- Copy to clipboard

- Moderator

- #196

- Messages

- 3,052

- Reaction score

- 1,516

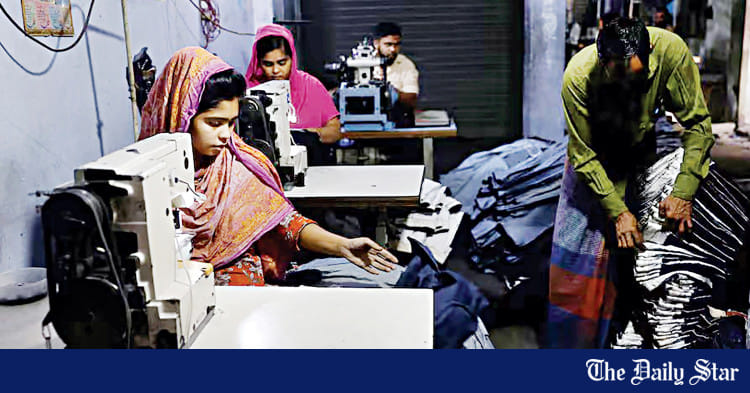

Trump’s victory: Is Bangladesh awaiting a boost in apparel exports?

Shuvonkar KarmokarDhaka

Updated: 15 Nov 2024, 23: 01

Prothom Alo infographic

The victory of Donald Trump in the US presidential election has ushered a ray of hope for increased demand for Bangladeshi apparel products in the US market.

During his campaign, the US president-elect announced plans to raise import tariffs on Chinese products. If implemented, the move is expected to shift purchase orders away from China, and Bangladesh may receive a share of the redirected orders, said local entrepreneurs.

During Donald Trump’s first term as the US president, Bangladesh experienced a similar benefit as the China-US trade war led to additional purchase orders for Bangladeshi products and subsequent boost in national exports.

Some apparel exporters said there are still two months before Donald Trump’s scheduled assumption in the office, but some of the US buyers are already communicating about placing more orders, leaving a little room for discussion on potential tariff hike on Chinese imports.

The manufacturers are considering it as a sign of new opportunities as well as business. They, however, fear that it will be too tough to expand their business unless the prevailing woes, including energy crisis and banking complications, are solved.

In the first term of Donald Trump, a trade war began between the US and China in 2018, and it started to move away a significant share of US purchase orders from China in 2019. Bangladesh captured a portion of the redirected purchase orders.

In 2019, apparel exports from Bangladesh to the US rose to $5.93 billion, the highest in seven years. In 2022, the figure peaked at $9.72 billion, despite disruptions inflicted by the Covid-19 pandemic. However, it declined in 2023, due to the Russia-Ukraine war.

According to the office of textiles and apparel (OTEXA) under the US department of commerce, apparel exports from China to the US market declined by $11.06 billion over five years from 2018. In the same period, Bangladesh's exports went up by $1.89 billion, while Vietnam’s exports increased by $1.96 billion.

Tariff is likely to be the common tool for Donald Trump to reduce imports from China. During the election campaign, he repeatedly announced his plan to impose a 10–20 per cent tariff on overall US imports, and it will climb to 60 to 100 per cent for Chinese products.

At an Economic Club event in Chicago last month, Trump said, “To me, the most beautiful word in the dictionary is tariff. It's my favorite word.” His policy encourages US domestic manufacturing.

Expectations

SM Sourcing, a garment factory in Gazipur recognized for its eco-friendly facilities, derives 25 per cent of its exports from the US market.Its owner, Mirza Shams Mahmud, told Prothom Alo, “We are expecting something good in the US market. We have received a forecast for good business from the US buyers. Some buyers are even showing flexibility while fixing prices of garments.”

There are around a thousand buying houses that act as intermediaries between foreign brands and local factories. A significant portion of exports are carried out through buying houses.

Kyaw Sein Thay Dolly, director of the Bangladesh garment buying house association (BGBA), said US buyers and brands took Trump’s tariff plans seriously, while Chinese exporters already started searching for new markets.

In fact, all are making backup plans. Hence, there have been growing queries in Bangladesh factories. India is also preparing to capture the purchase orders, he added.

Apparel exports to the US market started to rebound in the last few months, overcoming backlash of the Covid-19 pandemic. But Bangladesh lags behind its competitors like Vietnam, Cambodia, Pakistan, and India in terms of growth in apparel exports to the US.

While talking to Prothom Alo, Fazlul Hoque, a former president of the Bangladesh Knitwear Manufacturers and Exporters Association (BKMEA), said there are grounds to be optimistic about the US market following the victory of Trump.

Trump is appointing individuals with anti-China stances to key positions in his administration. If tariffs are hiked eventually, the purchase orders will be redirected from China. Vietnam already has higher orders than its capacity, and it has no scope for expansion. On the flip side, Bangladeshi factories are running below their production capacity. To grab the opportunity, the supply of gas and power should be increased, in addition to more cooperation from the banks, he explained.

Expert insight

Khondaker Ghulam Moazzem, research director of the Centre for Policy Dialogue (CPD), said the current US president, Joe Biden, did not move away from his previous administration's China policy. He maintained the tariffs imposed on Chinese products before 2020.During his election campaign, Donald Trump declared to impose new tariff on Chinese products. He actually wants to strengthen US domestic industries. Hence, the US will increase tariffs on products that they intend to increase domestic production, he said, adding it is less likely for the garments business to receive more business.

Khondaker Ghulam Moazzem also explained that the investors in China already received a message from the victory of Trump, and some of them will now shift to other places, including Bangladesh and Pakistan.

“We are struggling to ensure proper structural facilities for the current investors. Against such a backdrop, it will be tough to grab the opportunity if infrastructural issues, labor dissatisfaction, and political tension are not addressed,” he added.

*This report appeared on the print and online versions of Prothom Alo and has been rewritten in English by Misbahul Haque