taxes must be curtailed and the loopholes in revenue collection must be closed. A fully self-assessment system must be introduced in income tax.

Thirdly, the budget deficit should be made a low as possible. Initiatives must be taken to meet the deficit with funds in the pipeline, the loans and assistance that have been committed so far, by making an effort to avail low-interest long-term loans and cutting expenditure from our own funds.

Prothom Alo : Thank you.

Zahid Hussain Thank you too.

Banks are being merged due to lack of farsightedness

Zahid Hussain

Dr Zahid Hussain is former lead economist of the World Bank's Dhaka office. In an interview with Prothom Alo's AKM Zakaria, he talks about the country's overall economy, the dollar crisis, bank mergers, inflation, lifting subsidies in the power sector and the budget.

Updated: 20 May 2024, 12: 39

Prothom Alo : There had been apprehensions for quite some time that the economy would be at risk. Economists had been warning about this too. Compared to the state of the economy three or four months ago, have things deteriorated further?

Zahid Hussain It certainly hasn't improved. None of the indicators regarding the economy are in good shape. If we consider the available data on inflation, reserves, revenue income, the financial sector's dwindling resources, negative imports, the GDP or industrial growth – the situation has taken a nose dive. The only area where there is some respite is in remittance. For the past few months, remittance of USD 2 billion (USD 200 crore) has been coming in monthly. The export figures don't look bad either but are these figures accurate? They don't tally with reality.

Prothom Alo : Does that mean the economists' apprehensions were not taken into consideration? Or were the right steps not taken at the right time?

Zahid Hussain I would say that timely measures were not taken. Now some measures are being taken which can be called correct. But then in certain cases, these are confusing – such as in the case of the foreign exchange market and management. It is difficult to say whether these measures will yield results. There have been assurances and promises that all sorts of things will be done regarding the monetary policy, the exchange rate and so on. We must wait to see if this is reflected in the forthcoming budget.

The structural reforms that were needed at this time, have not taken place. The regulatory bodies did not, or could not, play their due role in establishing good governance in the financial sector. It had been expected that they would have an active role regarding weak institutions. The bottom line is, the initiatives and policies required for the situation, were not taken up.

Prothom Alo : Why could these measures not be taken? What is your opinion?

Zahid Hussain The path chosen to resolve the problems are, in many cases, not correct. Then again, I do not think that the government or the policymakers are doing this out of ignorance. Let me give an example. The 9 per cent ceiling on interest has now been lifted. We have gone back to the previous policy. It is a misconception that business will do well if interest rates are low. Why was this done then? This was done to facilitate certain vested interest quarters. The consideration was possibly that if loans can be given cheaply, it will be possible to remain in power.

We see that same wrong policy in the case of market management. When the prices of onion and such commodities go up, we talk of market manipulations. What does the government do then? It fixes a retail price. This can never work. The government does not touch, or does not want to touch, the importers, the stockists or the wholesalers. How can it be effective it if does not intervene where necessary?

Prothom Alo : We see the dollar price scaling up. Now the government has used the crawling peg system to devaluate the taka. Many say that this should have been done earlier. What do you say? Can this crawling peg measure make any difference now?

Zahid Hussain There are questions about whether it is actually a crawling peg that has been put into effect here. If the system put in place is actually crawling peg, then there must be space for fluctuation. Here we see that Bangladesh Bank has fixed a rate for the dollar, that is, 117 taka. The Bangladesh Bank circular doesn't mention how far it will rise or fall above or below this. According to the media, it may fluctuate up or down by a taka. Then there is matter of the buying and selling rate of the dollar. This is not clear. We see the "peg" fixed at 117 taka, but we don't see the "crawling".

The question is, if we cannot pay more than 118 taka for the dollar, will the inflow of dollars though formal channels drop? The market itself doesn't believe this rate will last. The currency market has become volatile. Since there is no possibility of the dollar rate falling, exporters who receive their bills in dollars may delay bringing in their dollars in the hope of the dollar price going up further.

The crawling peg system is in place in Nicaragua and Vietnam. Nicaragua's situation is different. And in Vietnam, the central bank fixes the rate every day based on the previous day's market. Buying and selling can be done at a 5 per cent fluctuation, up or down. Interestingly, IMF has given recognition to what is being done in Bangladesh in the name of crawling peg. I feel that they know something that we don't know. Perhaps they have been told the ceiling of the dollar buying and selling rate.

We may be creating special zones for foreign investment, but why will they invest here if they have apprehensions regarding the country's macro-economy, if they feel they will not be able to take their money back? They have alternative countries for their investment.

Prothom Alo : What do you think of the interest rate being wholly opened up?

I think it is good, albeit late. There is no need to worry about where the interest rate will go or whether it will spiral very high. It will be determined by bank-customer relations and that is nothing new. Problems crop up when the interest rate is fixed with no considerations to the risks involved. Now there will be scope to amend that. The interest rate can be higher for loans where there are risks. And where the risks are low, the banks can lend with low interest rates.

Many may feel that the financial institutions can hold the borrowers hostage by keeping the interest rates open. I feel that this will not happen. Our regulatory authorities must keep their eyes open and remain alert in this regard. No irregularities can be condoned.

Prothom Alo : The downslide of reserves can't be stopped either. Is there anything to be done here?

Zahid Hussain If the currency exchange is left to the market, then there is chance of the reserves increasing. However, the transparency of the market must be ensured. If Bangladesh Bank creates a platform in cooperation with BAFEDA, the the rate at which the various banks buy and sell dollars every day, can be availed on this platform. If the official market rate is near that of the unofficial rate, then a big obstacle to dollars coming through formal channels will be lifted. Transparency in exchange market will leave no room for manipulations.

Prothom Alo : Due to the dollar crisis, foreign companies are unable to take their profits back home. During his recent visit, the US assistant secretary of state Donald Lu expressed his concern in this regard. Will the dollar crisis discourage foreign investment?

Zahid Hussain It is very natural that there will be an impact on foreign direct investment. Those who are to come to this country with foreign investment, will lose confidence. They see that there is no continuity in policies here. We may be creating special zones for foreign investment, but why will they invest here if they have apprehensions regarding the country's macro-economy, if they feel they will not be able to take their money back? They have alternative countries for their investment.

Prothom Alo : Inflation emerged as a serious problem worldwide since the Ukraine war. Everyone managed to get things under control, but why not us? Even Sri Lanka which had faced bankruptcy managed to speedily tackle the situation.

Zahid Hussain We have to take into consideration what are the weapons with which inflation can be tackled. The central bank had the monetary policy, the government has the fiscal policy and the regulatory authority. We took the reverse route with the monetary policy. Money was printed to meet the budget deficit. Rather than taking contractionary measures, the budget was expanded. In order to save dollars, tariff on commodities was increased. This increased inflation further. After the outbreak of the Ukraine war, everyone increased interest rates, while we reduced interest rates. There was talk about savings in the revenue policy, but this was not reflected in reality. In market management, we fixed prices at the retail level, but took no measures against those manipulating the market. We did not use the weapons we had to control inflation.

In no way can there be any decrease in allocations for the health, education and social safety net sectors. On the contrary, allocations to these sectors should be increased. People may question the spending capacity in these sectors, but that cannot be an excuse to cut allocations. Focus should be on why the funds can't be spent. The procedures must be simplified

Prothom Alo : Loans are being taken from IMF because of the economic crisis and they have laid down all sorts of terms and conditions. Is their involvement yielding results?

Zahid Hussain We have to see how it was before IMF became involved and how it is after. Over a year has passed, but we are yet to see any results. They have given all sorts of policy advice. Implementation of some of the recommendation has started. The interest corridor policy has been adopted, the taka has been devalued, an automatic system has been put in place to determine the price of fuel oil. Our biggest area of concern is whether inflation has lessened or not, whether reserves have increased. We can say some work has been carried out, but this has had no impact so far. And we must bear in mind that not all of IMF's advice will be effective.

Prothom Alo : Meanwhile, in keeping with IMF conditions, the government is reducing subsidy on electricity, sending electricity costs up. This is an extra burden on the people already floundering under the weight of inflation.

Zahid Hussain IMF has said that there can be no subsidies, particularly in the case of energy and power. There is a link between power production and environment and climate change. In our country the government buys electricity at high costs and sells it to the people at low costs. There are two ways to reduce this subsidy. One, increase the price of electricity. Two, reduce the government's costs in purchasing electricity. The government took the easy way out of hiking power prices to slash subsidies. But it took no measures to slash corruption in this sector and to move away from the illogical deals to purchase power from private producers. During the quick rental deal, there were conditions that even if power is not generated, capacity charge must be paid. The term of the contract is over, but the government simply renews it again and again. The government could save a lot of money by taking up a 'no power, no pay' policy. But instead of doing that, the price of electricity is being increased.

The government can also save a lot of money by load management. Power can be purchased first from producers that can provide power at the lowest cost, then gradually from others according to price. Power can be bought at lower costs in winter when the demand is less. The government can save a lot of money by applying these methods of loan management. A study of the World Bank says that the government can save up to around USD 1 billion (USD 100 crore) by means of proper load management.

Prothom Alo : So what has happened about the bank mergers? It looks like Bangladesh Bank's initiative has failed.

Zahid Hussain The government adopted 'prompt correction action' or PCA to address the banking sector problems. Weak banks were divided into four categories. These banks were supposed to have been given a chance to overcome their weaknesses. If they failed to do so, then they could face termination, acquisition or merging with another bank. But it is being said that this will be implemented from 2025. Why? What was the problem is doing that from now?

Instead, Bangladesh Bank took measures to merge weak and bad banks with some good ones. This provoked negative reactions. A sense of anxiety was seen among the good banks. This initiative has been suppressed for the time being. If measures were taken in accordance to the PCA, at least some process would have started. Instead of doing so, banks are being merged due to a lack of farsightedness.

Prothom Alo : After the hike in the dollar price, there is talk of stopping incentives in the export sector. What do you think about that?

Zahid Hussain Even if the price of the dollar did not increase, I would still be in favour of reevaluating the matter of incentives in the export sector. We have provided incentives to the readymade garment sector as well as various other export-oriented industries. The main objective was to diversify exports. This was hardly effective.

Also, after LDC graduation, we will have to maintain WTO standards. That means we will not be able to provide incentives to many industries, even if we want to. That is why we should wrap up the matter of incentives from beforehand. And now in place of 84 taka, we are getting 117 taka per dollar. So there is no need for incentives. There is no scope to keep any industry alive on life support.

Prothom Alo : The budget is ahead. How should the budget be, given the prevailing economic condition? What would some of your basic recommendations be?

Zahid Hussain I would like to place stress on certain factors regarding the coming budget. Firstly, expenditure must be curtailed, wasteful expenditure must be dropped with contractionary policies particularly in the purchase of vehicles, construction of buildings and travel. And in no way can there be any decrease in allocations for the health, education and social safety net sectors. On the contrary, allocations to these sectors should be increased. People may question the spending capacity in these sectors, but that cannot be an excuse to cut allocations. Focus should be on why the funds can't be spent. The procedures must be simplified.

Secondly, we hear of certain good measures being taken in the case of revenue. We agree that revenue income must be increased, but not by increasing tax rates. The concessions in place regarding taxes must be curtailed and the loopholes in revenue collection must be closed. A fully self-assessment system must be introduced in income tax.

Thirdly, the budget deficit should be made a low as possible. Initiatives must be taken to meet the deficit with funds in the pipeline, the loans and assistance that have been committed so far, by making an effort to avail low-interest long-term loans and cutting expenditure from our own funds.

Prothom Alo : Thank you.

Zahid Hussain Thank you too.