Saif

Senior Member

- Joined

- Jan 24, 2024

- Messages

- 15,397

- Reaction score

- 7,874

- Nation

- Residence

- Axis Group

Corruption and capital flight

AS A social worker, it is a great opportunity to work with grassroots people. I worked for two years and seven months...

www.newagebd.net

www.newagebd.net

Corruption and capital flight

Mohammed Mamun Rashid | Published: 00:00, Mar 07,2024

AS A social worker, it is a great opportunity to work with grassroots people. I worked for two years and seven months at Transparency International Bangladesh. It enhanced my visionary zeal for the anti-corruption campaign a lot because of my work in civic engagement, social movements, and good governance. Still, I abide by it. Once I asked one of my neighbours, ‘what do you mean by good governance?’ Naturally, he did not answer theoretically, as we usually expect. But he gave some real expectations from his heart. He said, ‘I want an honest officer-in-charge, land registration without bribery, easy access to public health services, etc.’

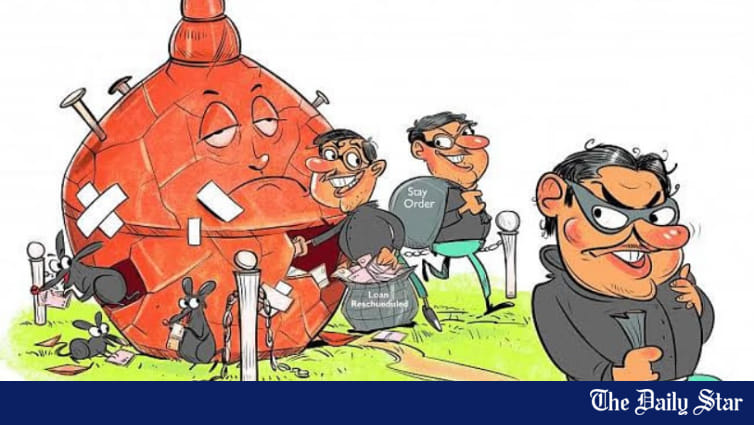

People’s pains, predicaments and expectations are often reflected in newspaper or television reports. Corruption and money laundering are two of the most important factors that cause inequality to grow and make people suffer. Corruption is not limited to bribery but can take a number of other forms, such as extortion, influence peddling, nepotism, fraud, the use of speed money (money given to government officials for speeding up their consideration of a business matter falling within their jurisdiction), embezzlement, etc. There are three broad forms of corruption: petty administrative or bureaucratic corruption, grand corruption and state capture or influence peddling.

Petty corruption means isolated corrupt transactions by individual public officials who abuse their office; grand corruption occurs when vast amounts of public resources are devoured or misappropriated by state officials, usually members of the political or administrative elite; and state capture or influence peddling takes place when actors of the private sector operate in collusion with public officials or politicians for their mutual and private gain. Corruption in the public sector, particularly in developing and lower-middle income countries like Bangladesh, is a more serious problem than that of the private sector.

Corruption in Service Sectors: National Household Survey 2021 by the TIB shows that overall, 70.9 per cent of households have been victims of corruption while taking services from 17 sectors. The seven most corrupt sectors are, according to the survey, law enforcement agencies (74.4 per cent), passport offices (70.5 per cent), BRTA (68.3 per cent), judicial services (56.8 per cent), health (48.7 per cent), local government institutions (46.6 per cent) and land services (46.3 per cent). The estimated total amount of bribery at the national level is around Tk 108,301.1 million, which is 5.9 per cent of the national budget (revised) for the fiscal year 2020–21 and 0.4 per cent of the GDP of Bangladesh.

The Corruption Perceptions Index 2023, released by Transparency International on January 30, 2024, shows further worsening of Bangladesh’s performance. The country has scored 24 on a scale of 100, the 10th lowest global score.

Another sophisticated, heinous, and complex crime is money laundering. The Global Financial Institute, a Washington-based think tank, identified four major ways of money laundering: under-invoicing of exported products, over-invoicing of imported goods, Voice Over Internet Protocol business, and Hundi. According to a Global Financial Integrity report for 2020, every year more than $7.5 billion is laundered from Bangladesh, much of which is via the mis-invoicing of export-import trades. The reports say dishonest businesses, politicians and financial institutions are often involved in smuggling money out of the country. Sadly, the country does not seem to be effectively using any of the tools to recover laundered money. The process of claiming money back typically involves identifying laundered money, the persons or groups behind the crime, and the location; gathering evidence; filing lawsuits in the country the money has been located in; obtaining a judgement from the court; and enforcing the judgement in the specific country.

Money laundering damages financial sector institutions that are critical for economic growth, promotes crime and corruption that slow economic growth, and reduces efficiency in the real sector of the economy. These problems also have social consequences. The increasing inequality causes social degeneration. One of the most critical damages of black money is its negative effect on income distribution. The gap between individuals in terms of income distribution increases the tendency to commit crimes and makes money attractive. Moreover, it is a serious burden for honest people to maintain their daily lives, which is difficult to measure by so-called indicators. The silent pains of those people are being overlooked.

The agencies, such as the Anti-Corruption Commission and the Bangladesh Financial Intelligence Unit, that are mandated to curb corruption and money laundering appear to lack capacity, resources and logistical support to deliver their duties. In addition, these institutions are not free from political and bureaucratic influence. Overall, there is a lack of political will.

Corruption and money laundering are like a metastatic cancer in Bangladesh. It is a serious threat to our economic growth. This metastatic cancer also creates hindrance to other social progress. The government never fails to give a lip service to the issue, often vigorously stating its zero tolerance policy against corruption, but when it comes to walk the talk, it fails.

Dr Mohammed Mamun Rashid has recently obtained his PhD degree from Universiti Sains Malaysia.

Mohammed Mamun Rashid | Published: 00:00, Mar 07,2024

AS A social worker, it is a great opportunity to work with grassroots people. I worked for two years and seven months at Transparency International Bangladesh. It enhanced my visionary zeal for the anti-corruption campaign a lot because of my work in civic engagement, social movements, and good governance. Still, I abide by it. Once I asked one of my neighbours, ‘what do you mean by good governance?’ Naturally, he did not answer theoretically, as we usually expect. But he gave some real expectations from his heart. He said, ‘I want an honest officer-in-charge, land registration without bribery, easy access to public health services, etc.’

People’s pains, predicaments and expectations are often reflected in newspaper or television reports. Corruption and money laundering are two of the most important factors that cause inequality to grow and make people suffer. Corruption is not limited to bribery but can take a number of other forms, such as extortion, influence peddling, nepotism, fraud, the use of speed money (money given to government officials for speeding up their consideration of a business matter falling within their jurisdiction), embezzlement, etc. There are three broad forms of corruption: petty administrative or bureaucratic corruption, grand corruption and state capture or influence peddling.

Petty corruption means isolated corrupt transactions by individual public officials who abuse their office; grand corruption occurs when vast amounts of public resources are devoured or misappropriated by state officials, usually members of the political or administrative elite; and state capture or influence peddling takes place when actors of the private sector operate in collusion with public officials or politicians for their mutual and private gain. Corruption in the public sector, particularly in developing and lower-middle income countries like Bangladesh, is a more serious problem than that of the private sector.

Corruption in Service Sectors: National Household Survey 2021 by the TIB shows that overall, 70.9 per cent of households have been victims of corruption while taking services from 17 sectors. The seven most corrupt sectors are, according to the survey, law enforcement agencies (74.4 per cent), passport offices (70.5 per cent), BRTA (68.3 per cent), judicial services (56.8 per cent), health (48.7 per cent), local government institutions (46.6 per cent) and land services (46.3 per cent). The estimated total amount of bribery at the national level is around Tk 108,301.1 million, which is 5.9 per cent of the national budget (revised) for the fiscal year 2020–21 and 0.4 per cent of the GDP of Bangladesh.

The Corruption Perceptions Index 2023, released by Transparency International on January 30, 2024, shows further worsening of Bangladesh’s performance. The country has scored 24 on a scale of 100, the 10th lowest global score.

Another sophisticated, heinous, and complex crime is money laundering. The Global Financial Institute, a Washington-based think tank, identified four major ways of money laundering: under-invoicing of exported products, over-invoicing of imported goods, Voice Over Internet Protocol business, and Hundi. According to a Global Financial Integrity report for 2020, every year more than $7.5 billion is laundered from Bangladesh, much of which is via the mis-invoicing of export-import trades. The reports say dishonest businesses, politicians and financial institutions are often involved in smuggling money out of the country. Sadly, the country does not seem to be effectively using any of the tools to recover laundered money. The process of claiming money back typically involves identifying laundered money, the persons or groups behind the crime, and the location; gathering evidence; filing lawsuits in the country the money has been located in; obtaining a judgement from the court; and enforcing the judgement in the specific country.

Money laundering damages financial sector institutions that are critical for economic growth, promotes crime and corruption that slow economic growth, and reduces efficiency in the real sector of the economy. These problems also have social consequences. The increasing inequality causes social degeneration. One of the most critical damages of black money is its negative effect on income distribution. The gap between individuals in terms of income distribution increases the tendency to commit crimes and makes money attractive. Moreover, it is a serious burden for honest people to maintain their daily lives, which is difficult to measure by so-called indicators. The silent pains of those people are being overlooked.

The agencies, such as the Anti-Corruption Commission and the Bangladesh Financial Intelligence Unit, that are mandated to curb corruption and money laundering appear to lack capacity, resources and logistical support to deliver their duties. In addition, these institutions are not free from political and bureaucratic influence. Overall, there is a lack of political will.

Corruption and money laundering are like a metastatic cancer in Bangladesh. It is a serious threat to our economic growth. This metastatic cancer also creates hindrance to other social progress. The government never fails to give a lip service to the issue, often vigorously stating its zero tolerance policy against corruption, but when it comes to walk the talk, it fails.

Dr Mohammed Mamun Rashid has recently obtained his PhD degree from Universiti Sains Malaysia.